Agnico Eagle Stock Is Soaring. Has It Peaked, or Is There More Upside?

Key takeaways

Agnico Eagle’s cash flow and balance sheet set it apart from other gold miners

Ongoing production growth and expansion projects at gold high prices are compounding earnings

I believe the stock offers strong defensive value for Canadian portfolios

3 stocks I like better than Agnico Eagle.Gold stocks aren’t all created equal. In fact, most of them are run very poorly, and all it takes is a single bear market in terms of gold prices to destroy their fundamentals. However, Agnico Eagle might be one of the best in the country, and its balance sheet is turning into a force that should be able to weather any environment.

The company has outpaced most of the sector despite being a blue-chip producer while plenty of gold miners still struggle with consistency.

The real catch? Agnico isn’t just riding higher gold prices. It’s operated well in pretty much any environment.

Their production outlook looks steady, margins are at record highs, and the company is stockpiling cash.

Let’s dive into whether or not this company provides strong value at this point in time, or if the upside is gone.

Record Margins and Net Cash Status

n Q1 2025, Agnico produced nearly 874,000 ounces of gold at total cash costs around US $903 per ounce. The all-in sustaining cost (AISC) came in at just US $1,183. For an operator that has all its mines in safe regions with higher costs, this is an outstanding AISC.

Why? Even if gold slips, Agnico keeps margins strong. Here’s a quick comparison table:

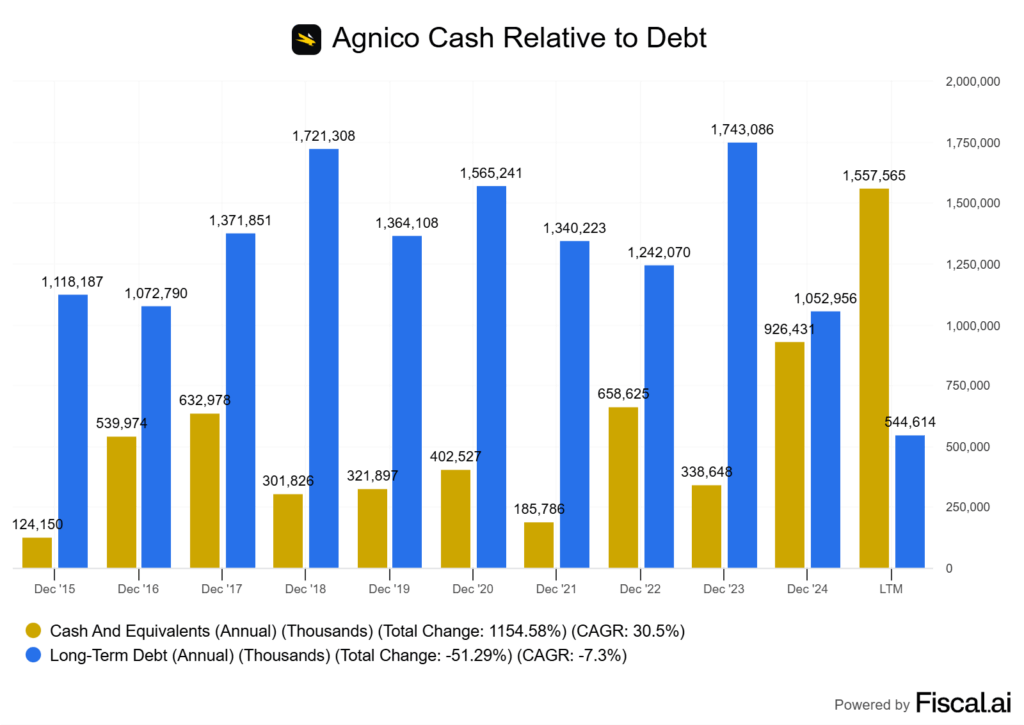

The company ended Q2 with a net cash position of US $800M~. Yes, you read that right. A gold miner with a net cash position. This means that if, in theory, it paid down all of its debt right now, it would still have $800M left over.

A miner with cash on hand and a low-cost base can weather weak gold prices far better than a leveraged competitor. This is why even if gold dips, Agnico should still thrive.

Not only should it thrive, but it should be able to utilize this cash for a lot of M&A from struggling players in the industry.

Can Growth Projects Stay on Track?

Agnico Eagle’s latest update reassured investors that 2025 production guidance remains unchanged. The company still targets between 3.3 and 3.5 million ounces of gold, with cash costs expected between US $915 and US $965 per ounce.

| Metric | 2025 Guidance |

|---|---|

| Gold Production | 3.3–3.5 million ounces |

| Cash Costs | US $915–965/oz |

| AISC | US $1,250–1,300/oz |

All-in sustaining costs (AISC) should land in the US $1,250 to US $1,300 range. After producing 866,029 ounces in the second quarter and reporting free cash flow of US $1.305 billion, Agnico is tracking close to halfway on its full-year goals.

The consistency in guidance is encouraging, but it all hinges on Agnico’s ability to deliver at its key growth projects. I’m particularly watching the progress at the Odyssey mine at Canadian Malartic, Upper Beaver, and Detour Lake. These projects will be key in the company hitting targets.

Odyssey, the flagship underground project at Malartic, is critical because it is the backbone of future output in Quebec. From what I see in the latest drill results and updates, development is largely on schedule. But in this industry, anything can change.

Upper Beaver’s recent reserve update gives me more confidence. Detour Lake’s ongoing expansion helps anchor Ontario’s goal of a 50% production increase by 2030.

Still, mining permits and cost pressures always lurk in the background for projects of this scale.

Guidance is just that, a best estimate. Watch whether drill and construction targets get met each quarter to judge how reliable these forecasts will be moving forward, especially as Agnico juggles multiple major sites at the same time.

With valuations at the stage they are right now, hitting guidance is key. And more importantly, if you own producers like this, you need to know how to analyze the progress of the company’s projects.

Dividends, Buybacks and Shareholder Yield

If you’re holding Agnico Eagle, capital returns like dividends and share buybacks matter a lot. After all, this is a relatively cyclical industry, and the majority of shareholders would rather the profits be delivered back to them during the good times. We’ve seen this with a lot of top Canadian oil and gas stocks.

In the last two quarters, Agnico Eagle paid a quarterly dividend of US $0.40 and put over US $150 million into buybacks, even raising its buyback limit to US $1 billion.

The company reported strong free cash flow, even with gold production dipping slightly. Net debt remains low, letting management tackle both dividends and repurchases without putting the balance sheet at risk.

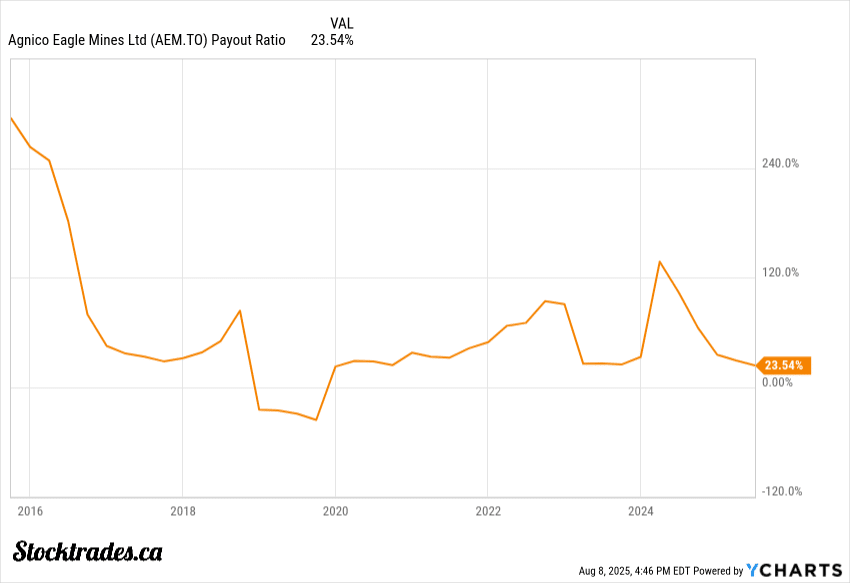

The best part? The dividend is well covered, making up only 23% of earnings.

In my view, the combination of free cash flow and minimal net debt keeps Agnico’s payout ratio healthy. The dividend isn’t just sustainable, it’s quite secure, even if gold prices were to tank.

Meanwhile, buybacks give a lift to shareholder yield when the stock is undervalued. I would argue now might not be the best time to buy back shares. However, I said that a year ago too, and gold has done nothing but go up.

Gold Price Tailwinds vs. Operational Discipline

Agnico has a unique combination right now. It’s benefitting from strong gold price tailwinds, but it is also extremely well managed and disciplined. While it’s true that every gold stock benefits from a hot commodity, not all keep expenses under control when the market’s running hot.

Look no further than the previous gold bear market in the early 2010s.

Let’s break it down with some numbers. In the first quarter of 2025, Agnico locked in an average realized gold price near US$2,891/oz. With gold now breaking $3500/oz, I’d imagine these numbers keep coming in higher to close out 2025.

But here’s where Agnico sets itself apart: their production costs stayed well below the industry average, putting them in a position where they don’t need sky-high prices to stay profitable. In fact, all it does is accelerates the company’s profits.

If gold prices were to retreat, it is likely that Agnico’s proven cost control will cushion the downside where others might stumble.

For me, that’s a sign of a cyclical company I can hold long-term.

Australia Expansion on the Horizon

I see real intrigue building around Agnico Eagle’s interest in Bellevue Gold.

Although it is simply rumors right now, if Agnico makes a move, it would mark its first major step into Australia, which already stands as one of the world’s lowest-risk mining jurisdictions.

What’s the draw? Bellevue’s flagship mine in Western Australia is modern, high grade, and on the radar for potential suitors thanks to its growth runway.

The operation recently hit commercial production with expansion plans under review, setting it up as a future cornerstone project for anyone looking to scale production globally.

Multi-jurisdiction miners often trade at higher multiples due to reduced geopolitical risk. Agnico just so happens to operate in relatively safe jurisdictions. If Agnico locks in this asset, it should mean less earnings volatility tied to a single country’s legal or tax swings.

However, it’s not without risk. Integrating a new culture and team half a world away could challenge any company. Costs and capital needs often run higher in the early years of an overseas project. However, if there is one company that could pull it off, it’s Agnico.

My Take on Agnico Eagle

I find it tough to look past Agnico Eagle’s record of steady growth. The company’s shown real financial discipline, keeping net debt low and delivering top-tier margins that rival technology companies. That kind of track record stands out to me, especially in a sector where the vast majority of publicly traded companies are long-term losers.

I also appreciate how Agnico is set up to handle swings in gold prices. Its mines stretch across several countries, which helps cut down the risk if one region hits a snag.

Costs stay well managed, so the bottom line holds up even when gold dips. That’s not something many miners can say.

The talk about expanding into Australia catches my attention. I know these big moves don’t always go perfectly, but with a balance sheet this healthy, Agnico can afford to chase some strategic growth and absorb the bumps if they come, because they will not need to issue much debt or equity to get the deal done.

In my own portfolio, I lean toward companies built to last deliver strong total returns. Agnico’s history, that conservative balance sheet, and its focus on shareholder returns? I’d call the stock a buy at today’s prices.