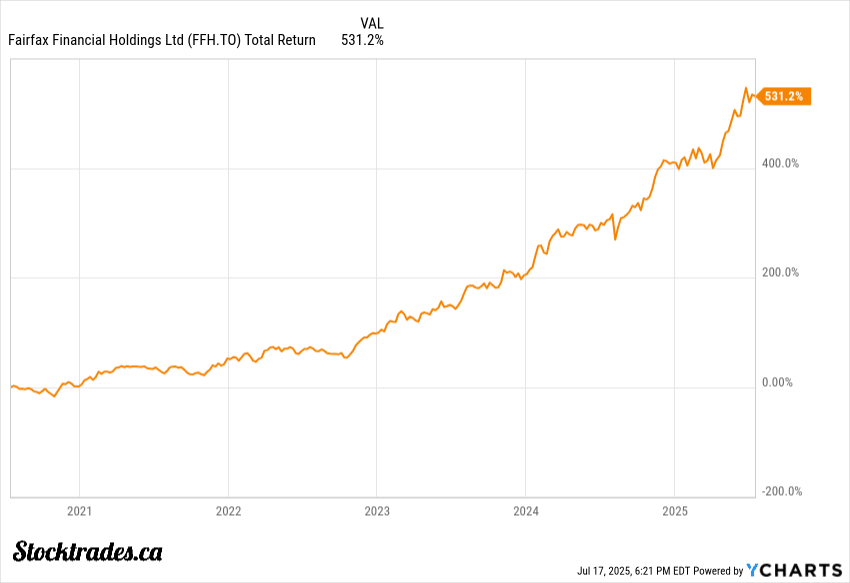

Has Fairfax Financial Stock Ran Out of Steam or is There More Upside?

Key takeaways

Fairfax’s investment success depends on smart, flexible decisions in a changing market.

The insurance business offers steady cash flow even when conditions get tough.

Growth relies on balanced risk and a healthy balance sheet.

3 stocks I like better than Fairfax right now.Fairfax Financial feels like one of those well-kept secrets among Canadian investors. It’s built a reputation for resilience, and is often dubbed the “Canadian Berkshire Hathaway.”

The company’s mix of insurance and investments has delivered for years, despite a large slipup during the financial crisis in 2008. I still think Fairfax looks like a buy, but only if you’re patient and can handle a few bumps along the way.

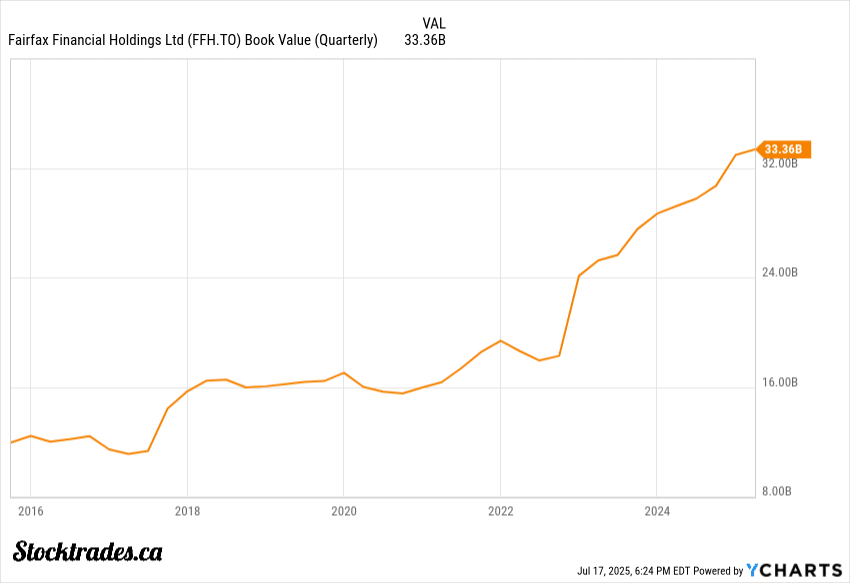

As mentioned, the business model reminds me of a smaller Berkshire Hathaway, where disciplined underwriting meets investing. The only difference is Fairfax is a bit more unconventional than Berkshire. Under Prem Watsa’s leadership, Fairfax has compounded book value faster than most companies on the TSX.

But it’s not all smooth sailing. Fairfax’s gains have be unpredictable due to its aggressive investing strategy, and investors need to be aware of this.

Can Fairfax’s Investment Gains Keep Delivering in a More Volatile Market?

Fairfax’s investment engine posted a standout quarter, with net investment gains topping US$1.05 billion. Most of that came from strong results in both equities and bonds, which backs up the stock’s reputation for making shrewd calls in unpredictable markets.

This isn’t the first time we’ve seen this pattern. Prem Watsa, Fairfax’s CEO, has earned his “Canadian Warren Buffett” status for good reason.

Watsa doesn’t shy away from bold macro bets or building meaningful positions in select companies. I’ve watched his moves for years, and he’s not afraid to zig when others zag. Outside of some poor bets during the financial crisis, he has done very well.

The approach is high conviction and sometimes a bit contrarian. How do they handle risk with this approach? Fairfax’s fixed-income portfolio leans heavily on government bonds, with a shorter duration than some Canadian insurers. This reduces their rate risk, so rising rates don’t hit them as hard.

Equities are a wildcard. Fairfax keeps a larger chunk of assets in stocks than many TSX insurers, and that’s led to both big wins and swings in book value. But it also takes aggressive bets in turnaround plays like Blackberry, which I’m not all that big of a fan of.

Fairfax’s boldness has paid off in the past, but the same risk-taking can sting if rates or markets move against them.

Underwriting Stability in the Face of Catastrophes: Still a Strength?

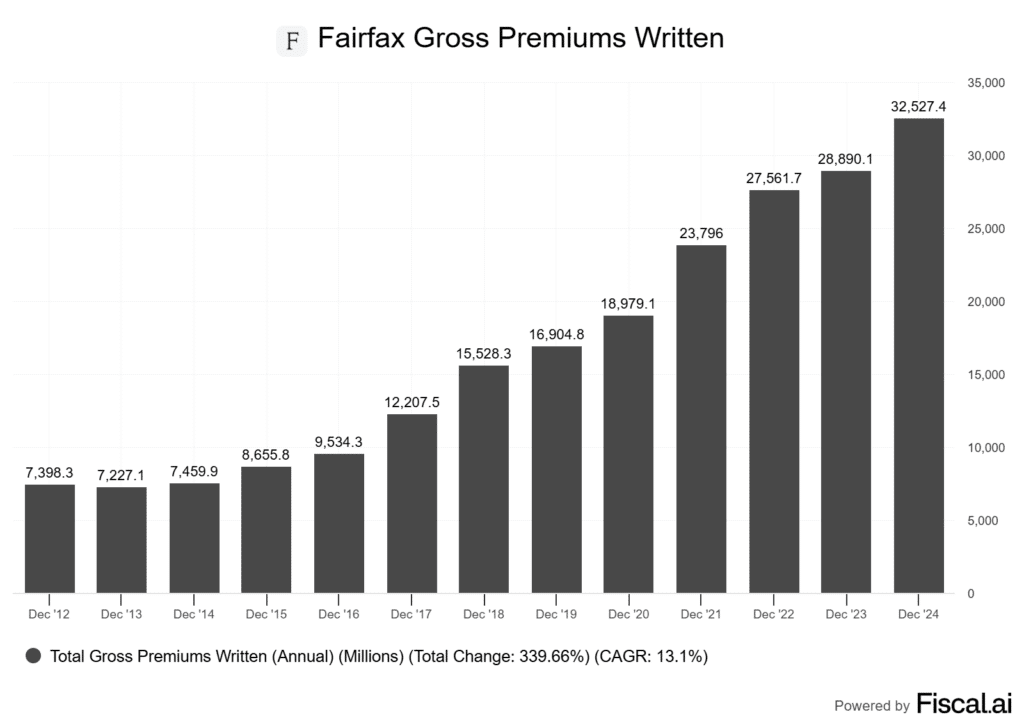

Fairfax’s success is based off its underwriting, even after a turbulent stretch of catastrophic losses. The company posted a Q1 combined ratio in the low 90% range, meaning premiums more than covered claims and expenses. This allows them to then invest those profits into equities and fixed income.

Natural disasters like the California wildfires have an impact. Fairfax estimated losses of up to $750 million from these events, which is big, but didn’t tip the company into a sustained underwriting loss.

That matters for Canadian investors focused on steady performance. A key advantage is Fairfax’s global reach and mix of property and casualty insurance. On the insurance side of things, it is more geographically diversified than Berkshire, which exposes it to underserved insurance markets in Asia.

When wildfires, hurricanes, or floods hit, Fairfax isn’t left exposed in just one market or product. This diversification lets the company absorb large hits and still produce a profit on its underwriting in most years.

Fairfax still acts like a disciplined insurer at its core. Even when catastrophe losses spike, reserve redundancies and tight expense management keep volatility in check.

Insurance Float Meets Opportunistic Investing

Fairfax Financial’s approach is a rare blend I genuinely respect. At its core, the company runs a dual-engine model.

First, it writes property and casualty insurance policies that, by collecting premiums up front and paying claims later, generate “float”, which is capital Fairfax can put to work in the interim.

Unlike most insurers who channel this float into stable government or corporate bonds, Fairfax actively steers its investment portfolio to seek outsize returns. This isn’t conservatism, it’s calculated risk-taking.

Here is how Fairfax does things differently:

| Traditional Insurers | Fairfax Financial | |

|---|---|---|

| Investment | Mostly bonds, low-yield | Equities, private deals, global holdings |

| Management | Passive, risk-averse | Active, opportunistic |

| Float Use | Preserve capital | Grow capital for compounding |

Prem Watsa, the company’s founder, has made bold moves before. For instance, Fairfax doubled down on Indian infrastructure when other insurers sat out.

The company took significant stakes in names like Altius Minerals and Eurobank Ergasias, showing a willingness to park capital where the odds seem most attractive, even if that means waiting years for a payoff.

I find this hybrid model appealing. While lumpy returns and patience-testing periods are part of the deal, Fairfax’s willingness to take calculated bets sets it apart from the sleepy insurance crowd.

How Leveraged Is Fairfax’s Growth Strategy?

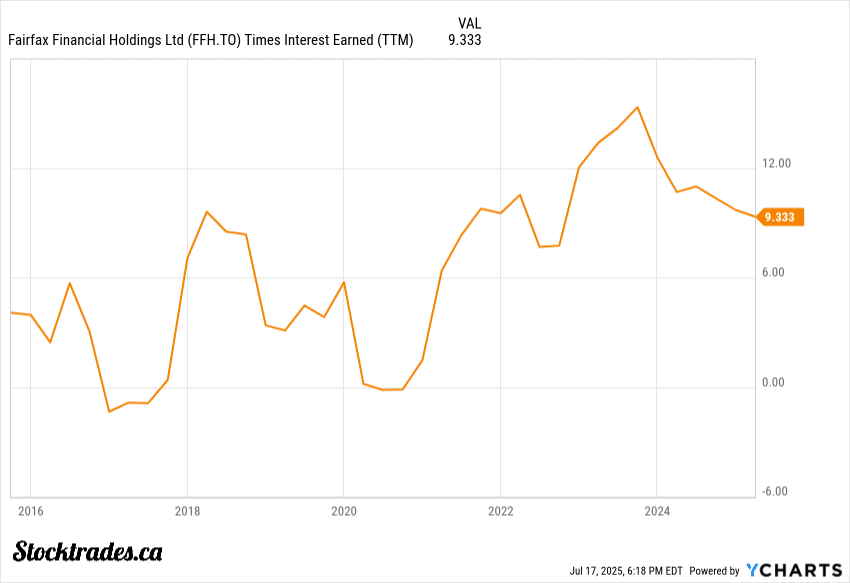

I look at Fairfax’s balance sheet and see a company built for resilience, not just growth at any cost. Their numbers show what some call a “fortress balance sheet.” High cash reserves and strong equity compared to total debt.

This gives them flexibility to act when others can’t. As of July 2025, the company held about $4 billion in cash and short-term investments. Their book value per share jumped 14.5% over the past year.

Unlike some insurers or conglomerates chasing yield by piling on leverage, Fairfax keeps their debt in check. Their interest coverage ratios remain well within the “comfortable” range.

The modest dividend (roughly C$20 per share, about 0.8% yield) isn’t a mistake. Fairfax prefers to put profits back into new investments or buy undervalued assets, a move that’s grown book value for years, and ultimately rewarded investors.

Some investors want a higher payout, but honestly, the focus on compounding value just makes more sense for long-term investors. If you’re banking on dividend income, Fairfax may feel a bit underwhelming.

For me, the real story is their discipline. They’re ready to strike with cash in hand if markets wobble, while others scramble for liquidity.

So, would I buy the company? If you’re looking for a Canadian option, absolutely I would. I do prefer Berkshire Hathaway over Fairfax because of its more conservative and long-term investing style, but I also acknowledge that during bear markets like the one we are in now, Fairfax has a real chance to outperform because of its more aggressive strategy.

Both are outstanding companies, period.