Is This Blue-Chip Defensive Stock Too Expensive To Consider in 2026?

Key takeaways

Membership fees keep profits steady, but growth relies on expansion and spending trends

E‑commerce and private labels offer potential, though cost pressures could limit margins

High valuation rewards stability, leaving modest near‑term upside but solid long‑term appeal

3 stocks I like better than Costco.Costco Wholesale feels like a company priced for execution, not discovery. Its valuation sits well above Walmart and Target, but the business keeps showing why people pay up.

The company’s recent quarter showed 9% year-over-year revenue growth. Net income keeps climbing, powered by a membership model that keeps renewal rates near 93% in North America.

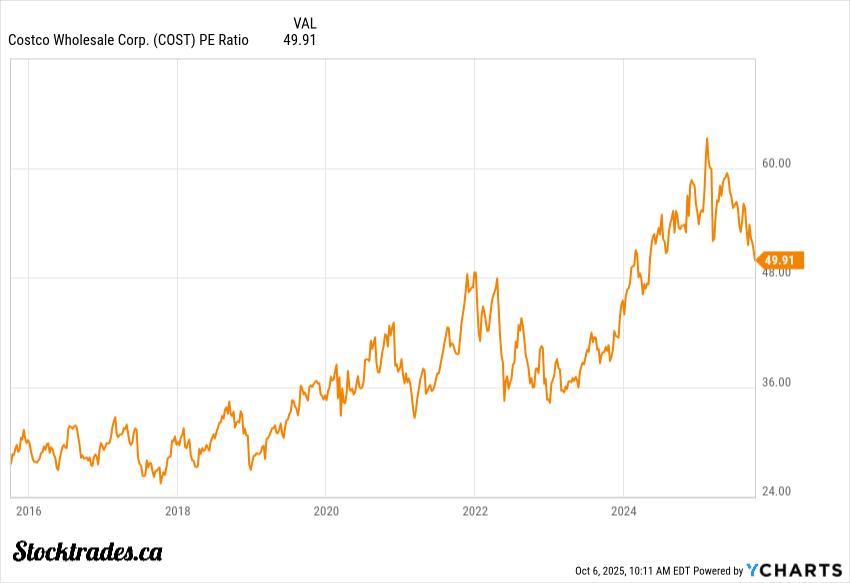

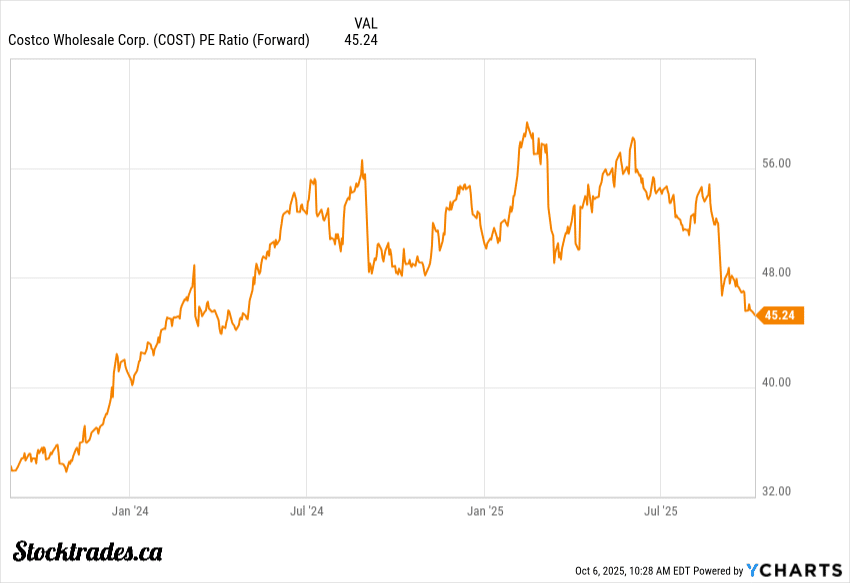

However, the company is certainly expensive, even after a relatively rough year, trading at 50x earnings. This is more expensive than many of the top tech names like Nvidia, Microsoft, or Alphabet.

I see Costco as a long‑term hold for stability and modest growth, not a bargain for quick upside. The company still has a ways to go before we get back to historical valuations.

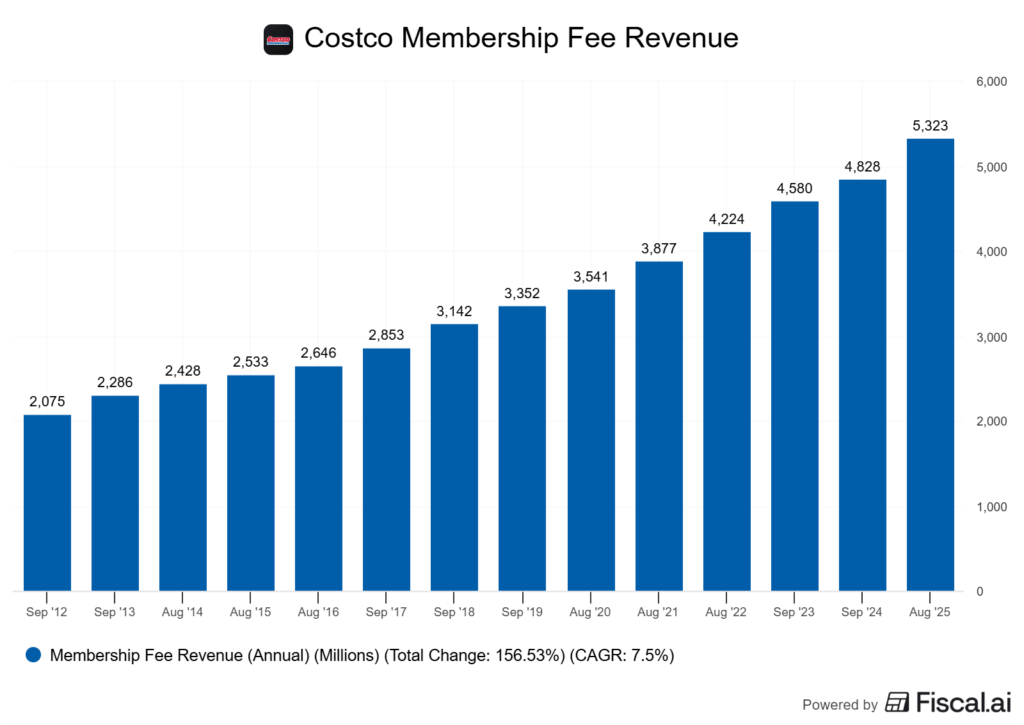

Predictable membership fees and disciplined cost control drive the company’s strength. The September 2024 fee hike added some momentum, bumping membership revenue over and above new additions.

But with the stock’s high multiple, there’s not much room for error if margins tighten or expansion slows. That’s the trade‑off. Dependable cash flow, but limited near‑term upside.

Costco fits best in a defensive portfolio that values consistency over speed. New warehouse openings and private‑label growth might lift earnings, but global cost pressures, consumer sentiment, and execution will really decide what investors get.

Membership Model Anchors Resilience, But Growth Isn’t Unlimited

Costco’s latest quarter showed the membership engine still works. Net sales rose about 8% year over year, and membership fees climbed roughly 11%, hitting US$1.24 billion for the quarter.

That’s the quiet power behind the business: steady, high-margin income that cushions thin retail margins. The company’s renewal rate sits near 90%, a level most subscription businesses would envy. Consumers almost immediately find value in a Costco membership.

Loyalty forms a structural moat. It’s not just repeat traffic. It’s predictable revenue that funds expansion and keeps prices low. But Costco’s growth depends on adding new members, not just selling more to existing ones.

Executive memberships grew faster than total member. What this tells me is more consumers are making Costco their core shopping experience, as a minimum amount of spend is required to make executive memberships worth it.

The risk? Growth doesn’t scale forever. Renewal rates can’t rise much higher, and warehouse expansion has physical limits.

If competitors like Amazon or Walmart chip away at perceived value, Costco’s retention edge could shrink. Still, the membership model remains the company’s anchor. A simple idea that keeps delivering, even if the growth runway isn’t as long as it used to be.

E‑Commerce & Private Label Drive Upside, But Margin Pressure Looms

Costco’s latest quarter shows steady growth in the right places. Net sales rose about 8% year over year. Online sales jumped roughly 15%.

The company’s omnichannel push is working, but logistics costs and wage inflation are tightening the screws. The Kirkland Signature brand is a quiet engine, now driving a big share of total revenue and helping Costco defend its pricing edge.

Analysts say Costco’s private label strategy fits a broader retail trend, where private label growth is reshaping margins. The upside? Costco controls quality and sourcing.

The risk: It doesn’t scale cleanly if input costs rise faster than national brands can adjust. Here’s how I see the moving parts:

Competitor dynamics are shifting. Retailers like Costco face intensifying price competition from private labels.

That keeps Costco’s scale advantage relevant, but limits pricing power. It works for now, if margins stay stable as digital fulfillment and supply chain costs rise.

Expansion Strategy Is Solid But Execution Risks Remain

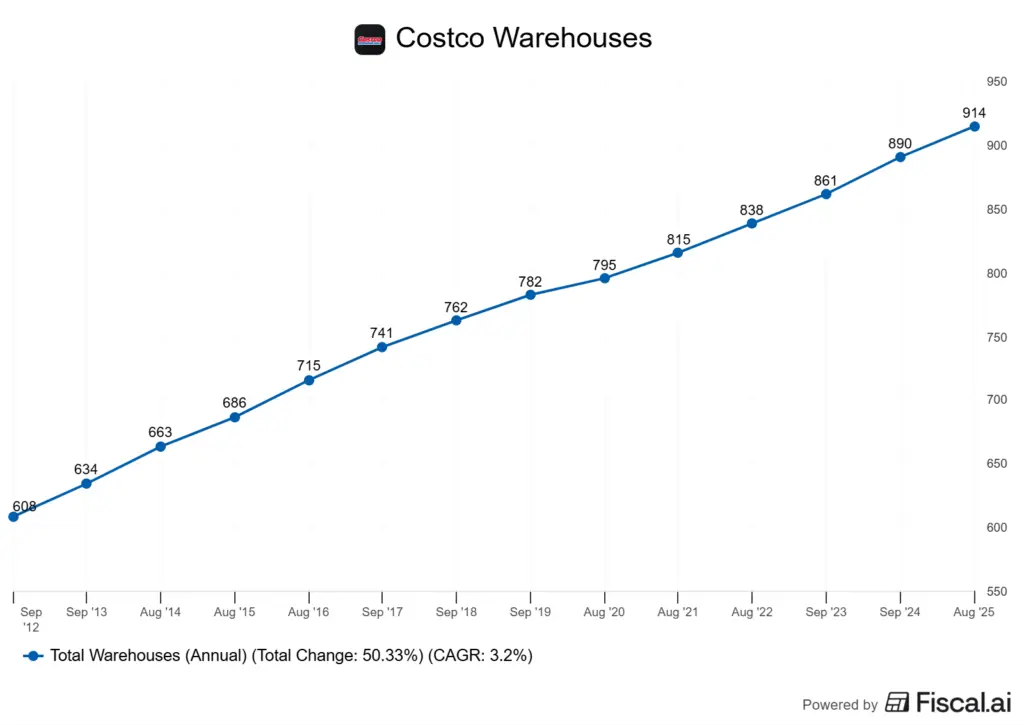

Costco’s growth still runs on physical expansion. The company plans about 28 new warehouses in fiscal 2025, including sites in South Carolina, Pennsylvania, and Ontario.

That’s steady progress for a retailer already running more than 900 locations worldwide. The question is whether each new build still adds meaningful value.

The membership model gives Costco unusual predictability. Annual fees cover a large share of operating income, while new warehouses add local scale and help spread fixed costs.

Capital expenditures, about $5 billion, reflects Costco’s focus on steady, self‑funded expansion. It works if new markets keep absorbing that capacity without eroding returns.

But there’s a catch. Expansion in mature U.S. regions risks cannibalizing existing stores. A new warehouse can shift sales rather than grow them, especially in dense markets.

International growth adds complexity. Entering markets like China, Japan, and Mexico brings upside but also regulatory, real estate, and cultural hurdles that slow ramp‑up.

Execution is the swing factor. Building 25–30 sites a year sounds manageable, but each opening demands strong local sourcing, staffing, and logistics.

If same‑store sales slip below mid‑single digits for any extended period of time, I’d call that a sign of saturation pressure. For now, Costco’s footprint still expands efficiently, but it’s priced for near perfect execution.

Tariff, Inflation & Inventory Risks Cast Shadows

Costco’s latest quarter showed strong traffic and steady membership gains. But the earnings miss hints at cost pressure building beneath the surface.

Profit margins slipped as tariffs and inflation pushed up import and logistics costs. The company did boost gross margins, however, primarily off of strategic methods of sourcing for its products.

That’s the tension I’m watching most closely. CEO Ron Vachris says Costco will try to limit the impact of tariffs on customers, but that’s easier said than done.

Less than one‑sixth of U.S. merchandise is imported from China, Mexico, and Canada, which helps. Still, higher import exposure can ripple through commodity inputs and packaging materials, narrowing Costco’s buffer margin.

CFO Gary Millerchip said tariff uncertainty led Costco to pull forward inventory purchases. That cushions supply chain disruption but ties up working capital and increases inventory risk if demand softens.

It’s a fine balance between resilience and over‑stocking. Inflation adds another layer. Rising fuel and commodity costs erode the thin operating margin that defines Costco’s model. One that works very well, but also one that is exposed to more risk today than it was 3-4 years ago.

Costco’s scale helps, but inflation’s stickiness limits flexibility to absorb shocks without passing them along.

Tariffs could weigh on near‑term profitability. Costco’s business model is genius, but it is a model that has never faced this kind of volatility.

The loyal membership base is a big upside. But cost discipline alone might not offset global price pressure. I guess we’ll see how it plays out.

So, Is The Company a Buy at 50x Earnings?

Costco’s latest quarter showed steady execution. But honestly, the market already prices it as if growth will stay this consistent for years.

At roughly 50 times trailing earnings and near 45 times forward earnings, the valuation looks stretched compared with Walmart and Target. Those two trade closer to the mid‑20s. Yes, Costco’s flywheel deserves a premium valuation. But this much? It’s difficult to say.

Even BJ’s Wholesale sits well below Costco’s multiple. The premium really reflects Costco’s reliability, but it also leaves little room for short‑term upside unless margins expand faster than expected.

Most of the company’s margin tailwinds come from scale efficiency and membership renewal strength, not pricing power. A modest membership fee hike could lift operating income, but that lever is limited. In fact, considering they just did one last year, I don’t expect another anytime soon.

International expansion remains a long‑term catalyst. Still, it probably won’t move near‑term earnings enough to justify the current multiple.

If earnings growth slows below or margins compress, that upside disappears quickly. The swing factors? Sustained membership renewal above 90%, disciplined cost control, and measured international growth.

I think Costco is one of the best businesses on the planet. However, I also think it is important that investors separate the business from the valuation. It is simply too expensive at this point in time to have any sort of meaningful margin of safety.

There will be a time to enter, and in my opinion, that time is not now. That doesn’t necessarily mean Costco has to go down in price. It could simply consolidate like it has over the last year while it grows into its current valuation.