Analysts Love This Top Canadian Stock. Is the Upside Gone?

Have you ever looked back at a top Canadian stock and said “man, I wish I had bought that, I wonder if there is still an opportunity there?”

If you have, you are not alone. You’ve likely done it before, and you’ll likely do it again in the future. Purchasing a stock when it’s gone up 50%, 60%, or even 100% creates somewhat of a mental block. You think it can’t possibly go up any more.

We had investors tell us this constantly on one of our Stocktrades Premium recommendations Goeasy Ltd (TSE:GSY). After highlighting the stock in the $32 range, we were told time and time again that it was too expensive as it gained in share price. Fast forward less than 3 years later, that stock is now trading at $202.

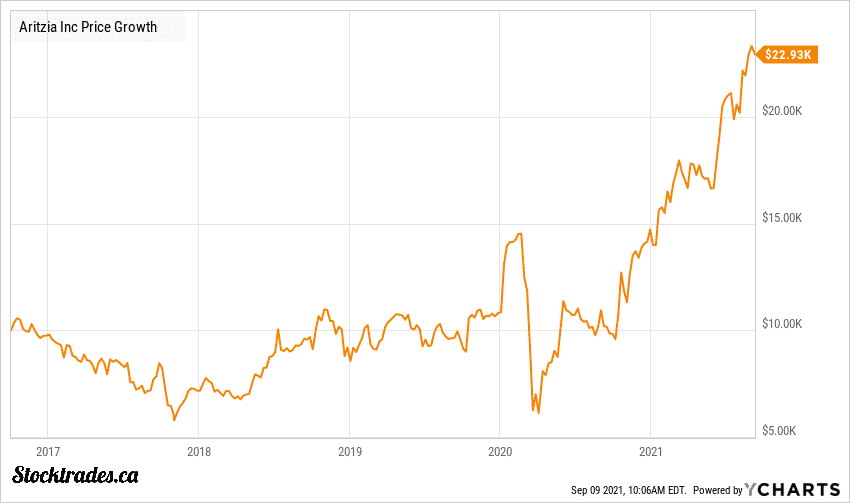

Today we’re going to look at another top Canadian growth stock that has accelerated in price and has many investors asking whether or not they should still be buying stocks today, and that is Aritzia (TSE:ATZ).

By the way, did I mention this was yet another Stocktrades Premium pick? Lets have a look at what exactly Aritzia does.

What is Aritzia’s (TSE:ATZ) business model, and how has it been so successful?

Aritzia is a designer of exclusive fashion brands. Not only does it design clothing, but it also offers accessories, selling them under the Aritzia banner. The company produces anything from t-shirts to jumpsuits and has operations not only here in Canada but in the United States as well.

However, it is key to note that the bulk of its revenue does come from Canada, as its expansion efforts into the United States are relatively early.

A key concept about Aritzia is that its clothing is not cheap. It isn’t an extremely expensive designer, but it is by no means a discount one either. Many investors are wondering how the company has been able to drive such impressive growth rates during a slow economy pre-COVID and even throughout the pandemic.

Brand recognition, middle of the line price points and US expansion have helped the company grow significantly

If we are to think of fashion on a scale of say, super luxurious to discount brands, Aritzia arrives at somewhere in the middle. They aren’t exactly a luxury brand, but they’re far from a discount brand.

When you can provide a top quality product at a middle of the line price point, you’re going to get a lot of recognition and eyeballs on your brand. Aritzia has been doing just that. To add to this, a rapidly expanding network in the United States is exposing its brand to a much wider audience down south.

As of right now the company has 68 boutiques in Canada and 35 in the United States. A few years ago, this ratio leaned much heavier towards Canada.

Add all of this together and you have an outstanding company that is able to consistently drive top and bottom line growth for investors.

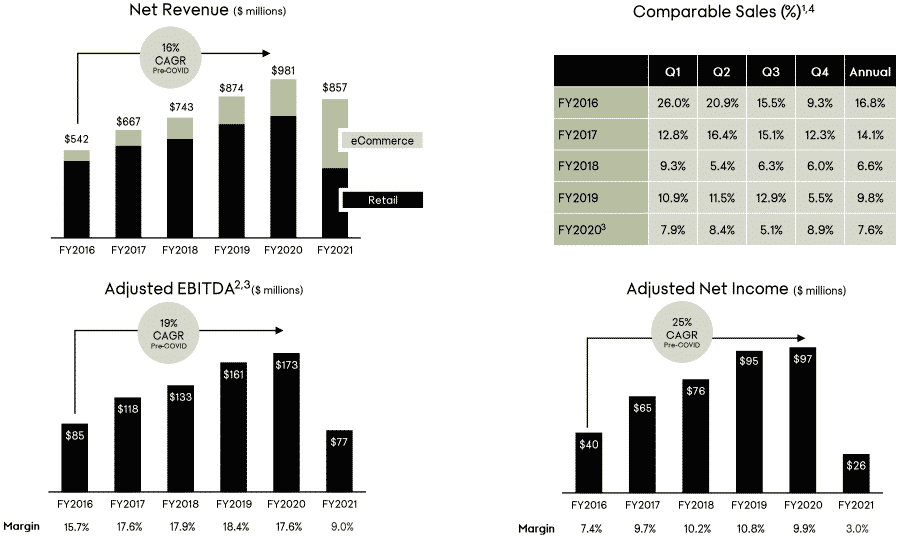

Aritzia had a compound annual growth rate of 19% on adjusted EBITDA and a 16% CAGR on revenue over the 5 years leading up to the COVID-19 pandemic.

More importantly, this is a company that was consistently profitable, with a 25% CAGR on net income over that same period. Even if we look to the COVID-19 pandemic, the company was able to remain profitable, primarily because of its ability to drive e-commerce sales, which saw a significant boost in Fiscal 2021.

So, the growth story is certainly there. But, do valuations make sense at this point, or is this a growth stock that’s simply reaping the benefits of all time market highs, and is set to correct?

Despite its recent price strength, Aritzia is neither cheap nor expensive

With a growth company, I like to investigate forward looking growth estimates and compare them to current multiples.

Aritzia is expected to close out Fiscal 2022 with revenue of $1.209B and earnings per share of $1.04. This would represent growth of 41% in terms of revenue and over 500% in terms of earnings.

However, we’re cheating a bit here as we are comparing the company’s growth rates to an unprecedented environment as peak lockdowns plagued them in Fiscal 2021.

If we look to growth and compare it to two years ago, 2022 numbers would represent a 23% increase in revenue and a 28% increase in earnings. In Fiscal 2023, the company is expected to deliver over 30% earnings growth and 20% revenue growth as well.

Considering all this, with Aritzia trading at 30 times forward earnings and 3 times forward sales, I’d say the stock is fairly valued. This is a profitable, fast growing company that is expanding at a quick pace in two key segments, the United States and online.

But if you’re a bargain hunter, looking to find stocks trading at attractive risk/reward ratios, Aritzia is likely not for you. A valuation of 30 times forward earnings will require the company to perform at the pace it has been, or else the market might go sour and with a growth company this can often mean some quick price movements.

However, if it does keep up the pace of growth over the next 3-5 years, valuations paid today will seem like a discount. The company has maintained double digit ROIC and ROE ratios since 2017. So, management has shown they’ve been able to consistently turn shareholder dollars into profits over the last 4 years. It will be interesting to see if they can continue to do so.

Next, check out Crescent Point Energy (TSE:CPG), a company that saw a spike in share price when they restored their dividend to pre-pandemic levels.