Is Canadian Pacific Railway Stock a Buy?

Key takeaways

CP Rail is trading at a cyclical low, attracting a lot of value-focused investors.

Earnings and freight volume remain strong despite macro headwinds.

Long-term growth potential and industry advantages make CP a strong opportunity.

3 stocks I like better than CP Rail right now.CP Rail’s recent slide to the bottom of its 52-week range has a lot of investors wondering if this is a once-in-a-cycle opportunity, or a value trap dressed up like a recession bargain. I don’t blame anyone for hesitating, the numbers look inviting, but the headwinds aren’t just noise.

Right now, I believe Canadian Pacific offers a compelling long-term for investors who want stability, earnings growth, and an economic moat most TSX companies can only dream of.

The company’s outlook still points to double-digit earnings growth, even with economic headwinds and questions about tariffs, labour deals, and integration challenges following its big merger with Kansas City Southern.

Growth like that doesn’t come cheap, especially with the moat they have, but with volume resilience in the face of a freight recession, CP is fundamentally strong.

Is CP a Recession Discount Opportunity?

Historically, when rails dip towards their 52 week lows, it means opportunity for investors. We’re already seeing this a bit in its price (see chart above.)

Some see the recent pullback as a warning flag. Freight volumes are soft, and the word “recession” gets tossed around. But I think much of that risk is already priced in. Compared to many alternatives on the TSX, CP’s underlying business is more resilient.

When I check analyst sentiment, I see it’s split almost evenly between buy, hold, and sell ratings. I don’t base my investment decisions on any sort of analyst ratings, but what this tells me is that the market isn’t sure what’s next. But it also means any good news could have an outsized impact.

For Canadians thinking about adding, the lower share price could make CP more attractive as a long-term hold. I tend to favour companies with stable cash flows and essential infrastructure—CP ticks both boxes, especially in uncertain markets.

Railways have impenetrable business models. With the cost of developing rail lines in the millions of dollars per mile range (and this is for a completely flat track), it just doesn’t make sense for competitors to enter the market.

This means that despite weak freight volumes impacting results right now, it will not impact results over the long-term.

Freight Recession or Normalization? Q1 Results Show Resilient Volumes

Canadian Pacific Kansas City’s first quarter results cut through the noise around a so-called freight recession. Don’t get me wrong, freight volumes are down, we’ve witnessed it with trucking companies like TFI International. However, CP’s operations seem largely unimpacted.

Revenue came in at C$3.8 billion, up 8% from last year, while EPS grew by double digits. Sure, a large chunk of this growth is due to the Kansas City acquisition, but it’s growth nonetheless in a very rough operating environment.

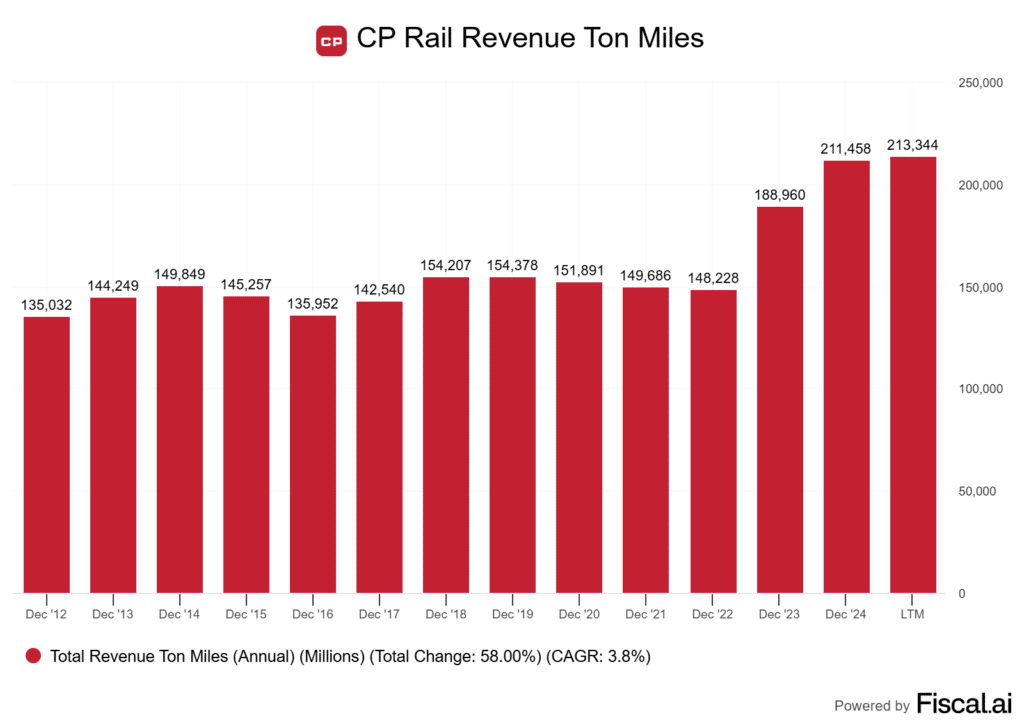

Volumes, as measured by revenue ton-miles, were up 4%.

In a market where many carriers are shrinking or consolidating, seeing CP’s growth in both revenue and efficiency stands out. The company’s operating ratio improved, dropping 210 basis points to the low 60% range. Despite a slowdown in volume, the company’s trains are becoming heavier, carrying more, all while improving fuel mileage.

It’s tempting to call this a full rebound, but management’s tone was sensible. They highlighted uncertainty around tariffs and trade policy. That cautious guidance shouldn’t be ignored. However, the numbers themselves point more toward normalizing demand outside of the pandemic than an outright recession.

How CP’s ‘Room to Grow’ Industrial Sites Fuel Its Moat

CPKC’s Room to Grow plan is a land development initiative where the company is utilizing over 6,000 acres of unused rail-connected land across North America to attract industrial customers like manufacturers, warehouses, and logistics companies.

Canadian Pacific Kansas City’s “Room to Grow” strategy is a textbook example of how a railway can deepen its moat in the North American market. CPKC isn’t just selling land, it’s selling access to critical infrastructure.

The lots are prime, rail-served sites stretching across Canada, the U.S., and Mexico. Anyone who understands how industrial site selection works knows that proximity to efficient rail access is a non-negotiable for big shippers. This is because rail is still out primary form of shipping.

Here’s why these Site Ready properties matter:

- Faster Development: Businesses can build quickly, with much of the site work and rail access already in place.

- Recurring and Diversified Revenue: Rail-served industrial tenants can anchor long-term leases or usage agreements, adding new revenue streams beyond just moving freight.

- Strategic Location: Many of these sites are close to major trade corridors, allowing CP to benefit from economic growth in key regions.

Is the Company Valued Correctly for Double Digit Growth?

Canadian Pacific Kansas City’s (CPKC) forward guidance, has management aiming for 12% to 18% earnings per share growth in 2025. Those numbers are strong by any TSX large-cap standard and reflect confidence in the cross-border rail network’s competitive advantages.

But the market isn’t leaving much on the table for bargain hunters. The latest numbers show CPKC trading at around 26x earnings and 16x EV/EBITDA. Make no mistake about it, the railways are never “cheap”, primarily due to their large economic moats.

Here’s a quick snapshot of CP versus its competitor CN Rail. As you’ll notice, CN is cheaper, but CP is expected to grow much faster because of the acquisition of Kansas City Southern.

| Company | P/E Ratio | EV/EBITDA | EPS Growth (Est. 2025) |

|---|---|---|---|

| Canadian Pacific Kansas City | 26× | 16× | 12–18% |

| Canadian National Railway | ~20× | ~13× | 5–7% |

Is it worth the premium? I would argue yes. When companies trade at high valuations like this, I tend to look to historical averages to learn why. And in this case, the market has paid this price for the railways for many years, and it is likely they’ll continue to pay this valuation moving forward.

The Downside: Tariffs, Labour Deals & Execution Could Trip up CPKC

It’s impossible to ignore the backdrop of trade friction. The threat of renewed U.S. tariffs hangs over cross-border rails like a grey cloud.

Recent U.S. rhetoric about 25% duties on Canadian and Mexican goods is likely holding back the railways right now.

If tariffs kick in, freight volumes between the U.S., Canada, and Mexico could take a direct hit. Some shippers might try to front-load shipments, but that’s a short-lived boost. After the initial rush, expect cross-border flows to slow, hurting both top-line revenue and margins.

Labour also brings real execution risk. Teamsters in both Canada and the U.S. have secured significant gains in recent rounds of arbitration and bargaining. We all know how the rail strikes have went in Canada.

Higher wages and improved benefits mean rising operating costs, at a time when profitability is already under pressure. If we see more strikes or even slowdowns, operational reliability can quickly deteriorate, and investors should expect increased volatility.

Execution risk extends into integration, too. Merging three national rail networks isn’t as easy as the company might suggest. They are obviously inclined to be bullish. Cultural differences, regulatory hurdles, and ongoing capital needs could all sap management’s ability to integrate Kansas City efficiently.

However, I do believe that the long-term prospects of the railways outpace the headwinds. I’m a buyer of CP Rail at these levels, and I do believe they will be one of the best performing railways moving forward.