This Top Canadian Stock Has Crushed Nvidia – But Has It Peaked?

Key takeaways

AI-focused hardware growth is driving strong revenue gains

Profit margins and cash flow are improving at a steady pace

Outlook and guidance support further upside potential

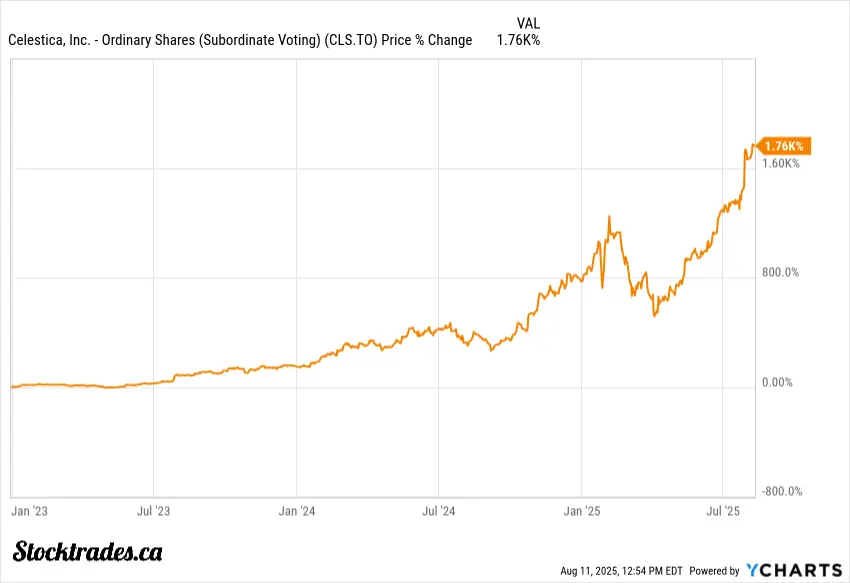

3 stocks I like better than Celestica.Celestica has been one of the most impressive performers on the TSX over the last 2-3 years. Surging demand for AI infrastructure and a shift in focus to higher-margin business lines have launched the company.

I’ve followed Celestica for quite some time, and the transformation from a traditional electronics manufacturer to a serious player in artificial intelligence is impressive. This was really not all that good of a company prior to the AI boom at all.

In fact, if you owned it from 2010-2023, you had only 3.2% annualized returns, barely outpacing inflation.

What grabs my attention isn’t just the revenue growth, it’s where that growth is coming from. The Connectivity and Cloud Solutions segment, especially in AI-focused hardware platforms, is driving significant results.

Pair that with disciplined cost control and rising margins, and you get a business that’s executing at a high level. There’s still room to expand, too.

However, valuation is always tricky with a stock like this. But when I compare the numbers to the growth outlook, the premium seems justified, which is crazy to say after a 1700%+ run.

Let’s dive into whether or not this company is still a buy today.

28% Revenue Growth in High-Margin AI Hardware

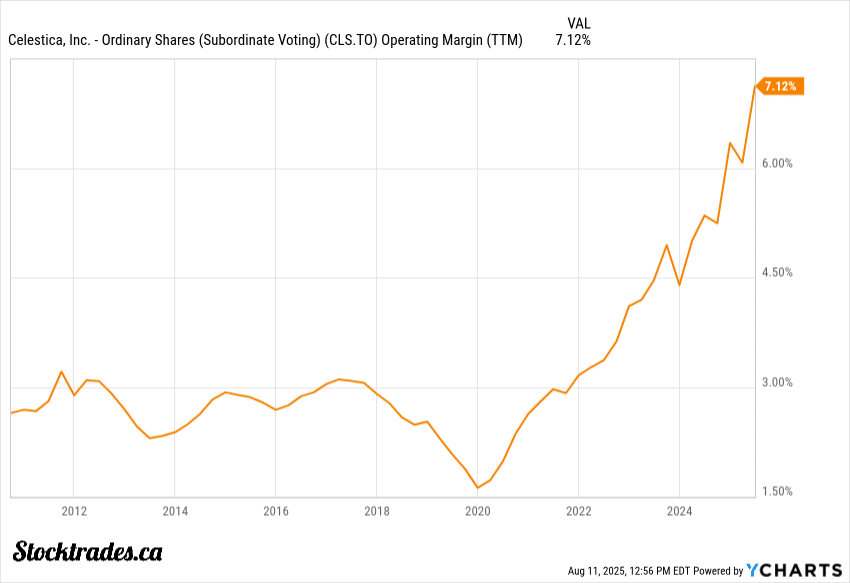

Celestica’s latest results showcase how much its Connectivity & Cloud Solutions is growing. In Q2 2025, CCS revenue climbed 28% year-over-year to $2.07 billion with an operating margin of 8.3%.

Prior to the AI boom, you’d be lucky to see this company’s operating margins go above 4%.

The real driver here is AI and hyperscaler infrastructure demand, especially when it comes to data centers.

Celestica is shipping high-value hardware like the ES1500 campus switch. This aligns with open-source network software such as SONiC, giving large cloud customers more flexibility while keeping costs competitive.

Hyperscalers are in the middle of multi-year AI buildouts, and Celestica has secured its place in that supply chain. The only difficulty now is predicting the cyclicality of that buildout.

The nearly 82% jump in Hardware Platform Solutions revenue shows they’re winning meaningful orders, not just incremental upgrades.

Celestica isn’t chasing volume at the expense of profitability. Instead, they’re scaling in areas where operational leverage is strongest. If AI infrastructure spending holds up, Celestica’s earnings will keep growing. Which seems crazy to say considering they’ve increased by 1200% since 2019.

7.4% Adjusted Margin and Free Cash Flow Up Sharply

As mentioned, Celestica delivered 7.4% operating margisns, the highest the company has posted in decades.

That’s a sign they’re running a tighter, more disciplined operation. As a result, free cash flow jumped about 86% to $120 million on the quarter and now sits at $530M through the last 12 months.

Management kept capital spending lean at only 1.1% of revenue, which is rare for a manufacturer. In fact, when I looked at the company I really didn’t believe this number at first glance.

Strong free cash flow gives Celestica more flexibility, whether that’s buying back shares, investing in higher-margin segments, or simply building a cash buffer to strengthen its balance sheet to ride out the waves of a potential reduction in AI spend.

I see this as a competitive edge. Many tech manufacturers chase revenue at the expense of margins, but Celestica is proving it can grow while keeping profitability front and centre.

Full-Year Outlook Raised to $11.55B Revenue and $5.50 EPS

| Period | Revenue Guidance | EPS Guidance |

|---|---|---|

| Previous FY2025 | $10.85B | $5.00 |

| Updated FY2025 | $11.55B | $5.50 |

After a solid Q2, Celestica boosted its 2025 outlook, now targeting $11.55 billion in revenue and $5.50 in adjusted EPS.

That’s an increase from $10.85 billion and $5.00 just a quarter ago. What this tells me is they don’t feel demand is going anywhere.

The Q3 forecast also looks healthy. They expect revenue between $2.875B and $3.125B and adjusted EPS between $1.37 and $1.50.

If they hit the upper end, it keeps their momentum intact and reinforces the case for holding this company even through a meteoric run, as I know a lot of investors are going to be looking to take profits.

When a company like Celestica raises guidance this much, it can justify a higher multiple. Especially for a TSX tech name that still trades at a discount to U.S. peers.

I also see this as a sign management is navigating supply chain and macro headwinds better than most. That makes the stock more appealing, particularly compared to other industrial tech plays with flat or lowered guidance.

Disciplined Capital Returns

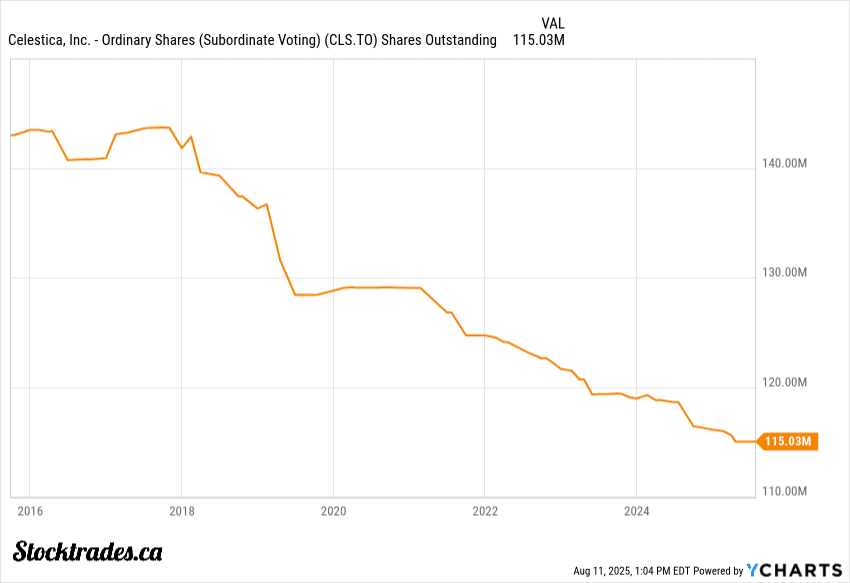

I like to see a company return capital without stretching its finances, and Celestica fits that bill. In the last quarter, they repurchased 0.6 million shares for $40 million, bringing the year-to-date total to $115 million. If you look to the chart below, the company has repurchased nearly 20% of shares outstanding over the last 10 years, with buybacks accelerating now.

With CAPEX coming in at 1%~ of revenue, you’re ultimately going to have a lot of free cash flow left over to buy shares.

Net debt sits around 0.9× trailing EBITDA and only around 2x their annual free cash flow. To sum it all up, the balance sheet is rock-solid.

This kind of steady buyback strategy and low levels of debt can quietly compound returns over time. It’s not flashy, but reducing share count at reasonable valuations has a lasting impact on long-term value.

I’d rather see this measured approach than a splashy, debt-fuelled buyback. It signals management is thinking about both the next quarter and the next decade.

Strategic Shift to AI Infrastructure

The real story with Celestica now is its pivot from low-margin electronics manufacturing services (EMS) to a higher-value Original Design Manufacturer (ODM) role. This isn’t just a rebrand, it’s a structural shift that changes how the company operates.

By focusing on AI data centre infrastructure, Celestica is targeting customers like hyperscalers who need custom, high-performance hardware. The interesting thing here is that Celestica also designs the hardware, creating a very sticky business model, as hyperscalers will go back to Celestica because the system is custom.

This is a smart way to shield itself from the commoditization that plagues standard manufacturing. Higher margins and longer-term contracts improve earnings stability, which is exactly what investors want to see.

This shift positions Celestica to capitalize on cloud and AI spending cycles, rather than being at the mercy of short-term electronics orders.

My Take on Celestica

Celestica stands out as one of the most interesting growth stories on the TSX right now. In fact, it is even crushing some of the US-related AI names like Nvidia, Microsoft, etc.

The move toward higher-margin ODM services feels like a smart shift. It’s helping profitability and giving Celestica more control over its own value chain.

Strong free cash flow and steady share buybacks tell me management’s focused on creating value for shareholders.

But I can’t just ignore the valuation. With a P/E close to 48, the market’s already pricing in a lot of good news. At 28x expected earnings, it seems a bit more “fair”, however it is hard to ignore how bullish analysts are on AI in the future, and as always, forward P/E is based on their expectations.

The stock’s upside probably depends on whether hyperscaler demand and margin gains stick around through 2026. That’s not exactly a sure thing, especially if AI hardware spending slows down.

I’m cautiously optimistic about the company. If you’re buying and holding at these levels, there is still plenty of upside if AI capex continues to accelerate. However, if we see a slowdown here, we will likely see a downgrade in forward earnings revisions and some extensive volatility in Celestica’s stock price.