Has This Top Canadian Dividend Growth Stock Gotten Ahead of Itself?

Key takeaways

Brookfield’s fee-driven model and capital base remain strong

Growth potential lies in new infrastructure and technology exposure

Valuation is frothy, an the company will need to deliver to justify prices

3 stocks I like better than Brookfield Asset ManagementBrookfield Asset Management has been one of the most talked-about stocks on the TSX since being spun out, and honestly, it’s easy to see why. The company’s delivered strong returns, built a huge base of fee-bearing capital, and keeps finding ways to attract global money.

But is there still upside after such a strong run? Right now, I’d say Brookfield Asset Management looks fairly valued to even slightly overvalued, so it’s not the most compelling entry point for new buyers who are sticklers on price.

However, just because the company is fairly valued doesn’t mean it can’t continue to execute and drive strong returns. The firm’s pivot into credit and infrastructure tied to artificial intelligence could open up new growth opportunities. Its ability to monetize investments has proven reliable even when it was tucked into Brookfield Corporation.

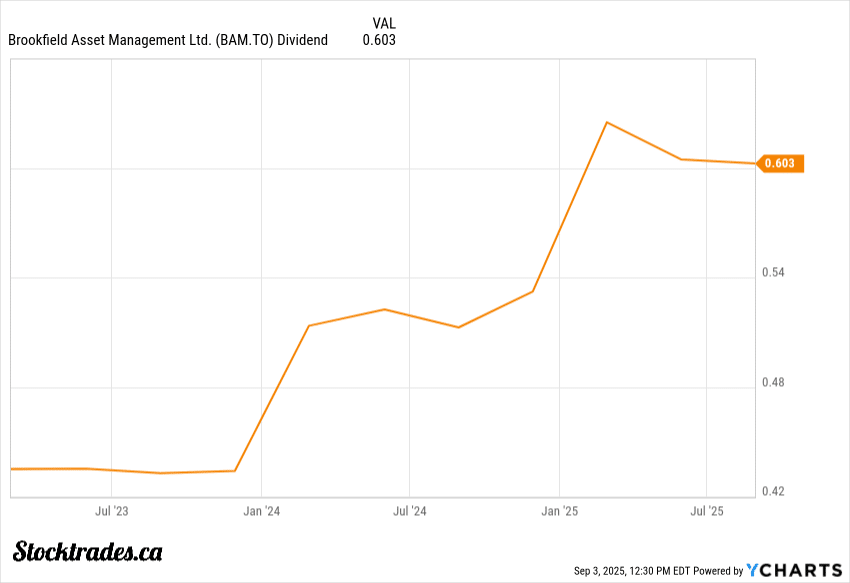

The decision comes down to balancing steady dividend growth against the risk of buying at a peak. I see Brookfield as a long-term compounder, but timing does matter.

Let’s dig into the company’s results and whether I think investors should be buying the company at these valuations.

Fee engine and capital base

| Metric | Result | YoY Change |

|---|---|---|

| Fee-related earnings (FRE) | $676M | +16% |

| Distributable earnings | $613M | +12% |

| Fee-bearing capital | $563B | +10% |

| Capital raised | $22B | — |

| Dividend per share | $0.4375 | — |

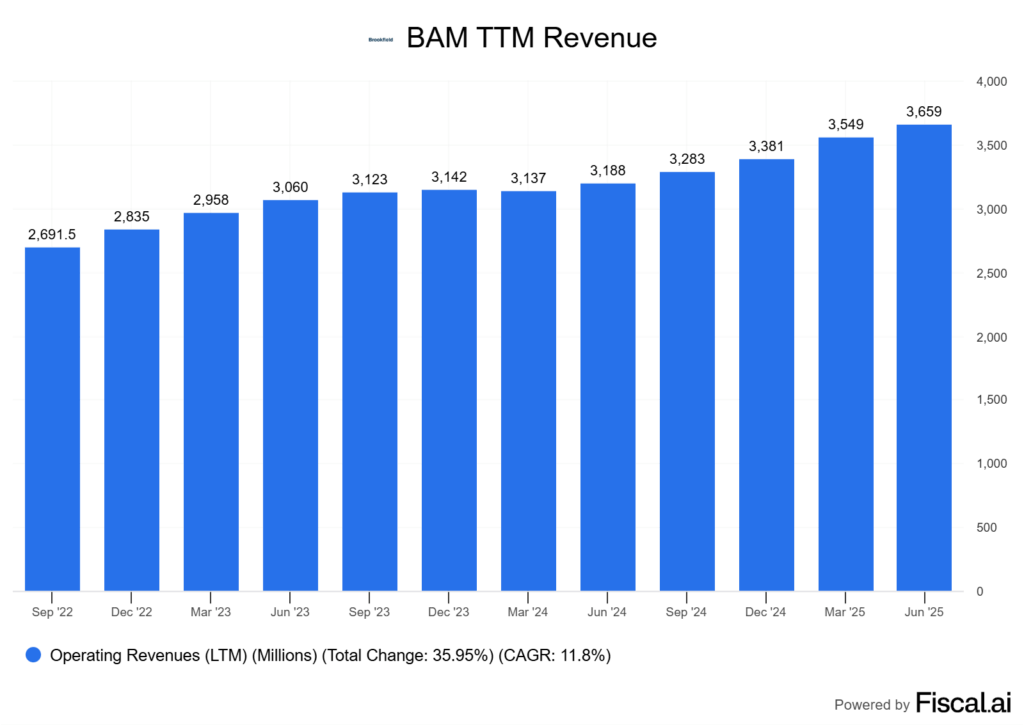

Brookfield’s fee bearing capital is what drives this company. In Q2 2025, fee-related earnings rose 16% year-over-year to $676 million.

Distributable earnings climbed 12% to $613 million. These are solid numbers, especially for investors who want steady income streams in their RRSPs or TFSAs.

Fee-bearing capital base also hit $563 billion, up 10% from last year. Nearly 90% of this capital is long-term or perpetual, which gives Brookfield a rock-solid foundation and makes the business less sensitive to short-term market swings or policy rate chatter.

Brookfield raised $22 billion in fresh capital this quarter, which highlights its ability to attract investors across credit, infrastructure, and renewables.

It’s clear Brookfield’s capital-light model is working, cash comes in through management fees, and a good chunk goes right back to shareholders in the form of a dividend and buybacks.

For income-focused Canadians, this blend of growth and yield is why so many are taking a closer look despite high valuations.

Monetization’s and Carry

Brookfield’s monetization pipeline jumps out at me. The company sold more than $55 billion of assets year-to-date, which directly unlocks carried interest.

These sales turn paper gains into cash, and that cash flows into distributable earnings. Carried interest doesn’t show up until assets are actually realized, so with this much activity, I expect carry to lift results over the next few quarters.

Fundraising momentum adds yet another layer. in Q2 alone, inflows reached about $22 billion, and the company now sits on roughly $128 billion of uncalled commitments.

That’s a ton of dry powder. It gives BAM flexibility to deploy into new opportunities or realize gains when the timing feels right.

I see this combination, that being monetizations plus industry leading fundraising, as a key driver of distributable earnings growth. With all that capital flexibility, BAM can pivot quickly and keep converting activity into cash.

Strategy shift to AI infrastructure

Brookfield’s moving past its traditional role of building the shells of data centres and providing the power. The company is now leaning into the inside of the box. That being the hardware and systems that actually run AI workloads.

That means GPUs, liquid cooling, and chip infrastructure. This isn’t a small pivot. By stepping into these areas, Brookfield is widening the pool of assets private capital can own.

Instead of just leasing space and energy, now it can participate in the tools AI companies need to scale. That creates a more diverse and defensible revenue stream in an area that is rapidly growing.

Two recent deals show the scale.

| Project | Location | Size/Value | Focus |

|---|---|---|---|

| Hydro Framework Agreement with Google | U.S. | Up to 3 GW | Clean power for AI data centres |

| Sweden AI Data-Centre Program | Sweden | ~$10B | Full-scale AI-ready facilities |

The Google agreement matters because it ties Brookfield to one of the largest AI users on the planet. It has also secured previous deals with Microsoft through its renewable segment. Supplying up to 3 GW of hydro power means stable, long-term cash flow and credibility with other hyperscalers who have mountains of money to spend.

The Sweden program is just as important. A $10B commitment shows Brookfield can execute at global scale, not just in North America.

Product Mix and Operating Leverage

What should stand out about Brookfield Asset Management is how its product mix drives operating leverage.

The firm isn’t just collecting fees on real estate anymore. Assets under management now lean heavily toward infrastructure, credit, and renewable transition strategies.

Client demand in these areas remains strong and sticky. That shift feeds straight into margins.

Brookfield reported a fee-related earnings (FRE) margin of about 56%, which really shows the power of scale here. Once the fixed costs of running a global platform are covered, every new dollar of fees drops to the bottom line at a higher rate.

Recurring fee growth is also key. Brookfield has been raising larger flagship funds and layering in new strategies, which means management fees keep compounding. That recurring base supports a steady dividend policy without needing to stretch the balance sheet.

The mix of higher-margin strategies and operating leverage gives me confidence Brookfield can keep expanding cash returns over time, and thus returning that capital to shareholders via dividends.

Risks & Items To Watch

As an investor in BAM, you need to keep a close eye on fundraising cycles because they can swing with macro conditions. When the Bank of Canada holds rates higher for longer, institutional LPs often slow commitments.

That can delay growth in fee-bearing capital. Performance fees are another area where timing matters. They’re tied to exits, and exits don’t happen on a smooth schedule.

A single quarter can look weak if realizations slip, even if the long-term pipeline is solid. This lumpiness makes it tricky for retail investors who prefer companies with more predictable cash flow.

Execution risk is also real. Brookfield’s push into scaled infrastructure for AI data centres sounds promising, but it comes with hurdles.

Permitting, power availability, and delivery timelines can all drag out projects, and delays here don’t just affect returns, they can strain partnerships with tech operators. I also think about integration risk as they broaden into AI assets.

The opportunity size is attractive, but managing new partners and unfamiliar supply chains adds complexity. It’s not the same as running hydro dams or office towers, and the learning curve could dent margins if execution slips.

My Take on Brookfield Asset Management Ltd.

Brookfield Asset Management stands out as one of those rare Canadian-listed companies offering both growth and income potential. Most of our blue-chip dividend payers don’t really provide much growth at all.

What really makes me like the company is its capital-light model. Management keeps raking in steady fees on over $500 billion of fee-bearing capital. That number just keeps climbing as they raise new funds.

This approach creates a compounding effect, and it doesn’t depend on constant asset sales or risky leverage. It’s a bit of a flywheel. Once it’s spinning, it’s tough to slow down.

Sure, there are risks. Fundraising ebbs and flows with the market, and carry can swing wildly depending on deal exits.

But honestly, I see those as timing hiccups rather than anything fundamentally broken with the business. Private markets capital keeps getting more popular, and Brookfield’s got a front-row seat.