Stocktrades Canada

Founded in 2016, Stocktrades.ca has picked up a lot of slack in an underserved market: Information for Canadian investors.

Part of our mission has always been less flair and more value. More data, more insight.

We have always said at Stocktrades that here, you will not find gimmicky perceptions involving expensive cars or fancy watches and suits.

The reality is that appearances are simply not our focus. We know what Canadian investors are looking for, and we are busy welcoming and catering to those interests by providing the highest quality material that is easy to digest.

At Stocktrades.ca, Canadians will find in-depth research and insights on stocks, ETFs, mutual funds, fixed-income securities, and more to help them make better investment decisions.

Canadian Stocks

I have spent 1000s of hours alongside other Stocktrades writers analyzing some of the best companies in Canada and others. Find all the research here.

Exchange Traded Funds

What are ETFs? How to buy ETFs? Which are the best ETFs in Canada? Find all these answers here.

Reviews

I have several reviews on different bank accounts, and brokerages for self-directed investors.

Guides

How to buy stocks? What are Bonds? How to invest in a TFSA or RRSP? You’ll find all this and more here.

We aim to solve many of the difficulties that cause DIY investors to go back to an advisor

Average number of hours of research for active self-directed investment?

20-40+ hours per month. Many aspiring DIY investors don’t have the adequate amount of time needed to build successful portfolios on their own. They need a resource they can trust to deliver them information in minutes that would otherwise take them hours to find.

Due diligence is not a luxury when it comes to investing. It is a necessity. The markets move quickly these days, and with the excess of information, most opportunities have come and gone before people even realize it.

Lack of legitimate Canadian stock information

Part of our mission at Stocktrades.ca is doing away with spammy content skewed by the personal gain of writers and analysts with no regard for the integrity of their information. That kind of content creates a “digital fog” of sorts, and a massive time delay for investors trying find quality stock information.

Not to mention the constant “all in alerts” or “this could be like buying Nvidia at $5” grabby headlines. Stocktrades.ca works toward being a reliable source of information, not just click-bait headlines.

Knowledge brings around confidence and informed decisions

We understand that many people are hesitant regarding investing. DIY investing is just like anything else, increasing knowledge allows for increased confidence.

Lack of knowledge can lead to considerable negative consequences when investing. One thing we love to remind people regarding investing is this: know what you are buying and why you are buying it.

Stocktrades aims to help people start to get through this with our investment guides, high-quality investment research, and market commentary. Our readers can tap into decades worth of experience in the markets and avoid learning the hard way.

Fund fees and low-return savings accounts can significantly erode long-term returns

This is why we are huge supporters of self-directed investment, and we can show you why.

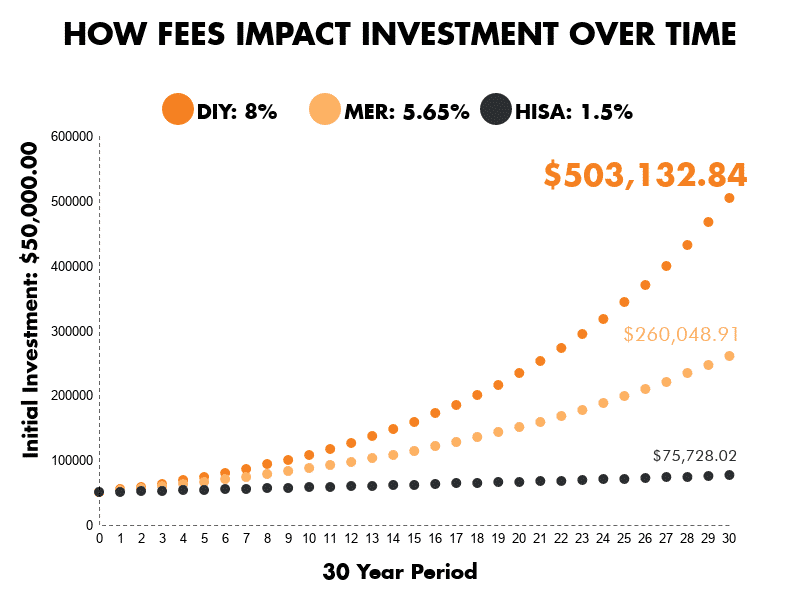

Take a look at this graph where we show the substantial difference a few percentiles can make over the life of an investment portfolio…

The DIY portfolio earns 8% a year, the mutual fund portfolio earns 8% a year less a 2.35% fee (for 5.65% annual returns), and the High Interest Savings Account earns 1.5%.

As you can see, the difference after 30 years between the DIY method and paying your bank to invest your money is two hundred and forty three thousand dollars! If a person plans on having a $60,000 per year budget in retirement that difference equals 4 years worth of retirement lost.

Stocktrades today

Over the last several years visitors like yourself have helped us carve out a place for Stocktrades.ca and this allows us to reach more people than ever with our messages.

- Over 1.8 million Canadian visitors

- 20,000 YouTube subscribers

- Newsletter list of over 25,000 Canadians itching to find the next best stock

- Stocktrades Premium platform where over 1,800 Canadians are utilizing in-house designed tools and research to improve their portfolios

Bringing you the unbiased, educational and to the point investment news, strategies, and tips.

Daniel Kent

Dylan Callaghan

Join Stocktrades Premium Today!

Write a short descriptive paragraph about your product. Focus on your ideal buyer. Entice with benefits of using your product.

In the media

Over the years Dan’s research has been highlighted in numerous major financial publications, including Business Insider, Entrepreneur, CBC, The Globe and Mail, Crypto.com, and more. To highlight the extent of his expertise, Dan was invited by the now Alberta Premier Danielle Smith to do a one-on-one interview about the state of the markets in 2021.

In addition to this, he has worked with some of the largest financial institutions in Canada, including Toronto Dominion Bank and the Bank of Montreal.

Head-to-head debate with Dan Kent, hosted by TD Bank: Is living off dividends a good idea

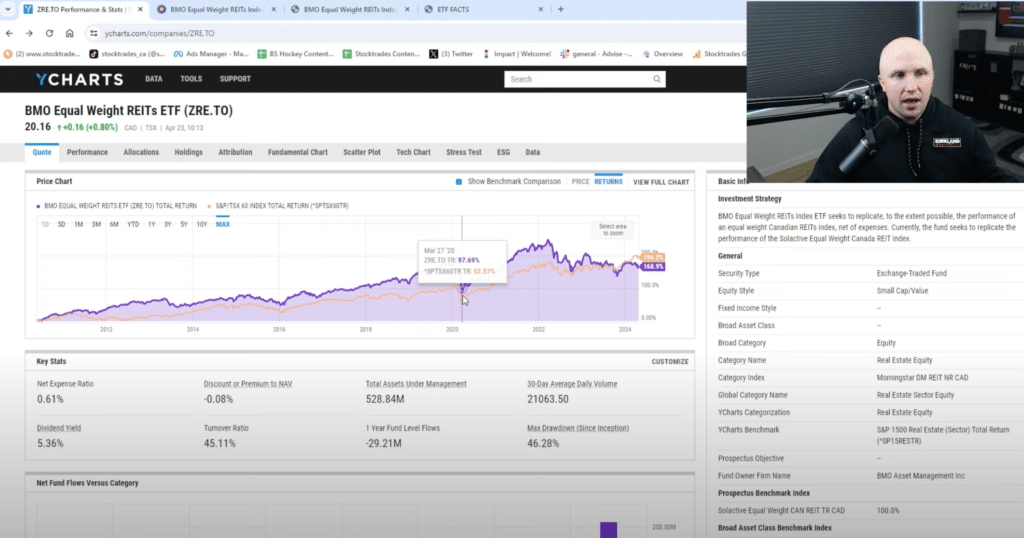

BMO ETF Market Insights: Dan Kent, simple all-in-one portfolio solutions for long term growth

The Canadian Investor Podcast

Dan co-hosts one of the largest investing podcasts in Canada, the Canadian Investor Podcast with Simon Belanger, providing up-to-date opinions, commentary, studies, and more on some of the most prominent companies in Canada.

With over 20,000+ listeners an episode, the podcast is one of the largest in Canada when it comes to investing, and primarily focuses on earnings analysis, market commentary, and education to help investors improve their skillsets.

Interested in working with us? Learn more:

Connect

Resources

© 2025 Stocktrades Canada Ltd

Stocktrades is an independent media portal covering the development related to stocks on the TSX. However, Stocktrades is by no means associated with the Toronto Stock Exchange, or any of the companies we cover. All content on Stocktrades is the views of the individual reporters. Stocktrades offers strictly investment opinions, not investment advice. It is important to seek out a qualified investment, tax or legal professional before making any decisions related to your own personal investments. The information on Stocktrades.ca represents the views of the authors and should not be misconstrued as advice.