The Low-Yield, High Dividend Growth Study

We’ve got an amazing piece of content for you today that will be an eye-opener for many investors. In fact, it may literally change the way you invest.

Let’s jump right into it.

Last month we talked about the pitfalls of chasing high yields. Today, we will look at the opposite end of the spectrum – avoiding low yields.

While investment strategies always depend on one’s own investment goals, we believe avoiding low-yielding stocks is a mistake, especially in the context of dividend growth investing.

With the sheer amount of income based influencers and websites online, we’re definitely swimming against the current with our opinions on this. And often, we do face heavy criticism. But historical returns have been firmly on our side for decades now, and we’re going to highlight that later on in this e-mail.

Avoiding low yielding companies can be especially costly for those new to the market and early in their investment careers.

I was a staunch dividend growth investor. Over the years, I took a more balanced approach by introducing growth to my portfolio. That said, the bulk of my portfolio is still made up of strong dividend growers.

Anything I read back in the day relating to dividend growth investing, most of the experts had some sort of starting yield in their screeners, usually in the 2.5-3% range minimum. These so-called ‘experts’ in the dividend growth field would screen out any company that didn’t meet the minimum yield criteria.

I never understood it and still don’t, as one can potentially miss out on some excellent investments.

Again, we’ll discuss this and show real-world examples later in this piece, results that will likely surprise you. They definitely surprised us.

Let’s start with debunking the biggest misconception about low-yielding stocks

The misconception is that a low yielder is a low dividend growth stock. This is categorically false. Looking at every Canadian Dividend Aristocrat (those with 5-year plus dividend growth streaks) that has raised the dividend by an average annual rate of at least 10%, approximately 55% of those have yields lower than 3%.

So why is this? How can yield stay so low with growth so high?

There is really only one way this can happen, and that is if the stock price is increasing. When we think about the definition of yield, it is simply the stock’s price compared to its dividend.

Unless there are some significant missteps within company management, a fast-growing dividend will mean fast-growing earnings. And considering in the vast majority of cases the market values companies based on a multiple of their earnings, we can now see why their share price would be increasing as well.

Let’s move on to another curious statistic.

A high-yielding Canadian Dividend Aristocrat is more likely to cut the dividend

Of all the Canadian Dividend Aristocrats with yields below 3%, approximately 30% of them had at least one instance of a dividend cut in their history. This compares to 42%~ for those with yields above 3%.

One can extrapolate from this that a low yield likely means a safer dividend. It doesn’t, however, guarantee that the dividend is safe. In fact, there are many companies with yields less than 3% whose dividend looks quite suspect and have payout ratios well above 100% or in the negative. As usual, one must still do their due diligence on the safety of that dividend, even if it has a lower yield.

However, statistically, you are more likely to face a dividend cut with a higher yielding stock.

Now let’s turn our attention to the single biggest reason why we believe it is a mistake to ignore low yields in an attempt to chase income

You’ve likely heard us talk about the importance of total returns in the past, but dividend investors tend to have a bias of preferring high yield over total return.

If one needs dividends today, such as those that are in retirement, then we can understand why one would worry less about total returns and more about the annual income they generate.

However, if one does not need access to income from their investments, then in most cases they are leaving money on the table by attempting to generate income now.

Let’s circle back to the Canadian Dividend Aristocrats. Of all those companies that yield greater than 3%, only 7.6% of them have a five-year double-digit compound annual growth rate in terms of their share price. That is only 4 companies.

In contrast, 62.5% of Aristocrats with yields below 3% have achieved five-year CAGRs in the double-digits. That is quite the statistic.

Now, we know what you are thinking – share price appreciation doesn’t include total returns. We need to be including dividends and even the potential reinvestment of those dividends.

That’s right – so let’s illustrate with some data using total returns

We wanted to see how the overall returns of a portfolio that contains exclusively low-yielding Canadian stocks would stack up to a portfolio of some of the most popular high-yielding options in the country today.

We will admit, when we first started this comparison, we knew low-yielding stocks would outperform the high-yielders. What we didn’t realize is how truly drastic the separation is.

We made up two model portfolios, each of which contains an equal weighting of 8 stocks. The low-yielding portfolio contained:

Alimentation Couche-Tard (TSE:ATD)

Brookfield Corporation (TSE:BN, formerly BAM.A.TO)

CCL Industries (TSE:CCL.B)

Canadian National Railway (TSE:CNR)

Equitable Bank (TSE:EQB)

Loblaw (TSE:L)

TFI International (TSE:TFII)

Waste Connections (TSE:WCN)

While the high-yielding portfolio contained:

Sunlife Financial (TSE:SLF)

Power Corporation (TSE:POW)

Emera (TSE:EMA)

BCE (TSE:BCE)

Bank of Nova Scotia (TSE:BNS)

Enbridge (TSE:ENB)

Manulife Financial (TSE:MFC)

Canadian Imperial Bank of Commerce (TSE:CM)

How were the stocks chosen?

Every company in the low-yielding portfolio is either currently being highlighted or has been highlighted at our flagship platform Stocktrades Premium

On the high-yielding end, Manulife Financial and Power Corporation have been highlighted in the past. But for the most part, these are income stocks here in Canada that have large volumes and are extremely popular amongst yield seekers.

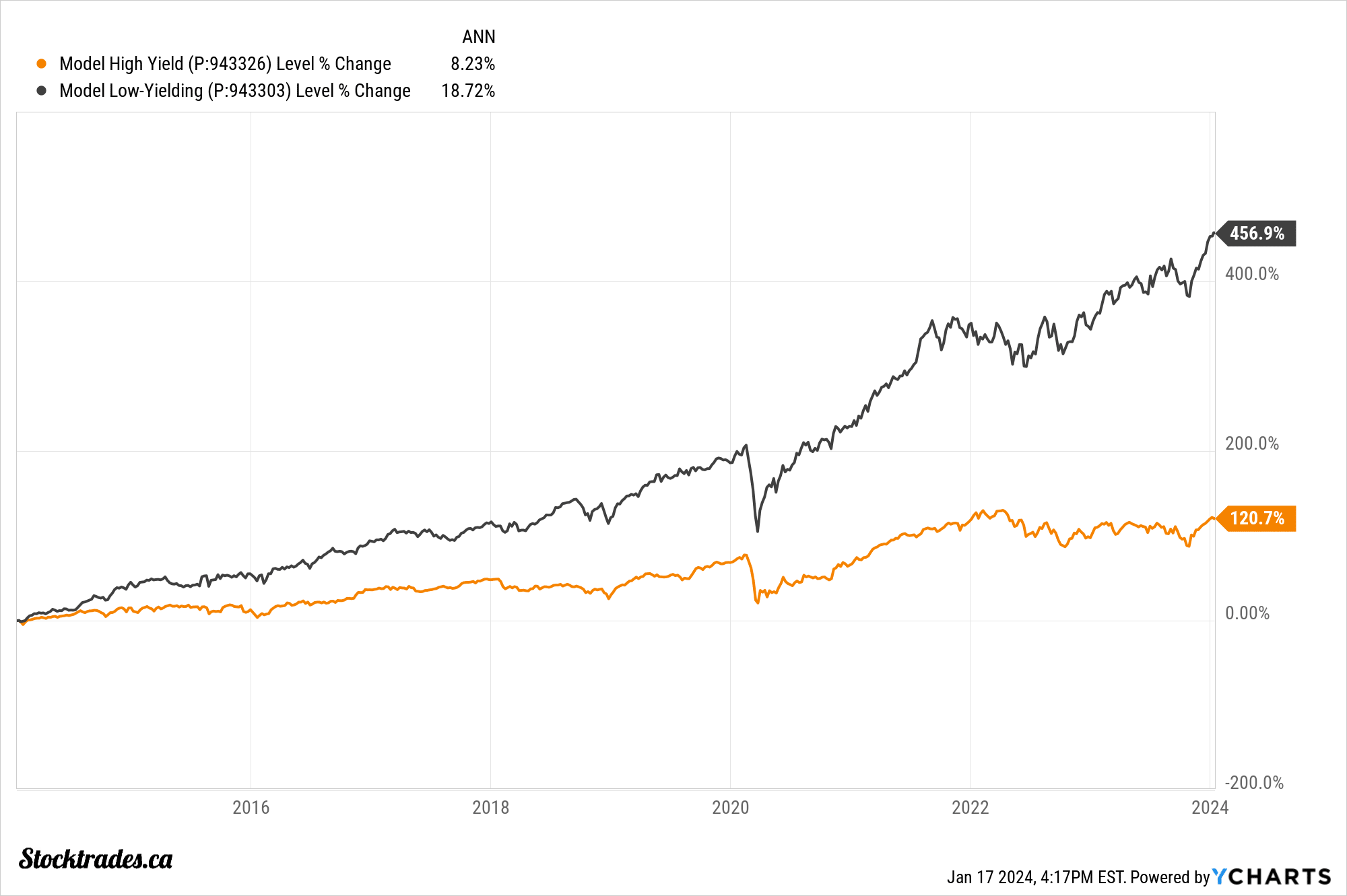

In the chart below, you will see the total returns from the low-yielding portfolio when compared to the high-yielding portfolio. Of note, this would include the investor reinvesting the dividends to allow compounding.

The compounding effect

As we can see, despite the ability to take the dividends and reinvest them, the “compounding” effect in terms of overall returns was felt significantly more with the portfolio of low-yielding companies.

This is another misconception investors have about compounding. Many feel they need to receive a high yield from the company in order to buy more shares. The common “snowball effect” mentality. When in reality, compounding can occur at a faster rate if the company is able to reinvest the capital internally to fuel growth.

In fact, the low-yielding portfolio put up significant annualized returns of nearly 19%. This not only outperforms the S&P 500 but the NASDAQ as well.

If we look at hard dollar numbers instead of percentages, $100,000 invested in the low-yielding portfolio 10 years ago today would have you sitting on $560,000. The high-yielding? $220,700.

Keep in mind, you also would have had to re-invest the dividends in both of these portfolios over that time span, so you would not have benefited from the actual income stream from the high-yielders.

Let’s dismiss some likely counter-arguments to this comparison

For many, the justification for this outperformance may come from the idea that many of the companies in the high-yielding portfolio were large, established blue-chip companies a decade ago.

It makes sense that a portfolio of smaller companies could outperform them. Once the low-yielding companies become larger, they will struggle to grow as fast.

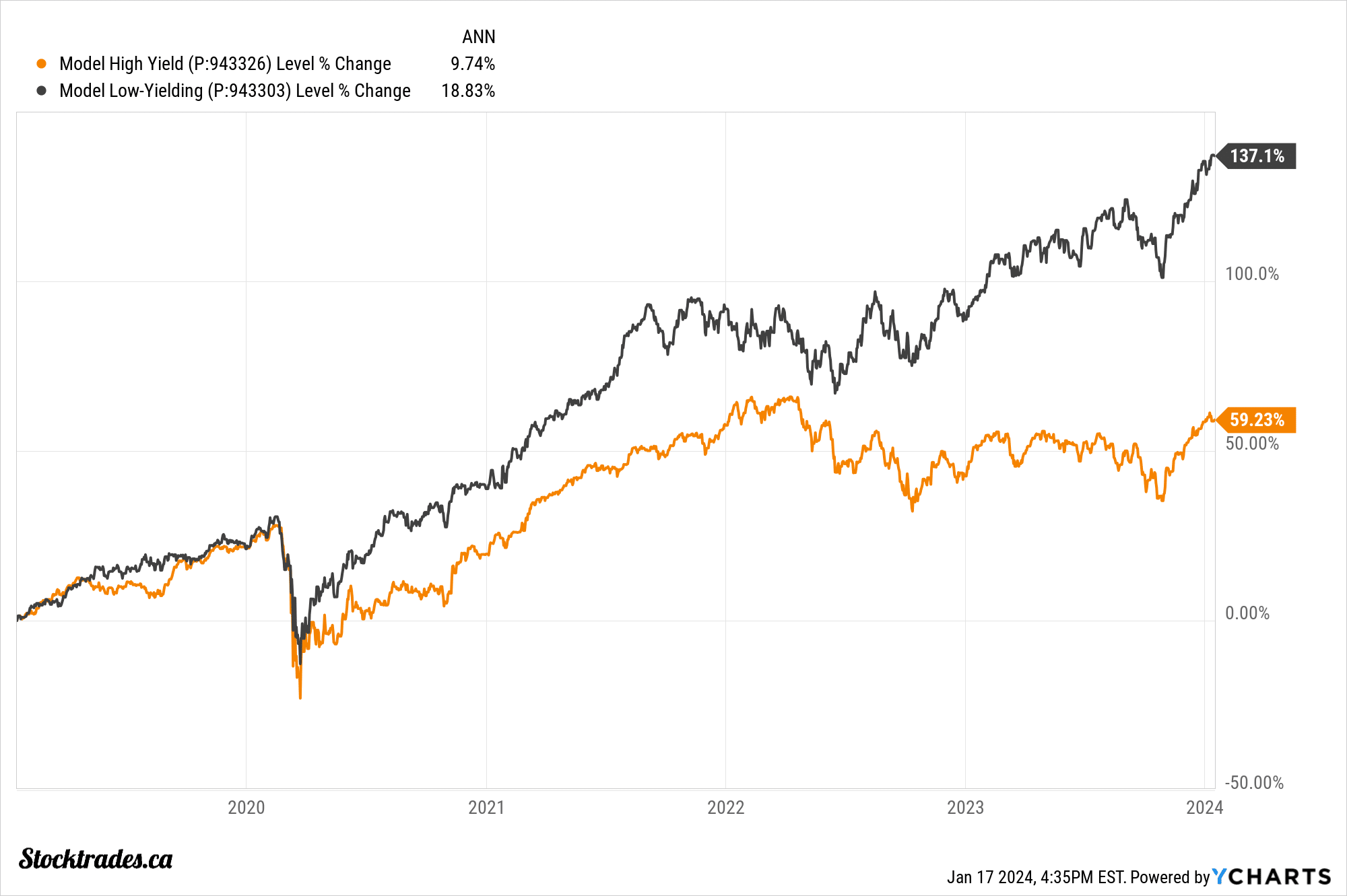

And while this is true in the fact the low-yielding portfolio has not grown as fast over more recent time spans, its outperformance versus the higher-yielding portfolio has been larger in recent times. Let’s look at these portfolios over the last half-decade:

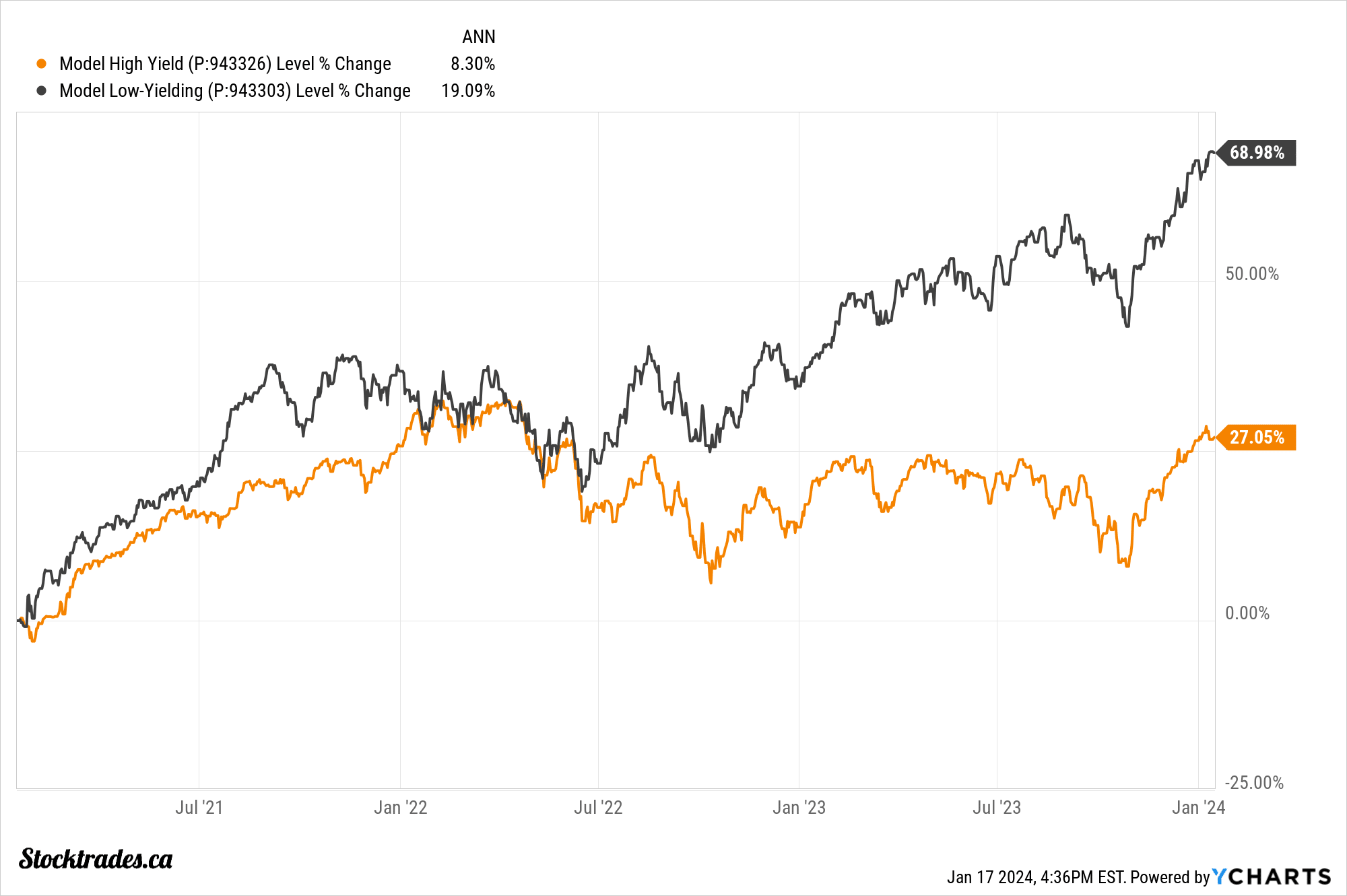

And 3-year periods:

Why is this the case, and can we expect the same thing moving forward?

There is a logical reason as to why this is happening, and why it is likely to continue happening moving forward.

As a company matures there are often fewer opportunities for organic growth. Reinvested capital back into the company is unlikely to be fruitful for investors. So instead, they begin to pay larger dividends.

It is difficult for a company to be paying out a 5%+ dividend yield and delivering strong internal growth. It’s highly likely that the company is paying out that dividend because it cannot find anywhere better to spend it. This is why you’ll often see high-yielding companies with low earnings growth.

On the flip side, low-yielding companies are often finding ways to spend cash flow organically to expand the business. There is no reason for them to pay out a large dividend, as the money is better spent internally, fueling earnings growth, and thus dividend growth.

A core valuation model in the stock market is price to earnings. If a company can continually grow its earnings, its share price will grow. If it can use internal capital to fuel growth rather than paying it out as a dividend, it can result in compounding earnings growth.

So, low-yielding is automatically better then?

Not so fast. There are plenty of poor low-yielding companies. So don’t get the idea that every low-yielding company is a diamond in the rough.

The point of this week’s newsletter was not to convince you to sell all of your high-yielding stocks, or to exclusively look for stocks with low yields.

The point of this week’s newsletter was to get those who have the tendency to say:

” I’m not going to bother looking at that company, it only yields 1%”

To instead dig deeper and look at the company overall.

Wrapping it up

As you can see, if one ignores low yields they are likely missing out on some especially high-quality investments. Investments that have a proven history of outperformance.

In our low-yielding portfolio, it’s not like we cherry-picked small-cap growth companies. It contains some of the largest companies in Canada in Loblaw, Canadian National Railway, Alimentation Couche-Tard, and Brookfield Asset Management.

One of the hardest things to do as investors is to learn, adapt, and put aside biases – the latter being the most difficult. Investing is not black and white.

At the end of the day, investors should do what is best for them. However, to be a successful retail investor, one must always be learning, willing to listen, and let one’s bias be challenged.

Unfortunately, in our experience, staunch dividend growth investors will have strong opinions on why low-yielders should be ignored. This is especially true of pundits that claim to be experts in their field.

In an age where everyone is an expert on social media, be weary of those who don’t have an open mind and those who insist that their way is the only ‘right’ way.

At the end of the day, it always comes back to one’s investment goals. But the key here is that screening out companies based on yield can lead to missed opportunities – especially if one is targeting total returns at their stage of investing.