Is This The Best AI Stock Opportunity in Canada Today?

Key takeaways

Sales growth has slowed while higher costs pressure margins.

Diversified demand helps steady revenue but limits big upside.

Valuation looks balanced and will depend on the next earnings move.

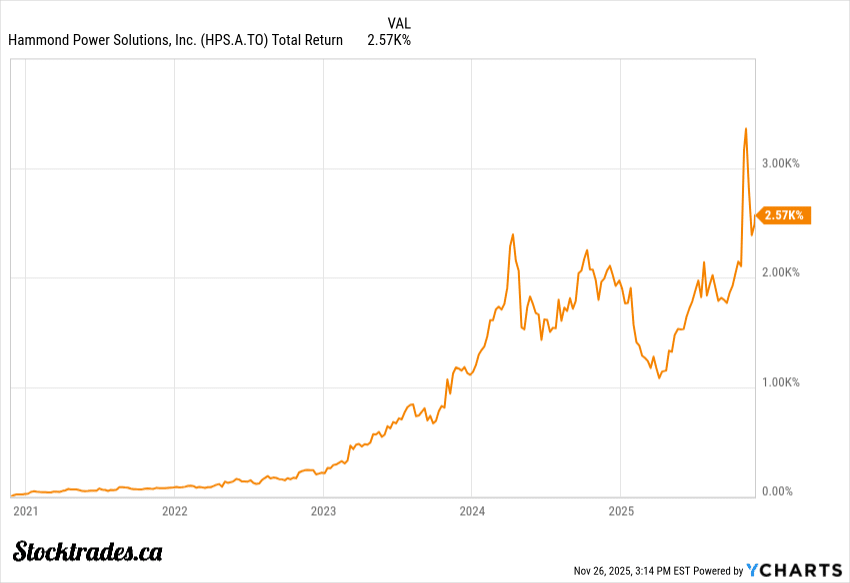

3 stocks I like better than Hammond PowerFor the last few years, Hammond Power Solutions (HPS.A.TO) has been one of the absolute darlings of the TSX.

If you were lucky enough to get in early, you’ve ridden a massive wave of electrification, data centre build-outs, and industrial onshoring. But lately, checking the stock price feels less like a victory lap and more like a rollercoaster.

The volatility is ticking up, and the “easy money” phase seems to be in the rearview mirror. It leaves many Canadian DIY investors asking the same tough question: Is this a buying opportunity on a dip, or is it time to take chips off the table?

The problem? It’s hard to separate the long-term tailwinds from the short-term noise. My goal today is to strip away the hype and look strictly at the fundamentals.

We need to figure out if Hammond is still a compounder for your portfolio or if the growth story has hit a substantial snag. Remember, this company is up 2500% over the last half decade, but it’s still a small cap stock.

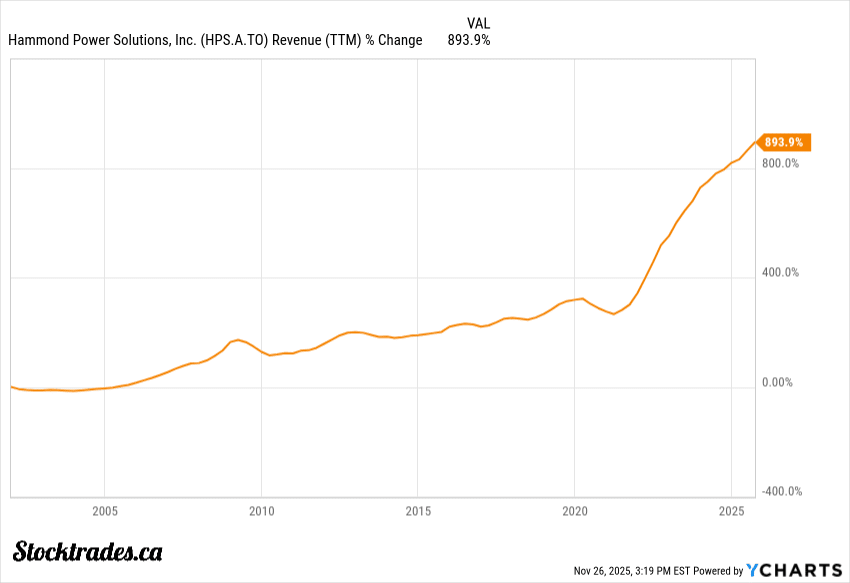

Growth is There, But It’s Normalizing

If you just glance at the headlines, everything looks rosy. In the third quarter of 2025, Hammond posted revenue of $218 million. That is a record for Q3 and a solid 14% bump over the same time last year.

But if we dig a little deeper, the story gets more nuanced. The breakneck speed we saw in 2023 and 2024 is starting to level off. We are moving from “explosive” growth to “slower” growth.

The driver here is clearly the U.S. and Mexico. Sales in those regions surged by over 21%, effectively carrying the company on their backs. In contrast, the Canadian market dipped slightly, and India was essentially flat.

The question?

Where is the demand actually coming from?

The answer is the “electrification” trade in action. We are seeing substantial demand from private label partners and the data centre sector. However, the backlog, which had been rocketing upwards, is now stabilizing as shipments catch up to orders. That’s healthy, but it means we can’t bank on the backlog growing to the moon forever.

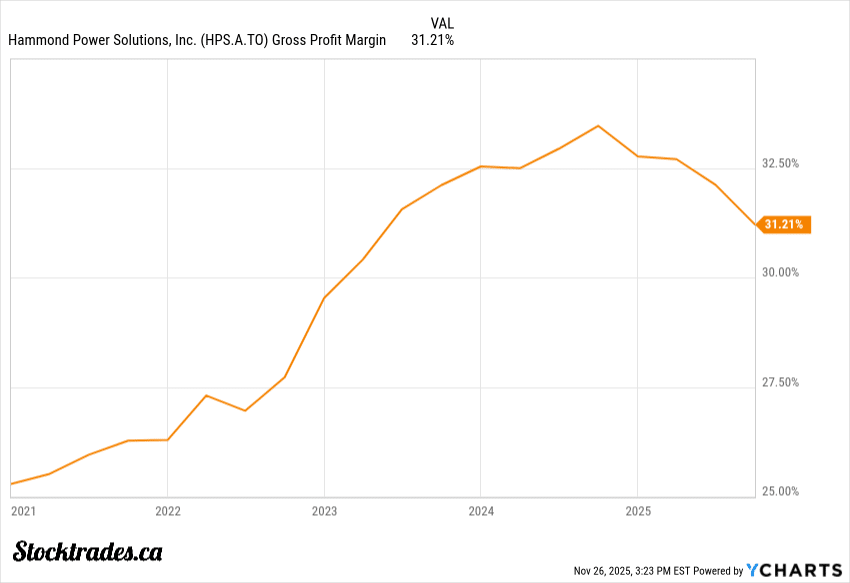

The Margin Squeeze: A “Snag” or a Red Flag?

Here is where the optimist in me gets a little cautious. Revenue is great, but as investors, we get paid on profits. And right now, Hammond is working harder to keep those profits.

Gross margins in the latest quarter slipped to around 31.1%.

For context, we were used to seeing this number closer to (or above) 33% during the peak supply-chain crunch when pricing power was high.

Why the drop? It’s a mix of headwinds:

- Ramp-up Costs: The massive expansion in Mexico is necessary for long-term capacity, but right now, it’s adding overhead and training costs that drag down efficiency.

- Input Inflation: The cost of raw materials and logistics hasn’t vanished.

- Mix Shift: They are selling more “standard” units compared to the high-margin custom units that flew off the shelves previously.

I firmly believe this is a temporary snag rather than a broken business model. Management is trading short-term margins for long-term market share.

That is usually the right move, but it means the next few quarters might look “messy” on the bottom line.

If you’re looking to accumulate shares, your line of thinking is probably “who cares”. Which is the right idea. You get to buy on the cheap for longer.

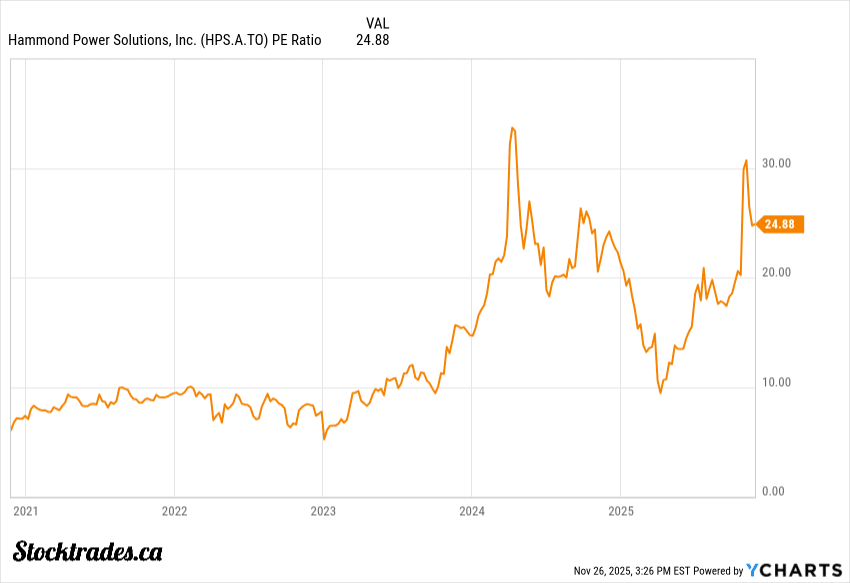

Valuation

A year or two ago, you could buy Hammond for a single-digit P/E ratio. It was a deep value play that the market had ignored.

That secret is out, however.

Today, the stock trades at a valuation that fully reflects its quality.

It’s not expensive compared to high-flying tech stocks, but for an industrial manufacturer, it’s certainly not “cheap.” The market has priced in a lot of the good news. specifically the data centre growth.

If margins stay compressed in the low 30s, the current valuation might face some pressure. The stock needs earnings growth to justify the price tag, and without margin expansion, that earnings growth has to come entirely from selling more transformers. Which ultimately needs more data centre expansion.

Possible, but not guaranteed.

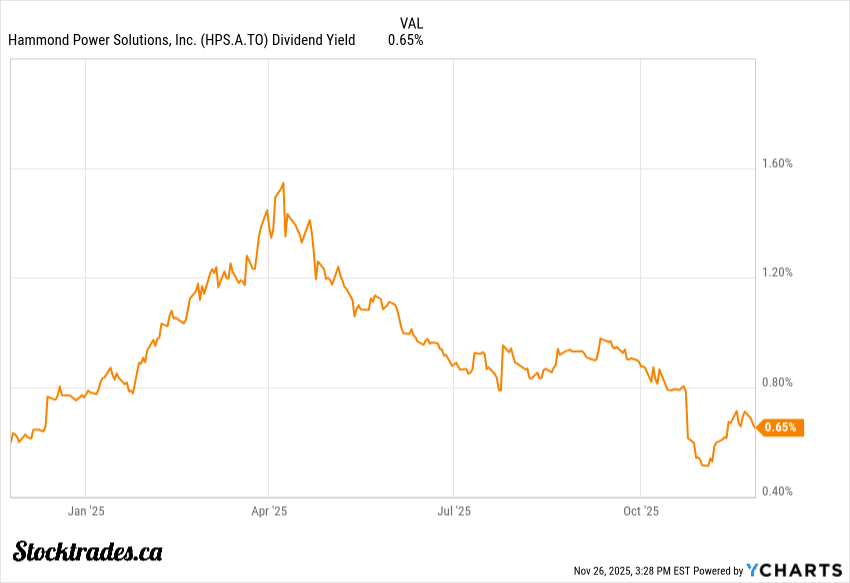

Don’t Forget The Dividend

I know some of you are looking at the yield and shrugging right now. It’s small. But with Hammond, you shouldn’t be focused on living off the yield today. This is a total return play.

The dividend is safe, and they have room to grow it, but the company is (rightfully) pouring cash back into factories and inventory to meet demand. Don’t fall into the trap of dismissing a compounder just because it doesn’t pay 5% right now.

The company has more than tripled the dividend since 2022, yet the yield still sits at 0.6%. The only way this can happen is if prices go up. As investors, we benefit when prices go up. I find that yield chasers looking for the best dividend stocks tend to forget this.

The Bottom Line

Hammond Power Solutions is at a transition point. It is graduating from a nimble small-cap growth stock to a more mature industrial player.

Some Pros:

- Massive secular tailwinds (Data Centres, EV infrastructure).

- Dominant market position in North America.

- Management that thinks in decades, not quarters.

Some Cons:

- Margins are under pressure.

- Valuation is no longer a “screaming buy.”

- Cyclical risks if the U.S. economy slows down.

The electrification story is in the early innings, and Hammond is selling the picks and shovels. The only thing here is it’s not as cheap as it once was. That doesn’t necessarily mean you’d have poor returns if you bought. It’s just not the slam dunk as it once was.