Is Amazon the Best Mag 7 Stock on the Market Today?

Key takeaways

Revenue momentum holds, but weaker cash flow raises concern

Core cloud margins face pressure from costs and competition

Consumer and ad growth offset near-term strain, but risks remain

3 stocks I like better than AmazonAmazon looks like one of the most fairly valued Mag 7 stocks out there. While companies like NVIDIA and Microsoft are trading at high valuations, Amazons retail side of the business is keeping it cheap.

The wild card is still the cash flow profile tied to AWS margins. The retail end of the business is often seen as the moaty one. However, it’s lower margin and slower growing. AWS is the story here for Amazon.

The company just posted another quarter of solid top-line growth. Operating cash flow dipped as investments in AI infrastructure and logistics weighed on near-term returns, but that’s going to be much the same with any of the other tech companies.

Amazon remains a reasonable long-term hold if AWS can keep margins steady while e-commerce and ads grow at a decent clip.

The flip side? Competition in cloud and rising costs could erode that stability faster than expected.

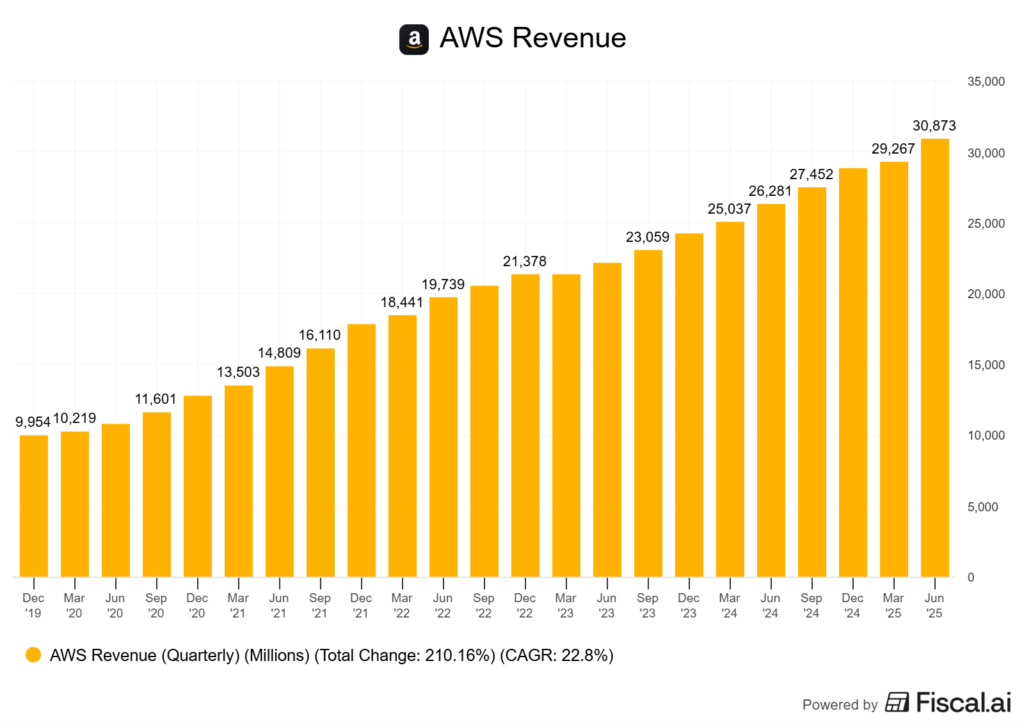

The core engine is AWS. It delivered 19% year-over-year revenue growth last quarter, hitting USD 30.8 billion.

The segment missed consensus estimates by a small margin. That matters because AWS contributed about half of operating income, and its profitability funds Amazon’s bets in logistics, AI, and satellite internet. Often, when these growth segments of these stocks missed expectation, price comes down.

E-commerce still holds about 40% of the U.S. market. Ad revenue grew 18% year-over-year to USD 17.3 billion, showing resilience even in a mixed consumer environment.

Tariffs, FX, and consumer spending trends could cut into growth. The next year hinges on whether AWS can defend margin while Amazon absorbs heavy investment spending.

Let’s dig a bit deeper.

Strong Top‑Line Momentum, But Free Cash Flow’s Sharp Drop Raises Questions

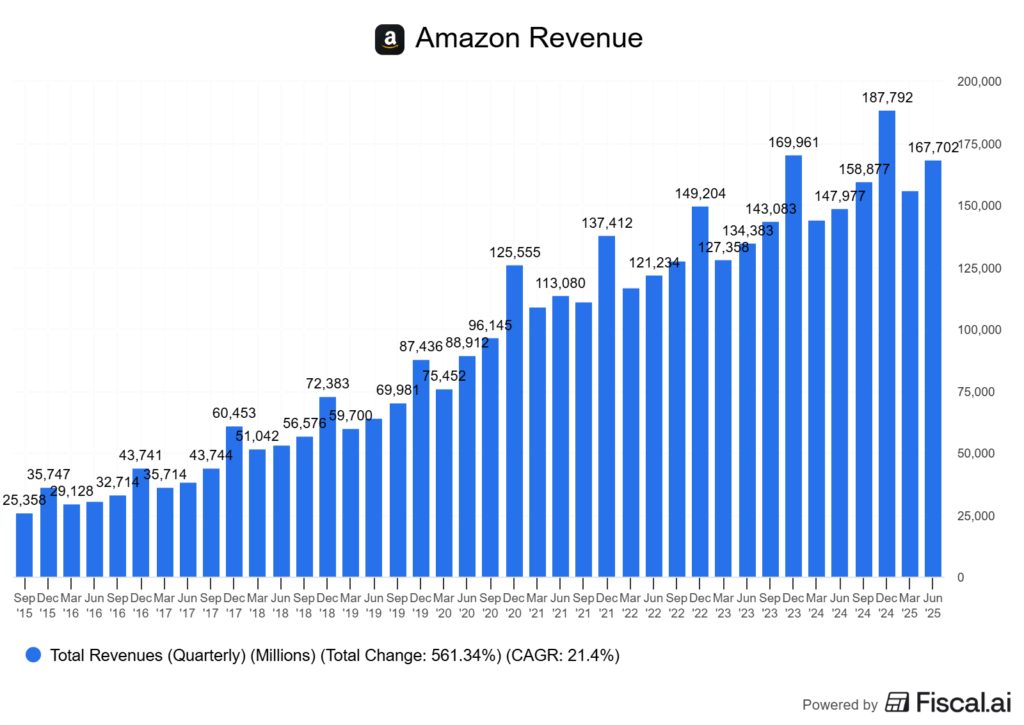

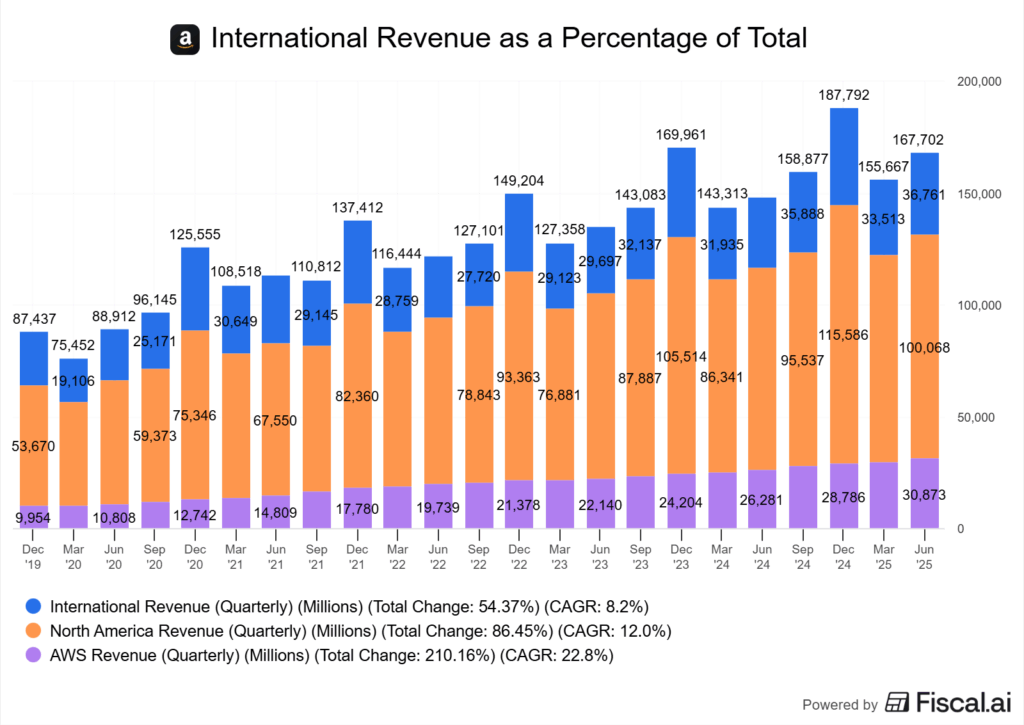

Amazon’s revenue story looks strong on the surface. Net sales climbed 13% year-over-year to $167.7 billion.

North America grew 11%. International rose 16%, and AWS advanced 17.5%. Each segment posted operating income gains, with AWS still carrying the highest margins.

But this all won’t hold without stronger cash flow. Operating cash flow rose 12% to $121.1 billion.

Free cash flow fell hard to $18.2 billion from $53.0 billion a year ago. The gap between the two shows how capital spending is eating into liquidity because of rapid developments in AI.

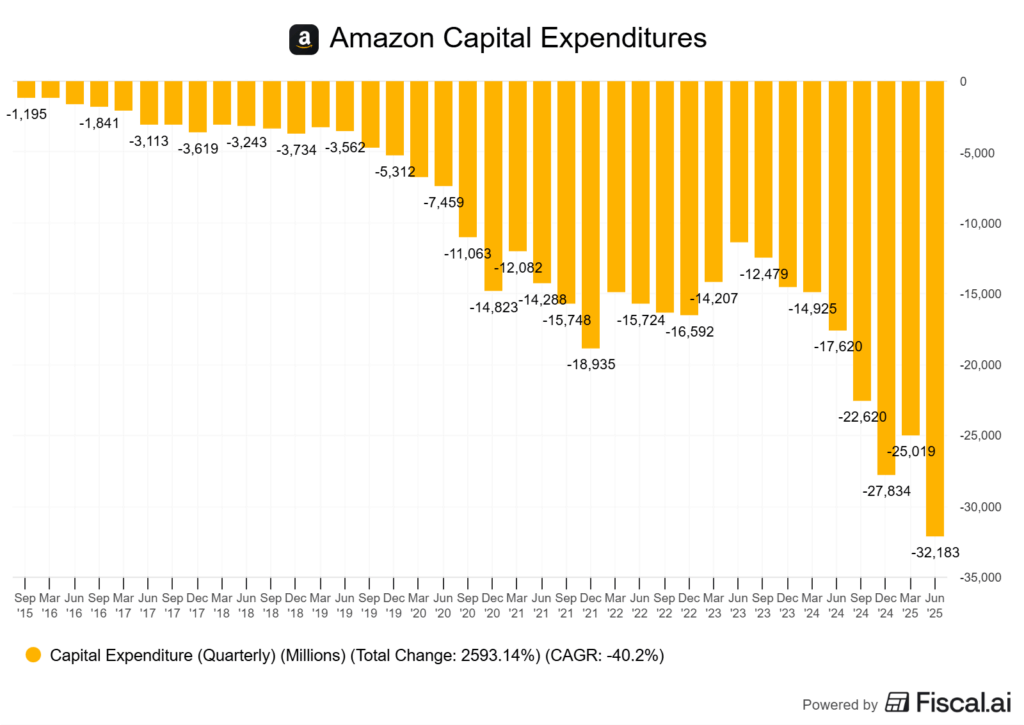

Amazon nearly doubled its capital expenditures, much of it tied to AWS data centres, AI infrastructure, and logistics upgrades. Those investments may improve long-term competitiveness, but in the short run, they weigh on free cash flow.

I also see pressure from working capital. Expanding faster delivery networks and managing larger inventories raise fulfilment and storage costs. That helps customer experience, but it also pushes up operating expenses and narrows the cushion on margins.

Amazon is growing across every major segment, there is no doubt. The risk? It doesn’t scale cleanly if free cash flow keeps shrinking while capital demands climb.

I don’t see this as a massive issue, but is certainly one investors need to keep an eye on.

AWS Grows Respectably, Yet Faces Rising Competitive & Cost Pressures

AWS posted revenue growth of about 17–19% year over year.

That’s solid, but it trails Microsoft Azure’s 39% and Google Cloud’s 32% growth rates in the same period. AWS is the largest player, so we can expect growth to be slower. However, it needs to keep up the pace or be at risk of being caught by competitors.

The business model is straightforward: recurring fees for compute, storage, and software services at global scale. Margins hinge on how efficiently AWS can spread massive fixed costs across that base.

The upside is obvious, and large. Scale brings resilience. The risk? Incremental revenue is slowing while capital intensity is rising.

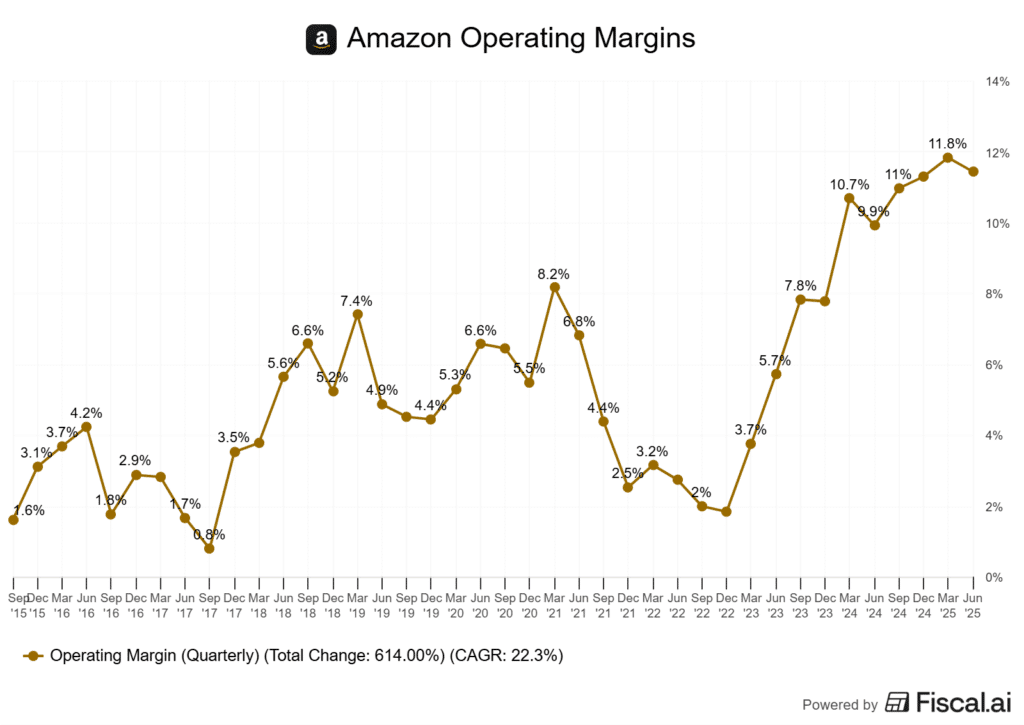

Operating margins have held up, but power, cooling, and chip costs are climbing.

AWS is investing heavily in custom silicon, which may reduce dependence on outside suppliers, but the upfront spend is high.

Competition isn’t just about raw cloud capacity. Customers are leaning into hybrid and multi‑cloud setups, which weakens AWS’s lock‑in advantage.

Microsoft benefits from enterprise software ties, while Google wins workloads tied to AI. AWS still has breadth, but the moat is thinner than it once looked.

I am confident that AWS can defend its lead, and the stock is priced attractively enough because of the competition.

What I’ll watch over the next year is whether backlog growth outpaces reported revenue. If that gap keeps widening, it signals AWS still has demand in hand despite the rising costs.

E‑Commerce Resilience Despite Tariffs and Consumer Trends

Amazon’s retail engine is still moving, but the pressure points are obvious. Tariffs on imported goods raise costs, and every round of trade friction with China makes supplier negotiations harder.

The company can spread those costs across its vast marketplace, yet it doesn’t erase the margin squeeze. That’s the trade-off investors need to watch.

Foreign exchange is another swing factor. A stronger U.S. dollar cuts into international revenue when converted back.

Overseas sales remain a meaningful slice of Amazon’s business.

Inditex recently flagged a 3% sales decline tied to FX shifts, and Amazon faces the same exposure if currencies move against it. The impact isn’t fatal, of course, but it chips away at reported growth.

Consumer demand trends are mixed. Shoppers lean into discounting, and Amazon’s marketplace model gives them plenty of choice.

Prime still pulls in recurring spend, but first-party sales carry heavier costs than third-party listings. More marketplace activity supports margins, while heavier reliance on first-party retail drags them down.

Fulfilment and shipping costs remain stubborn. Labour, fuel, and logistics inflation haven’t disappeared, and faster delivery expectations only add to the bill.

Amazon offsets some of this through automation and network density, but the baseline cost structure is higher than it was five years ago.

If consumer demand softens, those fixed costs become harder to absorb. We haven’t seen it drastically yet, but it doesn’t mean it won’t happen.

Investments in AI, Logistics, and Satellite Internet: Long‑Term Bets vs Near‑Term Strain

Amazon is spending at a scale few companies can match. In 2025, capital expenditures are set to reach about USD 100 billion, with most of it tied to AI, data centres, and logistics.

That’s the growth engine, but it also drags on near‑term margins.

AI R&D is front and centre. The company has put billions into generative AI integrations across AWS and retail, including Alexa+.

Voice assistants may deepen engagement, but the real money is in AWS workloads. The risk? Heavy chip and infrastructure costs could dilute margins if revenue growth slows and AI-related spending doesn’t prove to be as profitable. The same goes for many large tech stocks, like Google for example.

Logistics remains a swing factor. Amazon keeps expanding fulfilment infrastructure to cut delivery times, while last‑mile delivery costs keep rising. Faster service strengthens customer loyalty, but it leaves less room for operating margin recovery.

The retail side of the business provides a steady moat for the business, which allows it to expand into areas like AI with ease.

Then there’s Project Kuiper. The satellite internet rollout is pitched as a long‑term platform play, but it’s still years from profitability. Building and launching satellites is capital‑intensive, and the payoff depends on scaling a customer base that doesn’t yet exist.

Here’s the trade‑off: innovation vs margin dilution. These bets could secure Amazon’s relevance for the next decade or longer, but the money needs to be well spent.

The upside is clear: diversified growth levers. The downside? They don’t scale cleanly without sustained cash flow from AWS.

What I’ll watch over the next year is whether AWS margins continue to increase while AI investments start to show measurable revenue lift.

So Is the Company a Buy? Investors Remain Cautious Because of Forecasts

Amazon’s latest outlook hints at another quarter of growth. But there are some caveats.

The company guided Q3 revenue between 174 and 179.5 billion USD. That’s a bit ahead of consensus, which had expected something near the lower end of that range.

On the surface, that’s supportive. Still, there’s a catch.

Operating income guidance came in at 15.5 to 20.5 billion USD. The midpoint looks fine, but it doesn’t really reset expectations.

Investors wanted to see margin strength accelerate, not just hold steady. The market’s reaction showed that split message.

Shares slipped, even with the top-line beat. The profit outlook just didn’t match up with the more optimistic scenarios.

Sentiment feels fragile here. Revenue growth alone doesn’t cut it anymore.

AWS and advertising still underpin cash flow. But heavy capital spending and foreign exchange headwinds, like we saw in prior quarters, keep the operating line under pressure.

The key number to watch into next year? That’s operating margin. Revenue probably stays strong, but without better profitability, defending the stock’s premium gets tough.

I think the company is a good contrarian buy right now, considering the moat the company already has and the amount of capital it has effectively invested for numerous years. If there is a Mag 7 stock I trust, it would be Amazon.