2 High Yielding Canadian Dividend Stocks to Add Today

Many investors are looking to achieve financial freedom. Ditching that 9-5 job and being financially free is certainly a lifestyle to get excited about.

To achieve this, many buy high-yielding Canadian dividend stocks. But, what many don’t realize is that the dividend yield of a company is not the first thing you should be looking at. In fact, a high yield can sometimes be a looming disaster. Look no further than the record-breaking amount of dividend cuts we had during the COVID-19 pandemic.

There’s no point in purchasing a high yielding Canadian dividend stock if you’re going to watch your capital shrink. So, in this article we’re going to highlight a few options that not only present a high dividend yield for investors buying stocks to churn out more passive income, but a reliable dividend yield, one that can stand the test of time.

Reliability found in Enbridge (TSX:ENB)

If you’re an income investor, you’ve likely heard of Enbridge (TSE:ENB). The company has paid a notoriously high yield for decades, and has maintained one of the longest dividend growth streaks in the country, raising consistently for more than 2 and a half decades.

Enbridge is a midstream company with a growing renewable energy portfolio. To give an indication of the company’s dominance, it states that it is responsible for shipping more than 20% of the natural gas that is consumed in the United States, and 25% of North America’s crude oil.

Enbridge (TSX:ENB) and the renewable future

Its renewable energy portfolio is quite small, accounting for only 3% of 2020 adjusted EBITDA, but it is one that is growing fast, and investors should take note. As we move further into the future, renewables will no doubt play a key role in Enbridge’s growth.

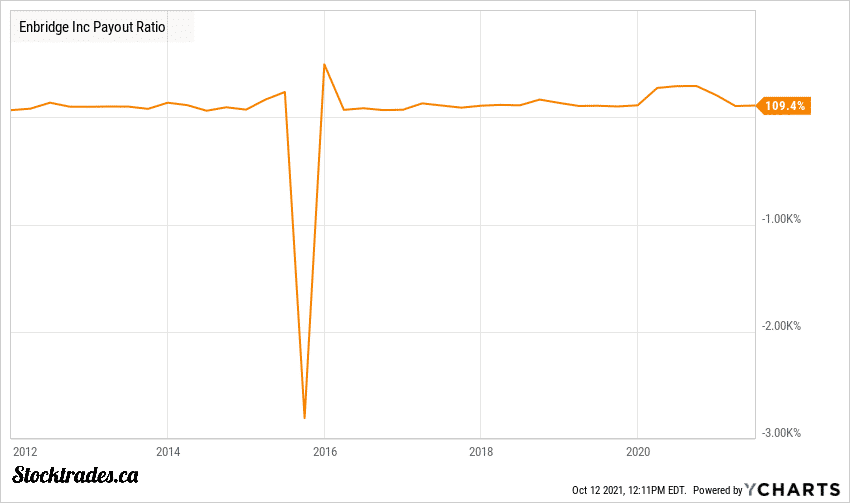

There’s also a chance you’ve glanced at Enbridge during a pre-screen and avoided the company due to excessively high payout ratios. Which, is fairly reasonable. The company is currently paying out over 110% of trailing earnings towards its dividend. But, you may be missing a massive opportunity here.

When analyzing pipelines, you want to be looking at something called distributable cash flow, or DCF. This cash flow calculation is produced by the company themselves, and calculations can vary to some degree. Given the complex business structure of a pipeline company, this is the most reliable indicator to use when it comes to dividend safety.

In 2021, Enbridge expects to generate $4.70-5 in distributable cash flow. With a dividend of $3.34 per year, this puts the company’s payout ratio at 66.8% on the high end. Of note, Enbridge’s target is to keep its payout ratio within this range, and the company has done so for quite some time.

Consistent cash flows in “take or pay” contracts

How has it managed to do so? Cash flow with pipelines is extremely consistent, due to long term take or pay contracts. Regardless of whether or not Enbridge is shipping product, the pipeline space is paid for. And not only this, Enbridge can turn around and charge someone else to utilize that space, even if it has already been paid for and goes unused.

This creates an extremely reliable cash flow stream despite the price of natural gas or oil, and is one of the major reasons why Enbridge and other midstream companies are not as susceptible to volatility in commodity prices.

Yielding 6.47%, Enbridge is a solid option to help you bolster your passive income stream and start generating long-standing wealth.

Beefy distribution in A&W Revenue Royalties Income Fund (TSX:AW.UN)

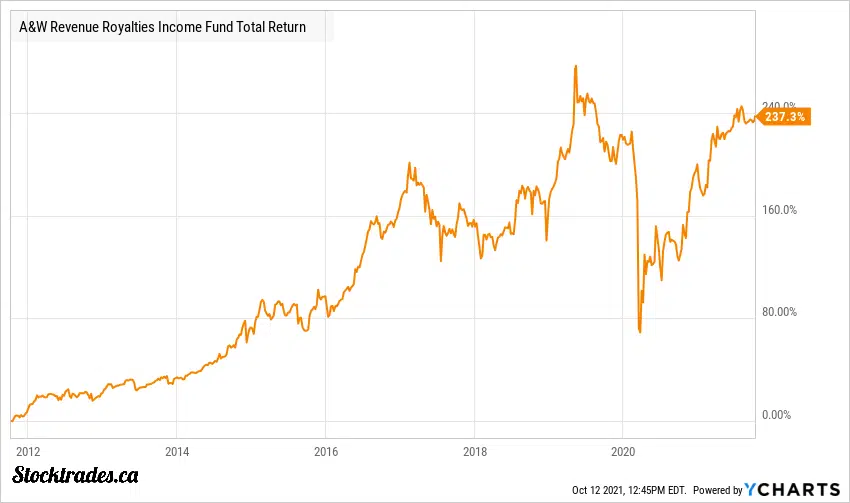

Royalty funds are often avoided due to their complex and confusing structure. However, many of them provide excellent opportunities for investors looking to generate passive income. A&W Revenue Royalties Income Fund (TSE:AW.UN) is one that does just that.

Many bears will point out that A&W in the United States has been struggling. However, in Canada it is a much different story.

A&W thriving in Canadian space

The company has over 1,000 restaurants in Canada and had system sales of over $1.4B in 2020, despite being in a global pandemic. The company has proven to be exceptionally skilled at marketing its products and has some of the best industry leading growth out of all fast food chains in Canada.

As a royalty company, A&W Royalty collects “top line” cash flows. Which means it is solely dependent on the sales driven through A&W restaurants. This means that its distribution can vary depending on how well the restaurants do, but overall it has been extremely reliable when it comes to payments.

Yes, the chain did suspend its $0.10 monthly distribution because of the pandemic in 2020, however it quickly made up for this by providing 2 special distributions of $0.30 and $0.20 when operations started back up later in the year.

Sales growth through the first 6 months of 2021

Prior to the pandemic, the company had achieved mid to high single digit same store sales growth over the last half decade, and it’s off to a roaring start in 2021 as well, with 12.2% sales growth through the first 6 months. Through the first 6 months of the year the company has also added 34 new restaurants. To put this into perspective, the company added 37 in all of Fiscal 2020.

The fund yields 4.77%, and pays out on a monthly basis. Payout ratios will look high, but if you understand the operations of a royalty company, you’ll know that it aims to pay out the vast majority of its distributable cash back to shareholders.

Overall, it seems consumers are willing to eat at A&W despite higher costs, which bodes well for the company’s growth. It does this with great marketing and higher quality food than similar chains like Burger King and Mcdonalds, and investors are likely to enjoy a beefy (no pun intended) distribution for quite some time.

Now that we have gone over these two high yielding Canadian dividends, lets look at two Canadian dividend stocks that could be in danger.