Apple’s Innovation Engine is Stalling – And The Numbers Prove It

Key takeaways

Upgrade cycles are slowing, putting pressure on hardware-driven growth

China demand remains uncertain, even as production stays steady

Valuation looks high unless core product sales maintain momentum

3 stocks I like better than AppleApple (AAPL) is priced like a growth stock, yet it provides very little growth. There’s real execution risk tied to iPhone upgrade cycles, plus numerous other factors.

The June quarter showed record revenue of USD 94 billion, up 10% year over year. iPhone and services drove those gains. That kind of growth is solid. But the stock’s long-term path depends on whether device demand can hold up as consumers stretch replacement cycles.

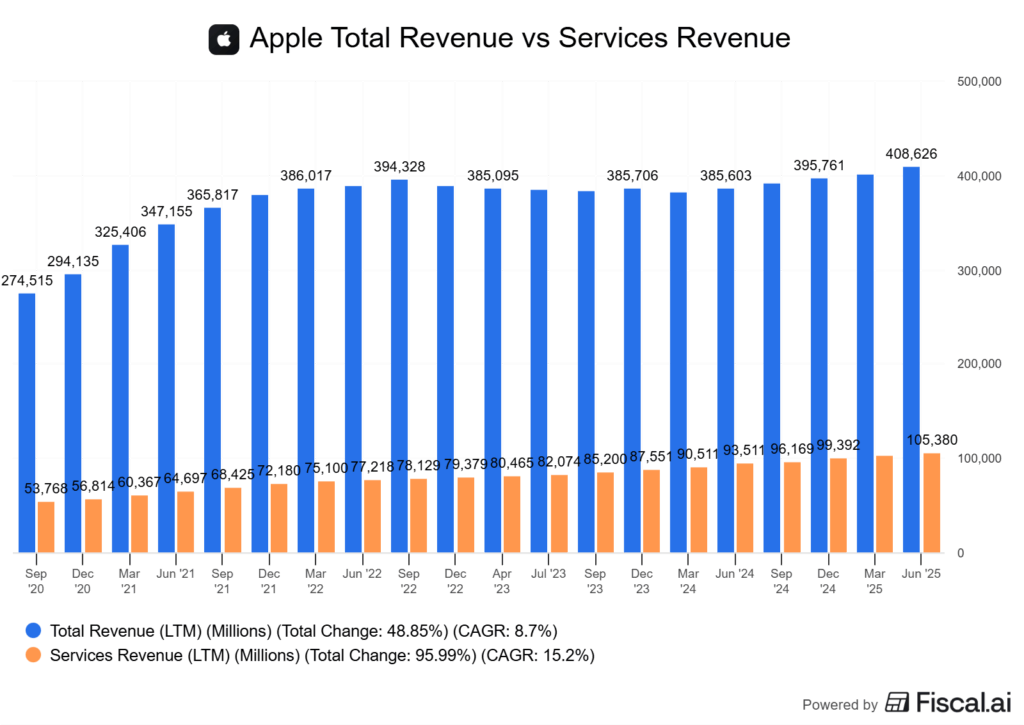

If upgrades keep slowing, the growth narrative weakens quickly. The business model still leans heavily on hardware sales, with services providing a steadier margin base, but just doesn’t carry the punch in terms of revenue generation yet.

iPhone revenue remains the swing factor because it drives both direct sales and the installed base that supports services expansion. Services revenue hitting an all-time high is encouraging, but without stable iPhone volumes, that momentum just can’t scale cleanly.

China complicates things. Softer demand pressures are partly offset by strong local manufacturing, so the outlook could shift either way over the next few years.

iPhone Upgrade Cycle Slows as Consumers Hold Onto Devices Longer

The average iPhone in use today is about 35 to 37 months old, depending on the market. That’s nearly three years of life before replacement, and it’s a clear sign that consumers are stretching their devices further.

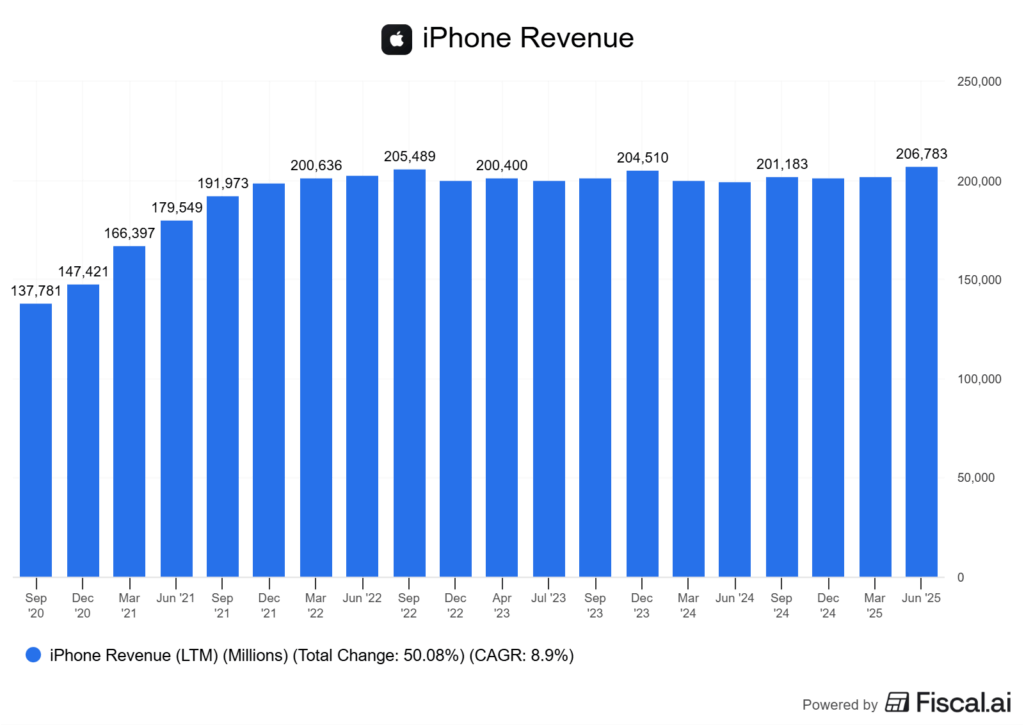

For Apple, that means fewer predictable upgrade spikes. There’s more pressure on services to carry growth. We can see this in the chart below, as iPhone revenue has flatlined post-pandemic.

UBS recently pointed out that users in the U.S., U.K., and Japan are all holding onto iPhones longer than before. In Japan, the average device age is closer to 40 months, while in China it’s only about 23 months.

This gap matters because China remains one of the few regions where upgrade cycles are still short enough to drive volume. What stands out is how little hardware has changed since the iPhone 13.

Each new model has brought incremental improvements. Better cameras, brighter screens, slightly longer battery life, but nothing that forces a mass refresh. In times of tighter discretionary spending, consumers just won’t upgrade for small features.

This caps Apple’s hardware momentum. The delayed rollout of Apple Intelligence, the company’s AI platform, has also slowed demand.

If AI features remain staggered across models, the upgrade cycle could stay muted even after the iPhone 17 launch.

Unless Apple can compress the average device age back below three years, the stock will keep facing questions about its growth ceiling.

Mixed Signals from China

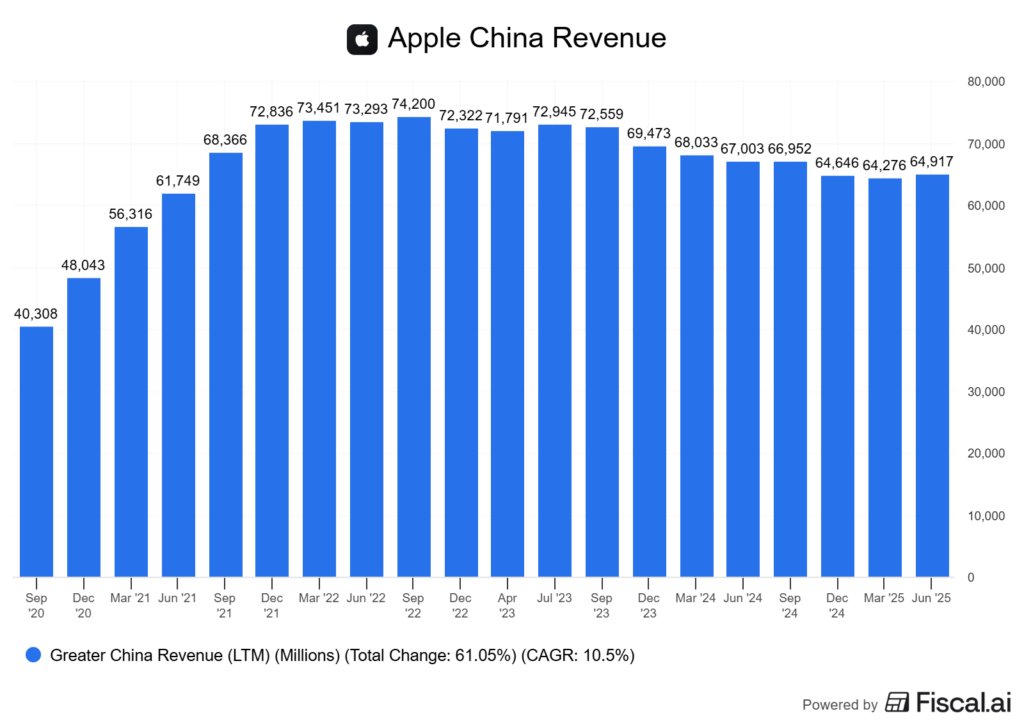

China remains Apple’s most difficult market right now. iPhone sales are soft as consumers shift toward Huawei’s new models, while local sentiment favors domestic brands.

Weak demand shows up in the official manufacturing Purchasing Managers’ Index (PMI), which stayed in contraction at 49.4 in August. The private Caixin PMI ticked up to 50.5, hinting at some resilience among smaller firms (EconoTimes).

Apple’s trying to lower its exposure to these swings. Roughly 14% of iPhones are now made in India, part of a “China+1” strategy to spread production risk.

This shift helps, but it’s still early. The majority of iPhones remain tied to Chinese supply chains, which leaves earnings vulnerable to both tariffs and local demand cycles.

Tariffs are already showing up in the numbers. The company expects about US$900 million in added costs in Q2 2025 from new duties.

That’s a meaningful hit to margins, especially when paired with softer China sales. Unless Apple scales non-China production faster, these costs will keep dragging on profitability.

At the same time, Apple is pushing suppliers to adopt automation for the upcoming iPhone 17 assembly lines. The goal is to offset wage inflation and improve consistency.

This could protect gross margins over time, but it requires upfront investment. There’s execution risk if suppliers fall behind.

The picture is mixed: demand headwinds in China on one side, and manufacturing stability efforts on the other. The swing factor is whether Apple can grow its India footprint quickly enough to blunt both tariff pressure and weakening Chinese consumer demand.

Is Apple Still a Growth Company?

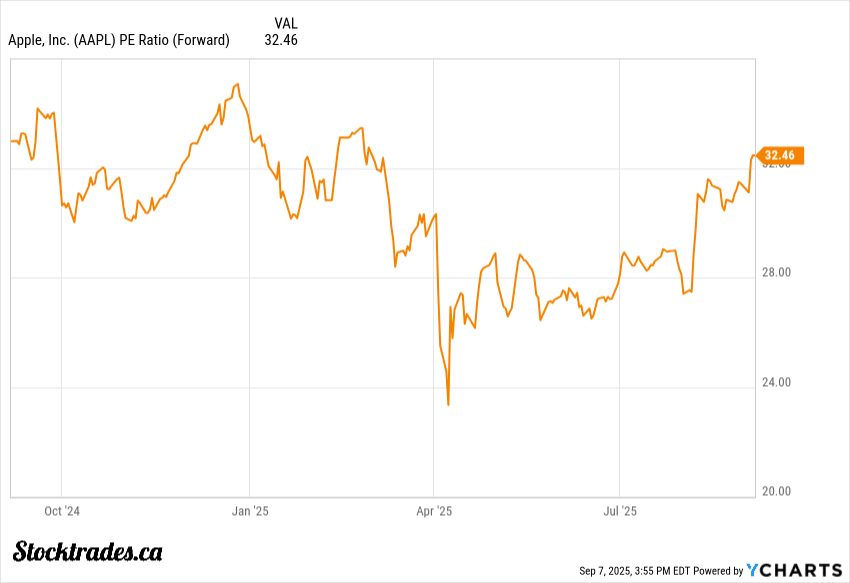

Apple’s stock still trades at a premium, with a forward price-to-earnings (P/E) ratio in the 31–36× range. The S&P 500 average sits closer to 20–22×.

That gap only makes sense if Apple can deliver stronger growth than the market. Recent quarters show the opposite.

The company’s Services division is the one bright spot, growing at double-digit rates and now making up about one-fifth of total revenue. By contrast, iPhone sales have been flat to negative.

Other hardware lines like Mac and iPad remain too small to offset that drag. Without a new growth engine, revenue momentum looks capped.

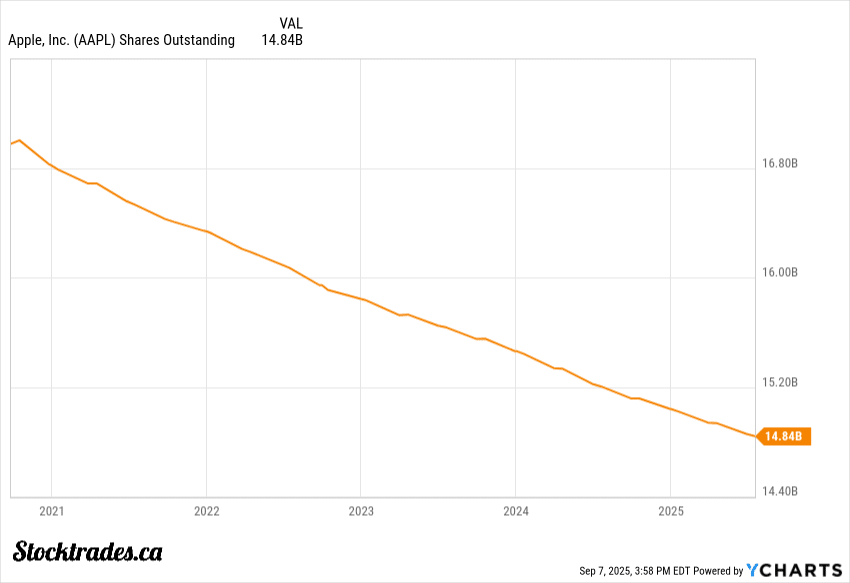

One factor propping up earnings per share (EPS) is Apple’s $95 billion buyback program it had in 2024. Reducing the share count over the last year boosts reported EPS even if total profit isn’t growing much.

That strategy helps support the stock price, but it doesn’t change the underlying growth profile of the business. Eventually, you can only buy back so many shares.

Competitors in artificial intelligence, such as Nvidia (NVDA) and Microsoft (MSFT), are seen as having clearer catalysts, while Apple’s AI rollout has been slower and more limited.

The key test is whether Apple can show that AI or another product cycle can reignite demand. If Services growth slows, the stretched valuation just gets much harder to defend.

Ultimately, Buybacks Can’t Hide Slowing Fundamentals

Apple’s fiscal 2024 buybacks came in near USD 95 billion. They spent another USD 23.6 billion in a single quarter in 2025.

That’s a staggering amount of capital returned. Still, hardware revenue from iPhone, iPad, and Mac keeps dropping.

To me, that signals the core engine is sputtering even as services hold up. The company’s reliance on repurchases isn’t new, but the diminishing return feels more obvious now.

At today’s valuation, each dollar spent on buybacks lifts earnings per share less than before. Some analysts warn that the return on equity could weaken if actual earnings don’t catch up.

Unless management shifts some of that cash flow, investors may wonder if the strategy still fits the times. What matters is whether Apple can grow its services fast enough to offset hardware declines.

If hardware revenue stays negative for for much longer, buybacks start to look like financial engineering. If services growth really picks up, the picture changes, but that’s the swing factor I’m watching.

Overall, I think this is a business entering a more mature stage, and it just doesn’t justify a 30x~ earnings multiple over similar tech names.