Canadian Dividend All-Stars – Week of 07 26

As is typical during the early summer months, dividend growth action has been quite slow for Canadian dividend stocks. The good news is that earnings season is going to ramp up over the next few weeks and investors should be seeing a few more dividend raise announcements. It kicks off this week with a lone All-Star expected to announce their annual dividend raise.

Before we jump into that, let’s do a quick update of the past couple of weeks.

Of note, all figures are in Canadian dollars unless otherwise noted.

Recent dividend updates

Our last update was from a few weeks ago and at that time, there was only one All-Star that was expected to raise dividends. Empire Company (TSX:EMP.A) came through for investors.

|

Company |

EST DGR |

EST Increase |

Actual DGR |

Actual Increase |

New Div |

|---|---|---|---|---|---|

|

EMP.A |

7.69% |

$0.01 |

15.38% |

$0.02 |

$0.15 |

Consistent with its historical pattern, Empire announced their annual raise in late June along with fourth quarter and year-end results.

The raise was a hefty one. Coming in at 15.38%, the $0.02 per share raise was double my expectations and much higher than the company’s high, single-digit historical average.

Grocers continue to be excellent long-term and defensive holdings as the markets struggle to find direction. While Empire’s 1.50% yield may not be enticing to some, the raise extends its dividend growth streak to 27 years. This makes it one of the most reliable dividend growth stocks in the country.

Upcoming dividend raises, cuts or suspensions

Capital Power (TSX:CPX)

Current Streak: 7 years

Current Yield: 4.97%

Earnings: Wednesday, July 28

What can investors expect: Capital Power (TSE:CPX) is a North American power producer whose principal activities are developing, acquiring, and operating power plants. While its operations are primarily based in Alberta, the company has been taking steps to diversify outside of its home province.

Since the company’s seven-year dividend growth streak began, Capital Power has consistently raised along with second quarter results. In its short history, it has averaged 6-7% dividend growth over the past three and five years.

How much will the raise be this year?

Expect the raise to come in slightly below historical averages at approximately 5%. How do I know this? Capital Power has already stated that the company intends to raise the dividend by 5% in 2021. Considering the company has typically raised in-line with its targeted ratio, there isn’t any reason to believe the raise will be materially different.

|

EST DGR |

EST Increase |

New Div |

|---|---|---|

|

~5% |

$0.0275 |

$0.54 |

Capital Power is an organization that we brought to the attention of Stocktrades Premium members in early 2020 and it has since returned 57%. At the time, the company was trading at a steep discount to peers and had attractive growth rates.

We still like the company and although the valuation gap has since closed, it remains well positioned to deliver an attractive combination of capital appreciation and dividend growth.

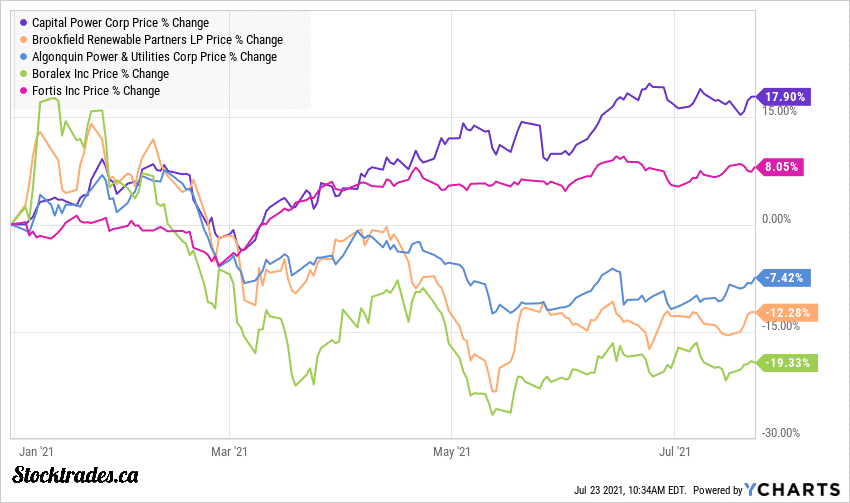

In fact, it is one of the best performing utilities of 2021 and has far outpaced leading renewable companies and traditional regulated utilities.

Next we will take a look at the Canadian Dividend All-Stars for the week of August 3rd.