Alphabet Stock Looks Unstoppable Right Now – Here’s Why

Key takeaways

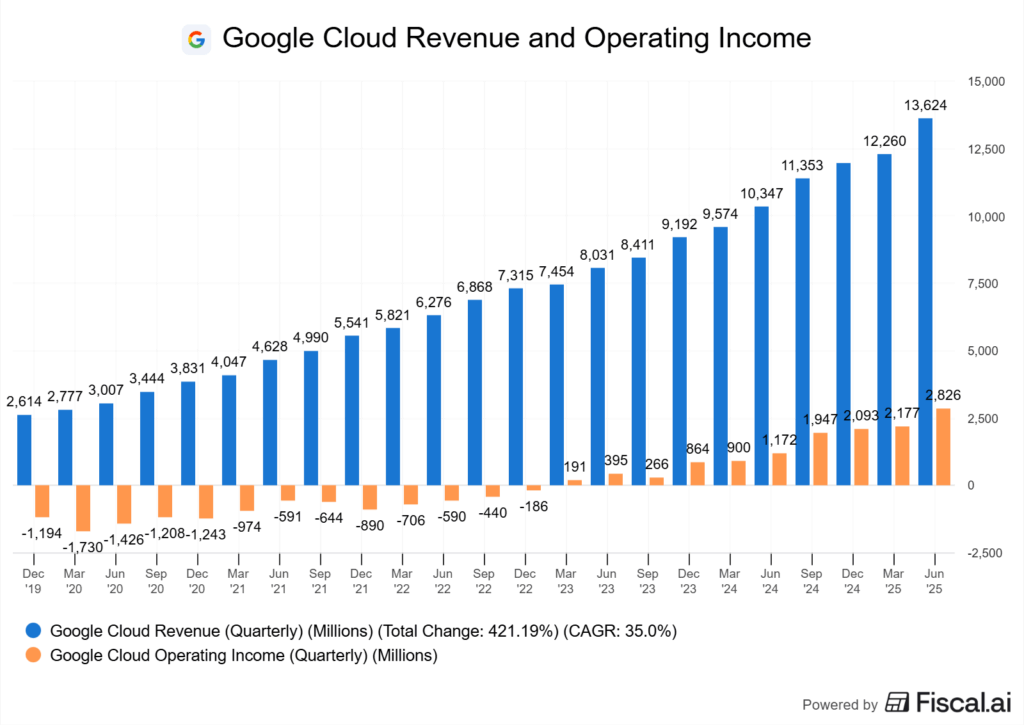

Cloud margins are the key swing factor for earnings growth

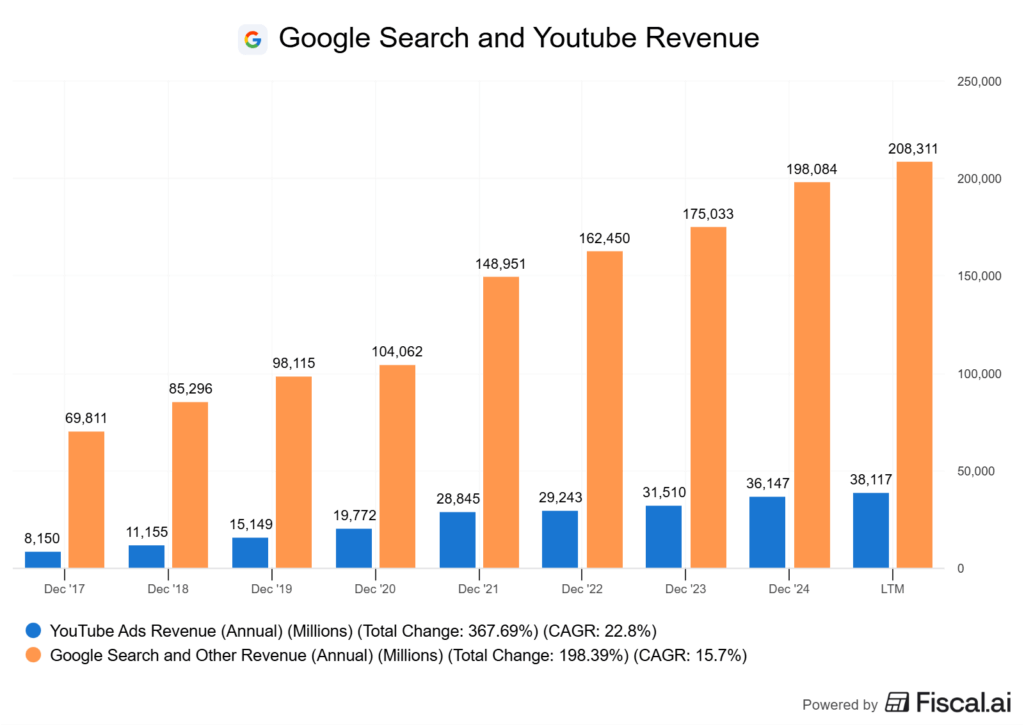

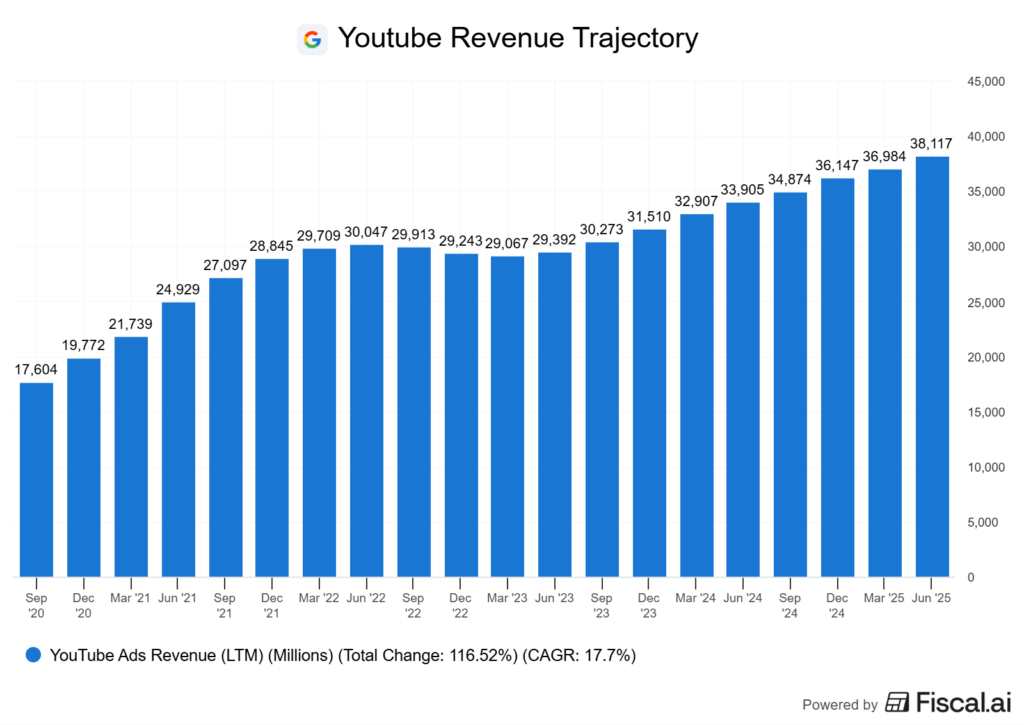

Search and YouTube still deliver strong cash generation despite AI pressure

Balance sheet strength and buybacks provide stability for long-term holders

3 stocks I like better than Alphabet right nowAlphabet (GOOG) seems fairly valued right now. In an environment of sky high valuations with tech stocks, this is a good thing. But there’s some real execution risk.

The big question is whether Google Cloud can keep margins healthy as AI spending ramps up.

For years, the company leaned on search and YouTube, but lately, real earnings growth is coming from Cloud profitability. That’s the upside.

The risk? AI competition could hurt search economics faster than Cloud can make up for it. Search and YouTube are still the cash engines, producing steady profits.

Those segments give Alphabet the balance sheet to fund its AI bets and buybacks.

But the durability of those profits is being tested as new AI models change how people search and consume information. Cloud’s margin trajectory matters more than just revenue growth now, because the element of disruption on its search platform will always exist.

If margins hold up, Alphabet’s case as a stable compounder gets much stronger.

Google Cloud’s Operating Leverage Is Finally Showing Results

Google Cloud is finally showing the kind of operating leverage investors have wanted for ages.

Revenue climbed 32% year over year to about USD 13.6 billion. Operating margin reached 20.7% this quarter, way up from a few years ago. That’s a big shift in Alphabet’s earnings profile.

The business model’s simple: sell compute, storage, and AI infrastructure through Google Cloud Platform (GCP), then layer on higher-value services like data analytics and generative AI. As enterprise clients scale up, fixed costs get spread out, so margins expand faster than revenue. This is classic operating leverage.

The backlog suggests demand is solid. Alphabet disclosed about USD 106 billion in contracted cloud revenue, with several deals over USD 1 billion signed in the first half of 2025. That kind of volume shows big enterprises are locking GCP into their long-term budgets.

But those contracts still need to be delivered efficiently, and capex requirements are heavy. Efficiency is the swing factor. If margins can hold above 20% while Alphabet pours billions into data centers and AI infrastructure, Cloud becomes a consistent earnings contributor.

If cost discipline slips, though, leverage unwinds fast. The upside is real, but it all comes down to execution.

Next quarter, I’ll be watching whether operating margin continues to grow. That’s the signal the model is scaling right.

YouTube and Search Continue to Print Cash, Even as AI Competition Intensifies

Search and YouTube still fund everything else at Alphabet. In Q2 2025, Search and Other revenues hit about USD 52.4 billion, up 12% year over year.

YouTube ads grew another 13%, proving advertisers still see it as a must-buy channel despite TikTok’s rise.

One thing fueling Youtube Ads right now is the fact people can develop ads via AI now, taking much of the annoyance out of developing video ads.

Google’s money-making here is pretty straightforward: ads tied to intent. On Search, that’s sponsored results when people look for products. On YouTube, it’s pre-rolls and targeted video ads. Both lean on AI now to refine targeting, which helps engagement and holds cost-per-click steady, which causes more advertisers to return to the platform.

AI Overviews and the new AI Mode are the wild cards. Alphabet says AI Overviews already reaches 1.5 billion users monthly and could scale to 4 billion by year-end. I don’t find them all that valuable right now, but if there is any company that can churn profits out of it, I’d be betting on Alphabet.

That’s a huge reach, keeping search queries inside Google’s ecosystem instead of leaking to Microsoft’s Copilot or Meta’s Llama-driven tools. The risk? If AI answers reduce ad clicks, the monetization model gets shaky, unless they adapt.

Competition isn’t sitting still. Microsoft is embedding AI into Office, where enterprise adoption is sticky. Meta is pushing AI into its social platforms, where time spent is massive.

Google’s edge is integration. Search, YouTube, and Workspace all tied into Gemini. That creates network effects, but only if regulators don’t force open access.

I’ll be watching ad monetization rates within AI Overviews over the next year. If they launch them and they stay close to traditional search, Google keeps its cash machine running. If not, the AI pivot looks a lot less sturdy.

Alphabet’s AI Bets Are No Longer Just Hype—Real Products Are Rolling Out

Alphabet has moved from promises to real rollouts. The Gemini app now reaches about 450 million users, while AI Overviews in Google Search as mentioned touch an estimated 1.5 billion. That’s not just a pilot. That’s mass adoption on a scale only a few firms can claim.

AI Mode, live in the U.S. and India, already has over 100 million monthly active users. People aren’t just testing it, they’re sticking with it. Sustained usage matters more than flashy launches.

Agentic AI is another swing factor. These systems handle tasks end-to-end without constant prompts. If Alphabet can make this reliable at scale, it could reshape how people and businesses interact with its ecosystem.

The risk? Deployments might still be too narrow to move revenue quickly. The product rollout goes beyond search. Google Cloud is layering generative AI into enterprise tools, and YouTube’s experimenting with AI-driven editing and recommendations.

Each move ties back to Alphabet’s core model: more engagement means more monetizable surface area. Billions of users are already exposed to AI features. The risk? It doesn’t scale cleanly in every market Alphabet touches.

I’ll be watching how user adoption of AI Overviews and Gemini translates into higher ad yield and Cloud revenue next quarter. That’s the metric that’ll show if this is more than just engagement at scale.

Antitrust Headwinds Ease After Recent Resolution, Clearing a Path Forward

The Department of Justice’s long-running antitrust lawsuit against Google Search finally has a resolution. The judge didn’t force a breakup, which was a relief for investors, and instead imposed targeted remedies.

This outcome is a huge win for Google. It reduces structural risk while still acknowledging Google’s monopoly ruling. The court barred Google from paying for exclusive search placement deals but allowed default arrangements to continue.

That keeps the Apple partnership intact, worth about USD 20 billion a year.

The remedies also require Google to share some search data with competitors and stop tying certain products together. On paper, that opens the door for rivals like Microsoft and DuckDuckGo. In reality, the impact looks minimal.

These firms still face scale disadvantages, and the rise of generative AI has already created more competition than regulators could engineer. Investor confidence jumped after the ruling, and Alphabet’s shares reflected that relief. I see that as markets pricing in stability, not sudden growth.

The risk? Remedies only work if regulators enforce them consistently. If Google pushes too hard on default deals or data control, regulators could revisit structural options. But for now, the regulatory resolution gives Alphabet some much needed breathing space.

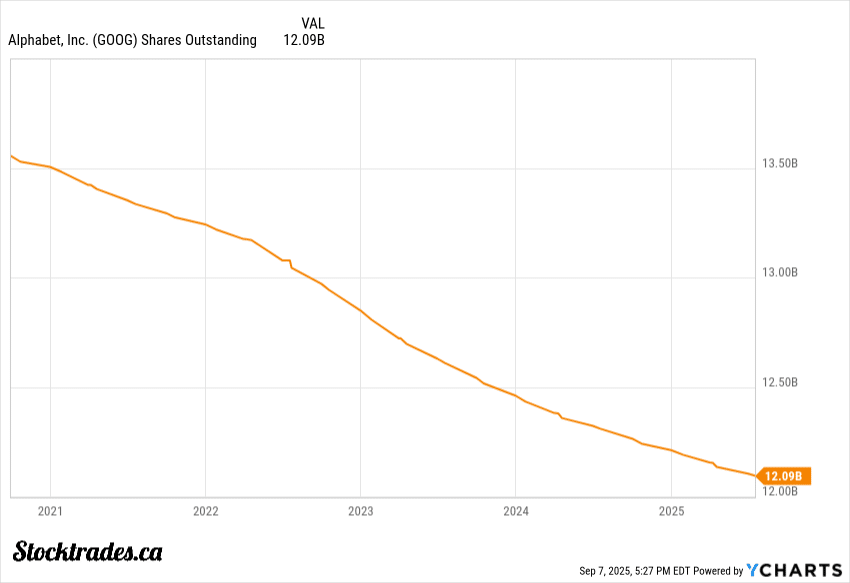

Alphabet’s Massive Buybacks and Cash Position Offer Shareholder-Friendly Stability With Large Upside

Alphabet’s capital return strategy is tough to overlook these days. In 2024, the company announced a $31.4 billion share buyback. I’d expect amplified buybacks to continue in 2025.

Moves like that don’t just shrink the share count. They also send a pretty clear message. Management sees real value in its own stock.

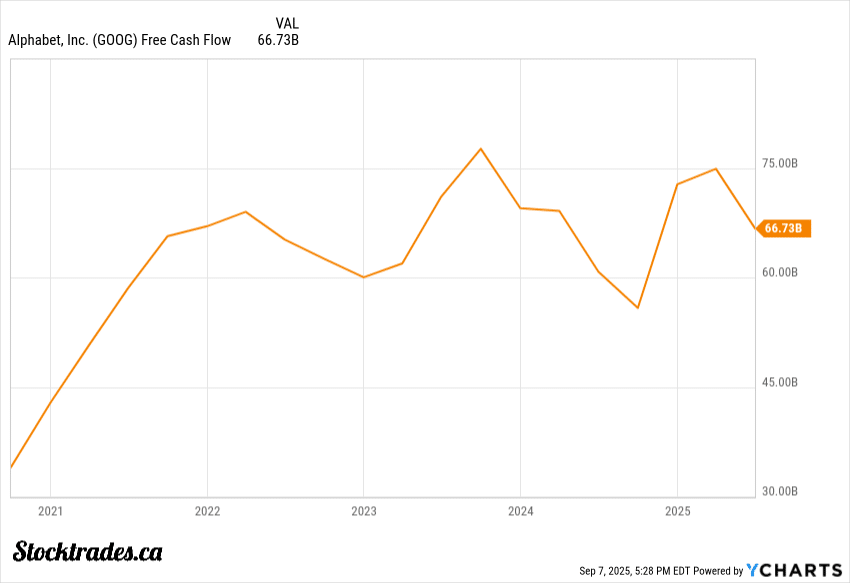

The real backbone here is free cash flow. Alphabet generated USD 5.3 billion in free cash flow last quarter.

Trailing twelve-month levels hit USD 66.7 billion. That kind of consistency suggests the advertising and cloud engines are still printing cash at scale, which can allow it to expand its AI offerings without utilizing debt.

For investors, it’s the durability of that flow that matters more than any one quarter. Cash reserves remain another point of strength.

Alphabet ended the period with roughly USD 95 billion in cash. That’s not just idle money. It gives the company room to keep investing in AI, fund acquisitions, and still return capital without stretching its balance sheet.

Not many peers can balance growth spending and capital returns at this scale. The mix leans heavily toward buybacks, which tend to be more tax-efficient than dividends for a lot of investors. However, I’d imagine the dividend continues to grow.

However, the tilt towards buybacks makes me believe management wants the flexibility to not have a large fixed-payment in terms of a dividend. If margins weaken or ad spend slows, the cash engine could lose some of its buffer, and if they raise the dividend too much, the commitment would slow them down.

But right now, Alphabet’s financial strength gives it the room to keep rewarding shareholders while still funding its growth bets. I view it as one of the best tech stocks on the planet. Yes, right up there with the NVIDIA’s and Apples of the world.