This 7% Yielding Canadian Blue-Chip Could See Positive Momentum Moving Forward

Key takeaways

Telus’s infrastructure investment could reward patient shareholders.

Growth in health, agriculture, and digital offers new revenue streams.

High yield is tempting, but debt and competition remain risks.

3 stocks I like better than TELUS right now.It’s not every day you see a blue chip dividend payer yielding north of 7%. TELUS has been battered by higher interest rates and market worries about rising debt and new competition.

However, right now, I believe Telus is still looking attractive from a valuation basis, and could be a contrarian play in a sector that is getting zero love.

The company’s focus on building out its massive fibre and 5G networks has strained its balance sheet. But Telus is also quietly growing in areas like health tech, agriculture, and AI, maybe more than most people realize, and certainly more so than players like Rogers and BCE.

Can Telus’s $70 Billion Infrastructure Push Deliver Long-Term Shareholder Value?

TELUS is planning to invest $70B~ into Canada through to the end of 2029. The sheer scale of this investment, fibre optic upgrades, expanded 5G, dedicated AI data centres, and rural service pushes is certainly something that could benefit TELUS.

However, for a company that has been criticized for debt levels, there are certainly some people who are hesitant.

Lets dig into the potential upsides.

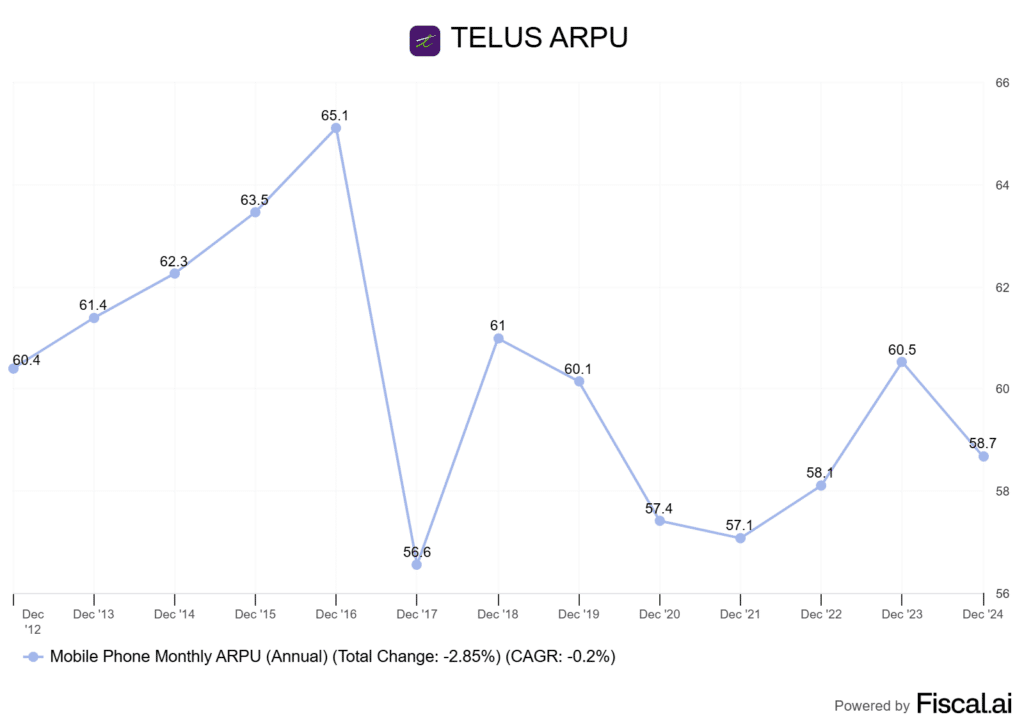

- Stronger ARPU: As Telus upgrades thousands of communities to PureFibre and ramps up 5G, I expect average revenue per user (ARPU) to rise for both residential and business segments. Faster, more reliable service often commands a premium.

- Customer Loyalty: Connecting rural and Indigenous areas, plus new AI “data factories” in BC and Quebec, could lock in customers who don’t have compelling alternatives. This definitely helps with retention.

- Durable Assets: Fibre and digital infrastructure are long-lived. Unlike tech fads, a high-quality network becomes more valuable as digital demand grows.

Now, the main downside.

This kind of spending isn’t risk-free. Balance sheet pressure exists, especially if interest rates from the Bank of Canada stay higher for longer.

High capital outlays mean Telus needs solid top-line growth and cost control to keep dividend growth on track and avoid a stretched payout ratio.

Telus Health, Agriculture, and AI: Diversification or Distraction?

Telus has pushed hard into sectors like digital health, smart farming, and artificial intelligence, and honestly, I think it’s a smart move, at least on paper. The Canadian wireless market is mature and ultra-competitive.

Relying on mobility or internet alone makes long-term growth tough, especially with ongoing pressure on pricing and regulations. We can look to Rogers and BCE, who have had relatively lackluster results and even a dividend cut due to relying too much on mobile/media divisions.

In the first quarter of 2025, Telus Health revenue rose 12 percent year-over-year. Telus Agriculture and Consumer Goods did even better, growing revenue by 20 percent.

| Business Unit | Q1 2025 Revenue Growth | Commentary |

|---|---|---|

| Telus Health | 12% | Strong demand for digital care |

| Telus Agriculture & Consumer | 20% | Agtech, IoT seeing traction |

| Telus International (Digital) | Decline, integration | Recent struggles, restructuring |

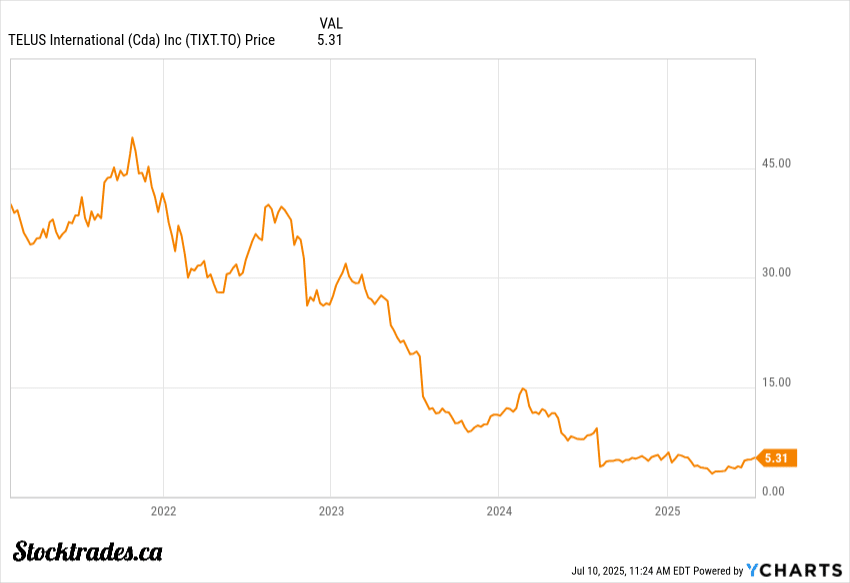

But it’s not all smooth sailing. Telus Digital (formerly TELUS International), their digital and AI arm, has faced headwinds.

Operational and integration challenges have slowed progress, and outside shareholders made it tricky for Telus to fully align strategy across the board. This is why Telus is now trying to take it private, aiming to tighten control and weave AI and digital offerings deeper throughout the company’s other divisions.

If executed right, this will certainly help Telus. However, it could hurt their reputation for future spinoffs. It has been well known for years they are planning to spin off their Health division.

Overall, these segments of the business are what I am expecting to drive future growth, not its mobility arm.

Is Telus’s Dividend Still as Safe as It Looks?

Telus’s dividend yield staying close to 7% is certainly a draw. For many Canadian investors, that’s an RRSP or TFSA-friendly income stream that can move the needle.

But with high yield comes the obvious question: can Telus actually keep this up? I think they can.

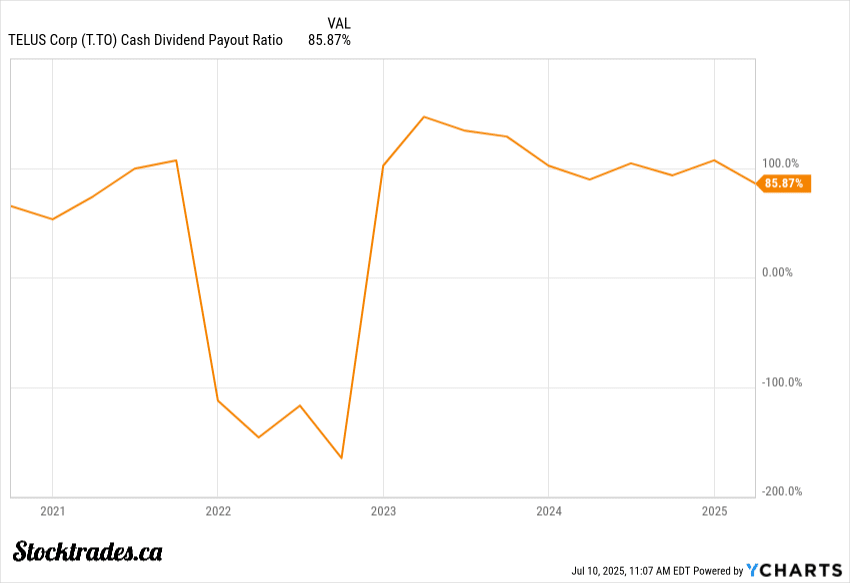

Typically, I expect safe TSX blue chips to keep their dividend payout below 75% of free cash flow (FCF). Telus’s payout ratio has been over and above this mark due to large capital outlays for years. However, it’s starting to come down now, but it’s still high at 85%.

That’s uncomfortably tight, especially given Telus is still pouring billions into 5G, fibre, and its newer digital health bets. High capex and rising debt, now well past $30 billion, is certainly something investors need to monitor.

Management continues to telegraph confidence, however, raising the dividend 7% recently.

Yet the sustainability of this streak depends on margin expansion and higher FCF as those investments mature. For me, a safe dividend means more than tradition, it is about the math and nothing more. Look no further than BCE, who desperately tried to hang on to its dividend because of its reputation as a strong payer. It ended up destroying the company’s stock price.

I’ll be watching earnings, debt levels, and especially free cash flow growth before calling it ironclad, however I do believe there is a low chance of a cut at this point.

The Hidden Cost of Telus’s Growth Ambitions

When I look at Telus’s financial position, the sheer amount of net debt, over C$30 billion, stands out.

With so much debt, even small moves by the Bank of Canada have a real impact on Telus’s bottom line. Telus has been hit by higher interest rates these past couple of years, and it is reflected in its share price. Investors just aren’t willing to pay as high of a multiple.

As borrowing costs have climbed, so have interest expenses. Margins have taken a hit, and it now costs more to finance the company’s heavy network upgrades.

Although interest rates have started to ease in 2025, the effects linger. Management is still balancing the need for investment with the reality of higher debt payments. Some capital projects may need to be delayed just to keep leverage in check. Recent refinancing efforts have helped.

Telus has pushed out major debt maturities to avoid the worst rate spikes, and that’s bought them some breathing room. But for those of us considering a position, it’s important to recognize that a company’s credit rating and cost of funds matter as much as headline growth stories.

If the Bank of Canada takes its foot off the brake and rate relief continues, there could be a real tailwind, which is why I do own this company as a short to mid-term investment. However, I also acknowledge it isn’t risk-free.

Is Telus Still Winning Where It Matters?

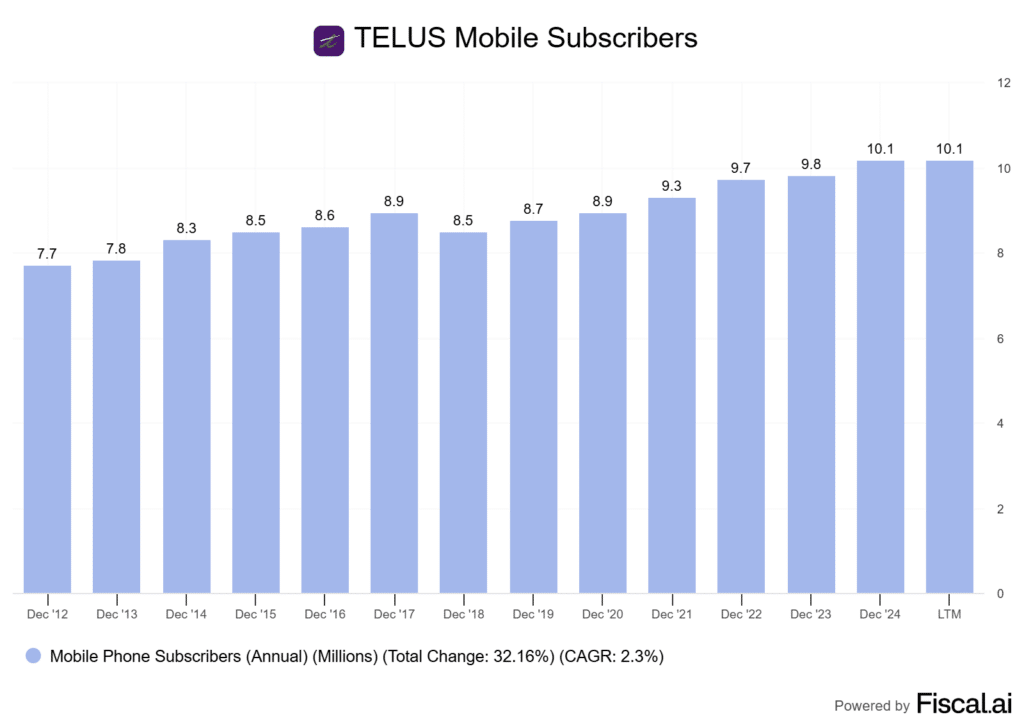

When it comes to the basics, mobile and internet service, Telus is still a force.

Telus holds around 30% of the national wireless market, which keeps it competitive with the big three. Over the last year, subscriber additions have been steady, not jaw-dropping, but strong enough to defend their turf.

What always gets my attention is Telus’ low churn rate. Canadians are just less likely to leave Telus for another Big 3 provider. Here’s a quick comparison for context:

| Metric | Telus | Rogers | Bell |

|---|---|---|---|

| Market Share (%) | ~30 | ~33 | ~33 |

| Churn Rate (%) | Best-in-class | Mid-range | Mid-range |

| ARPU Trend | Volatile, but stable | Flat | Slightly up |

ARPU = Average Revenue Per User

On the wireline front, Telus has lagged a bit in subscriber growth compared to the big players out east. Still, I respect their aggressive investment in fibre-to-the-home, especially across Western Canada. Being from Alberta, TELUS is definitely more prevalent here than the other major players.

Telus’ customer loyalty stands out. Their quick rollout of 5G and focus on Western Canada have locked in a sticky user base. Another tailwind for them will certainly be the growth of its faster growing segments like Health, Security, Agriculture, etc.

However, there are no doubt some issues. Revenue growth in core telecom is under pressure. ARPU has levelled off, and there’s less room for price hikes now that nearly every Canadian has a mobile plan.

With lower population growth due to lower immigration rates, the race for new subscribers is getting harder. That means Telus has to get more creative, like they’re doing with Telus Health and Agriculture, just to keep momentum, unlike in past years.

Overall, I think the company is a solid contrarian play, and one I hold on the back of expected valuation expansion in a lower rate environment. However, I do acknowledge the thesis is a bit risky, and certainly one that is not 100%.