With online shopping gaining a significant amount of traction in 2020 due to COVID-19, a lot of Canadian investors, especially those who are looking for strong Canadian dividend stocks, are wondering if major retailers are still a solid option.

Blue-chip Canadian retailers Like Canadian Tire (TSE:CTC.A) have paid consistent dividends for a considerable amount of time. However, is the landscape changing for brick and mortar stores, and should Canadian investors be weary about investing a portion of their portfolio into what some call an “ancient” business models?

In this article I’m going to dig a little deeper into one of Canada’s most beloved and strongest brands in the country, Canadian Tire.

Canadian Tire (TSE:CTC.A) dividend and stock analysis

Canadian Tire is a Canadian based retail store that sells home goods, sporting equipment, apparel, footwear, automotive parts and accessories, and vehicle fuel.

As of July 2020, the company operated over 1,700 retail locations and it carries with it some of the strongest brands in the country, ones it has added on to the business via acquisitions.

Along with Canadian Tire stores, the company also operates under iconic brands such as SportChek, Mark’s Work Warehouse, Atmosphere, Partsource, Helly Hansen, Pro Hockey Life, and most recently Party City.

To go along with its strong brand presence, the company also holds a majority stake in a financing arm, and a real estate investment trust CT REIT (TSE:CRT.UN).

It’s almost a guarantee every Canadian household will own a product, or multiple products from this Canadian conglomerate. As a result, it’s become an extremely popular investment here in Canada. But, is the company set for a rough patch moving forward?

First, lets take a look at Canadian Tire’s dividend

Canadian Tire has one of the longest dividend growth streaks in the consumer cyclical sector at 9 years.

It currently yields just under 3% as its stock price is slowly recovering from the COVID-19 pandemic, and its yield is generally inline with where it’s been for the last 2 years, save for a short term spike due to the market crash.

Market Cap: $8.99 billion

Forward P/E: 18.95

Yield: 3.08%

Dividend Growth Streak: 9 years

Payout Ratio (Earnings): 54.49%

Payout Ratio (Free Cash Flows): Premium Members Only

Payout Ratio (Operating Cash Flows): Premium Members Only

1 Yr Div Growth Rate: 15.28%

5 Yr Div Growth Rate: Premium Members Only

Stocktrades Growth Score: Premium Members Only

Stocktrades Dividend Safety Score: Premium Members Only

This isn’t a huge dividend yield, but it’s still an attractive one, especially when we consider how fast the dividend has been growing.

As I mentioned previously, Canadian Tire has raised its dividend for the last 9 years, and over the past 5 years, it’s raised dividends at a pace of 17.22% annually. The company’s most recent increase of 15.28% does fall shy of this mark, but I’m sure investors are still more than happy with a mid-teens dividend growth rate.

With this high of a dividend growth rate, Canadian Tire is essentially set to almost double its dividend every 5 years. Now, it’s likely the company will not be able to continue this torrid pace moving forward, as most all dividend growth companies hit a plateau.

And in the valuation and forward outlook section, I’m going to explain why I think Canadian Tire’s plateau will be coming sooner rather than later.

In terms of payout ratios, Canadian tire is currently paying out around 54% of trailing twelve month earnings. With an annual dividend rate of $4.55 and earnings per share of $8.11, by all means, this dividend is safe.

However, will it continue to be safe moving forward, due to both the pandemic, and stalling growth?

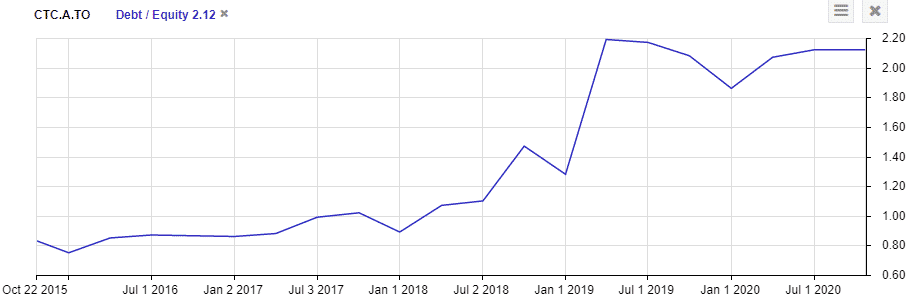

Canadian Tire debt load

Last year, Canadian Tire was subject to a short sell campaign by notorious short-sellers Spruce Capital. They stated the company was in simply too much debt to survive, and set a price point that was less than half of the stock’s current price.

Now, Canadian Tire’s stock did fall to nearly half the price it was trading at in late 2019, but I’d venture to say Spruce Capital got lucky because it’s likely the stock doesn’t reach even close to those levels if the global pandemic hadn’t occurred.

However, I do agree with them somewhat on the company’s debt load.

Charts provided by StockRover. Check out Stockrover Here!

Canadian Tire has an interest coverage ratio of only 3. Which means for every $3 Canadian Tire earns, $1 of that is going to satisfy interest payments on its debt. Now, an interest coverage ratio of 3 is nothing to be alarmed at. The company has more than enough capital to pay it’s dividend and pay the interest it owes on it’s debt.

The concerning thing comes from the company being able to fund growth, pay and grow it’s dividend, plus pay down debt when 33% of its current earnings is simply being used to pay interest.

Right now, I’d expect the COVID-19 pandemic plus the company’s high debt load to factor in to slowing dividend increases, reducing the attractiveness of the stock.

Canadian Tire forward outlook and future growth

Canadian Tire relies on an acquisition heavy model to drive growth. As such, it needs capital to do so. Bringing you back to the company’s high debt load and the fact that a large chunk of earnings is going towards debt interest, I think this is going to impair the company’s ability to grow moving forward.

There is no question the company knows how to drive retail traffic into its stores, and it’s also growing its e-commerce platform at a rapid pace. But with revenue growth on an annual basis of only 4.3% since 2015, and earnings expected to be impacted drastically by the effects of COVID-19, we could see a lull in the company’s operations for some time now.

Analysts expect revenue to grow by only 4% in 2021, and the company has also missed analyst estimates in terms of earnings in 5 of the last 6 quarters. They have a price target on the company that indicates there is actually 6% downside in todays price levels, at the time of writing of course.

From a valuation standpoint, the company is trading right in line with its typical averages, with a forward price to earnings of 12.8, while its 5 year historical average is 13.1.

Considering the company’s debt loads, economic outlook, and an outdated but evolving business model, Canadian Tire is a stock I’ve decided to move on from, selling it in my own portfolio on October 22nd 2020.

In my eyes, there are much better opportunities on the Toronto Stock Exchange today. And in the search for dividend growth, major lenders are being regulated to the point of pushing borrowers to alternative lenders. Buying stocks in that sector might not be a bad idea. One that has done quite well since 2001, Goeasy Ltd (TSE:GSY), in that piece we look at whether or not the company is still a solid dividend growth stock.