Investors looking to get exposure to the crypto space have a myriad of choices. Such as buying the cryptocurrencies directly, buying miners, exchanges, or asset managers, there are plenty of options.

In terms of publicly listed companies, where one chooses to park their money will be based on one’s own risk tolerance and their outlook on certain crypto assets. For example, some Canadian stocks are focused solely on Bitcoin, others on Ethereum, and those in the DeFi (decentralized finance) space are rapidly growing.

Today, we are going to take a look at two companies with vastly different business models that may be of interest to those looking for an overlooked crypto play. Of note, both trade on the NEO Exchange

Ether Capital (NEO:ETHC)

First up, let’s talk about Ether Capital which is primarily an asset manager that is also focused on technology development and ancillary blockchain services. According to the company, these key pieces of infrastructure “will pave the way for mass use and adoption of Ethereum and Web 3 platforms.”

The company is led by a combination of crypto experts and investment bankers. The company’s CEO, Brian Mosoff, is a member of the Investment Industry Regulatory Organization of Canada (IIROC) cryptocurrency working group that is helping shape Canada’s regulatory crypto framework.

Under a consultant agreement with Purpose Investments, it helped launch both Purpose Bitcoin ETF (TSE: BTCC) and the Purpose Ether ETF (TSE:ETHH).

Most importantly, the company has significant investments in two cryptocurrencies (Ether and MakerDao) and is an early stage investor in Wyre. Assets Under Management are valued at ~$168M, $10M, and $2M respectively, for a combined total of $180 million. Today, Ether Capital has a market cap of only $128.69M and presents an attractive risk to reward proposition.

At current asset prices, Ether Capital is trading at a ~40% discount to total asset holdings, ~30% if one was to include Ether only. Whenever the company has traded at a 20% discount, it has proven to be a buying opportunity.

Tokens.com (NEO:COIN)

Tokens.com just went public a few months ago and provides investors exposure to staking and DeFi. In fact, it may be one of the only publicly listed companies that is laser focused on generating revenue though crypto staking.

What is staking?

In simple terms, it is locking in your crypto holdings for a period to help support a blockchain. In return, stakers are rewarded in the form of crypto tokens. There is no need to go into the technical details for the purpose of this article, but for more information one is encouraged to research Proof-of-Stake.

Tokens.com generates money by purchasing cryptos and staking them. This rewards them with additional tokens which are then recorded as revenue. These tokens can then be re-staked for additional revenue, a compounding effect.

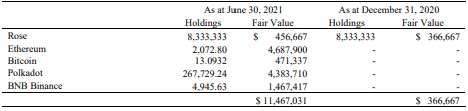

The company is solely focused on DeFi and had ~$11.5M USD worth of digital assets as of end of June 30, 2021. Through the first six months of the year, it generated $258,298 in staking revenue, a number that is expected to grow as more cryptos are purchased and staked.

Here is the company’s current asset composition:

The company used the proceeds from its public offering to purchase digital assets for the purpose of staking. In their last update, management announced that the funds were fully deployed and staked as of the end of June.

Worth noting, AUM as of end of June represented a time when crypto was trading near lows. As of writing, the assets listed above are worth ~$16M USD ($20.2M CAD) compared to a market cap for Tokens.com of $37M. Furthermore, since the process of staking took until the end of June, investors will have to wait until next quarter to understand the full impact of quarterly staking on revenue.

While Tokens.com doesn’t have the same pricing discount relative to assets as Ether Capital, the company’s business model makes it unique. The process of generating revenue through staking will provide consistent revenue and as mentioned, it is the only publicly-traded company with a focus in this area.

Next, lets see the bullish and bearish arguments for RioCan (TSE:REI.UN).