Is Great West Lifeco’s Torrent Run Over, or Is There Still Opportunity?

Key takeaways

Earnings come from a diverse group of business segments

Dividend yield and growth are appealing for long-term portfolios

Valuation is higher than before, so patience helps

3 stocks I like better than Great-West Lifeco.If you’re after dependable income and steady growth from a financial stock, Great-West Lifeco is tough to ignore. It has held up through a wide variety of market conditions and interest rate environments, and has certainly cemented itself as one of the best blue-chip stocks in the country.

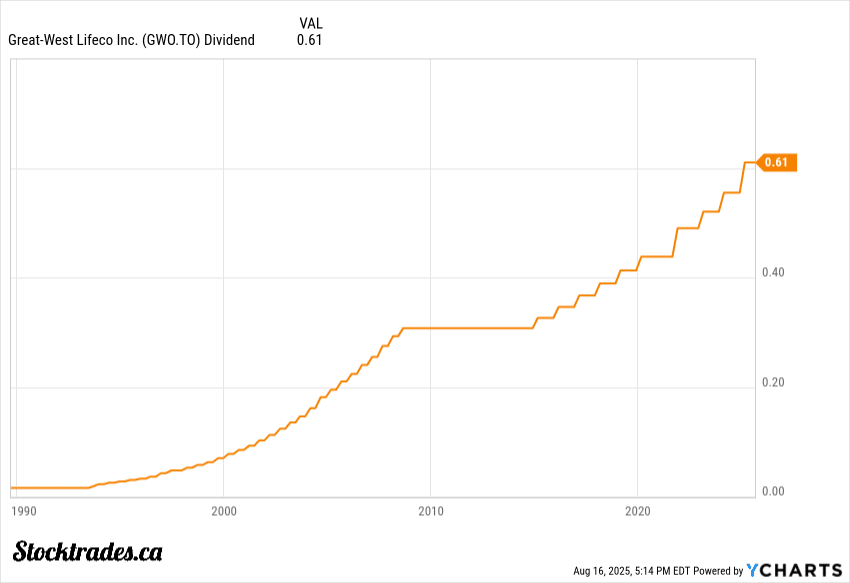

The company mixes insurance, asset management, and retirement services, so although it is a financial stock, it touches many areas of the space. Its dividend yield sits in the mid-4% range, and it’s got a strong record of boosting payouts, which is what I know income investors love.

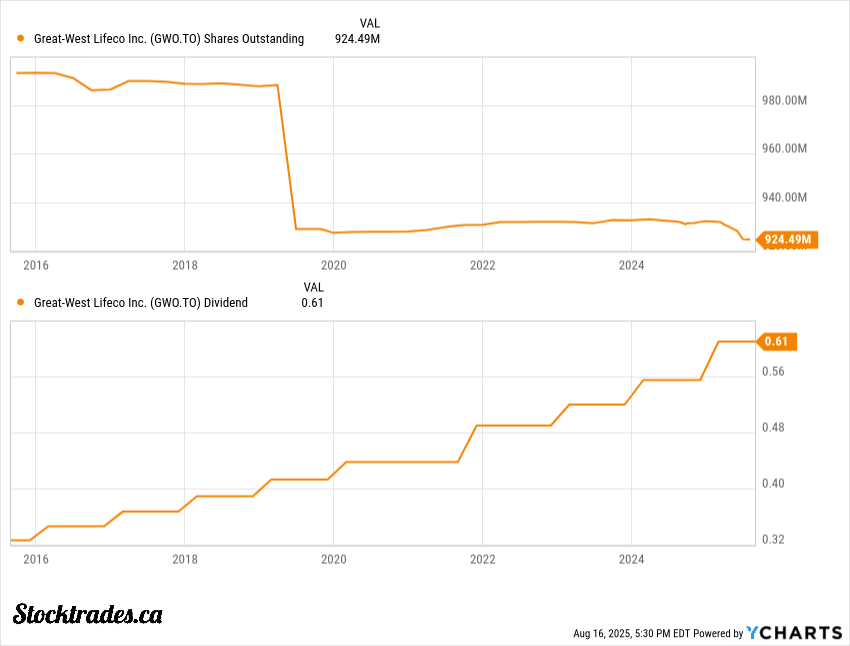

If you look to the chart below, you’ll notice the only time the company stopped dividend growth was post-financial crisis, which was the case with many companies.

The share price isn’t exactly cheap compared previous years, so patience and a long-term mindset are important here. Insurers went on a large run in a higher rate environment. Investors will need to watch for ongoing earnings strength in Canada, Europe, and the US.

Earnings, Mix, and What Drove Results

Great-West Lifeco’s Q2 was a solid beat on all fronts. Earnings came in at $1.24, which was 6% ahead of expectations and double digit growth from last year.

Organic growth and tight cost controls are starting to show. Reported net earnings dipped a bit, mostly from transformation charges and market impacts, but this shouldn’t be all that worrisome. Those costs tie into strategy shifts that should pay off down the road.

Here is a quick snapshot of how well the company did in each region it operates in.

| Segment | Performance Driver | Notes |

|---|---|---|

| U.S. (Empower) | Fee growth, participant gains | Retirement assets up, strong rollover flows |

| Canada | Group Benefits, Wealth | Disability benefits leadership, new estate planning partnership |

| Europe | Retail flows | Mass affluent focus offset by one-time institutional withdrawal |

| Capital & Risk Solutions | Organic growth | Exit from U.S. mortality reinsurance to focus on capital solutions |

The real growth came from fee-based Wealth and Retirement and Group Benefits. Empower in the U.S. added 500,000 participants, and workplace assets climbed about 10%.

That scale helps when you’re competing for rollover dollars that can end up in RRSPs or TFSAs for Canadians with U.S. exposure. Group Benefits in Canada posted a 17% earnings jump.

I want to see this mix shift continue toward capital-light, recurring-fee businesses. It supports sustainable ROE and frees up capital for buybacks and dividends.

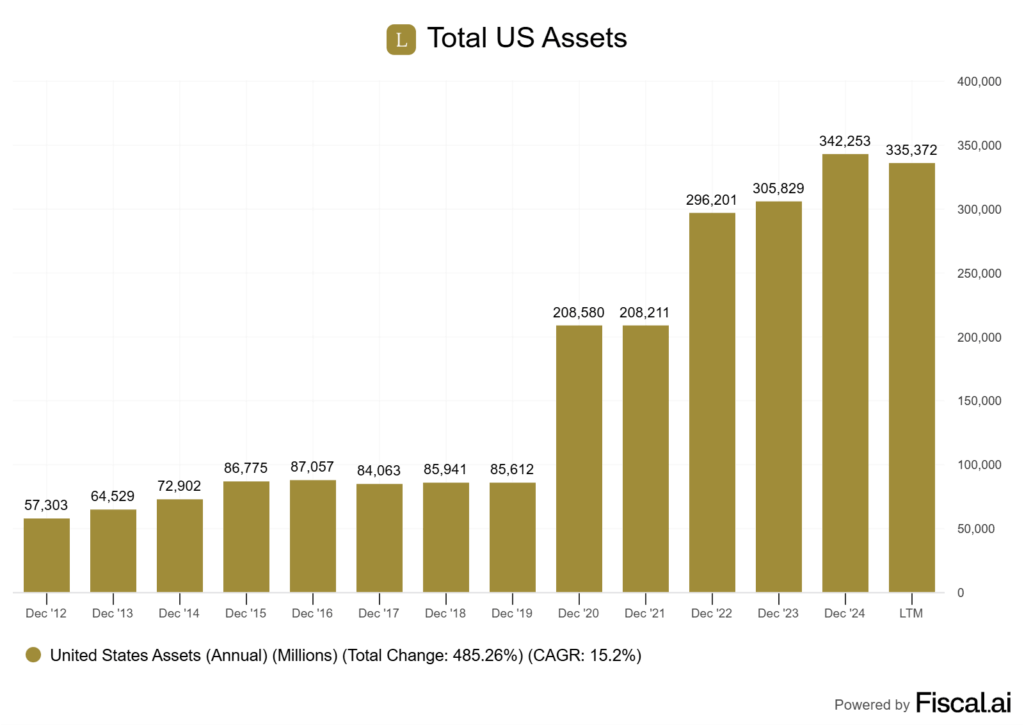

The U.S. Engine

Empower’s latest quarter brought in US$247 million in base earnings from its U.S. operations, and although its assets dipped a bit, they’re still showing exceptional growth post-pandemic.

When a company grows without tying up tons of capital, there’s more room for dividends and buybacks. The big driver here is scale, plan participants reached about 18.5 million, up 3% from last year.

Higher average account balances helped too, since the company ultimately makes more money the more assets it has, as they are fee-related. More participants and bigger accounts mean a stronger earnings base, and you’re not taking the same risks as traditional financial lenders.

Net flows in the Wealth segment soared 83% year over year to US$2.9 billion. Clearly, investors are moving assets into Empower, not out. Rollover sales from workplace plans drove a lot of that growth, and those assets tend to stick around, generating fees for years.

Management expects at least US$25 billion in net plan inflows for the second half of 2025, even after a major institution left in Q2. If they hit that, it’ll more than make up for the loss and keep the growth in this segment humming.

There is impressive growth here. With heightened competition south of the border, I will admit I was not confident of Empower to drive strong earnings growth. But here we are.

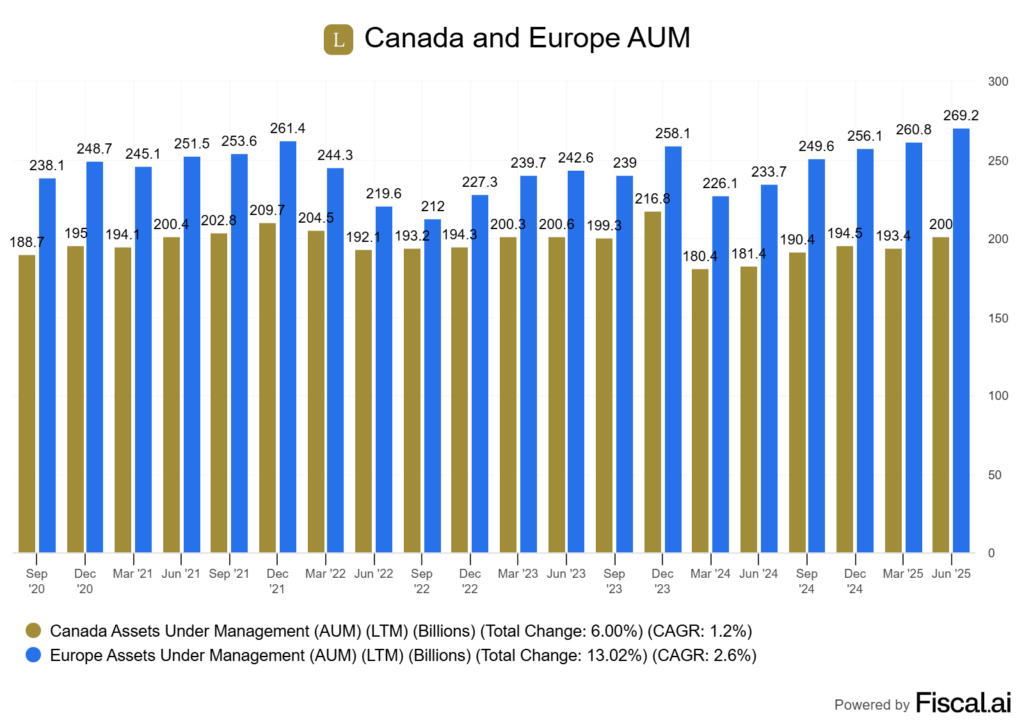

Canada, Europe, and Capital & Risk Solutions

Looking at Great-West Lifeco’s Canadian operations, it is definitely the backbone of the business but does have some challenges. Base earnings dropped 7% year-over-year to $316 million, mostly because of lower surplus income and weaker Group Benefits mortality experience.

Still, retirement and wealth asset growth helped soften the blow. Europe’s a different story. Base earnings climbed 6% to $239 million, thanks to higher Wealth fee income in Ireland and strong annuity sales in the U.K.

Assets under management continue to grow at a single digit pace in both regions.

Currency shifts also helped, so there’s a built-in hedge if the Canadian dollar stumbles. Capital & Risk Solutions posted $213 million in base earnings, up 4%, with solid capital solutions volumes and better claims experience.

Even after a $21 million after-tax hit from California wildfires, the segment stayed profitable. This is a signal of the company’s exceptional underwriting, as catastrophe losses tend to bury insurers who aren’t prudent.

Overall, both these segments kind of “smoothed” things over. While one region lagged, another stepped up. That balance keeps ROE steady and helps the company ride out rate changes or overall market volatility in a particular region.

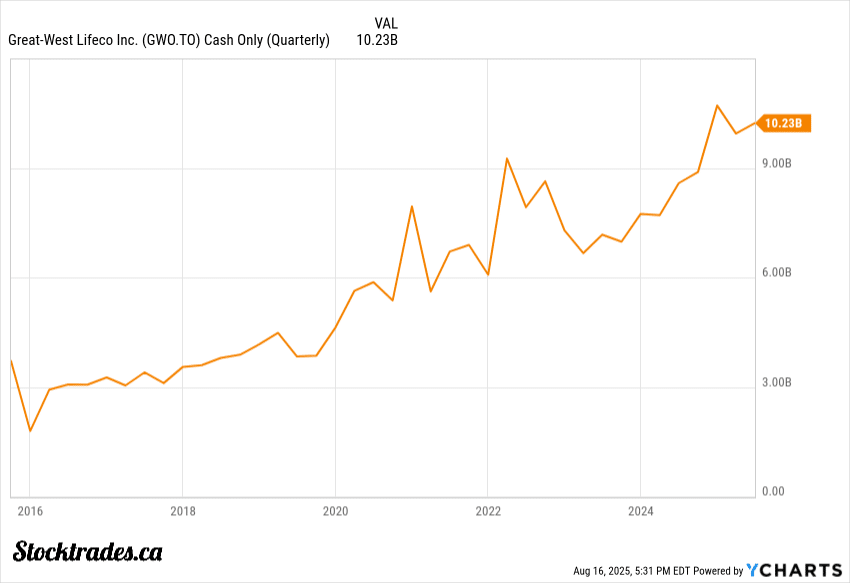

Balance Sheet & Capital Returns

The company has plenty of cash on the balance sheet, coming in at $10.2B. That gives management flexibility to not only be shareholder friendly, but also invest in the business.

In Q2, they bought back 6.3 million shares for roughly C$321 million. They’ve already said they’ll buy back another C$500 million in 2025.

Share buybacks like this are often felt the most by long-term investors, as a reducing share count ultimately fuels growing earnings.

I like that they’re pairing steady dividends with aggressive buybacks, both feed right into shareholder returns, but the buybacks are friendlier from a tax-perspective.

Markets, Execution, and Potential Risks

Market sensitivity is another big factor for Great West. Fee income from asset management and retirement services moves with equity markets.

If global equities drop 10%, management fees could shrink, especially in the Canadian retail and U.S. segments.

In addition to this, the company’s still working through transformation and restructuring costs. These charges might be temporary, but they can weigh on quarterly results.

If execution drags, investors may start to question whether management can hit their medium-term targets. These insurers have been on a heck of a run over the last while, and if momentum fades it can definitely be a drag on share prices. Not just for Great West, but for the industry in general.

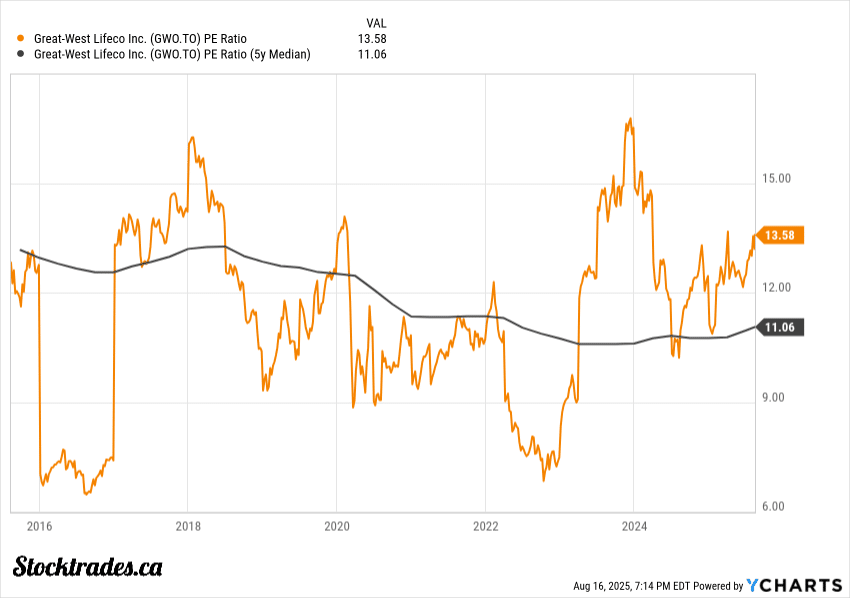

I see valuation as another risk. Sure, the company looks relatively cheap at 13.5X earnings. However, the company is currently trading at a double digit premium to its historical valuations due to how successful insurance companies have been over the last half-decade.

Here is a chart comparing the company’s current valuation to historical numbers.

The company is so solid in terms of execution I do see valuation as one of the main risks. However, slightly overpaying today isn’t the end of the world if you plan to hold long-term.

My Take on Great-West Lifeco Inc.

I see Great-West Lifeco as one of the more dependable names on the TSX for income-focused investors, but it probably won’t move the needle for growth investors. I do believe the large-scale returns from insurers, many of which traded at discounts pre-pandemic, are gone. Now, it will likely grow inline with earnings, which is typically at a high single-digit pace.

The current dividend of 4.5%~ is well-covered, and management keeps showing a willingness to raise it.

The combination of income and capital returns has been tough to ignore, honestly. I just have a lot of concerns as to whether or not they can keep it up.

The company’s scale in U.S. retirement services through Empower brings a steady inflow of assets, which should grow over time. Pair that with diversified earnings from Canada, Europe, and Capital Solutions. You get a business that isn’t overly dependent on one market or product line.

I just believe the valuation right now reflects all of that. It didn’t even a year or two ago.

Investor’s can’t be blind to the risks. Market swings and credit events can hit fee and spread income, and we are now sitting at all-time highs in the markets with a ton of uncertainty.

Execution on new products and platform upgrades will be critical. Competition in the U.S. retirement space is fierce, and regulatory changes could tighten flexibility.

I’d feel comfortable buying and holding this as a slower growing income play, but I do expect it to lag many of the major growth names. I expect some bumps from market cycles, but honestly, the long-term trajectory looks positive for conservative investors.