Is Advanced Micro Devices AMD a Buy? Analyst Insights & Stock Outlook

Key takeaways

Strong growth in AI and data centre chips drives near-term upside

Margins are improving but depend on disciplined execution

Competition and supply chain limits remain key swing factors

3 stocks I like better than Advanced Micro Devices.The problem with technology stocks right now? It feels like you’re either chasing a rocket ship that’s already left the launchpad, or trying to catch a falling knife. AMD, the company I’ll be going over in this piece, was that falling knife, but has since become the rocket ship.

What a crazy time to be an investor.

If you’re a DIY investor looking at your portfolio, the sheer volume of noise around Artificial Intelligence (AI) can be deafening.

Everyone talks about the “AI darlings” like Nvidia, leaving many to wonder if they’ve missed the boat entirely. It’s frustrating. However, the Fear Of Missing Out (FOMO) is a dangerous emotion to trade on. It cost me a ton of money when I started.

I want to cut through the noise. Today, I’m going to unpack AMD’s latest numbers. Not just the flashy headlines, but the details, to help you decide if this chipmaker belongs in your portfolio or if it’s better left on the watchlist.

The “Meat” of the Numbers: Execution is Everything

AMD is currently priced for execution, not comfort. This is in stark contrast to how cheap the company was for many years as investors had believed it lost its edge.

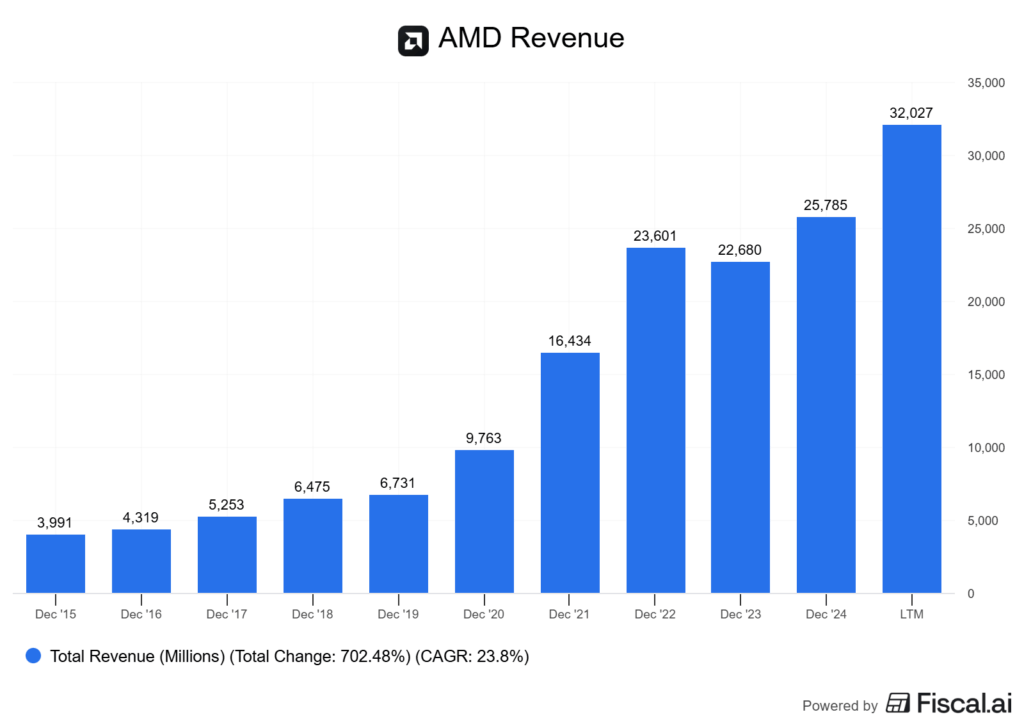

The company just posted record third-quarter revenue of USD $9.2 billion. That is a 36% jump year-over-year.

Historically, I’d call that a massive win. But in this market, context is king.

That growth is largely fueled by rising demand for their EPYC processors and Instinct AI chips, particularly following a major partnership with OpenAI.

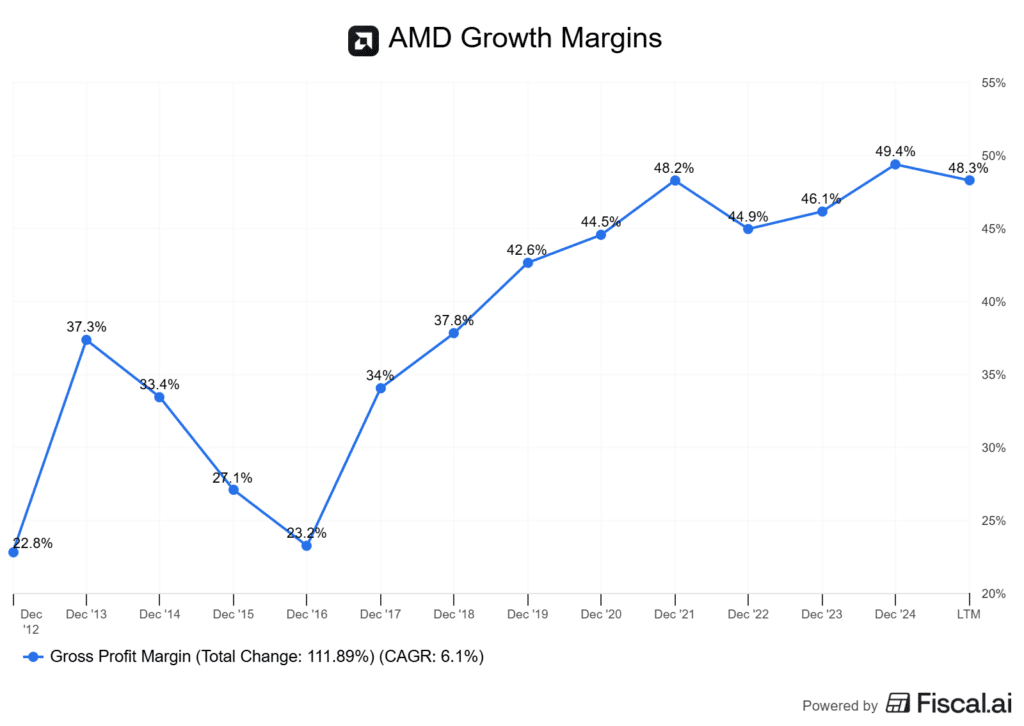

The business is clearly seeing tailwinds from the AI boom. However, looking at the margins tells the real story of their leverage. Gross margins have risen to 48.3%.

Simply put, they are becoming more efficient as they scale. But the question remains: can they hold this line? Rivals like Nvidia and Intel aren’t exactly sitting on their hands. Any snag in execution could narrow that advantage quickly, and if this happens, the price will fall.

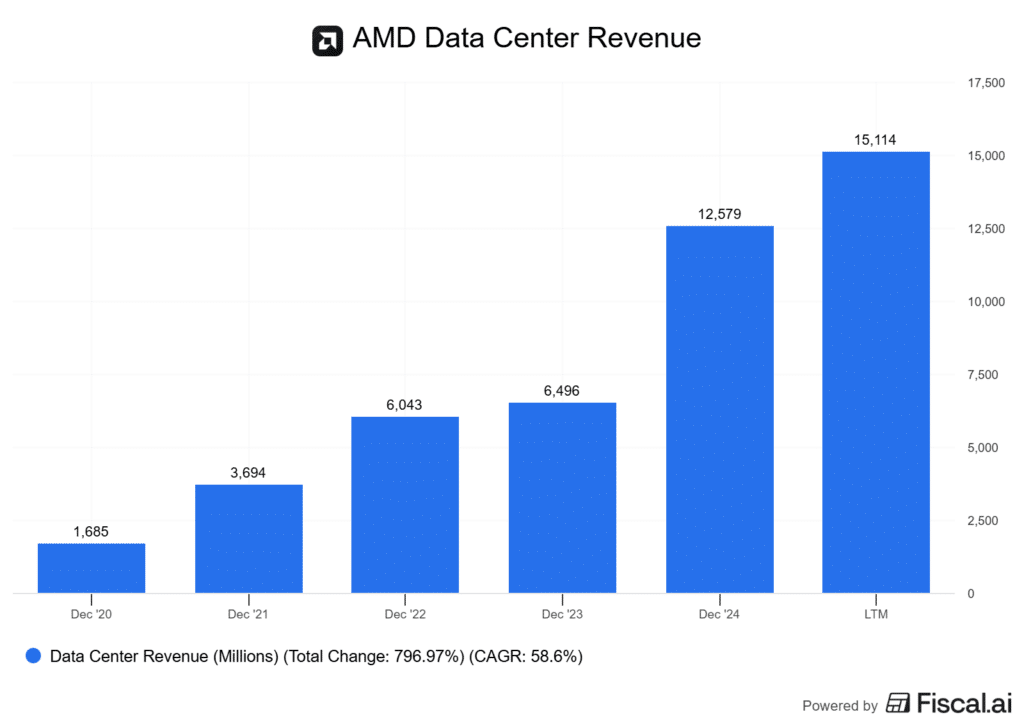

Data Center & AI: The Bull Case with a Catch

AMD’s data center business is growing at mind-boggling speeds. Not as fast as Nvidia, but still fast.

We are looking at expectations of over 60% annual revenue growth in this segment. This isn’t just hype; it is driven by hard orders for their Instinct MI350 GPUs and the upcoming “Helios” systems.

The EPYC server CPUs are the workhorses here, aiming to capture more than half of the server CPU market share with the next-gen “Venice” chips. That is an incredibly ambitious target.

The catch?

Optimism doesn’t offset execution risk. AMD has a roadmap that includes MI400-series GPUs and Pollara networking chips, but delivering these on time and at yield is difficult. While I love that they are leaning into open software via their ROCm platform, a smart move to broaden adoption, the competitive landscape is tightening.

If there is a stumble in manufacturing yields, the market will punish the stock mercilessly.

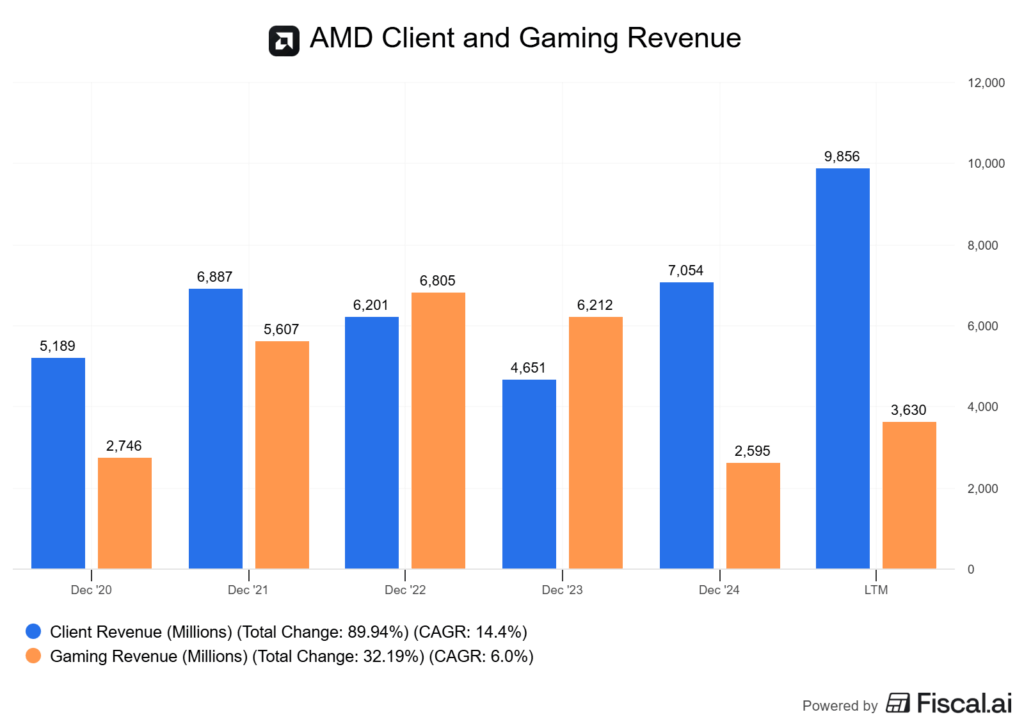

The Cyclical Reality: Gaming and Client Segments

For a long time, AMD was just “the gaming chip company.” While they have evolved, those roots still matter.

The client and gaming units have finally bounced back after a rough stretch. Reports indicate gaming revenue rebounded significantly in Q2 2025, up more than 70% year-over-year. That sounds fantastic, but we have to remember the steep 59% drop that preceded it.

These markets are highly cyclical. They truly are feast or famine.

The PC market is stabilizing, and Ryzen 7000 processors helped regain some ground. However, if households delay upgrading their home PCs due to economic tightening, this momentum could fade. Similarly, while Radeon cards are gaining ground, console demand is cooling as the current generation matures.

My take? Don’t bank on this segment for explosive growth. Treat it as a stabilizer that can occasionally drag performance down.

Let’s face it though. The vast majority of people are buying these chip companies for AI exposure, not gaming exposure.

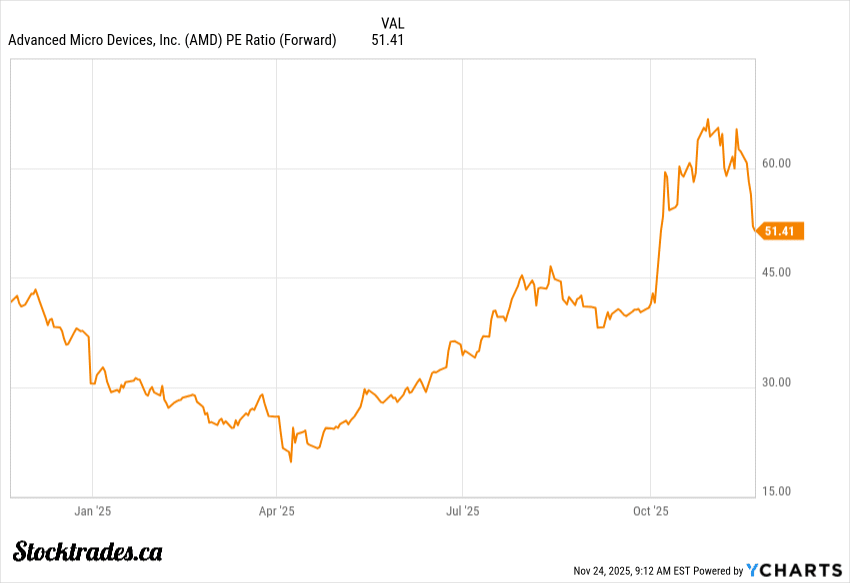

Valuation: Priced for Perfection

The stock is currently trading at a forward P/E near the upper end of its five-year range. The market is pricing AMD as if it has already won a significant chunk of Nvidia’s market share.

If their operating margin target holds around the mid-30% range, we could see earnings compound at a rate above 30% annually. That is the “promise.”

The Risk?

If AI infrastructure spending slows down, or if a product launch faces delays, that valuation premium evaporates. A mere two-point drop in operating margins could cut projected earnings power meaningfully.

Consensus growth assumptions are aggressive, modelling double-digit revenue growth through 2027. I’ll be watching the ratio of data center revenue to total sales closely. If that line flattens or margins compress, I think the thesis here could be broken.

The Supply Chain Snag: All Roads Lead to Taiwan

We cannot talk about semiconductors without talking about geopolitical risk. AMD’s growth story runs directly through Taiwan and TSMC.

As a fabless company, AMD designs the chips but relies on TSMC to build them. This gives them access to world-class tech without the capital bloat of owning factories, but it creates a single point of failure.

If lead times stretch, AMD’s product ramps slip. They are trying to diversify by using TSMC’s Arizona plant and potentially exploring Samsung, but these are long-term fixes.

For now, any tension in the region or tightening of US export controls is a significant headwind that could compress margins overnight.

Would I Buy the Company Today?

AMD is a fascinating company that has successfully transformed itself from a budget alternative to a true performance leader. But as an investment, it requires a strong stomach.

I would consider buying AMD if:

- You have a long time horizon (5+ years) and can handle significant volatility.

- You believe the data center market is large enough for two major players (Nvidia and AMD) to thrive.

I would hesitate if:

- You are not bullish on the future of AI spending

- You are prone to panic selling when high-beta stocks dip 10-15% in a week.

In my opinion, AMD is a buy only if you believe management can execute flawlessly on their AI roadmap. If they slip, the market won’t be forgiving. I’d say it is a buy for investors with higher levels of risk tolerance.