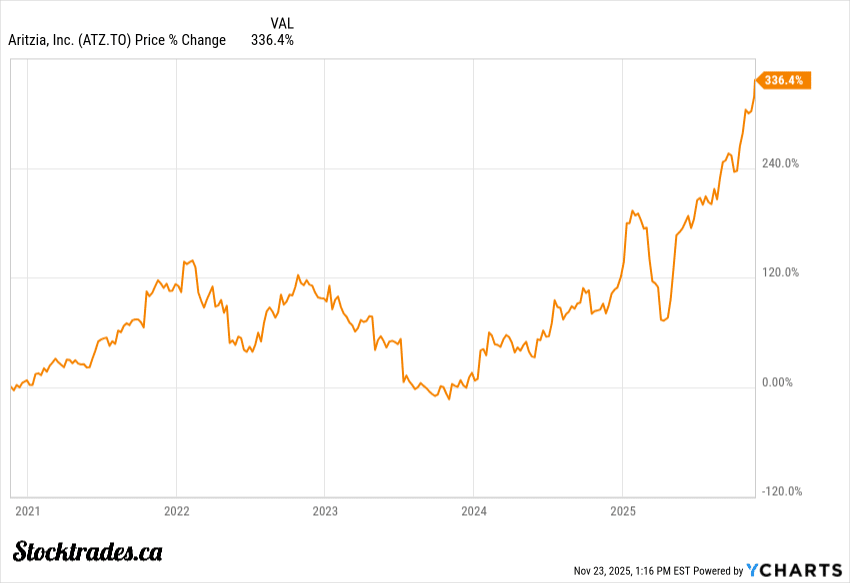

This Top Canadian Stock Is up 350% in 2 Years – Has It Peaked?

Key takeaways

Growth continues in the US, but valuations mean it must execute

Brand strength supports long-term potential

Efficiency and execution will determine future upside

3 stocks I like better than Aritzia.Retail investing can feel like navigating a minefield. One minute a stock is the darling of the TSX, and the next, it is crashing down to earth because of a single bad quarter or a shift in line trend.

Don’t take my word for it though. Just look to companies like Canada Goose, Lululemon, or Nike.

If you have been watching Aritzia, you are likely torn. The growth in the United States looks incredible, but the valuation now feels stretched.

It is a classic dilemma for the DIY investor. You want to participate in the growth, but you are terrified of buying at the top. I get it. It is hard to separate the hype from the fundamental reality. Buy low, sell high, right?

My goal in this article is to strip away the noise. I want to look under the hood of Aritzia’s recent performance, analyze the risks in their expansion plan, and help you decide if this retailer belongs in your portfolio.

The U.S. Expansion: Massive Tailwinds with a Snag

The headline story for Aritzia continues to be its aggressive push south of the border. The United States has been a massive tailwind for the company, with revenue climbing roughly 41% year over year.

Essentially, the U.S. is now the primary growth engine, making up nearly 60% of total sales. Back when I first bought this company 7-8 years ago, I believe it made up less than 40%.

That is a mountain of growth for a Canadian retailer. Most don’t have access to this level of growth because of how small our country is.

Most struggle to crack the American market, but Aritzia seems to have found a formula that works. They opened 13 new boutiques in the last year, and the data suggests these locations are paying back their investment capital quickly, in some cases under a year.

The question would be how much room is actually left?

While the numbers are great, the low-hanging fruit in prime Tier 1 American malls is largely gone. The snag here is that future expansion relies on second-tier markets where brand awareness is thinner. The company can execute, don’t get me wrong. It just becomes harder to do so now.

Comparable-store sales rose over 20%, which is fantastic. But can it keep these levels up? I would argue it can, just becomes much more difficult to do so.

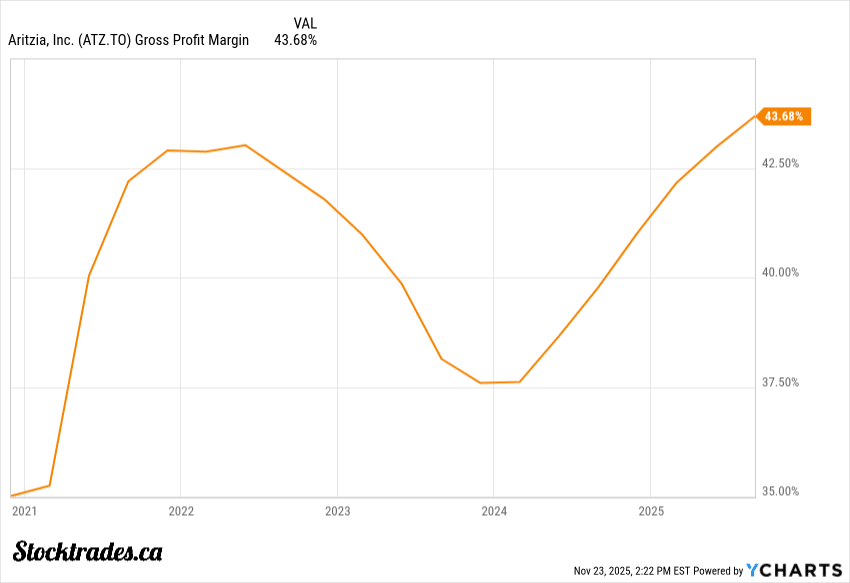

Margins: The Real Measure of Health

Top-line revenue is a novelty item. True quality lies in the margins. I was pleased to see Aritzia’s gross profit margin continue to improve to 43.8%, up significantly from 40.2% a year prior.

They’re able to sell more clothes at full price rather than discounting heavily to clear racks. They also managed to navigate freight and tariff costs better than expected.

Gross margins are still recovering from some inventory slipups the company went through a few years ago. A slip up that ended up being the best time to buy this company since its IPO.

The company saw Adjusted EBITDA more than double year over year. That sounds spectacular, but as with all my investments, I remain a defensive optimist here.

This level of profitability requires near-perfect execution. The business relies heavily on occupancy cost leverage and the brand continuing to gain traction. If sales dip even slightly, or if tariff headwinds pick up again, that 43.8% margin could compress very quickly.

Inflation is also still lurking in the background. While they gained some leverage on SG&A (Selling, General, and Administrative) expenses this quarter, the costs of running a larger, more complex logistics network in the U.S. are substantial.

I believe investors need to monitor this closely. If costs rise faster than that U.S. revenue growth, the stock price will likely react negatively, especially at these valuations.

Brand Power in a Crowded Room

In the fashion industry, your brand is your only real moat. Aritzia occupies a very specific niche often called “Everyday Luxury.” It is expensive enough to feel premium and aspirational, but not so expensive that it is out of reach for the upper-middle class.

Credit card data and third-party analysis suggest the customer base is sticky. Shoppers are returning, and the company is taking market share. This isn’t just a Canadian phenomenon anymore; the brand is resonating with American shoppers.

And in this “K” shaped economy, where the wealthy continue to spend money while lower income individuals struggle, this is ultimately the perfect environment for a mid-tier fashion brand. Unlike a lot of other retailers (Lululemon, Nike) which do focus on lower income households, Aritzia is not exposed to this market all that much.

The company uses a “house of brands” strategy (Wilfred, Babaton, Tna) which allows them to pivot design trends without rebranding the entire store. This offers some protection against shifting tastes.

However, the risk of “influencer fatigue” is real. A cloud could form over the brand if it becomes too ubiquitous. Aritzia relies heavily on social media and cultural relevance.

If Gen Z decides Aritzia is no longer “cool,” the fundamentals will deteriorate long before the financial statements show it.

This is not just a risk with Aritzia, but any fashion retailer out there.

Leadership and the Inventory Trap

I always pay close attention to management, especially after a transition. CEO Jennifer Wong has taken the reins and is tasked with balancing this high-growth strategy with operational discipline. Thus far, she has crushed it.

Along with this, the board seems to be backing her, and the executive team is a mix of retail veterans and supply chain experts. But there is always a risk when a company transitions from “founder-led creative chaos” to “professional corporate management.” The danger is that the company loses the creative spark that made it special in the first place. It hasn’t happened yet, but it still could happen.

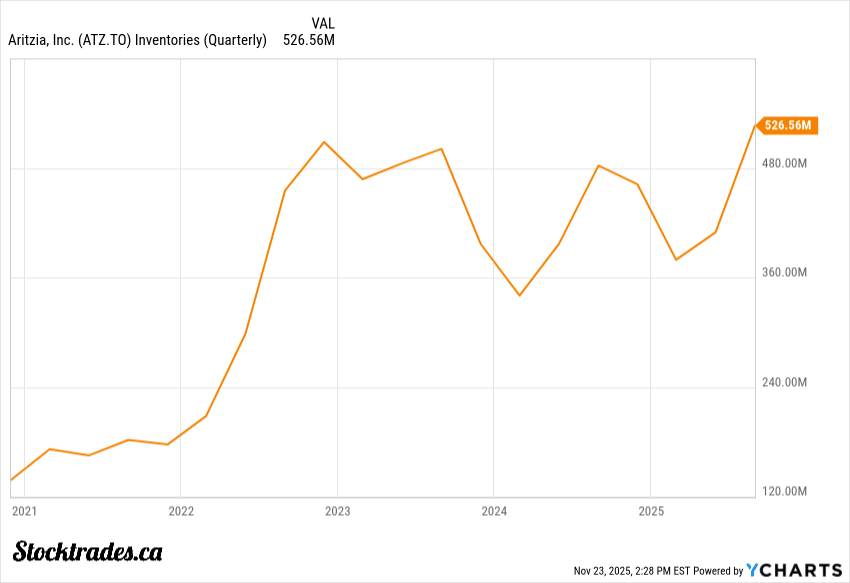

Finally, let’s talk about the inventory.

Nothing kills a retail stock faster than bloated inventory. We have seen a plethora of retailers end up in the graveyard because they bought too much stock that they couldn’t sell.

Recently, Aritzia’s inventory growth has slowed, which is a strong sign. It suggests that the massive buildup we saw in previous years is finally normalizing. They are turning stock into cash more efficiently.

You might notice inventories are at the same level as when they had issues. What is important to note is that the company was not seeing 20%+ same store sales back then. It is now.

But with the opening of new distribution centers, the logistics are getting complicated. My concern is that as they scale, the machine becomes too big to turn quickly. If they miss a fashion trend while holding massive amounts of inventory, the markdowns required to clear it would destroy profitability for the year, just like we witnessed a few years ago.

This isn’t something I’m overly concerned with, but is just a risk I’m watching.

The Bottom Line

Aritzia is, without a doubt, a massive Canadian success story. They have managed to export a retail concept to the U.S. successfully, which is rare. Lululemon did it, but outside of that, not many Canadian companies have.

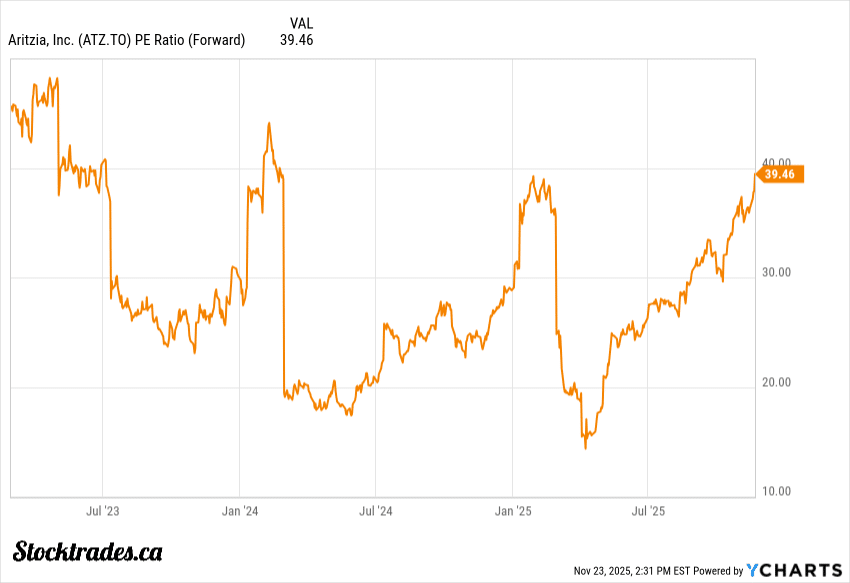

The growth numbers are undeniable, and the margin recovery is promising. However, the valuation reflects a lot of this optimism. At 40x expected earnings, the stock is priced to perfection in my opinion.

If you are a long-term growth investor, Aritzia checks a lot of boxes. But you must be comfortable with volatility. The retail sector is fickle, and Aritzia is now playing in a much bigger, more competitive sandbox.

I believe Aritzia is a “hold” for existing shareholders who can stomach the swings. If you are looking to enter, I would be tempted to wait for a better entry. The long-term thesis is intact, but the short-term risk-to-reward ratio is tight.