This Blue-Chip Giant’s Stock Is in the Gutter – Buy of the Decade?

Key takeaways

Profit margins remain under pressure from higher care costs

Optum continues to support earnings but growth has cooled

Stock valuation looks fair with modest long-term upside potential

3 stocks I like better than United Health Group.UnitedHealth Group (UNH) stands at a tough crossroads. The stock tumbled this year after management suspended its 2025 outlook and the company’s CEO was murdered. These moves rattled confidence in what’s usually a stable health insurance giant.

I still see UnitedHealth as a long-term hold for patient investors. Near-term uncertainty, though, might annoy short-term traders of the stock.

The company’s Medicare Advantage business has struggled with higher-than-expected medical costs, which cut into margins. Management blames rising care use and mispriced premiums, and it’s already planning higher 2026 bids to get profitability back on track.

Meanwhile, Optum, its healthcare services arm, keeps contributing, though growth isn’t what it used to be. That mix of pressure and resilience makes UNH a case study in how scale can both cushion and complicate a business under strain.

Valuation now looks attractive, however, trading well below historical averages.

So, is this a value trap, or a slam dunk buy? Let’s dig in.

Medicare Advantage Headwinds Remain a Drag on Profitability

UnitedHealth’s latest quarter made one thing clear: Medicare Advantage (MA) costs are rising faster than expected.

Care use from seniors climbed at about twice the planned rate, which pushed the company to lower its 2025 earnings forecast.

The stock took a hit, and peers like Humana and Elevance faced similar cost trends. UnitedHealth’s core earnings engine depends on keeping its medical cost ratio (MCR) stable.

When more members seek care, that ratio rises, and margins shrink. The company’s MCR jumped above internal targets this quarter, a signal that cost discipline is slipping in its largest business line.

That matters because MA now drives most of UnitedHealth’s insurance profit base. CMS payment adjustments haven’t helped much.

Recent payment reductions and slower reimbursement growth mean less revenue per member, even as hospital and outpatient costs rise. The real factor here is utilization: if high care use sticks around through 2025, even a 2026 rate bump might not make up the difference.

Planned exits in about 109 counties show where the math just doesn’t work anymore. UnitedHealth keeps rebalancing its PPO versus HMO mix to manage risk, but that takes time.

Reimbursement risk stays high until pricing matches the new cost base. For now, profitability depends on whether the company can realign MA pricing with what’s actually happening in care trends.

It is a difficult situation to navigate. But if one company is going to do it, it is this healthcare giant.

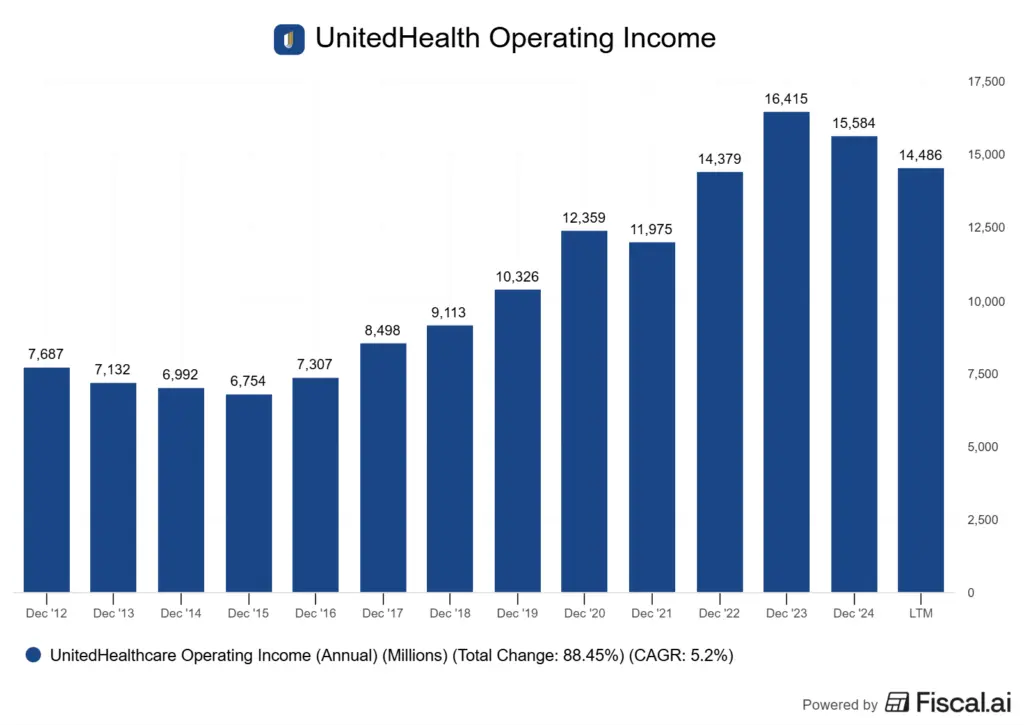

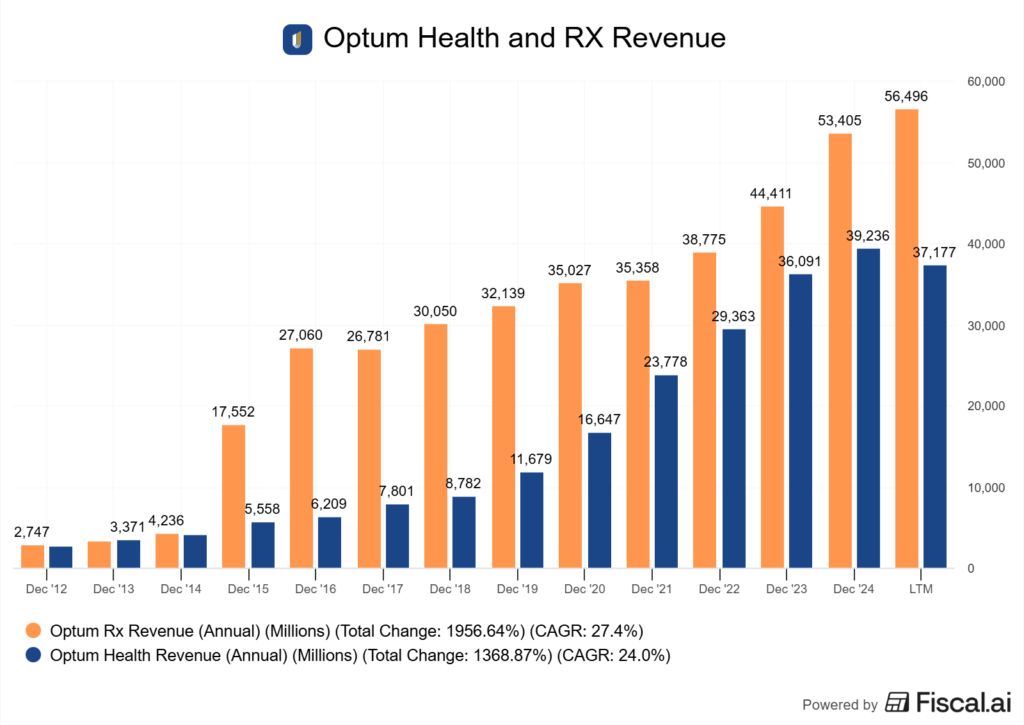

Optum Still Delivers, But Growth Momentum Has Moderated

Optum stays the backbone of UnitedHealth Group’s earnings mix, but its growth pace has cooled off. The business still props up margin stability, yet the recent quarter showed slower expansion across care delivery and data analytics.

Optum’s steadiness often softens volatility in the insurance arm. Revenue growth at Optum Health and Optum Rx is still positive, just not as strong as last year.

Retention remains high, but the mix is shifting toward lower-margin services, which could limit near-term earnings leverage.

Integration across Optum’s verticals, that being care delivery, pharmacy, and data, still drives cost synergies. The challenge is turning those synergies into margin gains while dealing with higher care activity and tighter reimbursement.

That’s especially true as Optum absorbs the impact of lower Medicare funding and changing patient profiles. The company simply needs to execute.

If Optum keeps integration gains and holds margins above the mid-teens, it can stabilize group earnings even as UnitedHealthcare feels cost pressure. But if reimbursement stays weak or complex patient volumes rise faster than expected, growth deceleration could stick around through 2026, despite the company saying it won’t.

Regulatory and Political Scrutiny Adds Uncertainty Ahead of 2025

UnitedHealth Group’s biggest overhang right now is regulatory. There is no doubt about that. The Department of Justice is looking into whether its Medicare Advantage units exaggerated patient diagnoses to collect higher government payments.

That kind of “upcoding” allegation isn’t new for the sector, but it’s serious when it comes back with fresh momentum. The stock’s monumental drop in 2025 shows how quickly sentiment can shift when Washington steps in.

The probe adds to other legal battles. The company already faces antitrust litigation tied to a blocked home-health acquisition and questions about how it integrates physician groups.

Each case tests management’s governance approach and the independence of its board. If oversight looks weak, regulators will keep pushing.

The policy backdrop isn’t easing up either. The Centres for Medicare & Medicaid Services is tightening audits and payment reviews across Medicare Advantage, which means higher compliance costs.

At the same time, changes to Affordable Care Act subsidies could alter enrolment dynamics and margins in the commercial segment. The political climate is shaping expectations, and when the government gets involved, it’s usually for the long-haul and not beneficial to the corporation, more so the consumer.

A new administration promising lighter regulation could slow enforcement, but that’s a big “if.”

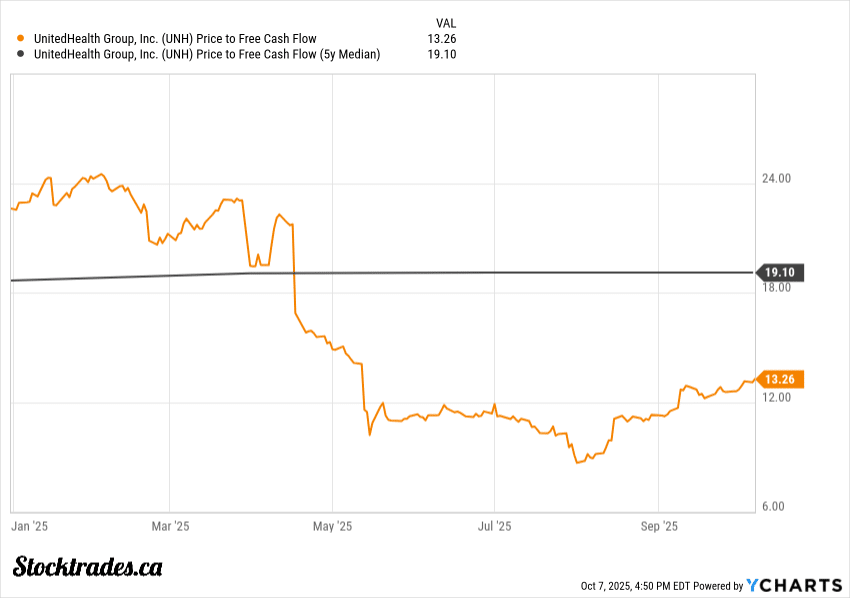

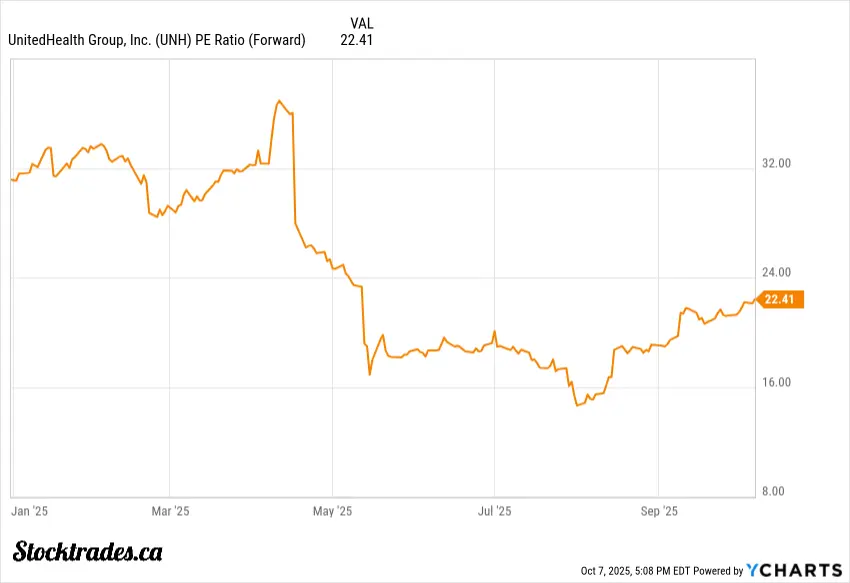

Valuation Looks Discounted, But Operations Need to Improve

UnitedHealth’s last few quarters really reset expectations. Earnings haven’t missed by much, but the bigger hit came from lower guidance and higher medical costs.

The stock’s drop pulled its valuation closer to what I’d call cheap. The market now prices in a slower rebound in Medicare Advantage margins.

At roughly 23x forward earnings, UnitedHealth trades near its five-year average and just a bit above peers like Humana and Elevance. It’s not like this is a super distressed valuation. However, the company routinely traded much higher than this.

If earnings can rebound in 2026 and beyond, this multiple is no doubt cheap.

The forward multiple hints at modest growth, not a full recovery. The discount to intrinsic value depends on which model you trust, and how much you think the company will be impacted by regulations.

If medical cost ratios stay near current levels, margins remain compressed and the P/E doesn’t expand.

In a bear case, another 100-basis-point rise in utilization could shave a dollar off annual EPS. In a base case, stable reimbursement and modest Optum growth keep earnings flat for a few quarters.

I see the stock as priced as a “show me” stock rather than growth. The upside is tied to discipline in cost control; the downside sits in any further Medicare Advantage volatility.

For now, the valuation fits a holding pattern more than a breakout, and I do think it will need to put up multiple consecutive quarters of strong results

Overall, the Long-Term Thesis is Intact, But Short-Term Volatility Persists

UnitedHealth Group’s short-term story still revolves around margin pressure and regulatory noise. The company’s latest earnings miss, Medicare issues, and leadership changes have unsettled investors.

Its long-term fundamentals look pretty solid, though. Shares have steadied after a steep pullback, so maybe the worst of the selling is behind us.

The business benefits from scale and vertical integration. Its insurance arm and Optum services network feed each other, creating a loop of data, cost control, and patient retention.

That structure gives it a cost edge that smaller health plans just can’t match. It’s not flashy, but it works, and this is why United was well on its way to being the first trillion dollar healthcare company in the world.

AI and analytics are becoming more central to how UnitedHealth manages medical cost trends. The company uses predictive models to flag high-risk patients and manage care more efficiently.

That’s critical as medical cost inflation runs above pricing assumptions. If those tools deliver even modest savings, they could support a slow margin recovery over the next couple of years, and the stock will benefit.

Regulatory clarity is still lacking. The Department of Justice inquiry and tighter Medicare Advantage audits add uncertainty.

If penalties stay limited, that overhang could fade by 2026. But if oversight expands, it could cap earnings growth.

The company’s integrated model and resilient cash flow justify patience, even as volatility persists. What I’ll watch next year is whether medical cost ratios start to flatten.

That’s the swing factor for any long-term margin recovery. It’s a waiting game, honestly, but one that might be worth the bet.