Is a Poor Quarter From Sunlife Financial Stock a Buying Opportunity?

Key takeaways

Sun Life continues to show strength across its core businesses

Dividend growth and international exposure support long-term value

Some U.S. and asset-management risks remain worth monitoring

3 stocks I like better than Sun Life FinancialSun Life Financial has been a staple on the TSX for a very long time. It’s known for steady dividends and a pretty conservative management style.

But the real question is whether this stock deserves a spot in your portfolio right now, especially after a subpar quarter caused shares to dip by double digits.

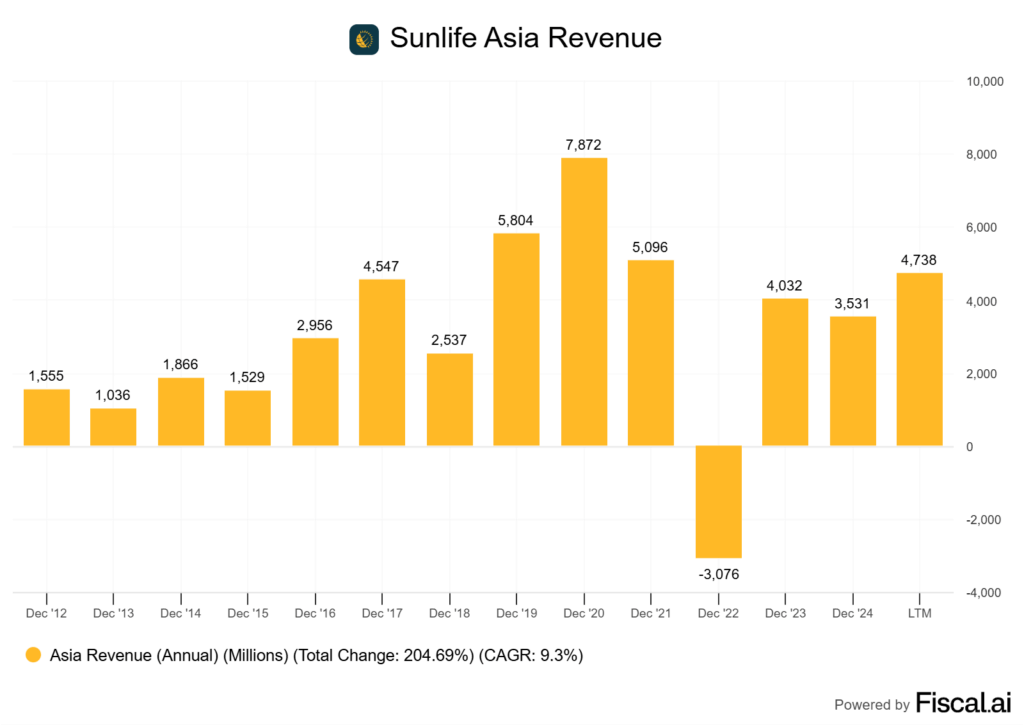

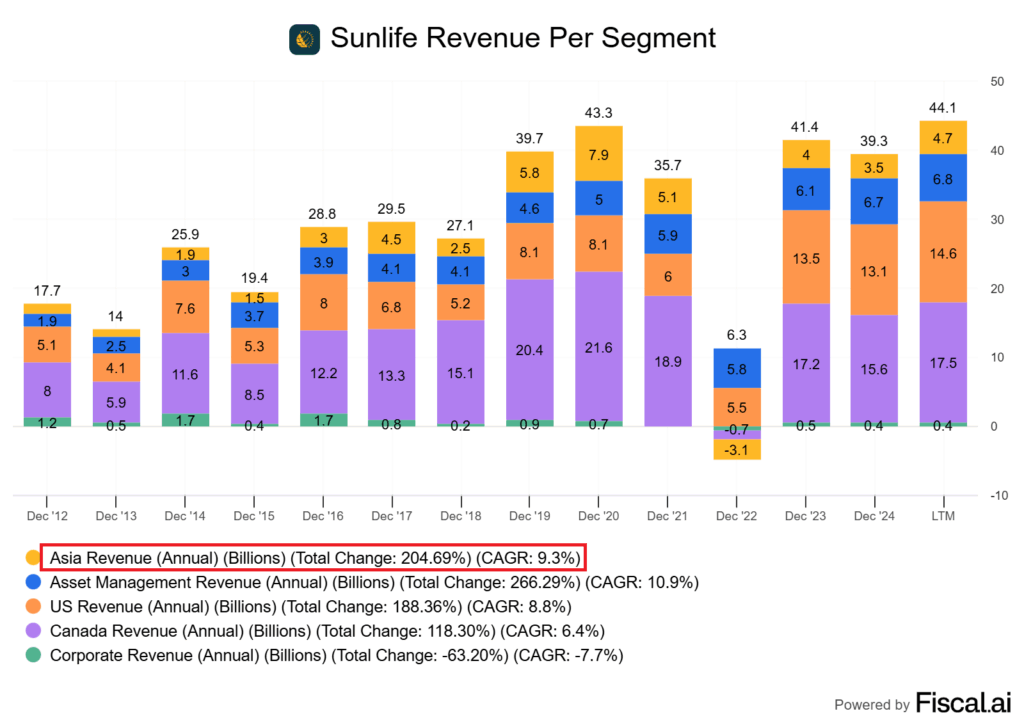

What makes Sun Life interesting isn’t just its insurance business in Canada. It’s also the growing presence in Asia and a strong asset management arm. Both of these elements have vaulted it to long-term outperformance.

Of course, there are risks. The U.S. group benefits business looks solid, but the dental segment faces a lot of uncertainty. They lost a massive contract which caused earnings to come in well short of estimates.

Sun Life’s push into alternative assets could boost earnings if management gets it right as well. I see enough strength in the core operations to outweigh near-term concerns.

Let’s dive into this one.

Q2/25 Snapshot and Business Drivers

Sun Life posted net income of about $1.02 billion, up 2% from last year. That’s a 17.6% return on equity, which is honestly one of the better ROE’s relative to its peers.

Asia delivered record results, with a 15% lift in bancassurance sales driving much of the growth.

That matters because Asia still has a long runway for expansion compared to the more mature Canadian and U.S. markets.

Asset Management and Wealth stayed steady at $455 million in net income. The markets are fairly choppy right now, so flat net income isn’t anything to be disappointed about.

Individual Protection showed softer results, but there are very few insurers that can ever have every segment firing on all cylinders.

Capital strength stood out this quarter. The LICAT ratio came in at 151%, comfortably above regulatory minimums. I won’t dive too much into what this ratio is, but lets just say higher ratios indicate a stronger financial position and a better ability to protect policholders.

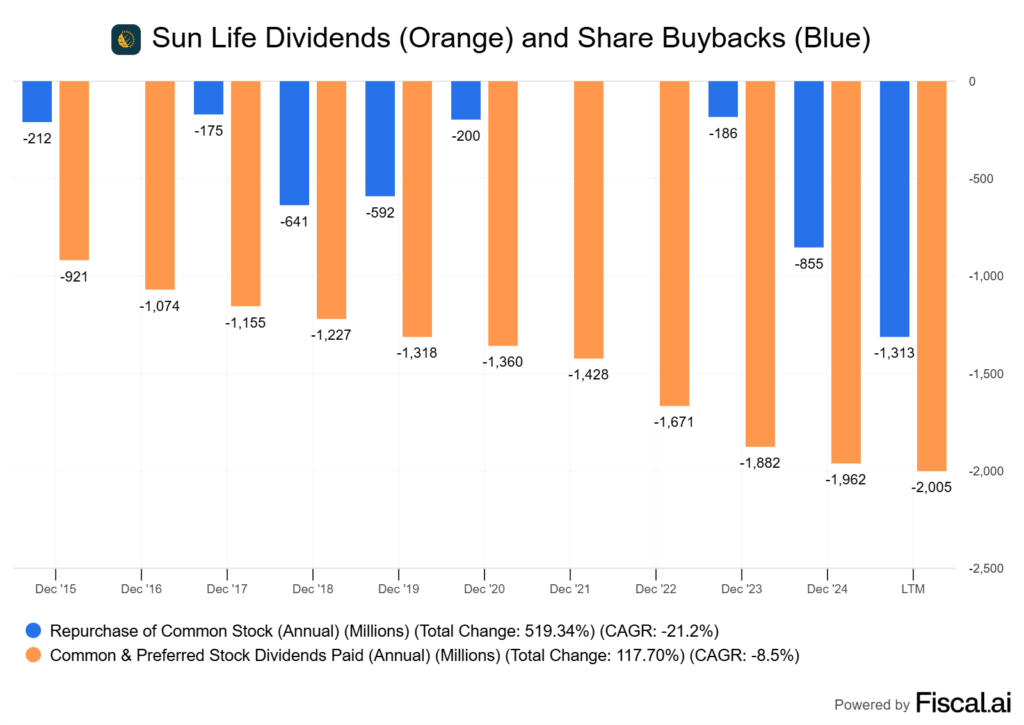

Sun Life also bought back more than $400M in shares on the quarter. I see that as a shareholder-friendly move that supports per-share growth. When you look to the chart below which combines dividend payments and buybacks, it’s been shareholder friendly for a long time.

Where Earnings are Coming From Now

One of the main benefits of Sun Life is its diversity. No single market or product line dominates, and that gives the company stability when one area slows down.

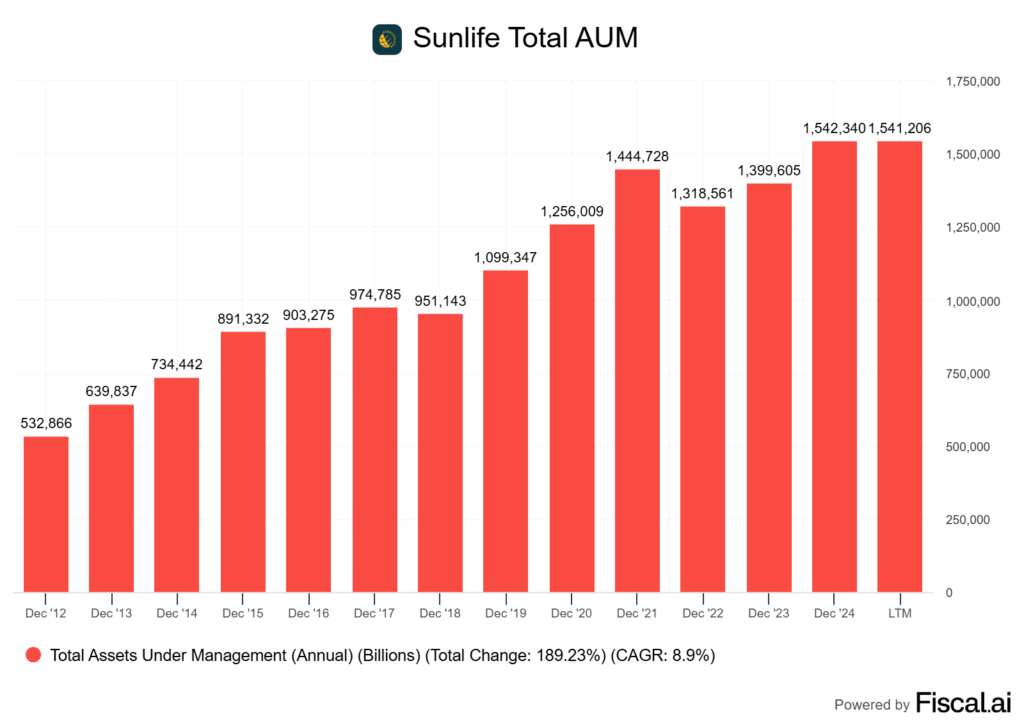

Asset Management is the biggest driver today, however.

Combined assets under management sit around $1.11 trillion with MFS at roughly $865 billion and SLC Management at about $250 billion. Sun Life’s total company AUM is closer to $1.54 trillion.

Here is a breakdown of the company’s different avenues of generating earnings.

| Segment | Notes |

|---|---|

| MFS | ~$865B AUM, fee income pressured by lower average net assets |

| SLC Management | ~$250B AUM, strong capital raising boosted fee-related earnings |

| Canada | Leading in group health and protection; steady RRSP and TFSA flows support wealth business |

| U.S. | Employee benefits and stop-loss insurance showing recovery after prior claims volatility |

| Asia | Growth led by Hong Kong and India, plus digital expansion in the Philippines |

What I like is the contrast. MFS is more market-sensitive, while SLC’s fee-related earnings are tied to institutional mandates and capital raising. That mix cushions results when markets dip.

Canada and the U.S. remain steady cash generators. Much like one of its competitors Manulife Financial, I see Asia as the real growth lever.

Sales in India and Hong Kong are climbing quickly, and Sun Life keeps investing in distribution scale to keep that momentum going. This combination of “moaty” cash flow businesses at home and higher-growth markets abroad gives Sun Life a unique business mix when we look to insurers.

Alternatives Continue to Drive Results

Sun Life’s asset-management flows tell two very different stories.

MFS, which is the segment of its business that focuses on things like equity and fixed income mutual funds, posted net outflows of about $19.8 billion, driven by institutional rebalancing and retail clients pulling back risk.

On the other hand, SLC Management, which focuses on institutional fixed income and private markets/alternatives, recorded $4.1 billion in net inflows, showing demand is still strong for these alternative investments. This split matters because it highlights the shift in where future growth will come from.

Traditional equities and bonds are facing headwinds. Alternatives like private credit, infrastructure, and real estate are booming.

Crescent Capital recently closed a €3 billion European specialty lending fund. BentallGreenOak continues to rank among the top private equity real estate managers globally.

These aren’t small wins either. They give Sun Life access to sticky institutional capital that tends to stay invested through cycles.

Alternatives often carry higher fees than traditional funds, and they’re less sensitive to short-term market swings. That combination can help smooth earnings, even if retail mutual fund flows remain volatile.

U.S. businesses – Dental Uncertainty

I see two very different stories playing out in Sun Life’s U.S. operations. On one side, the group benefits business continues to show steady growth.

On the other hand however, the dental segment is facing headwinds tied to Medicaid funding and higher-than-expected claims. Management recently admitted the U.S. Dental business will fall short of its 2025 profit goal.

Instead of hitting the original target, they now expect less than US$100 million in underlying net income next year. They cite uncertainty in Medicaid repricing and slower negotiations with states.

This is why you witnessed Sunlife fall more than 8.5%~ after posting earnings. At the same time, there are some encouraging signs.

Medicaid repricing has started to improve margins. The broader group benefits portfolio in the U.S. remains rock-solid.

This mix of operations makes the U.S. segment more complex to assess than Sun Life’s Canadian or Asian businesses. Here’s how I break it down:

For me, the real test will be how quickly Medicaid rate adjustments flow through and whether claims usage normalizes. We’ve witnessed many healthcare options south of the border get hammered because of this.

Growth Avenues and Risks to Monitor

Asia looks like the clearest growth engine for Sun Life in my opinion. The company has been steadily expanding in the region, and the rising middle class keeps demanding more wealth and protection products.

The July move to increase its stake in Hong Kong’s Bowtie shows a push to deepen digital distribution. That could be a long-term differentiator.

Digital adoption is another lever worth watching. Sun Life has invested in AI and automation to cut costs and improve service. If management executes well, these tools should not only improve margins but also open up cross-selling opportunities across wealth and insurance products.

On the risk side, I’m cautious about the U.S. dental insurance business. The recent guidance cut tied to Medicaid funding uncertainty already knocked the stock lower. The issue isn’t going away quickly. Policy changes could keep earnings in this segment volatile.

Asset management arm MFS has faced outflows and fee compression. Under IFRS 17, Sun Life’s earnings are more sensitive to market and credit swings. That makes equity pullbacks or rate cuts from the Bank of Canada and the Fed a potential drag. Here’s a quick breakdown:

My Take on Sun Life Financial Inc.

Sun Life stands out as one of the steadier names on the TSX, though the stock isn’t immune to headaches. The recent drop after Q2 earnings highlights some real worries, especially in the U.S. dental business where Medicaid funding remains a wild card. That risk isn’t fading anytime soon.

The company’s core strengths still hold up:

- Balanced earnings mix across insurance, wealth, and asset management. It is well diversified

- Strong Asia momentum, with double-digit growth in the region

- A conservative capital position will support buybacks and dividends

There are some risks that are tough to ignore. I won’t go over all of them again, but they do exist.

For Canadian investors looking to build long-term income portfolios, that 4%+ dividend yield stands out. The payout is safe, and management’s track record of steady increases is worth something.

To sum it up in a single sentence, I wouldn’t necessarily be in a rush to buy the company right now until we see some stability south of the border, but if I owned it I wouldn’t be rushing out to sell it. Asia’s growth and the asset management side keep me interested in the long-term story.