This Canadian Dividend Growth Stock Is 30% off Highs – Opportunity?

Key takeaways

Propel’s digital lending platform keeps expanding globally, boosting long-term revenue potential.

Profitability and dividend growth are solid, but tighter credit and higher costs add pressure.

Execution and credit quality control will decide if growth can offset rising regulatory and funding risks.

3 stocks I like better than Propel HoldingsThe search for growth in today’s market, at least at a fair valuation, seems nearly impossible.

You want capital appreciation, but the markets are littered with “growth stocks” that promised the moon and delivered nothing but volatility. You want income, but high yields often signal a business in distress. So when investors see a company like Propel Holdings trading at only 8x expected earnings with a 3.5% dividend yield, they tend to look twice.

My goal today is to cut through the noise surrounding Propel Holdings (PRL.TO). Is this a legitimate growth story with a runway ahead, or are investors right to be nervous about the current risks lurking in the consumer credit market? Let’s dive in.

The Business: AI-Driven Lending in a Cloudy Economy

Simply put, Propel Holdings is a lender for the people banks won’t touch.

Through its brands like CreditFresh in the U.S., Fora in Canada, and the recently acquired QuidMarket in the U.K., Propel focuses on non-prime borrowers. These are folks who might have a bruised credit score but still need access to funds.

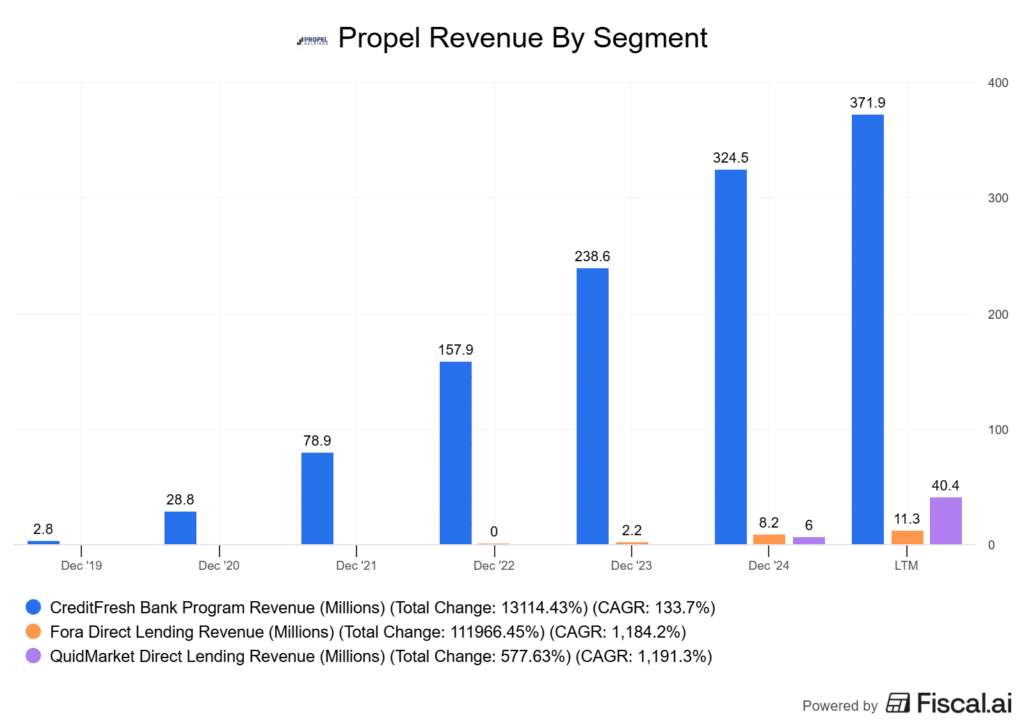

If you look to the chart below, you’ll see the vast majority of the company’s revenue is in the United States (CreditFresh)

The “secret sauce” here is their proprietary AI platform, which analyzes thousands of data points to assess risk better than a traditional FICO score could.

The problem? Lending to non-prime borrowers is risky business. The answer? Technology. By automating the underwriting process, Propel claims it can separate the good risks from the bad faster and more accurately than competitors.

In my opinion, the business model has substantial tailwinds right now over the long-term. Traditional banks are tightening their lending standards, effectively pushing more customers toward alternative lenders like Propel.

However, we can’t ignore the risks either. Just because I believe there are long-term tailwinds here doesn’t mean short-term headwinds don’t exist.

If unemployment ticks up or inflation remains sticky, the demographic that utilizes alt lenders is the first to feel the pain, potentially leading to a spike in defaults. We’re starting to see this with a Canadian alt lender in Goeasy Ltd.

The Numbers: Record Revenue Meets Market Skepticism

If you look purely at the financial statements, Propel seems to be firing on all cylinders.

In Q3 2025, the company reported a revenue jump of approximately 30% to US$152.1 million.

Both adjusted EBITDA and net income hit new highs, and EPS climbed 26% year-over-year. These aren’t just surface-level metrics; they show that the company’s “Lending-as-a-Service” model, where they partner with banks like Pathward to originate loans, is scaling at an outstanding pace.

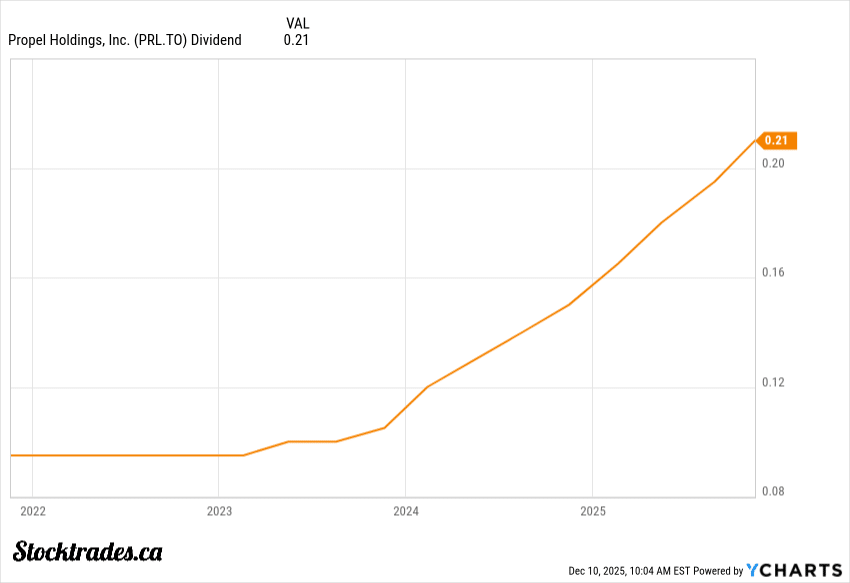

To top it off, the board raised the annualized dividend to CA$0.84 per share, marking an 8% increase.

But here is the snag. Despite these record numbers, the stock has faced significant pressure, dropping roughly 30% to 35% over the past year.

Why the disconnect?

I believe the market is pricing in a “credit event.” Investors are looking at that 26% EPS growth and asking, “Is this sustainable?” When a lender grows this fast, there is always a fear that they are loosening standards to chase volume. If the economy hits a wall, those loan books could deteriorate quickly.

The Dividend: A Growth Play, Not a Safety Net

For the dividend growth investors reading this, Propel offers an interesting, albeit risky, proposition.

With a payout ratio that looks manageable against current earnings, the dividend appears safe for now.

The company has a history of raising it, which is a key pillar of a dividend growth investor’s strategy. However, I must warn you against treating this like a utility or a telecom.

In the lending game, cash flow can evaporate if regulatory caps change (a constant risk in this sector) or if charge-offs rise faster than expected. The dividend is a nice bonus, but it should be viewed as a variable component of your return, not a guaranteed paycheck.

Look no further to the chart above in which the dividend payout ratio was over 70%.

Geographic Diversification: Hedging the Bets

One thing I appreciate about Propel’s strategy is that they aren’t putting all their eggs in one basket.

- United States: The primary growth engine, but highly competitive.

- Canada: A stable, albeit smaller, market with Fora.

- United Kingdom: The QuidMarket acquisition provides a foothold in a new region.

Essentially, this diversification acts as a buffer. If regulatory headwinds hit the U.S. operations, the Canadian and U.K. arms can help stabilize the ship. It mirrors the resilience we see in larger multinational banks, just on a much smaller, riskier scale.

With the US market making up 90%+ of revenue, this is likely to have a relatively minor impact, but an impact nonetheless.

My Final Thoughts

So, is Propel Holdings a buy?

I view Propel as a long-term buy on a consistently weaker consumer and higher cost of living. However, is it a buy right now? That really depends.

If you have a long time horizon and can stomach the volatility, the valuation reset (down ~30%) offers a compelling entry point for a company growing earnings at over 20%. The aura of fear surrounding the stock might be overblown, creating an opportunity to pick up a fast-growing alt lender at a discount.

However, if you lose sleep over macroeconomics or need 100% reliable income, look elsewhere. The risks of a consumer credit crunch are real, and Propel is on the front lines.

My opinion? If you decide to buy, keep your position size small, think 1% to 2% of your portfolio, and watch their provision for loan losses like a hawk in the next few quarterly reports. That single number will tell you if the growth story is still intact.