Is Nvidia the Next Trillion-Dollar Trap — or the Best Buy of the Decade?

Key takeaways

Nvidia’s growth depends on sustained demand for AI infrastructure

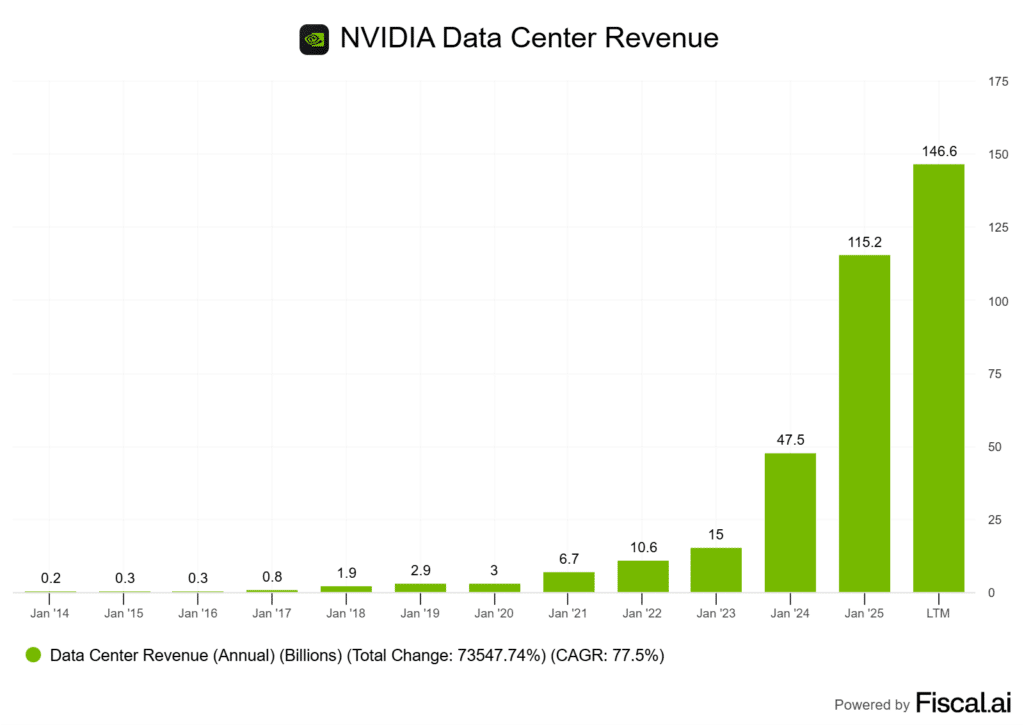

Data centre revenue now drives the bulk of earnings power

Valuation leaves little room for missteps on growth or geopolitics

3 stocks I like better than NvidiaNVIDIA (NVDA) looks priced for execution, not for comfort. The stock sits near record highs after reporting fiscal Q1 2026 revenue of USD 44.1 billion, up 69% year over year. Its data centre segment drove nearly 90% of that total.

The single factor that matters most right now is whether demand for AI infrastructure keeps scaling fast enough to support this level of growth. The counterpoint is pretty clear: export restrictions and a near‑40x forward earnings multiple leave little margin for error.

The business model is straightforward. Nvidia sells high‑performance chips and systems that underpin artificial intelligence (AI) training and inference. Data centres now dwarf gaming as the main profit engine. Government, enterprise, and cloud customers fuel orders.

Cash generation stays strong, with more than USD 53 billion on the balance sheet. That gives the company flexibility to repurchase shares and invest in manufacturing capacity.

What matters is whether this pace can hold. If AI spending from the likes of Microsoft, Amazon, and Meta slows, or if U.S.–China tensions flare again, the growth story weakens.

For long‑term investors, the stock fits a growth bucket. At this valuation, Nvidia has to keep delivering double‑digit revenue gains to justify its price.

Nvidia’s AI Moat: Is It Widening or Peaking?

| Strengths | Risks |

|---|---|

| Blackwell & Blackwell Ultra adoption | Rivals building in-house AI chips |

| Strong AI infrastructure ecosystem | Antitrust and regulatory scrutiny |

| Leadership in MLPerf benchmarks | Potential slowdown in AI demand growth |

Nvidia’s latest quarter showed data centre revenue of over $41 billion. The new Blackwell architecture drove much of that growth.

The company started ramping production of Blackwell Ultra, which management claims offers a major leap in training and inference performance. That’s the single most important driver of the stock right now.

Nvidia stays ahead not just with chips but with its full‑stack platform. Developers rely on CUDA software, networking tools, and rack‑scale computing systems like NVLink.

This ecosystem makes it harder for customers to switch. Nvidia reinforced that by topping every category in the latest MLPerf benchmarks.

The moat looks wide, but not unchallenged. Emerging competition in AI hardware from AMD, Intel, and custom silicon efforts at big cloud providers is real. These players push lower-cost alternatives.

The moat seems to be widening because revenue grew 56% year-over-year and gross margins stayed above 72%. But it could peak if competitors chip away at Nvidia’s dominance in AI infrastructure ecosystems or if customers seek more open platforms.

Data Center Growth: Can NVDA Sustain Its Breakneck Pace?

NVIDIA’s data centre revenue reached $41.1 billion in Q2 FY26. That’s a 5% increase from the prior quarter and 56% higher than a year ago.

Strong adoption of the Blackwell platform drove the sequential growth. Blackwell now anchors most of the company’s enterprise AI deployments.

The core engine here is simple: hyperscalers and large enterprises keep buying GPUs to train and run generative AI models. That spending shows up directly in NVIDIA’s data centre segment, which now dwarfs gaming and other lines of business.

I see three forces pushing demand:

- Enterprise AI demand from firms like Disney, SAP, and TSMC adopting Blackwell-powered servers.

- Hyperscaler spending as cloud providers race to expand AI capacity.

- European AI infrastructure projects, including DGX Cloud Lepton and sovereign model initiatives across France, Germany, and the U.K.

The question is whether this pace is sustainable. Growth relies on hyperscalers continuing to pour billions into AI, but that capex cycle won’t last forever.

Analysts already flag a possible slowdown in data centre growth as customers digest recent purchases. Europe’s push for sovereign AI models may extend the runway, but risks remain.

A pause in enterprise AI adoption, tighter capital spending, or geopolitical limits on GPU exports could all slow momentum. For now, the numbers are impressive, but they come with clear watch-points.

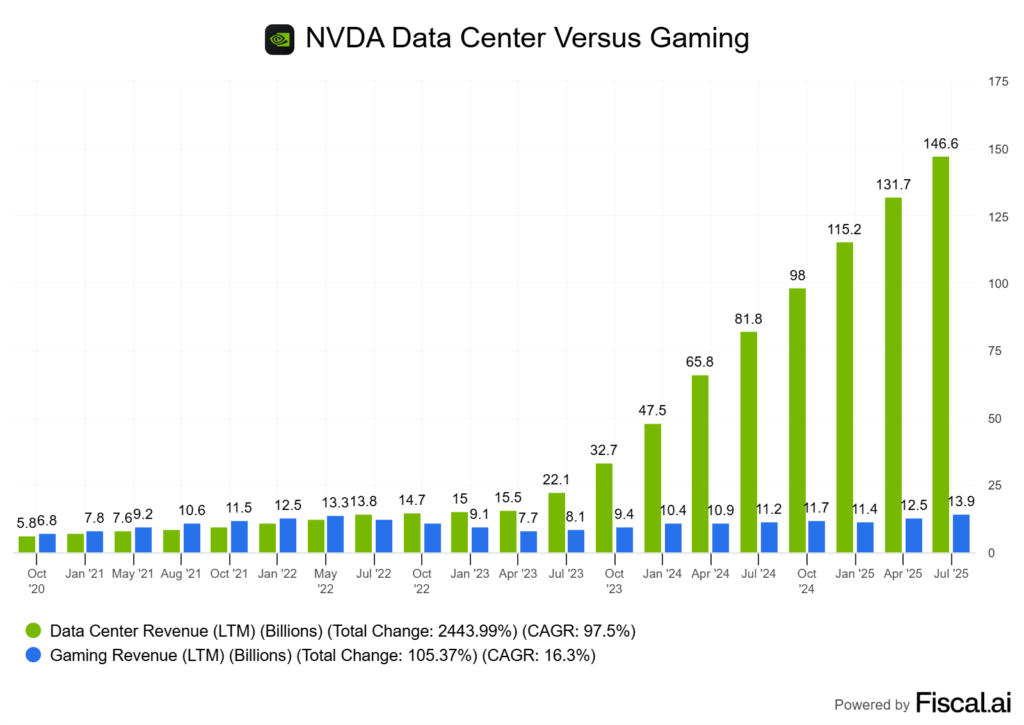

Gaming vs. Enterprise: Nvidia’s Business Mix Rebalancing

| Segment | Q2 FY26 Revenue (USD) | YoY Growth | Notes |

|---|---|---|---|

| Data Centre (AI) | $41.1B | +56% | Driven by Blackwell GPUs |

| Gaming | $4.3B | +49% | RTX 5060 + DLSS 4 adoption |

| Pro Visualization | $601M | +32% | Smaller but steady |

| Automotive/Robotics | $586M | +69% | Early ramp stage |

Nvidia’s latest quarter tells me the real engine is no longer gaming. Out of USD $46.7B in revenue, nearly USD $41.1B came from data centres, while gaming contributed USD $4.3B.

That’s a 49% year-over-year lift for gaming, but the scale difference shows how the business mix has tilted. The launch of the GeForce RTX 5060 gave gaming a boost, and Nvidia highlighted it as the fastest-ramping x60-class card.

Pair that with the rollout of DLSS 4 in over 175 titles, and I see why gaming still matters. But compared to enterprise contracts, these wins look modest in dollar terms.

Margins are where I pause. Gross margin slipped from 75.1% to 72.4% year-over-year.

That may not sound large, but it signals rising costs and heavier competition in AI chips. If those margins keep sliding, the enterprise-heavy mix could lose its shine.

The swing factor is whether gaming can keep growing at a double-digit pace while AI remains the clear priority. Gaming is still profitable, but unless it scales beyond the current 10% share of revenue, Nvidia’s fortunes will stay tied to enterprise demand.

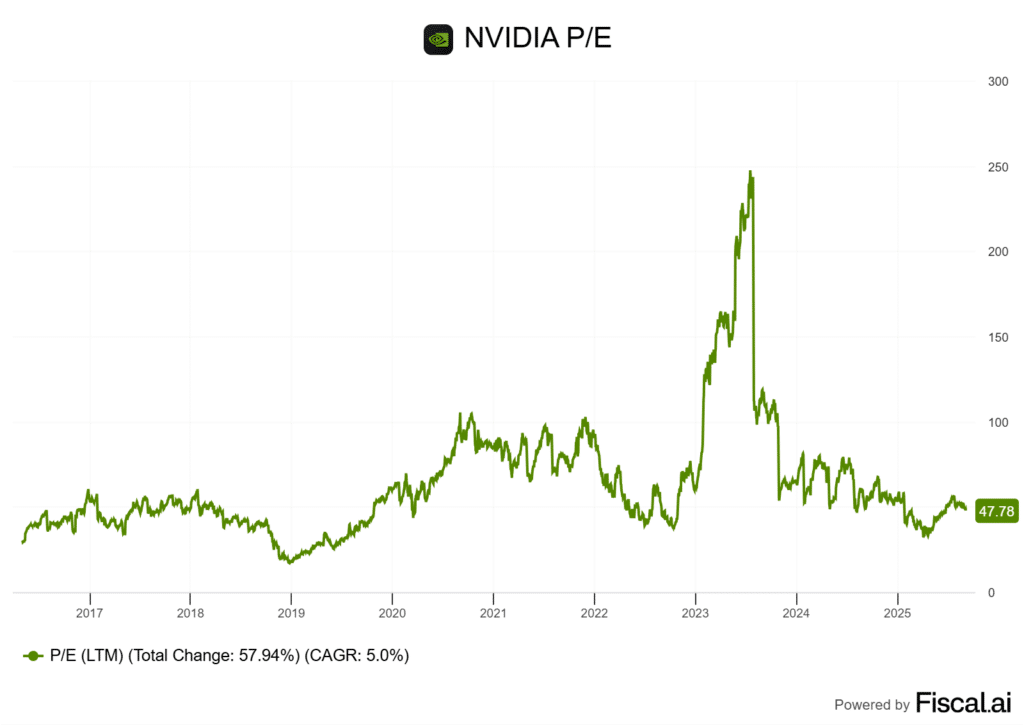

Valuation: Expensive, But Backed by Historic Growth

Nvidia’s latest quarter showed record revenue and profit, yet the stock still slipped. That reaction tells me the market is focused less on past results and more on whether the company can keep pace with expectations that already price in near-perfect execution.

The core issue is valuation. Nvidia trades at 40×–51× forward and trailing price-to-earnings (P/E), far above most large-cap technology peers.

It also carries a price-to-sales ratio above 20×. That raises the question: how much of the AI buildout is already reflected in today’s share price?

The business still leans heavily on its data centre division. Even a small miss relative to analyst forecasts can rattle investors.

It shows how tightly the stock is tethered to AI-driven spending cycles. I see parallels to past AI bubble concerns.

If demand growth slows or margins compress, the multiples look stretched. On the other hand, Nvidia’s authorization of USD $60 b in share buybacks signals confidence management feels there is upside.

The stock looks priced to perfection. Nvidia must keep data centre revenue expanding at a double-digit clip and protect its margins. Unless that happens, the current multiple becomes hard to defend.

China Exposure and Export Controls: A Manageable Headwind?

NVIDIA’s latest quarter really showed the weight of U.S. export restrictions.

Management flagged up to USD $5.5 billion in charges tied to unsold H20 chips. These chips got caught by the new licensing rules.

The H20 export restrictions matter because this chip was designed to comply with earlier U.S. limits. Once regulators tightened the rules in April 2025, even the H20 needed a licence for shipment to China, Hong Kong, and Macau.

That basically shut down NVIDIA’s only legal path to serving Chinese hyperscalers like Alibaba and Tencent. It’s a pretty dramatic shift for such a big market.

Washington has since allowed a workaround. NVIDIA and AMD agreed to a 15% revenue-sharing model with the U.S. government in exchange for export licences.

While unusual, this deal could restore partial access to China. The trade-off is lower margins, but it keeps the door open to one of the world’s largest AI hardware markets.

Is The Company a Buy Right Now?

Nvidia’s most recent quarter saw revenue bump 69% and net income margins exceed 40%. You just don’t see that often, even in tech.

Here’s the catch: customer concentration is high. Hyperscale cloud providers account for a big chunk of revenue, and some are starting to design their own chips.

If that trend picks up, Nvidia’s sales could flatten. Trade restrictions with China also remain a real risk, as the recent inventory write-down shows.

Valuation looks priced for execution. At these valuations, the stock only makes sense if Nvidia can keep double-digit revenue growth and margins above 40%.

I see it as a fit for growth-oriented investors, but only if they’re okay with the volatility that comes from customer concentration and geopolitical risk.