Investing Made Simple: Broad Market ETFs Are a Smart Choice

This piece is brought to you by BMO Exchange Traded Funds.

Here at Stocktrades, I get plenty of investors who message me asking for the easiest possible solution when it comes to getting started investing.

I also get a ton of requests from investors who have been doing this for a decade or longer that want to simplify their portfolio.

Maybe they want to still buy individual stocks, but run a core/satellite approach where the vast majority of their portfolio is in broad-based ETFs.

Broad market ETFs are a powerful solution. These ETFs give you exposure to hundreds of companies in a single trade, making them a foundational building block for any portfolio, whether you’re a seasoned investor or just starting out.

In this article, I’m going to give a brief explanation of what broad market ETFs are, and then follow it up with some of the lowest cost solutions in the country.

Let’s get into it.

Why Broad Market ETFs?

Broad market ETFs are designed to track major indexes, giving you instant diversification and reducing the risk that comes from betting on individual stocks.

Instead of trying to pick winners, you own the entire market segment. This approach is backed by decades of research showing that passive investing often outperforms active stock picking over the long term.

A Brief History of Broad Market Indexes

To appreciate the power of broad market ETFs, it helps to understand the history behind the indexes they track:

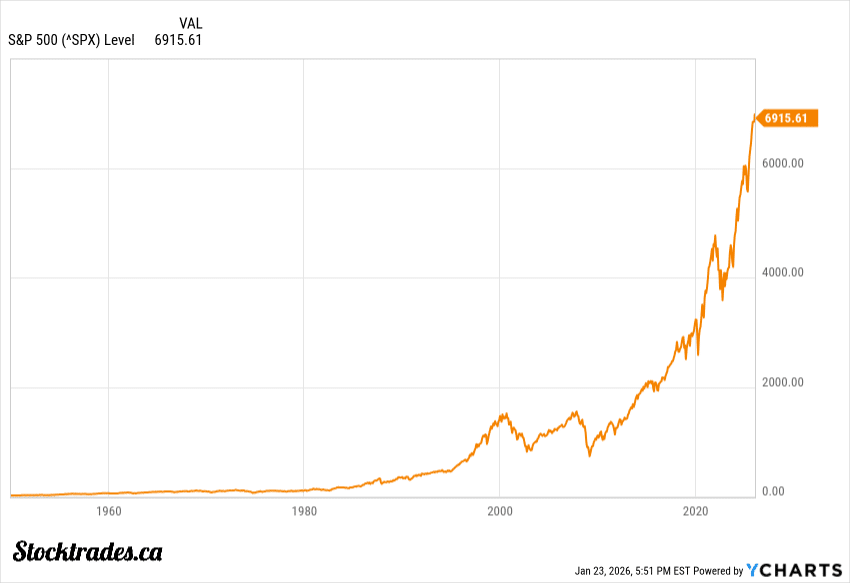

S&P 500

Launched in 1957, the S&P 500 became the gold standard for measuring U.S. stock market performance. It represents 500 of the largest U.S. companies and accounts for about 80% of U.S. market capitalization¹.

Over time, it has become a benchmark for global investors seeking exposure to the U.S. economy².

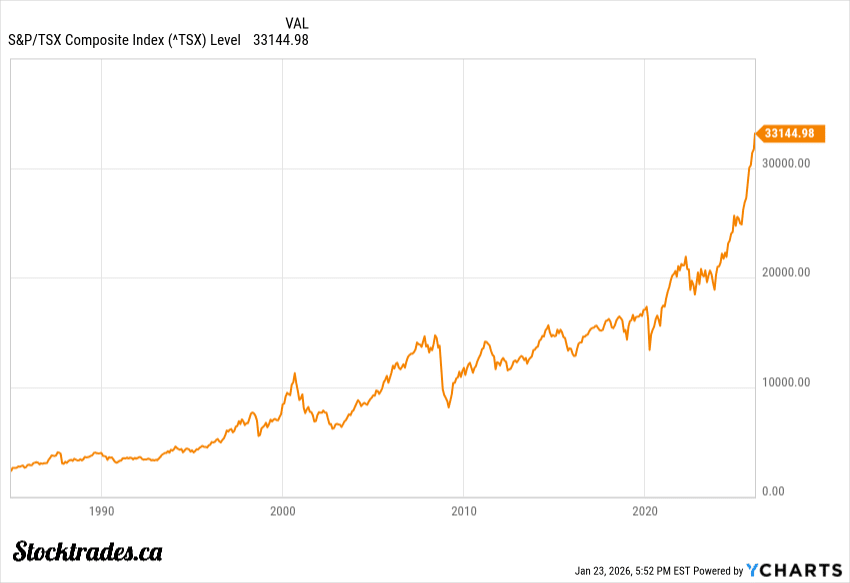

S&P/TSX Composite Index

Canada’s main equity benchmark has roots dating back to 1977⁴, evolving from an earlier version of the Toronto Stock Exchange index.

Today, it includes roughly 200 companies³ across sectors like financials, energy, and materials, reflecting Canada’s resource-rich economy.

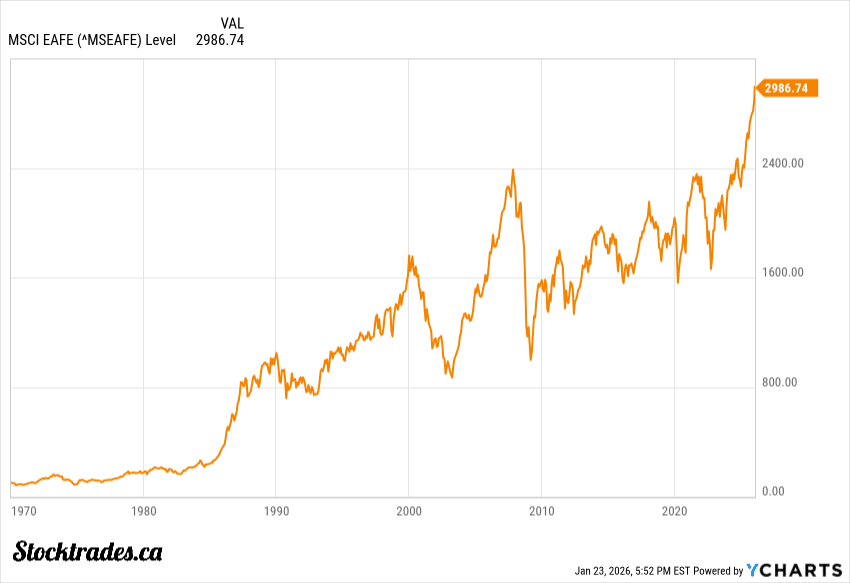

MSCI EAFE Index

An equity benchmark representing large- and mid-cap companies across developed markets worldwide, excluding the U.S. and Canada. It captures roughly 85% of the free float-adjusted market capitalization in each included country⁵.

These indexes were originally created for institutional investors and performance measurement. The rise of ETFs in the 1990s changed everything, making index investing accessible to everyone.

Today, ETFs tracking these benchmarks are among the most popular investment vehicles worldwide.

Investing in broad based ETFs

There are numerous providers that offer broad-based ETFs. However, one of the industry leaders and one that is continually coming out with new funds for Canadian investors is BMO Exchange Traded Funds.

BMO is one of Canada’s largest ETF providers, managing over $110 billion in ETF assets⁶. With a track record of innovation and investor education, I believe BMO ETFs is becoming one of the more trusted fund managers in the country.

So, why BMO for broad based market ETFs?

BMO’s Broad Market ETFs Offer

- Instant diversification across hundreds of companies

- Low management expense ratios (MER)* — for example:

- ZSP – BMO S&P 500 Index ETF: MER of 0.09%

- ZCN – BMO S&P/TSX Capped Composite Index ETF: MER of 0.06%

- ZEA – BMO MSCI EAFE Index ETF: MER of 0.22%

Plus, you get:

- Daily transparency — know exactly what you own

- Liquidity — trade throughout the day like a stock

- Expertise — backed by decades of experience in index investing

Key Takeaways

- Broad Market ETFs provide instant diversification at a low cost, making them an efficient way to access a wide range of securities in a single trade.

- Such ETFs track major indexes with decades of history and proven performance, offering investors a reliable foundation for long-term portfolio growth.

- BMO ETFs deliver trusted solutions for Canadian investors, backed by over $110 billion in assets under management (AUM) and more than 15 years of ETF expertise, with a comprehensive lineup of over 130 strategies⁷.

Ready to Get Started?

Building wealth doesn’t have to be complicated. With BMO broad market ETFs, you can invest confidently, knowing you’re diversified, cost-efficient, and aligned with time-tested strategies.

Explore BMO’s ETF lineup and find the right fit for your goals at bmoetfs.ca.

Sources

1 S&P Global, as of November 28, 2025, “S&P 500 Quick Facts.”

2 S&P Global, October 2025 . “S&P U.S. Indices Methodology,” Page 5.3 S&P Global, S&P/TSX Composite Index | S&P Dow Jones Indices, as of Dec 2025.

4 Source: S&P/TSX Composite Index | S&P Dow Jones Indices as of Dec 2025

5 Source: https://cetfa.ca/wp-content/uploads/2025/12/ETF-strategy.pdf, MSCI EAFE Index (https://www.msci.com/indexes/index/990300)

6 National Bank Report, January 3, 2025

7 https://www.bmogam.com/ca-en/products/exchange-traded-funds/

*Management Expense Ratios (MERs) are the audited MERs as of the fund’s fiscal year

Disclaimers

This content is sponsored by BMO Exchange Traded Funds. Stocktrades.ca is an independent organization and is not affiliated with BMO Global Asset Management.

This content is intended for information purposes only. Stocktrades.ca is compensated under this arrangement by BMO Exchange Traded Funds (ETFs), which is a part of BMO Global Asset Management. The views expressed herein are subject to change without notice. The content contained herein is not, and should not be construed as, investment advice to any party. Any securities described herein must be evaluated relative to the individual’s investment objectives and risk tolerance, and professional advice should be obtained with respect to the individual’s particular circumstances.

You cannot invest directly in an index.

The Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by the Manager for BMO S&P/TSX Capped Composite Index ETF and BMO S&P 500 Index ETF. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Manager. The ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

The MSCI EAFE Index ETF referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., an investment fund manager, a portfolio manager, and a separate legal entity from Bank of Montreal.