This Top Canadian Bank Stock Has Crushed It – But Are Cracks Forming?

Key takeaways

CIBC’s low price and attractive dividend could reward patient investors

Efforts to control expenses and improve efficiency show early progress

Leadership changes and U.S. exposure add both risk and opportunity

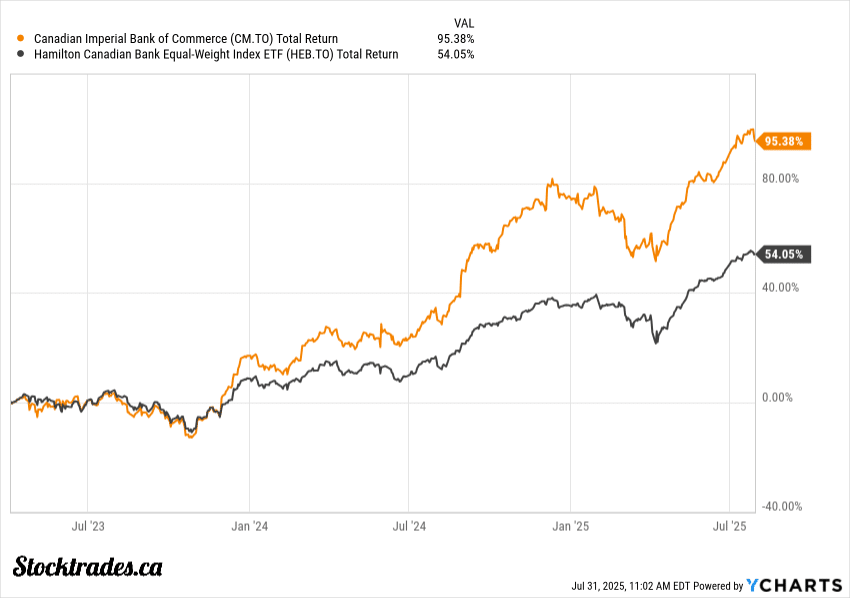

3 stocks I like better than CIBC right now.CIBC has had a heck of a run over the last few years. The market punished the company for elevated provisions coming out of the COVID-19 pandemic, but then subsequently rewarded it when it was clear the company had been a bit too cautious.

I believe CIBC’s low valuation and strong dividend make it look like an appealing option for shareholders. However, the bank’s Canadian exposure and late expansion plans relative to the other banks could pose issues.

Despite headlines hinting at muted growth and rising loan provisions, the bank has operated extremely well. Management has worked quietly but steadily on expense discipline and careful provisions.

Risks remain, especially with a new CEO and an ambitious U.S. strategy, but CIBC now, as it typically always has, sits as one of the cheapest of the Big Six banks.

So is the company a buy today? Let’s dig in.

Can Growth Return After a Muted Quarter?

CIBC’s second quarter of 2025 felt like a pause. Especially with the torrent pace the stock has been on over the last few years. Net income edged down slightly compared to last year, and loan growth barely budged.

Margins held up, but the bank didn’t show the same energy as some of its Canadian peers. I’m not necessarily surprised by this, as the bulk of CIBC’s success over the last while has been from a reduction in provisions, not actual banking results.

So, what’s putting the brakes on performance? Mortgage originations have slowed sharply, likely a consequence of dropping, but still higher interest rates and tougher qualification rules. There is no question the banks are tightening up lending practices.

These headwinds hit CIBC harder, given its outsized exposure to Canadian personal lending. Add in caution around commercial loans because of the tariff situation and there are certainly a few headwinds.

Is this just a blip or a signal of deeper challenges?

Some of the drag is cyclical. If rates continue to ease and the housing market stabilizes, lending activity could pick up. Still, CIBC’s retail-heavy strategy may cap its upside compared to banks with more diversified businesses.

Growth won’t reignite on momentum alone; it’ll take clear moves into new business lines or markets.

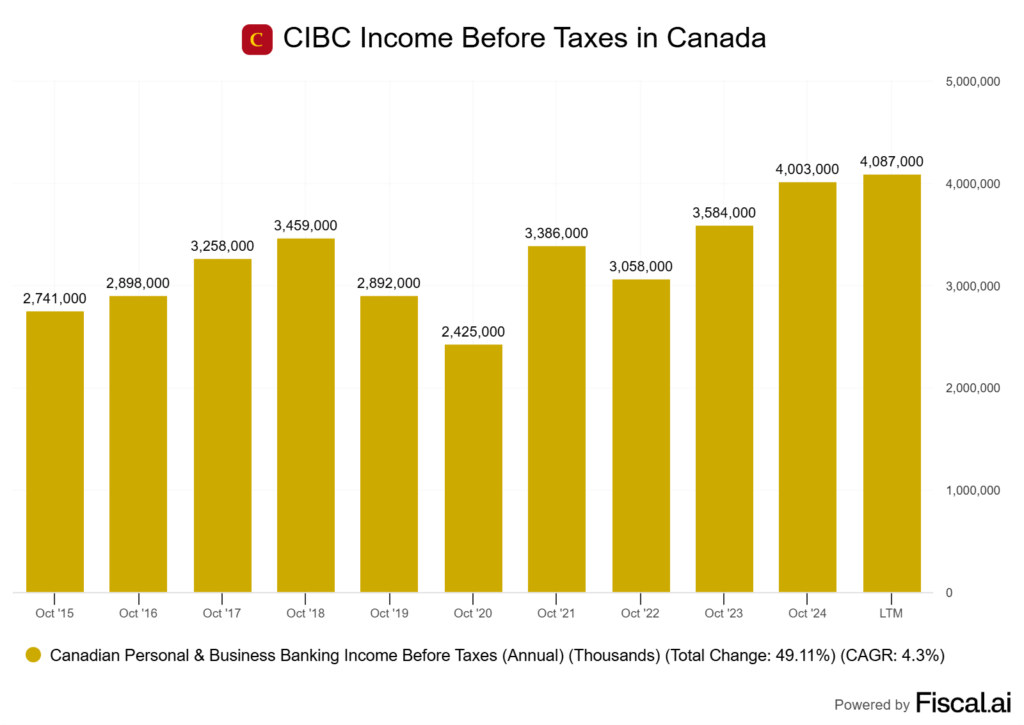

Expense Discipline and Efficiency is What Has Driven Results

What catches my eye about CIBC is their expense growth. It’s actually been more controlled compared to other big Canadian banks. This is what I mean by the fact that CIBC’s success hasn’t actually been from their banking results themselves, but more so controlled provisions and tighter efficiency.

CIBC’s adjusted efficiency ratio has hovered between 57% and 59%. That isn’t ground-breaking, but it does show that cost management is getting some traction.

A key factor has been their digitization push. The bank has put money into technology that aims to streamline operations and cut down on so-called “run the bank” costs.

These moves are supposed to free up capital for better client service and targeted growth areas.

Restructuring charges in the past year were to refocus the business, especially in areas where growth had slowed. I think it’s a solid move. Most Canadian banks avoid big shake-ups, but it sends a clear signal to investors about CIBC’s intent. It has struggled over the last 10-15 years relative to peers, and it’s looking to change that.

Is this enough to tip the scales for real operating leverage? The progress is promising but not yet dramatic.

While automation and restructuring have helped keep expenses in check, revenue growth still needs to pick up, especially if loan demand stays soft. This is something the company has always struggled with.

Credit Quality Holding, But Provisions Are Rising

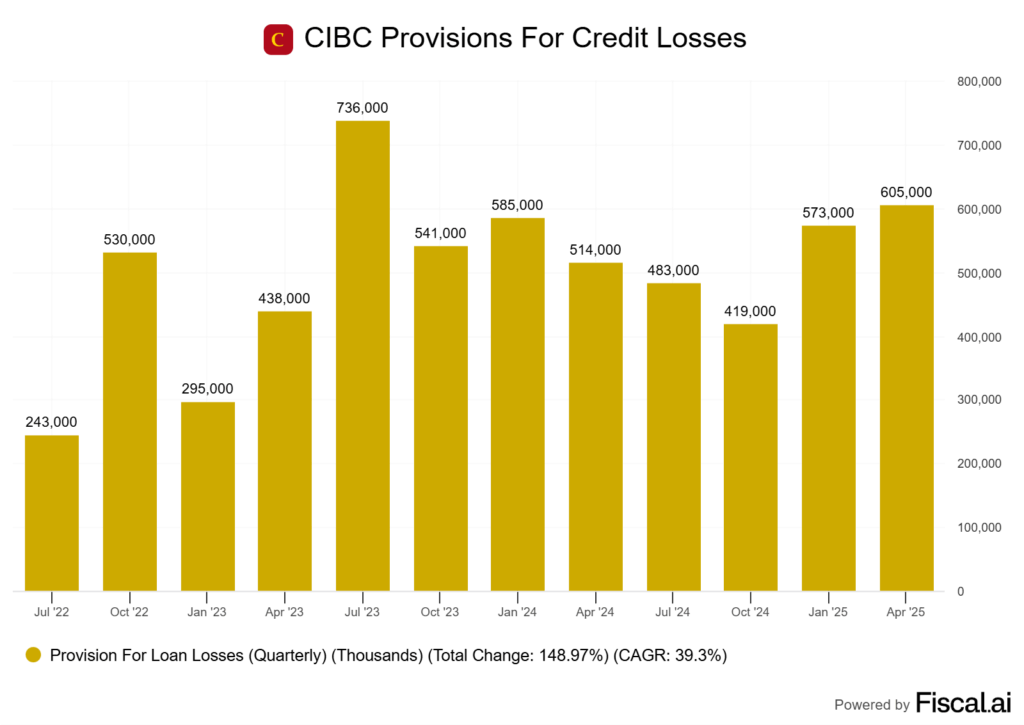

CIBC’s credit quality is holding up, but there’s no sugar-coating the trend. Although CIBC’s provisions aren’t as large as they were in 2022/2023, they’re still escalating due to the macro environment.

In the latest quarter, CIBC set aside $605 million for credit losses, marking an increase from both the previous quarter and last year. This is after 3 straight quarters of declines.

Most of that reserve comes from stress in U.S. office real estate and higher write-offs in Canadian credit cards and personal loans.

While delinquency rates have stayed relatively stable, I’m noticing a gradual uptick in impaired loans and early-stage arrears, especially in the troublesome sectors.

That said, compared to the other Big Six banks, CIBC’s PCL growth is actually one of the best of the bunch. The difficulty here is judging whether CIBC has been overly optimistic when it comes to their provisions, or if their loan book is really this solid.

I lean toward the conservative side on provisioning. It is better to take short-term lumps than face a nasty shock later.

Peers like Royal Bank are taking harder provisions now. However, if they end up overreporting and clawing some back, it will ultimately result in higher earnings growth in the future.

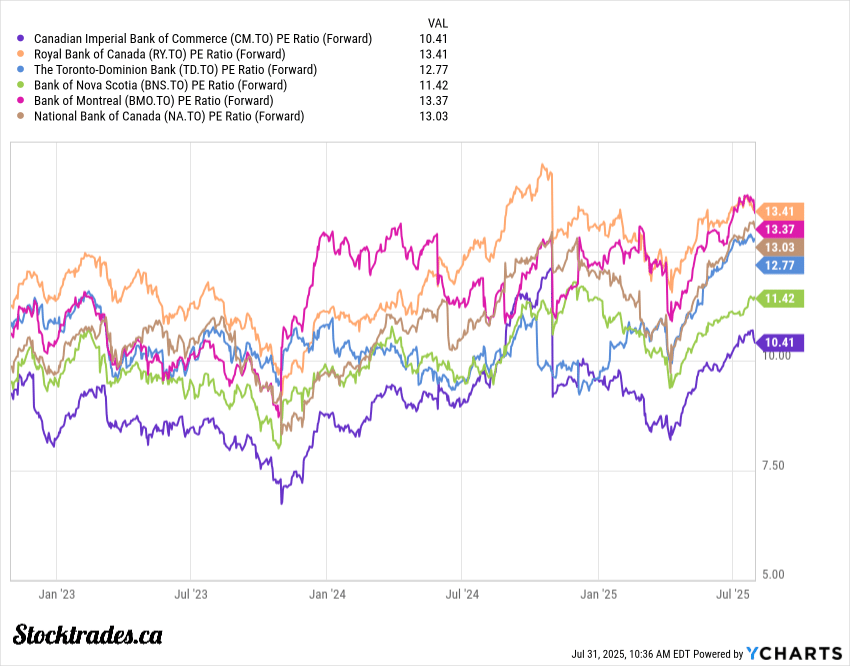

CIBC is One of the Cheapest Big Six Banks, But it Typically Always Has Been

Looking strictly at the numbers, CIBC is the bargain among Canada’s Big Six. If you look to the chart below, it trades at the lowest forward P/E of the bunch.

Is the discount to its peers justified? I’d argue yes for some, no for others. Although I’d expect institutions like Royal Bank and National Bank to trade at higher valuations, CIBC is, in my opinion, the superior bank to institutions like Bank of Nova Scotia and Bank of Montreal.

However, numbers like this show why I notice value-oriented investors turn to CIBC on a consistent basis.

The big question though: is the market wrongly discounting the bank, or are there real concerns here?

I have always felt that CIBC is consistently cheap because of its outsized Canadian exposure. Lots of mortgages and personal loans directed towards Canadians. Its peers trade at larger multiples because of a more diverse loan book. I don’t think this will ever change.

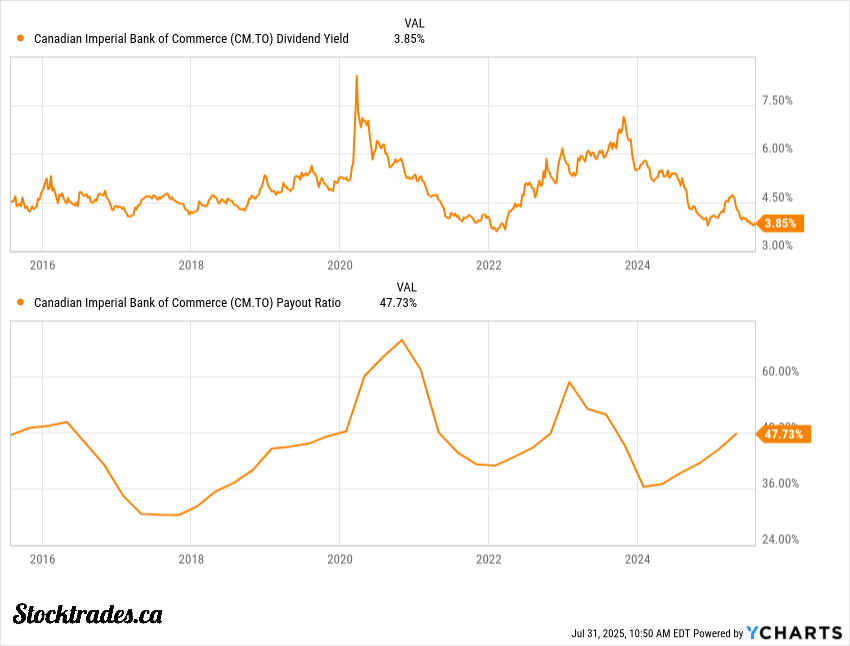

When we look to the dividend, it certainly gets attractive. For the longest time, CIBC used to be one of the higher yielding Canadian bank stocks. However, after a string of rock-solid results, this is no longer the case.

However, at nearly 4%, the company still has a relatively attractive dividend, and one that is well covered. The payout ratio recently sits in a comfortable zone for a bank, making up around 47% of earnings. The dividend is not stretched too thin, providing a cushion if provisions start to accelerate.

Unlike some American banks, CIBC and its major Canadian peers haven’t cut their dividends since the 2008 financial crisis.

It’s tempting to worry about rising payout ratios in tougher times, but historically, the Big 6 Banks have made dividend stability a top priority.

This isn’t to say there’s no risk. CIBC has more domestic mortgage exposure than most peers, so housing downturns are a concern.

But for investors seeking reliable, high-yield dividend income, CIBC’s current valuation and yield offer a compelling entry point. I don’t see a dividend cut or even slowing dividend growth in the company’s future. There is a solid cushion here.

Will a New CEO Shift the Trajectory in the US?

With Victor Dodig stepping aside in 2024, a new CEO in a company can always cause a lot of questions.

CEO transitions are never just about a nameplate. They can signal bigger moves when it comes to company operations, especially when it comes to something as bold as cross-border expansion.

The push into the United States, especially after snapping up PrivateBancorp back in 2016, was Dodig’s signature. But integrating an American bank isn’t a plug-and-play affair. Many Canadian investors saw this as a risky bet, yet CIBC doubled down, aiming for the diversification that many of its peers enjoy south of the border.

The incoming CEO faces the same realities: U.S. banking brings scale, but it’s fiercely competitive and heavily regulated. Will they keep chasing more U.S. deals, or is it time to hit pause and focus on getting more juice from what’s already in the pipeline?

There’s a real chance for stronger results if they close the performance gap with rivals like BMO, which have executed on cross-border growth much better. But CIBC has a long ways to go.

If the new CEO leans into the bank’s Canadian strengths, think high-margin retail, wealth and those all-important RRSP and TFSA deposits, they could de-risk the story at a time when U.S. exposure is looking less like a silver bullet.

Final Thoughts: Is CIBC a Buy Today?

CIBC is currently trading at all time highs, yet remains the cheapest bank on a forward basis in Canada. Right now, the dividend yield sits close to 4%, which is higher than what you’ll see at most of the Big 6 Canadian banks.

If you’re after steady income, that yield is hard to pass up. However, as a total return investor, I like to look at the whole picture.

Here’s what I find appealing about CIBC at the moment:

- Attractive valuation: At just 10x expected earnings, the bank is cheap, zero question. If it can continue to execute like it has over the last 2 years, it’s a solid price. However, if it gets back to the laggard it was in the previous decade, 10x is likely too much.

- Solid dividend: The yield combined with attractive valuations certainly sets up for a situation where total returns could be attractive.

- Domestic exposure: Although international exposure is nice, Canada’s banking system is heavily regulated, making CIBC’s loan portfolio nice for those who want stability without the risk of growth in foreign countries.

CIBC has heavier exposure to Canadian real estate loans compared to its size. If housing prices fall or interest rates stay higher, earnings could take a hit. This is why I think it is persistently undervalued by the market.

I wouldn’t blame investors for taking a position today. However, for me, I do prefer institutions like Royal and National.