Meta Stock Looks Unstoppable – But Has It Gotten Ahead of Itself?

Key takeaways

Strong ad business keeps funding growth but faces rising cost pressure

Slower user growth shifts focus to engagement and monetization quality

Heavy infrastructure spending must deliver returns to support the current valuation

3 stocks I like better than Meta PlatformsMeta Platforms (NASDAQ: META) just posted another strong quarter with revenue up double digits. The ad engine still drives most of the cash flow, and the company has gone on a meteoric run over the last few years after drawing down extensively after its metaverse bets.

The swing factor is whether rising AI infrastructure costs can be absorbed without eroding profitability. That’s what’ll decide if this valuation holds over the next year or so.

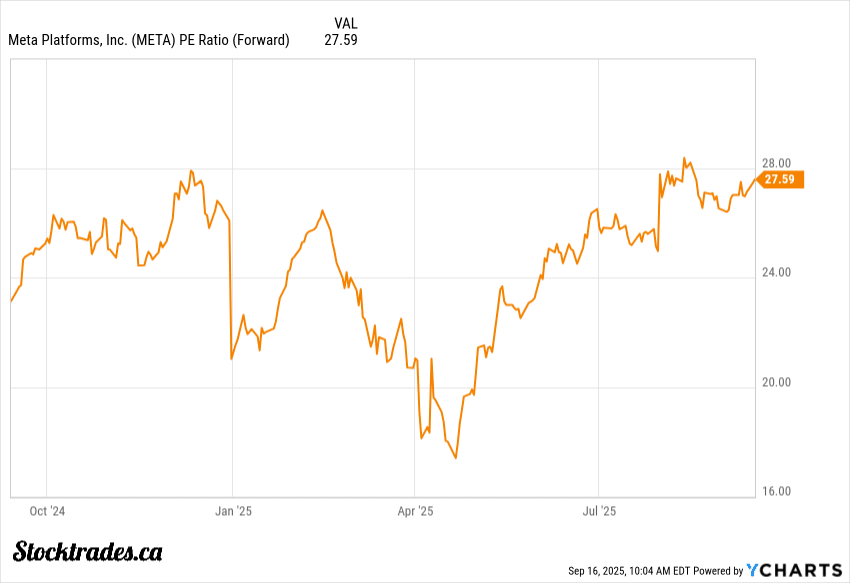

At 27x forward earnings, Meta is valued appropriately in my opinion relative to its growth. However, it needs to keep up with that pace of growth.

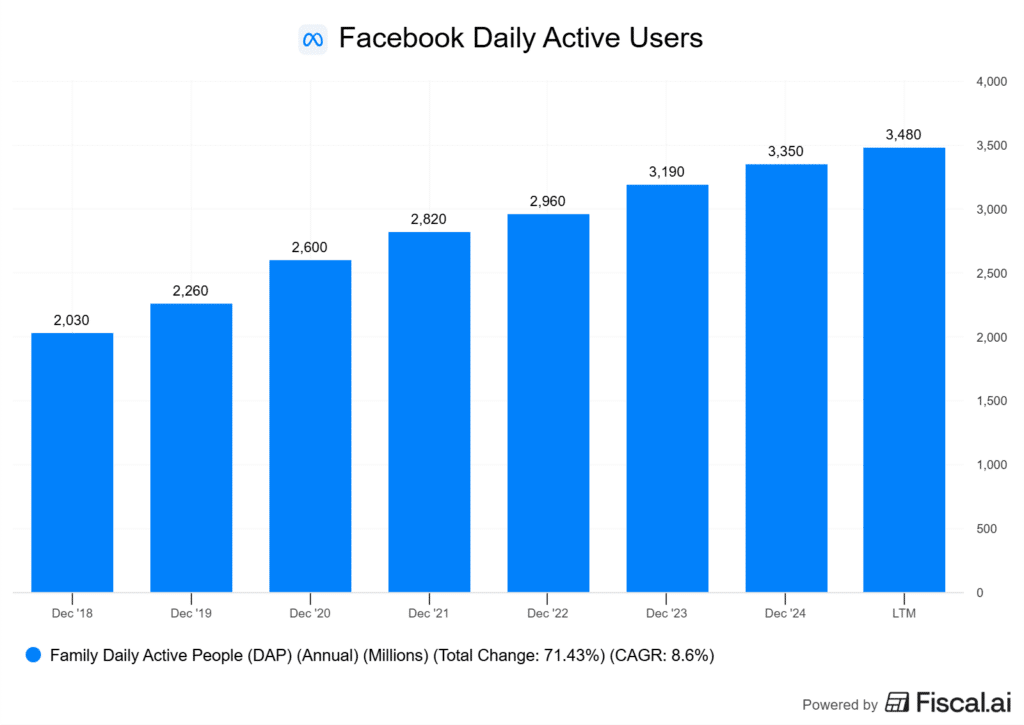

Meta still makes its money the same way: digital ads across Facebook, Instagram, WhatsApp, and Messenger. Engagement remains high. Growth in user numbers is slowing, which makes sense considering nearly half the world uses the platforms already. So more weight falls on ad pricing and time spent on the platforms.

AI-driven recommendations are keeping people active longer. But the cost of building out those massive data centres keeps climbing, and that’s where the tension really starts to show.

Honestly, Meta seems best for long-term investors who can handle volatility tied to spending cycles. The upside is obvious if AI investment pays off in higher monetisation.

The risk? Margins get squeezed before that return shows up.

Meta’s Ad Engine Roars Back, But Margins Face Pressure from AI Investments

Ad demand looks solid. Ad impressions grew 11% year-over-year, and the average revenue per ad climbed 9%.

That combo gave Meta a 22% revenue lift in the quarter, a pace that outstrips most peers in digital advertising. Operating margins reached 43%, up from 38% a year ago.

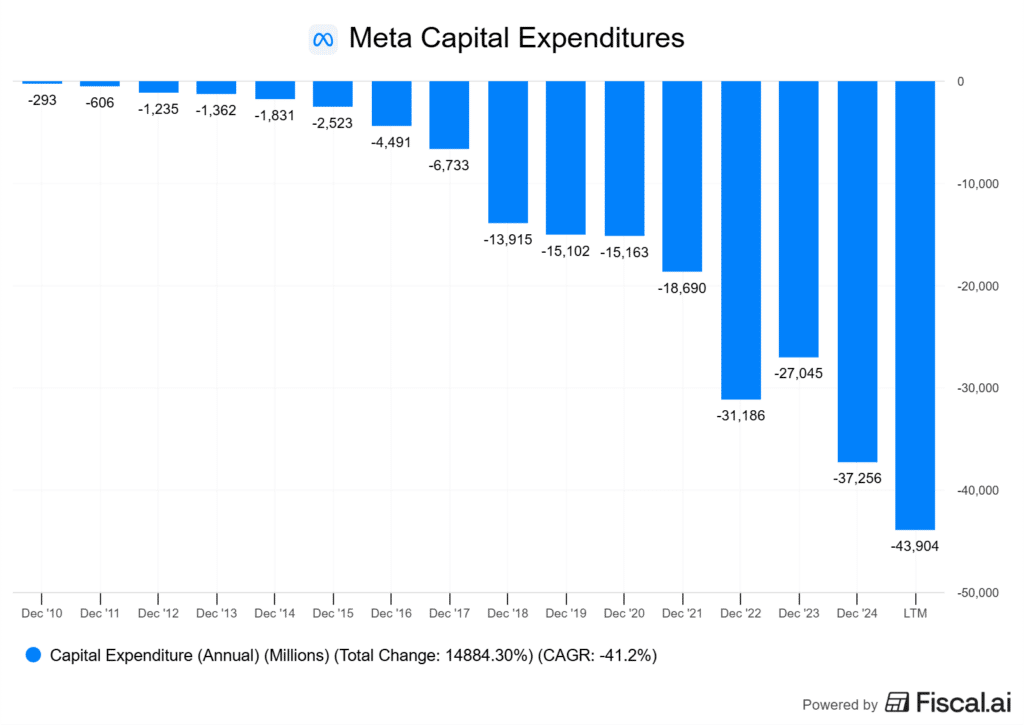

On paper, that’s a strong rebound. But expenses rose 12%, and management keeps flagging much heavier infrastructure costs ahead as AI data centres and model training scale up. Look at the surge in the company’s CAPEX below.

Free cash flow came in at $8.6 billion, which is healthy. But capital will keep climbing. Meta expects $66–72 billion in 2025 capex, driven almost entirely by AI infrastructure.

More of today’s cash generation is getting recycled into servers, chips, and data centres instead of going back to shareholders. This can pay off if AI investments prove to be profitable. But if it doesn’t, it could be a bunch of cash invested at low rates of return.

AI tools like recommendation engines and automated ad systems are helping advertisers see better results. That keeps budgets flowing into Meta’s platforms.

The risk? It doesn’t scale cleanly. Every percentage point of ad efficiency seems to come with another billion in infrastructure spend.

It works for now, but only if margins stay high. I see less room for error if ad growth slows.

User Growth Slows, Yet AI‑Driven Engagement Offers Upside

| Metric | Change | Driver |

|---|---|---|

| Daily active people | +6% YoY | Global adoption, slowing in mature markets |

| Time spent (Facebook) | +5% | AI recommendations |

| Time spent (Instagram) | +6% | Reels and AI‑curated content |

| Ad impressions | +11% YoY | Higher engagement |

| Avg. price per ad | +9% YoY | Stronger targeting tools |

Daily active people across Meta’s family of apps reached 3.48 billion in June, as I highlighted in the chart earlier. That’s a 6% increase from last year, but the pace is flattening as the company runs into saturation in mature markets.

Adding new users is tougher when most of the world is already on the platform. The catch is that engagement is rising even if user growth slows.

AI‑powered recommendation systems are driving more time spent on Facebook and Instagram. Reported gains are 5–6% in average session length. That deeper engagement is what advertisers pay for.

Revenue per user is edging higher as advertisers see better conversion rates. Smaller businesses, especially, benefit from AI‑driven ad tools that sharpen targeting and improve return on spend.

This is nice. However, more engagement only matters if it offsets the heavy cost of AI infrastructure. Which is truly up in the air at this point.

If this doesn’t occur, the gains in revenue per user risk being swallowed by rising expenses.

Capex Soars to Fuel Infrastructure. But When Does Payback Arrive?

Meta’s spending on infrastructure has shifted into another gear. Capital expenditures have hit more than $43B over the last 12 months.

Full-year spending is expected between $66–72 billion, up roughly $30 billion from last year. That’s a massive jump, even for a company with nearly $48 billion in quarterly revenue.

The bulk of this money is going into AI compute capacity. GPUs, servers, and new data centres. Management said future models like Llama 4 will need almost ten times more compute than the last generation. This is mind-boggling.

What this means is that costs aren’t levelling off anytime soon.

The challenge is obvious: when does all this investment start paying back? Generative AI isn’t yet a direct revenue driver.

Ads still make up almost all of Meta’s income. While AI improves targeting, the return on tens of billions in infrastructure isn’t easy to measure.

There’s also the capital return vs reinvestment trade-off. Meta returned about $11 billion to shareholders last quarter through buybacks and dividends. With CapEx climbing, those returns could shrink if cash flow tightens.

The risk? A long break-even timeline.

If AI-driven products don’t scale quickly, Meta could be sitting on underused data centres while depreciation eats into margins. Spending at this level is a bet on future payback, not current earnings.

This is a high quality company, but there is no doubt a degree of speculation here.

Regulatory Crosswinds Could Hamper Meta’s Global Expansion

I keep coming back to one fact: Meta still makes almost all of its money from ads. That dependence leaves the company exposed when regulators tighten rules around privacy and targeting.

The EU’s Digital Markets Act and GDPR have already led to fines and forced changes to its ad model. That cuts into profitability in key regions.

The U.S. is moving slower, but state-level privacy laws are stacking up. California and others now require clearer consent and transparency.

That doesn’t kill Meta’s business, but it does make ad targeting less precise, which lowers the value of its inventory. Competition regulators are also circling.

Antitrust scrutiny in Europe and the U.S. questions whether Meta’s control over Facebook, Instagram, and WhatsApp gives it too much power. If regulators push for structural changes, even modest ones, Meta’s scale advantage weakens.

We’ve witnessed this with other companies like Alphabet. Sure, it dodged a bullet in its recent anti-trust ruling, but who knows what bullets will need to be dodged moving forward.

The bigger challenge? The uneven global landscape. Europe enforces strict data rules, while emerging markets in Africa and Southeast Asia remain more flexible.

That split creates a two-speed business: stricter compliance costs in mature markets, and faster growth in less regulated ones.

Meta can still grow its user base abroad, but the ad machine that funds everything from VR to AI faces real headwinds. The risk? Regulation eats into margins before new revenue streams scale.

So, Can Meta Stay Ahead?

Meta’s gone all-in on new ad formats. Short‑form video through Reels is now the heart of its pitch.

Advertisers are paying more for placements as engagement climbs. That’s a huge positive right now, but margins on video ads still lag behind the old-school feed spots.

AI is the other big lever. The company’s rolled out recommendation tools and is testing assistants inside its apps to keep people scrolling longer.

Better targeting means advertisers usually get higher returns. Early numbers show conversion rates ticking up, which is promising. But all this only works if margins can stay high. And with all this spending, that’s not a given.

Meanwhile, competition isn’t sitting still. TikTok and ByteDance set the pace for short‑form discovery.

Snap keeps grabbing younger users. If people start spending more time elsewhere, Meta’s ad advantage could fade fast.

Meta’s also trying to diversify. WhatsApp ads, smart glasses, and a handful of other bets could open up new revenue streams. Most of these projects are still pretty early. There’s clear upside, but it’s messy and doesn’t always scale well.

And let’s not ignore the regulatory headaches in Europe. That could knock billions off ad sales if things go sideways.

Overall, I view the company as a bit expensive considering the forward uncertainty. However, the fact of the matter is the entire market is getting to the point where it is expensive. If we look to the market as a whole, Meta seems reasonably valued considering its forward growth.

But with margin debt hitting all-time highs this week, the markets are teetering on the idea that all of the AI CAPEX by these hyperscalers will turn into profits.