This Blue-Chip Stock’s Price is Down, But Profits Are Up. Buy Now?

Key takeaways

Leadership change brings execution risk despite strong foundations

Insurance margins and investment discipline drive long-term value

Large cash balance is both a buffer and a challenge

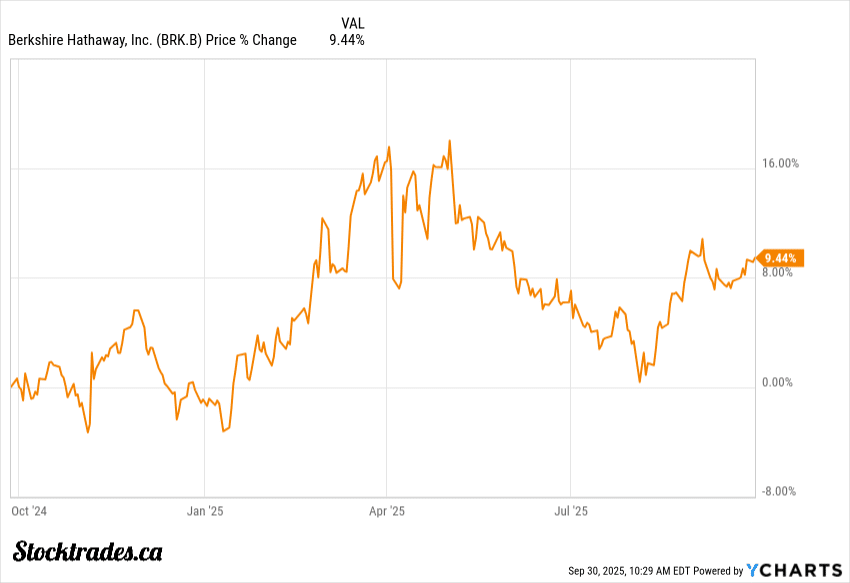

3 stocks I like better than Berkshire Hathaway.Berkshire Hathaway’s shares seem fairly valued, which is odd to say considering the drawdown it has gone through. However, even Buffett himself had scaled back buybacks on the company’s shares, citing valuation as the main concern.

The stock’s also been weighed down since Warren Buffett confirmed his retirement timeline, which makes sense. Succession always brings nerves. However, this has been in the works for many years, and I think it’s overblown.

The big question: Can Greg Abel keep up underwriting margins and maintain capital allocation discipline? Some people say Berkshire’s size and cash pile make it too defensive to fret about leadership changes. I’m not so sure; the real test will be how fast that cash gets put to work in productive assets.

After all, that’s why we buy Berkshire.

The business model’s simple enough. Insurance generates float, which funds investments across public equities and wholly owned subsidiaries.

Underwriting profitability, plus cash from steady businesses like railroads and energy, really drive the engine. That combo gives Berkshire resilience, but results can swing with catastrophe losses or weaker industrial demand.

Insurance margins matter, especially as weather events get pricier. The investment portfolio is a mixed bag.

Apple still dominates, and though Berkshire trimmed the position, there’s still valuation risk tied to one stock. The Kraft Heinz unwind shows mistakes can sting for years.

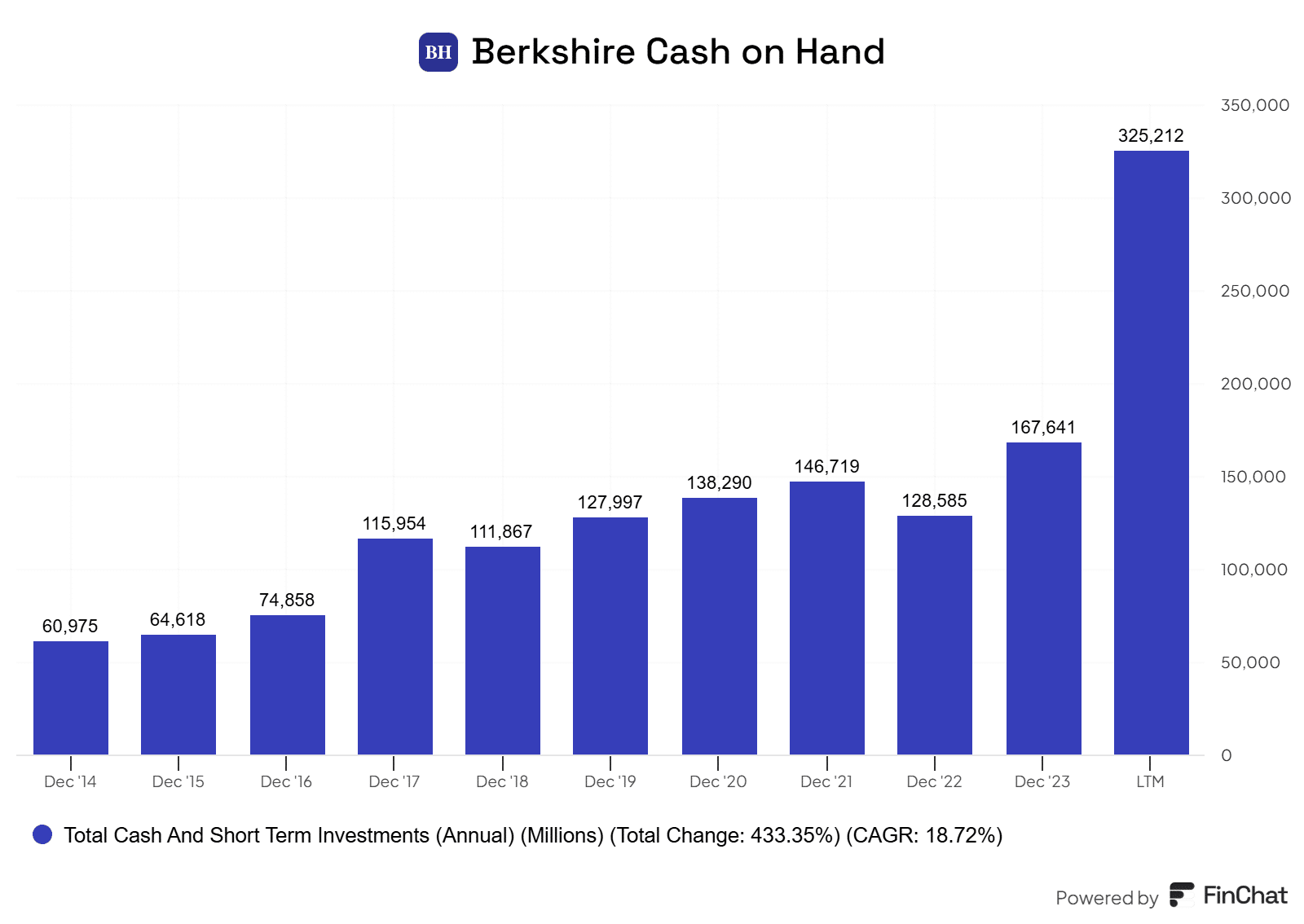

That cash pile, over $350 billion now, is a story in itself. It’s dry powder if markets reset, but dead weight if everything stays expensive. You don’t want to be earnings 4%~ in treasuries while the market rips 10-15% a year.

For long-term portfolios wanting a defensive anchor with some upside, Berkshire still fits. The real test will come in the next downturn.

Underwriting margin is the metric I’m watching. If it stays positive through rough patches, it will be hard to knock this business down.

Buffett’s Exit Could Bring Strategic Change and Uncertainty

Warren Buffett stepping down as CEO marks the end of an era that really shaped Berkshire Hathaway’s identity. He’ll stay on as chairman, but Greg Abel now handles the day-to-day calls.

That’s a big shift. Investors have long tied Berkshire’s value to Buffett’s judgment. Abel brings deep operating chops, especially from the energy side of the business.

He’s more hands-on than Buffett, so you might see changes in how Berkshire balances long-term strategy versus short-term execution. Will that mesh with Berkshire’s culture of decentralized management? That’s not obvious yet.

The board now has to make sure Abel respects the company’s tradition of autonomy while still putting his own spin on M&A and capital allocation. That will test both Abel and the board’s willingness to step in if needed.

Investors feel the shift, too. The “Buffett premium” has faded. Shares dipped a bit when the transition was announced, which shows there’s some doubt about whether Abel can keep up the same discipline. I tend to lean towards the idea that he will do just fine.

Continuity is the upside. The risk? Culture drift. Investors will have to watch closely to see which direction Abel takes.

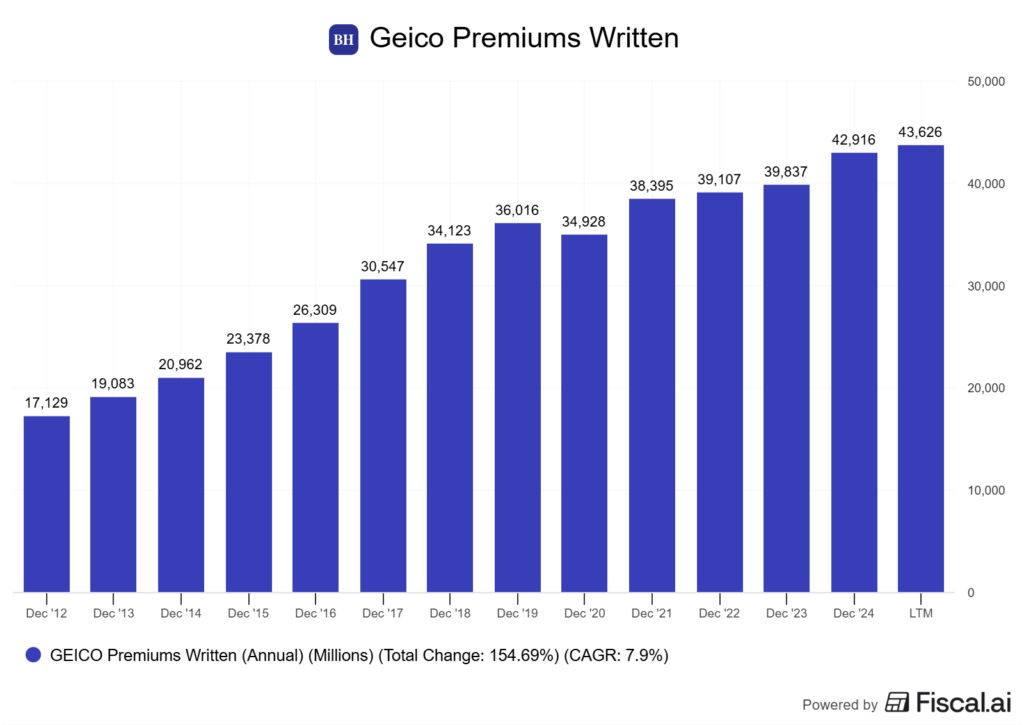

Insurance Business Profits Mix with Weather and Catastrophe Risks

Insurance still anchors Berkshire Hathaway. The mix covers Geico’s auto book, reinsurance, and specialty lines.

Each segment drives earnings differently, but they’re all tied to catastrophe risk. Geico’s been doing better lately. Premium hikes and fewer accident claims pushed underwriting profit up by double digits.

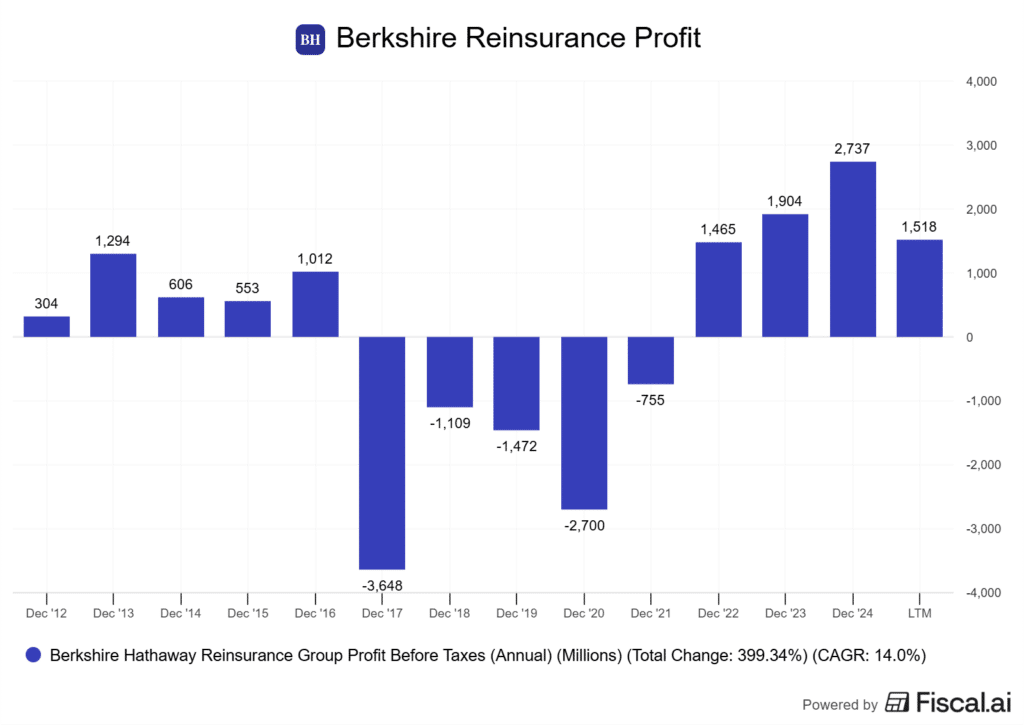

That suggests improved loss ratio discipline, though it only holds if claims don’t spike again. Reinsurance is a tougher beast.

It brings in big premiums upfront, but one bad wildfire or hurricane can wipe out profits. Recent wildfire claims alone nearly halved insurance profit.

That’s the trade-off. Strong cash inflow, but unpredictable losses. The combined ratio across the group is the clearest marker. Below 100 means profit; above, losses. As you can tell by the chart above, profitability is wild in this segment.

Reserve adequacy matters, too. Thin reserves can unravel even a good quarter later on. Climate risk adds another layer.

More wildfires and storms mean a higher chance of big claims. That could push regulators to demand stricter capital buffers or pricing limits.

Berkshire’s scale and balance sheet help it absorb volatility. Premium growth and reserve discipline give it some breathing room.

If catastrophe losses stack up for a couple of years, though, even Berkshire’s size might not protect earnings. I’ll be watching whether the combined ratio holds up during high-loss years. That’s the best test of whether the insurance business is compounding value or just staying afloat.

Investment Portfolio Strength, But Write‑downs & Valuation Pressure Grow

Berkshire’s portfolio still looks solid at first glance. Apple, American Express, Coca‑Cola, and Bank of America make up most of the equity value.

That concentration brings stability, but also exposure if one or two names stumble. The company’s booked big unrealized gains lately, but that can swing fast.

Market valuations are high, so there’s not much room for error. If rates stay up or inflation lingers, those paper gains could vanish quickly.

Kraft-Heinz is the poster child for write-downs. That stake has already forced Berkshire to take billions in lost value, proving that even Buffett is wrong sometimes. It’s a reminder that even long-term bets can go south, and those losses hurt book value per share.

Diversification has improved since a decade ago, but the portfolio’s still dominated by a few big bets. Energy exposure through Chevron and Occidental adds another layer of risk. That’s great when oil prices are strong, but if the cycle turns, returns can get hit.

BRK.B trades at about 1.6 times book value, which is pretty rich for the past decade despite its drawdown. The market’s already pricing in strong execution and stability.

To justify that, the portfolio needs to keep outpacing inflation and handle higher financing costs. I’m fairly confident the company can continue to do that.

Cash Pile Is Huge. Opportunity or Idle Capital?

Berkshire Hathaway now holds nearly $348 billion in cash, equivalents, and short-term U.S. Treasury bills. That’s a record for any public company.

The pile keeps growing because Berkshire’s been a net seller of stocks for ten straight quarters and has paused buybacks. This “dry powder” gives the company unmatched flexibility.

Berkshire could fund a huge M&A deal without borrowing, or jump in if markets freeze up. In theory, that’s a big advantage if valuations reset or distressed assets show up.

The downside is that idle cash drags on returns. Treasury bills yield a few percent, which is nice, but not much compared to what you could get from operating businesses or stocks.

Every quarter that cash sits, the opportunity cost ticks higher, and shareholders get more frustrated. Buffett’s always been strict about valuation. If he won’t buy Berkshire stock at a premium to book, it suggests he’s not seeing value elsewhere either.

That discipline helps avoid overpaying, but billions are just earning short-term interest. The acquisition market’s not helping either.

With valuations still high, Berkshire hasn’t found big deals. So, investors are left wondering if the cash pile is a strategic edge or just underused capital.

If Berkshire puts even part of its reserves into a smart acquisition or starts buybacks again, returns could pick up. If not, returns on idle capital will stay muted, and patience will keep getting tested.

His investment in UnitedHealth is one I feel will be beneficial. However, there are not many opportunities like that on the market today, and you need a lot of them to move that cash.

Railroad, Energy & Industrial Units Are Stable Anchors, But Cyclical Exposure Remains

BNSF is still one of the most important pieces of Berkshire’s non‑insurance portfolio. Freight volumes have dropped due to weaker industrial demand. We’re seeing this across pretty much every North American freight company.

Earnings from the unit have taken a hit, as recent results showed, with railway operations weighing on performance. That’s the trade-off: railroads give steady cash flow, but they definitely move with the broader economy.

Berkshire Hathaway Energy (BHE) tells a different story. It runs on long‑term contracts and regulated returns, so its earnings feel a lot more predictable.

The utility arm has pushed into renewables too. Its renewable generation now sits above the U.S. average, based on coverage of its clean energy progress.

The industrial subsidiaries and retail operations face more ups and downs. Manufacturing margins get squeezed when input costs rise.

Labour cost pressure keeps popping up. Inflation in raw materials and energy prices can erode profitability fast, and these businesses usually can’t just pass those costs through.

Infrastructure spending throws some support their way, especially for businesses tied to construction and heavy equipment. But that tailwind is uneven and doesn’t fully shield results if demand slows.

The regulatory environment adds another layer of uncertainty. Energy and utility operations face shifting rules on emissions and capital investment.

So is the Company an Opportunity Today?

Berkshire Hathaway is in transition, but its strengths remain durable due to its diverse business model. The insurance engine keeps generating float, the operating businesses keep generating significant cash, and the fortress balance sheet leaves the company with the ability to strike if the markets correct.

Greg Abel may not be Warren Buffett, but he doesn’t need to be. He inherits a culture of discipline, a decentralized model that lets great operators run their businesses, and a war chest most CEOs would envy. He just needs to spend that war chest wisely.

If the cash pile gets deployed into quality assets or if buybacks resume at attractive levels, book value and earnings power could climb faster than the market expects.

For investors wanting a resilient, cash-rich compounder that’s still capable of outsized moves in the next downturn, Berkshire Hathaway looks to be a solid option.