This Company is Betting The Farm on AI Expansion – Disastrous or Genius?

Key takeaways

Cloud growth is strong but near-term earnings remain uneven

Backlog supports long-term demand but execution is critical

Expansion requires cash flow discipline to prove sustainable

3 stocks I like better than OracleOracle (ORCL) looks fairly valued right now, but the execution risk is real. The company’s cloud infrastructure business is growing fast, and that’s the engine that matters most for earnings, and is the one investors could be paying attention to.

Whether Oracle is a buy today depends on how well it can convert its cloud backlog into profitable growth without eroding free cash flow.

Thus far, especially after earnings, this is proving to be true.

The appeal is clear: Oracle’s cloud bookings keep climbing, and its performance obligations backlog signals strong demand ahead.

The counterpoint? Near-term earnings have missed expectations, and legacy software is stalling.

That creates a gap between long-term potential and short-term delivery. It makes this less of a defensive name and more of a long-term growth bet. Its recent pop in regards to earnings wasn’t because of actual results, it was because of projections out to 2030~.

The swing factor over the next quarter is the cloud business. If Oracle can show that scale translates into cash flow, the stock fits well for long-term investors.

If not, it risks being priced for execution without the follow-through. Let’s dig into what actually matters over the next few quarters.

AI‑Driven Cloud Bookings Soar—but Near‑Term Earnings Miss Expectations

| Segment | Revenue (Q1 FY26) | YoY Growth |

|---|---|---|

| IaaS | $3.3B | +55% |

| SaaS | $3.8B | +11% |

| Total Cloud | $7.2B | +28% |

Oracle’s cloud business is moving at a very different pace than its earnings. Demand for AI infrastructure is piling up faster than I expected.

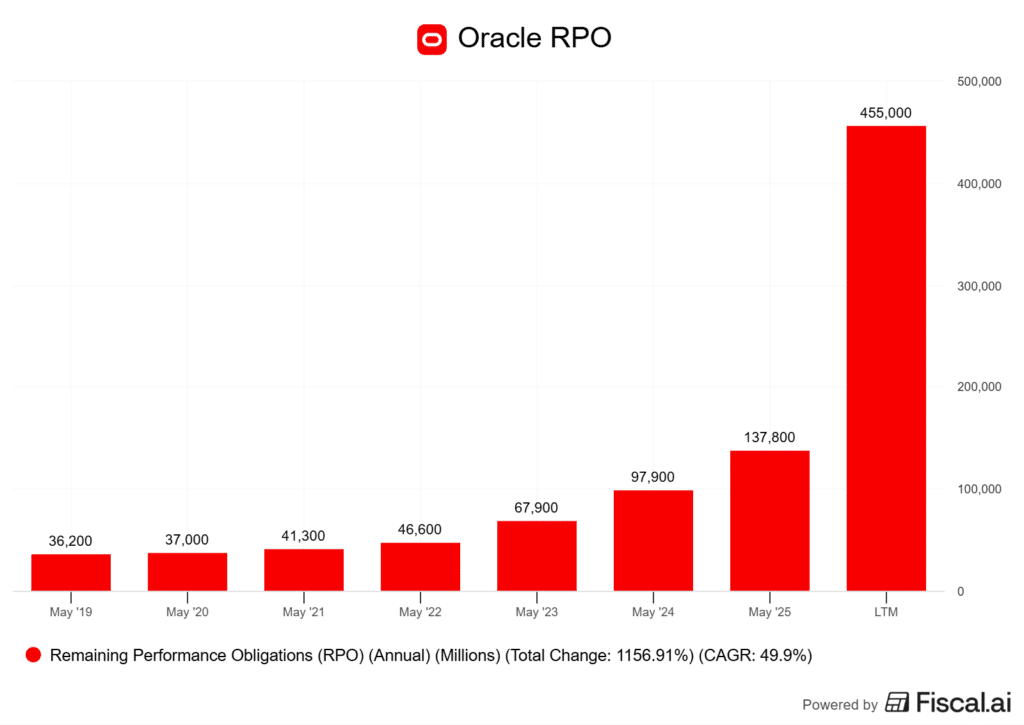

The company’s Remaining Performance Obligations (RPO) jumped to $455 billion, a 359% increase year over year. That’s a massive backlog of contracted revenue already locked in.

The split between cloud infrastructure and SaaS tells the story. Infrastructure-as-a-Service (IaaS) revenue grew 55% to $3.3 billion.

Software-as-a-Service (SaaS) rose just 11% to $3.8 billion. The weight of growth is clearly on infrastructure, where AI workloads drive the need for raw compute power.

Here’s the catch. Despite double-digit revenue growth, GAAP earnings per share slipped 2% to $1.01.

Non-GAAP earnings rose modestly, but margins remain under pressure. Heavy capital spending on new data centres and AI partnerships is fueling growth, but it’s also weighing down near-term profitability.

Investors have noticed this tension before. Earlier this year, Oracle’s stock fell after earnings missed estimates despite strong AI‑driven cloud growth.

The pattern keeps repeating: strong bookings, weaker earnings. The upside is clear — Oracle is winning big AI contracts and securing long-term revenue.

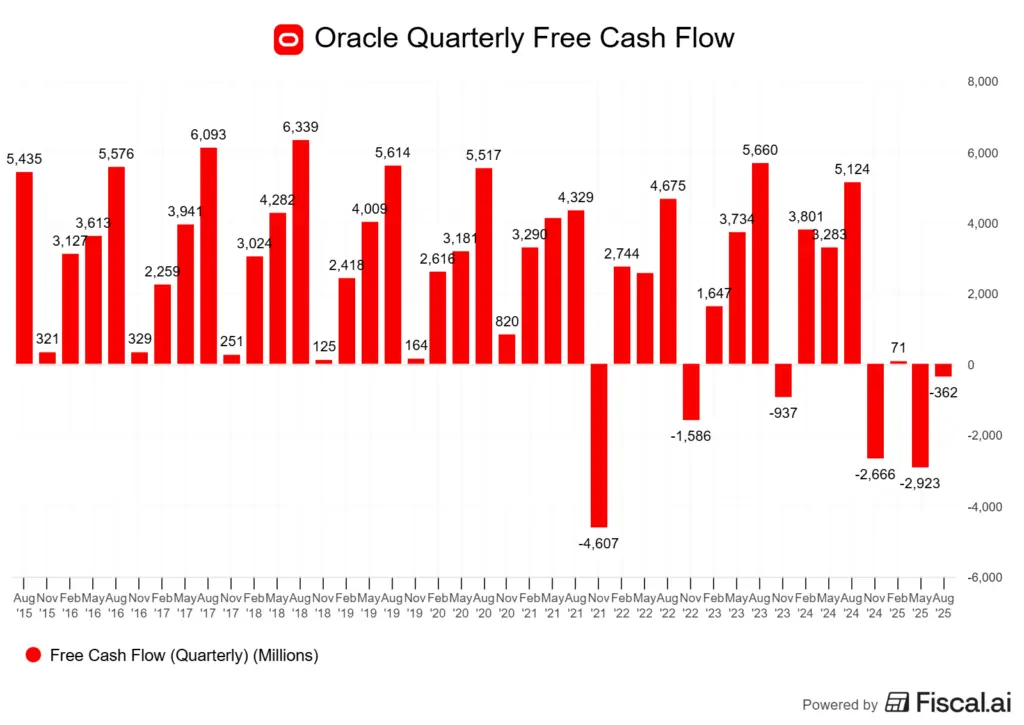

The risk? Those wins don’t translate into stronger profits right away. It works for now, but only if the company can keep operating on negative free cash flow.

Massive Performance Obligations Backlog Signals Strength—but Execution Path Matters

Oracle’s backlog of contracted revenue has become the headline number. Remaining performance obligations (RPO) increased by 40% YoY.

That kind of growth is unusual in large-cap software and signals strong demand for its cloud and AI services. A backlog of that size gives management and investors a degree of revenue visibility that most peers don’t enjoy.

Roughly a third of that figure is expected to convert within twelve months, which effectively sets a floor under near-term sales. Oracle also anticipates further acceleration in FY2026, with contract backlogs potentially doubling again.

Here’s the catch. A backlog is only as valuable as the company’s ability to deliver on it.

Execution risk is real when revenue guidance assumes 15% growth or more, especially in a market where hyperscalers like Microsoft and Amazon already dominate. Converting signed deals into profitable, recurring revenue requires disciplined cost control and consistent service quality.

Investor sentiment is leaning bullish because of the backlog, but the market will quickly punish any slip in conversion rates or margins, especially at these valuations. The swing factor is whether Oracle can scale its infrastructure fast enough to meet demand without eroding profitability.

If costs creep up or deployments lag, the backlog shifts from a strength to a liability. For me, the key number to watch over the next year is the pace of RPO conversion into actual cloud revenue.

If the conversion rate holds steady, the bullish case stays intact. If it stumbles, the backlog story loses its shine.

Cloud Expansion Accelerates at the Cost of Free Cash Flow

Oracle is leaning hard into its cloud buildout, and the numbers show it. Cloud infrastructure revenue rose 52% year over year in fiscal 2025.

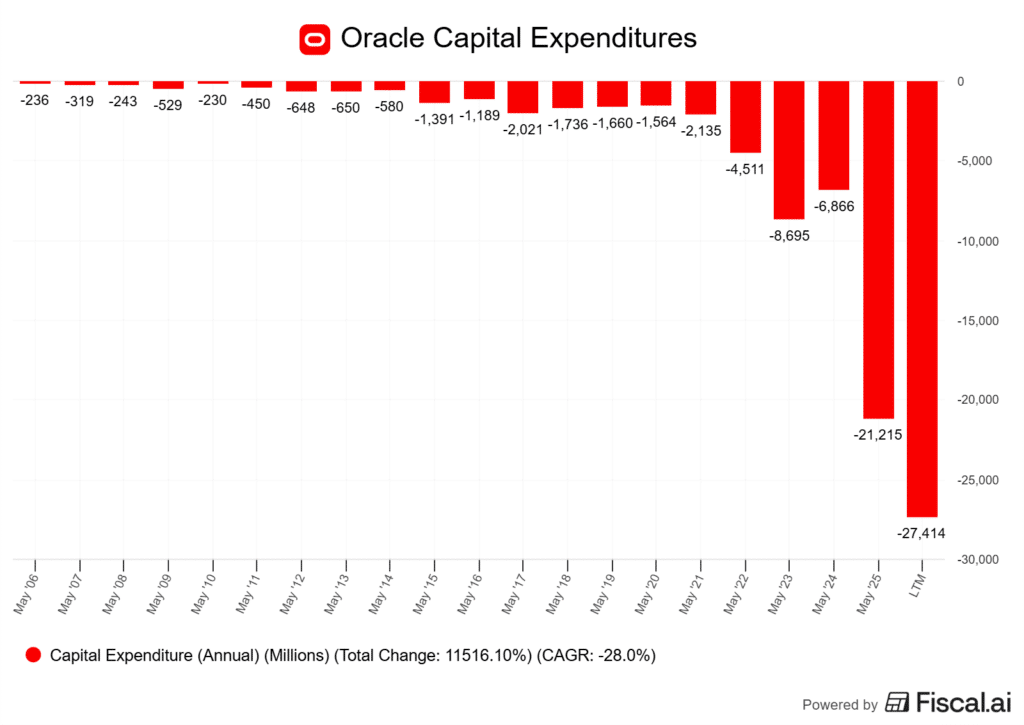

But free cash flow swung negative to about -$394 million from a positive $11.8 billion the year before. That’s a sharp reversal, and it tells me the growth isn’t coming cheap. In fact, the company is spending absolutely everything they have and then some.

The driver is capital expenditures. Oracle has laid out a $25 billion plan to expand its global footprint, adding new data centres, AI superclusters, and sovereign regions.

This is a scale of spending that now puts it in the same league as Microsoft and Google. The upside is stronger positioning in AI workloads. The downside is cash strain. I’ll show this chart again, which is mind-boggling.

Building cloud regions isn’t a one-and-done cost. Each new facility brings ongoing maintenance, staffing, and hardware refresh cycles.

Oracle poured nearly $27 billion into capex over the past year, and that level of spend is weighing heavily on free cash flow. Growth is real, but so is the financial pressure.

I see the long-term logic. Demand for AI infrastructure is rising fast, and Oracle wants to capture multi-billion-dollar contracts before rivals lock them up.

But the trade-off is clear: near-term profitability is being sacrificed for expansion. If the company doesn’t start to see a return from this massive amount of spending, the market will get spooked.

If Oracle can fill these new regions quickly, the spending starts to look like a smart bet. If uptake lags, it becomes a drag on returns. That balance will be critical to watch in the next set of results.

At the same time, the company committed to a record $25 billion infrastructure plan. Those two numbers tell the whole story: expansion is working thus far, but it’s ridiculously expensive.

Legacy Software Stalls Even as Cloud Gains Momentum

Oracle’s latest results show the same split I’ve been watching for years: cloud revenue is climbing, while legacy software is dragging. About a year ago, Oracle’s cloud services (SaaS plus IaaS) finally surpassed license support revenue.

That’s a milestone, but it also underlines how dependent the business still is on older contracts. The core engine used to be perpetual licences with annual support fees.

That model delivered predictable cash flow, but it’s shrinking. Licence support revenue is flat to down, while cloud services grew about 20% year over year.

The shift is real, but it’s not yet offsetting the slower legacy base. ERP and database customers are the swing factor.

Many still run on-premise systems, but Oracle is pressing them to migrate. Discounts and bundled AI features are the carrot.

The risk? Some firms delay upgrades because of cost, complexity, or culture. That leaves Oracle straddling two models, each with different margin profiles. The IaaS versus SaaS mix matters too. SaaS is steadier, with stickier margins.

IaaS is more volatile, tied to infrastructure demand and price competition with hyperscalers. Oracle has leaned into IaaS by signing large AI training deals, including with OpenAI, but those wins are lumpy and capital intensive.

Cloud transition is the upside. Legacy software revenue is the drag.

If cloud keeps growing at double digits while licence support erodes slowly, the balance works. If support revenue falls faster, the math breaks.

That’s why I’ll watch the ratio of cloud to licence support over the next few quarters. It tells me if the transition is holding. For context, analysts have noted that enterprise digital transformation often stalls because of legacy systems and upgrade timing.

Oracle is caught in that same tension: momentum in the cloud, but a customer base still tied to the past.

Is The Company a Buy?

I’m on the fence at this point in time. Much of the company’s valuation right now is tied up in the “story” of future AI infrastructure demand.

However, it is literally pouring every dollar it makes into satisfying that demand, of which we do not know how profitable it will be at this point in time.

It is a large gamble, one that could pay off tremendously, or one that could turn into a monumental amount of money invested at relatively low returns.

Time will tell. If I were to bet, I would say they succeed. But it is certainly not risk free.