Is Cenovus Energy a Buy Right Now?

Key takeaways

Cenovus has strengthened its balance sheet and met key debt targets

Refining operations help offset oil price volatility

Current valuation offers upside for patient investors

3 stocks I like better than Cenovus EnergyDespite some solid operating results, Cenovus stock has been on a multi-year slide. Naturally, when this happens, a lot of investors ask whether or not the company is still a buy.

I don’t blame investors for asking the question. Cenovus hit its net debt target and boosted production guidance. At today’s valuation, I think Cenovus is a reasonable option for those looking for exposure to the energy sector outside of the major producers like Canadian Natural, Imperial, or Suncor.

Cenovus isn’t just another oil sands play, which I appreciate as well. Its refining operations help smooth out earnings when crude prices swing, and the balance sheet looks healthier than most peers.

The energy sector is never risk-free. Commodity prices, regulatory pressures, and operational hiccups have plagued it for years. There is also the added element that, in my opinion, capital will always flow into this space at a slow rate due to the world’s insistence to go greener forms of energy.

But for a dividend stock trading at a reasonable multiple and returning large amounts of cash to shareholders, I can see the attractiveness.

Upstream/Downstream: What Q2 2025 Really Showed

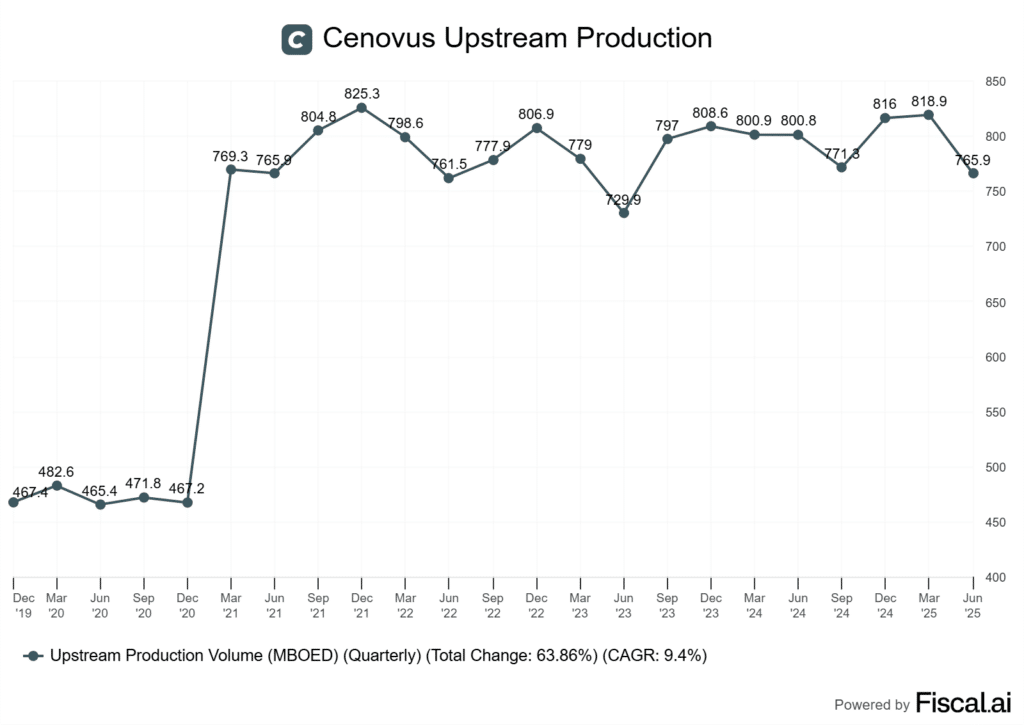

Investors need to pay attention to Cenovus’s upstream numbers. That’s where the real production leverage sits.

Output slipped to about 765,900 boe/d. This wasn’t a surprise once you factor in planned maintenance, the wildfire shutdown at Christina Lake, and the Rush Lake thermal outage.

The Rush Lake issue stands out. Management has now cut full-year production guidance to 805,000–825,000 boe/d, which trims some upside for 2025.

Crude throughput came in at roughly 665,800 bbl/d. Canadian refining ran at an impressive 104% utilisation.

This performance helped offset weaker upstream volumes and showed the value for investors when it comes to holding an integrated producer.

Cenovus finished the Toledo turnaround 11 days early. That not only saved costs but also brought capacity back online faster.

That kind of execution deserves more credit than it usually gets in the market. I worked in this sector for many years in Fort McMurray, and I’m not sure I was ever part of a turnaround that finished ahead of schedule.

For me, the quarter showed Cenovus’s integrated setup cushions the blow a bit when upstream hits a snag. If oil prices soften, that downstream stability could be the difference between steady dividends and a cut.

Where Net Debt Sits and Why It Matters

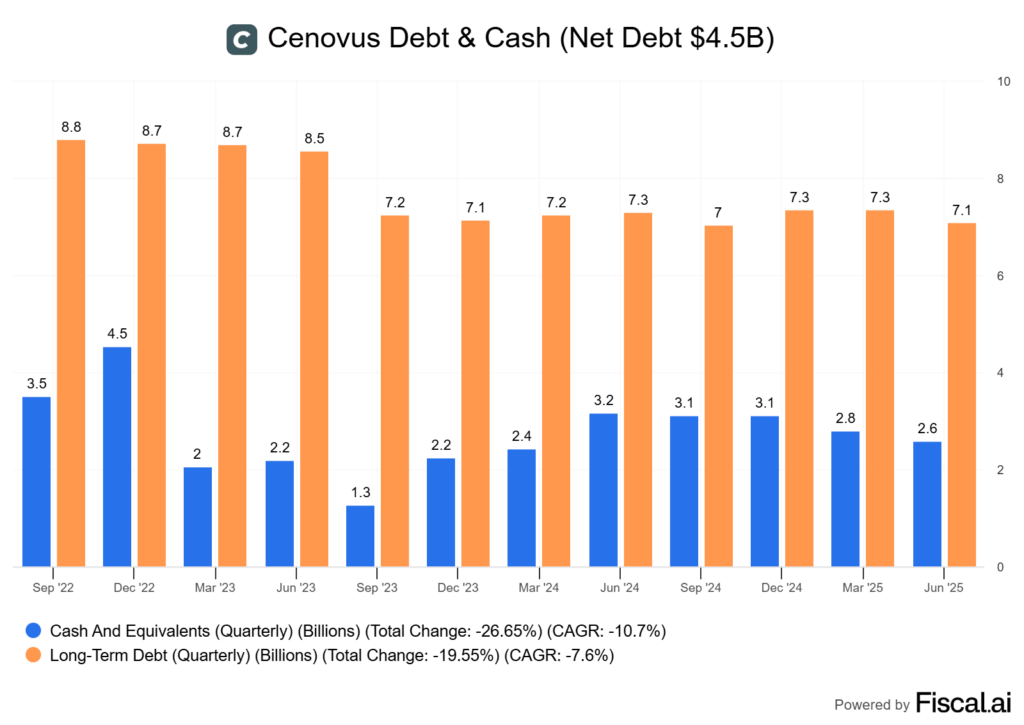

Cenovus closed Q2 with net debt of about C$4.5 billion.

The debt level is important because management has been clear about their overall shareholder return policy relative to their debt. Once net debt holds near C$4 billion, Cenovus aims to return 100% of excess free funds flow to shareholders.

The difference between C$4.9B and the C$4.0B target may not seem huge. But it decides whether cash gets split between debt and equity holders or flows entirely back to investors. In an industry that sees very little inflows in terms of capital from investors, I do believe returning money back to shareholders and letting them choose what to do with it is optimal.

For those holding Cenovus, that shift could mean a steadier stream of buybacks and dividends. It’s also a sign the balance sheet can handle commodity price swings without forcing a pullback in returns and a slowdown in dividend growth.

In my opinion, you need this disciplined approach in a sector where many companies chase production growth at the expense of shareholder value.

Utilization, Margins, and Outlook

I think the company’s downstream production is a bit of a buffer against swings in upstream pricing. In Q2, the company’s U.S. refineries hit a 58% market capture rate, well above expectations.

That kind of execution matters when heavy-light differentials widen. Refining margins have started to recover after a weak 2024.

Management expects the U.S. refining outlook to improve into the back half of the year. That should support crack spreads and enhance integration benefits.

| Metric | Recent Result | Comment |

|---|---|---|

| Utilization Rate | ~79% | Consistent with past five quarters, showing operational stability |

| Market Capture | 58% | Stronger than forecast, boosting margins |

| Cost Reduction Target | $2/bbl | Management goal for U.S. refining assets |

Why is this so important?

If upstream hiccups persist, like the persistent wildfires in Alberta or the Rush Lake shut-in, this refining strength can keep cash flow steady. I view this as a key reason Cenovus trades more like an integrated major than a pure-play producer.

The ability to capture higher margins while controlling costs is a pretty key strategic advantage.

Oil Sands Optimisation, Decarbonisation, and M&A Watch

Cenovus’s near-term growth isn’t about chasing barrels at any cost.

Incremental volumes will come from reliability and margin capture projects, not risky greenfield bets. The West White Rose project fits that mindset.

Long-term, the company’s licence to operate hinges on delivering credible emissions cuts. The Pathways Alliance carbon capture and storage plan is the centrepiece.

It’s ambitious, but policy clarity and federal/provincial funding will decide how quickly it moves from an idea to actual boots on the ground. Without that support, timelines could really stretch.

I like that Cenovus is already improving emissions intensity across its oil sands assets. Canadian producers have been reducing emissions per barrel faster than many global peers, which matters for an industry that already struggles to attract interested investors.

Still, absolute emissions caps will force tougher choices in the next decade. On the M&A front, rumors about a possible Indigenous-partnered bid for MEG Energy is intriguing.

It could consolidate high-quality oil sands production under a stronger balance sheet. But it’s certainly not risk free. Integration, price paid, and political considerations would all determine its success over the coming years if it happens.

What Could Break the Thesis With Cenovus

With all oil producers, short disruptions can end up impacting cash flow hard.

A shutdown at Rush Lake or a wildfire near core oil sands assets could force production cuts. That would delay buybacks, debt repayment or dividend hikes, which would no doubt frustrate shareholders.

Policy risk is another wildcard. If federal carbon capture funding shifts or new emissions caps tighten, cost curves could jump fast. This would squeeze margins and slow the pace of capital returns that investors would get.

Heavy oil differentials matter too. When the spread between Western Canadian Select and WTI widens, realized prices drop.

If pipeline bottlenecks stick around, Cenovus could see weaker netbacks. That makes it harder to keep both debt reduction and shareholder payouts moving.

Large acquisitions always bring execution risk. If management goes after a big deal like a MEG Energy bid, integration missteps or overpaying could put pressure on the balance sheet.

That would limit flexibility for buybacks, especially if oil prices dip at the same time.

Final Thoughts: My Take on Cenovus Energy Inc.

Cenovus is no doubt interesting, but I do tend to lean more towards a major player like Canadian Natural for energy exposure.

There are risks. Operational incidents and wildfire disruptions can hit both production and costs. However, this is much the same with any oil producer.

Policy uncertainty around carbon capture cost-sharing could affect long-term projects. The price differential between WTI and Western Canadian Select can also swing hard, impacting netbacks.

And although the MEG acquisition could add value, there is risk. If integration struggles, shareholders will be impacted.

If I were adding to my energy exposure today, Cenovus would certainly be on my shortlist, but as mentioned I think I would still opt for a major producer like Canadian Natural.