Warning – This Stock’s Revenue Streams Could Be a House of Cards

Key takeaways

User growth has slowed, but engagement levels are steady

Crypto exposure adds revenue but brings more volatility

Profitability progress is uneven and faces regulatory hurdles

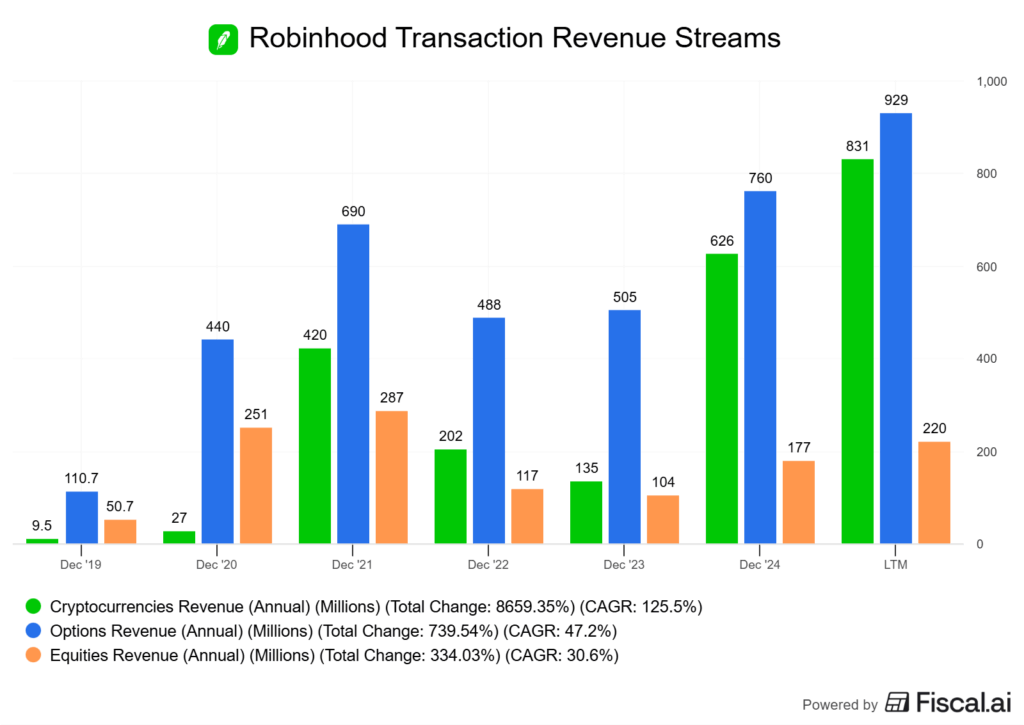

3 stocks I like better than RobinhoodRobinhood (NASDAQ: HOOD) sits at what looks like a fair valuation, but there’s clear execution risk. Its core revenue still comes from transaction-based activity in things like options and crypto.

These are short-term, bull market like transactions, ones that don’t necessarily do well during slower times. Look to the chart below to see how options and crypto related revenues tanked in 2022 during the bear market.

Although this company is a stock brokerage, equities revenue is a very small portion of total transactional revenue. I like to refer to Robinhood as a casino masked as a brokerage.

The stock’s gotten fresh attention after joining the S&P 500, which should broaden its shareholder base and boost market credibility. Honestly, the biggest thing to watch is whether Robinhood can turn steady user activity into real, lasting profits. I think it needs to integrate less “speculative” revenue in order to do this.

The business model depends on order flow payments, interest from cash balances, and trading volume. That works when users are active, but it means earnings swing with market moods, especially in crypto.

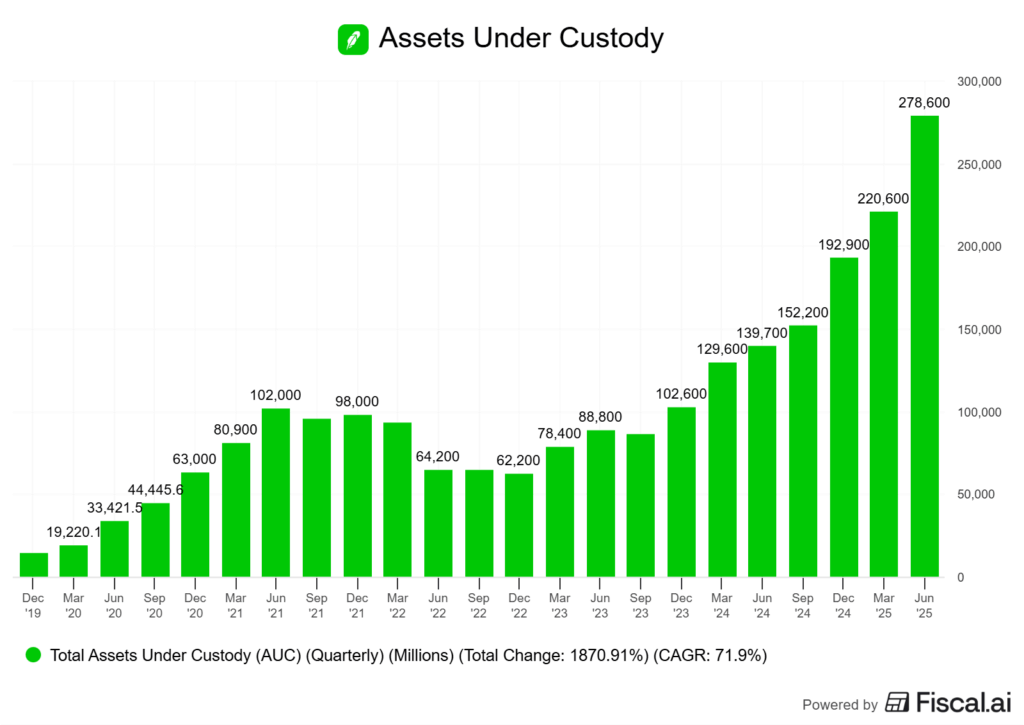

On the flip side, Robinhood keeps growing assets under custody and rolling out new products. That hints at a possible shift toward a broader financial platform, but it’s not a done deal yet.

There’s upside: a loyal user base and expanding services. The risk is clear, though. Profitability remains thin and regulatory pressure isn’t going away.

Over the next while, I’ll be watching to see if net interest income growth can make up for any drop in trading volumes. That’ll help show if Robinhood’s a long-term winner or just a high-beta play on market swings.

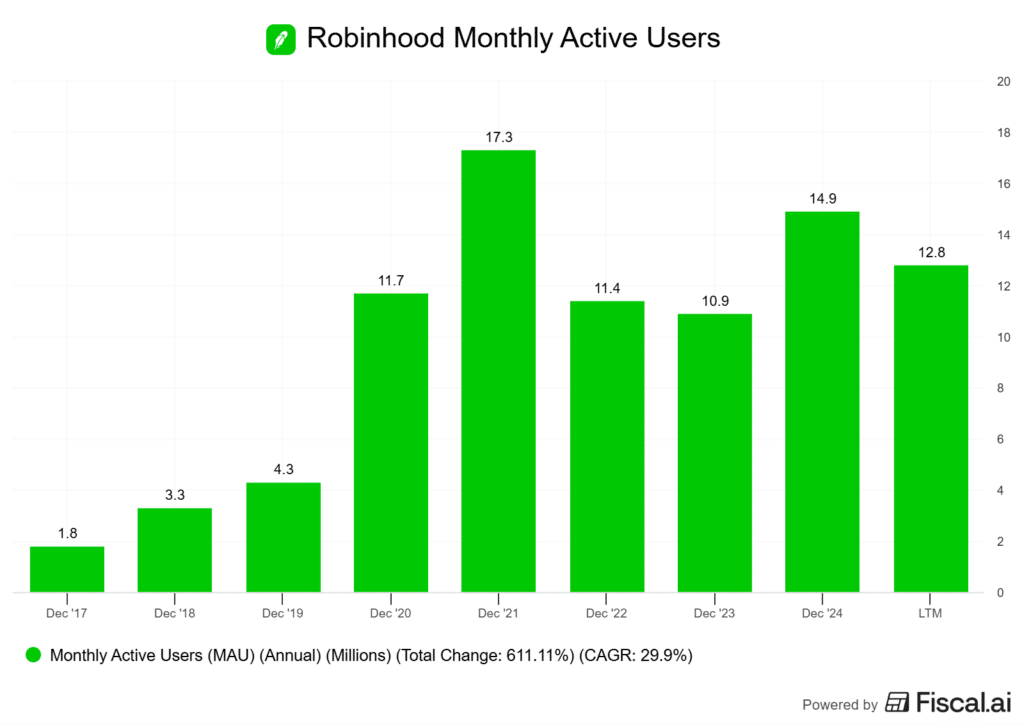

Robinhood’s User Growth Stalls, But Engagement Remains Steady

Robinhood isn’t bringing in new users like it used to, but its existing base is sticking around. Monthly active accounts peaked in 2021, and growth since then has cooled off. I don’t blame them for not being able to keep up with red-hot activity in 2021, but the decline over the last 12 months is definitely something to note.

Still, the company keeps reporting steady engagement from funded accounts. The main thing moving the needle is money coming onto the platform. In July, net deposits hit about USD 6.4 billion, pushing assets to roughly USD 278 billion by month’s end.

Those are big numbers. They show that even with slower user growth, customers are still putting more money to work.

Funded accounts are the key metric here. If someone funds an account, they’re actually investing, not just window shopping.

This stickier group helps explain why Robinhood’s ecosystem hasn’t hollowed out, even as sign-ups slow and market activity slows down.

Many of the pandemic-era traders left, but the ones who stayed are proving pretty durable. They’re still trading options, crypto, and stocks, keeping transaction revenue flowing.

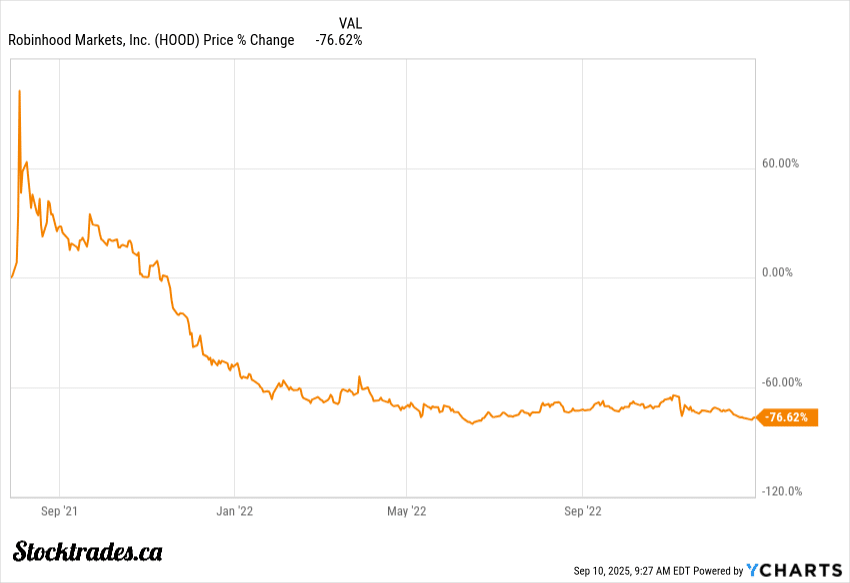

That’s encouraging, but it does mean the business is exposed if activity drops. Look to the company’s stock price during the large 2022 drop in activity.

Crypto Exposure Cuts Both Ways

Robinhood’s latest results make it obvious: crypto now swings its earnings in a big way. Crypto trading now brings in over half of transaction-based revenue.

That’s real momentum, but it also means the business is more sensitive to market cycles. At some point, crypto will go through a large drawdown, and trading will decline. Robinhood’s revenue engine is simple. It earns money when users trade.

Equities trading tends to be steadier, while crypto volumes spike or crash depending on sentiment, regulations, or even the news cycle. That makes profits jump in good quarters and shrink fast in bad ones. The only difficulty is equities make up a small portion of overall transaction revenue.

Here’s the tricky part. Crypto trading volumes don’t always move in sync with revenue anymore.

IO Fund pointed out that Robinhood recently pulled in higher transaction revenue even on lower volumes. Pricing and spreads matter as much as activity now, but it makes results bumpier and harder to forecast.

Volatility hits margins directly. A strong crypto quarter can lift revenue by 30–40 percent, as seen in Investing.com’s review. But the reverse is also true.

If volumes drop, transaction revenue falls sharply, leaving earnings exposed.

I’m watching to see if Robinhood can smooth out these swings with other services. Banking features, advisory tools, or even boosted equity trading can help. There is just too much revenue here that relies on speculative trading activity.

Profitability Still Elusive

Robinhood’s latest numbers show net interest income is giving results a lift. Interest revenues are growing at a 25%~ clip, thanks to growth in interest-earning assets.

I certainly like the momentum, but it won’t last without stronger margins.

The model still depends a lot on transaction-based revenue from crypto and options. At the end of last year, crypto revenue jumped over 700% and options climbed 83%. Is this sustainable? Highly unlikely.

Those are wild swings, highlighting just how volatile revenue can be.

On paper, GAAP profitability looks great. Net income reached USD 916 million at the end of last year, way up from previous eyars.

But a closer look shows one-time tax benefits and regulatory reversals helped inflate those results. Adjusted EBITDA hit USD 613 million, up more than 300% year-over-year. That’s better, but still not a perfect measure of recurring earnings.

Scaling costs against revenue growth is the real test here. Operating expenses only rose 3% year-over-year, but when you include share-based comp, total adjusted costs climbed 14%.

That suggests efficiency is uneven. If costs keep outpacing sustainable revenues, margins will shrink fast.

If interest rates drop sharply, as some analysts predict, the cushion from net interest income will shrink. That risk doesn’t scale cleanly and leaves Robinhood exposed to the same revenue concentration issues it’s faced since its IPO.

Regulatory Uncertainty Casts a Long Shadow Over HOOD’s Business Model

The latest fine from FINRA isn’t small. Robinhood agreed to pay $26 million in penalties plus $3.75 million in restitution for gaps in its anti-money laundering controls and issues in its clearing systems.

That points to a pattern of operational weaknesses that regulators just aren’t ignoring anymore.

Trust is the backbone of Robinhood’s business model. If users start doubting the platform’s reliability or fairness, engagement drops, and so does transaction revenue.

That’s the real risk: reputational damage that lingers well after any one-time fine is paid.

The SEC is still scrutinizing how Robinhood handles crypto assets. Even if no new penalties land soon, uncertainty about which tokens count as securities keeps a cloud over its crypto segment. It works for now, but that could change fast if rules tighten.

I can’t ignore the compliance gaps flagged by regulators. Anti-money laundering systems and disclosure practices aren’t just paperwork, they’re what keep licenses safe and restrictions at bay. We’ve witnessed US regulators hammer on a company like Toronto Dominion Bank for AML issues.

Paying fines is one thing; rebuilding trust with regulators and retail investors is another.

Is Robinhood Quietly Building a Long-Term Financial Super App?

Robinhood just hit a fresh high, backed by a sharp rise in funded accounts and assets under custody. But it probably won’t last without a stronger foundation beyond trading fees. The company simply relies too much on trading activity that only exists in highly speculative markets.

The company seems to know this. Recent product rollouts point to bigger ambitions, but they will take a while to roll out.

The new wealth management arm, launched in March 2025, feels like a clear step toward recurring revenue. Advisory fees scale more predictably than transaction-driven income.

If adoption grows, Robinhood could smooth out the lumpiness of trading volumes. That’s a big “if,” but it’s a direction at least.

International expansion is another piece of the puzzle. The UK and Lithuania launches give Robinhood a foothold in Europe.

Its tokenized ETF and stock offering could set it apart from traditional brokers. The upside looks tempting, but there’s a catch. Regulatory pushback could slow the rollout or limit what Robinhood can offer. That’s always lurking in the background.

On the product side, the Gold Card and new prediction markets show Robinhood is testing ways to keep users engaged. These moves probably won’t replace core revenue, but they do build stickiness.

If customers treat Robinhood as their daily money app, not just a trading account, the economics improve. That’s the big hope, anyway.

For me personally, this company simply relies too much on particular assets that I do think will continue to grow in size, but will be exceptionally volatile to the point where its share price will suffer significantly like we witnessed in 2021 if that activity slows down.

Bear markets are inevitable. What will truly matter is whether or not Robinhood will be diversified enough by then to shelter itself from the catastrophic losses it witnessed a few years ago.