This Top Canadian Energy Stock Prints Money, but Is It a Buy Today?

Key takeaways

CNRL’s growth ambitions and cost discipline could fuel higher returns.

Recent acquisitions add opportunity but bring some integration risk.

Strong dividends and buybacks help make the stock attractive for Canadian portfolios.

3 stocks I like better than Canadian Natural right now.Oil is in the tank, and naturally nobody is talking about oil stocks. Yet Canadian Natural Resources keeps quietly powering through the negative sentiment.

If you care about stable dividends and serious staying power, this company stands out among its peers. I think Canadian Natural Resources is a buy for long-term investors who want growing income and exposure to Canadian energy assets. And at lower crude prices, it provides attractive valuations.

Relentless production growth, defensive cost moves, and commitment to rewarding shareholders have made them hard to ignore.

The trade-off between short-term volatility and steady long-term rewards makes this stock worth a closer look, and in this article I’m going to give you that look.

Can Canadian Natural Outpace Its 12% Production Growth Target in 2026?

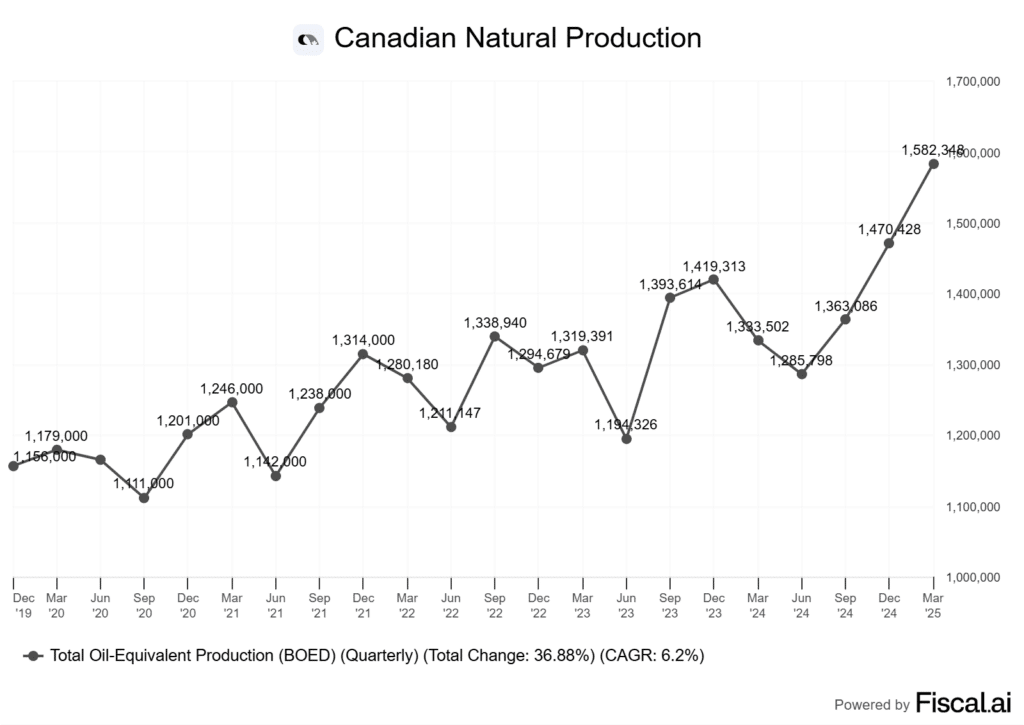

Canadian Natural Resources (CNRL) isn’t shy about its ambitions for 2025. In fact, it’s never really been shy about ambitions. The company aims to ramp up production by about 12%, targeting 1,510 to 1,555 MBOE per day.

That’s a significant jump for a firm that is already one of the largest energy producers on the planet. What’s driving this? CNRL plans to drill 361 net wells this year, an increase that stretches their previous pace.

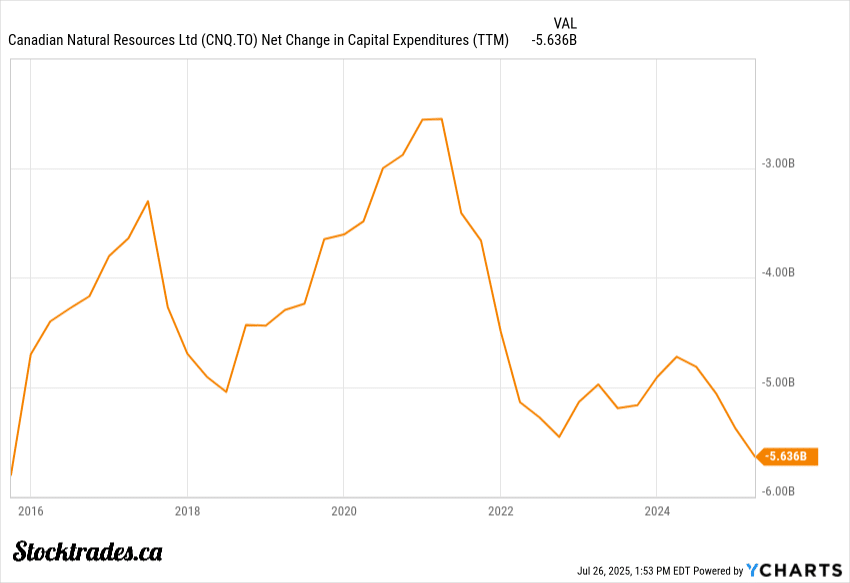

The capital budget rises from roughly C$5.42 billion in 2024 to C$6.15 billion for 2025. It’s a big bet, especially with allocations across heavy crude oil, light oil, and growth projects in the Duvernay and SAGD segments.

The company has always been aggressive at deploying cash, which is what makes it one of my favorite options in the sector.

Key drivers that should support this growth:

- Expansion in both heavy and light crude oil projects

- Increased activity in the Duvernay shale play

- Investment in SAGD (Steam Assisted Gravity Drainage) to lift oil sands output

Will they actually outpace that 12% growth benchmark? The operational plan looks solid, but there are a few question marks.

Supply chain delays and inflation on services could slow well completions. Oil and gas prices, always volatile, also set the pace for how much it makes sense to bring online.

The company’s track record of hitting production targets gives me some confidence. If market demand holds up and CNRL executes on schedule, beating the 12% mark isn’t out of reach.

Yet, as any investor who’s held energy names through a few cycles knows, execution risk is never zero. If you’re looking for upside, watch their quarterly drilling results and updates on well performance.

Fast progress there would be the clearest sign that CNRL could surprise to the upside.

Record Q1 Production and Cost Cuts: Is Efficiency the Real Catalyst?

Canadian Natural posted a record 1.58 million barrels of oil equivalent per day, with both liquids and natural gas output setting all-time highs.

That level of production isn’t just a one-time spike. It reflects years of steady asset optimization and smart investments that are now paying off for shareholders. It is evident in the chart above.

What really stands out though is the company’s cost discipline. Site C Original (SCO) operating costs came in at about US$15.25 per barrel, some of the lowest in the sector.

For context, many legacy oil sands producers struggle to get below US$20 per barrel. In my view, this kind of efficiency gives Canadian Natural more breathing room if crude prices continue to drop or input costs rise.

The numbers on capex and debt are just as impressive. Management delivered $100 million in capital spending savings this quarter and knocked down debt by another C$1.4 billion.

| Q1 2025 Highlights | Result |

|---|---|

| Production (boepd) | 1.58 million |

| SCO operating cost (US$/bbl) | $15.25 |

| Capex savings | $100 million |

| Debt reduction | C$1.4 billion |

I think these kinds of cost cuts are more than just quarterly “window dressing.” The company has a track record of scaling its cost structure to match market conditions and shifting its spending quickly when opportunities arise.

Still, the big question for me is how sustainable these margins are as new regulatory requirements and decarbonization costs creep higher across Canada. Not all of Canadian Natural’s assets are as low-cost as its flagship oil sands operations.

Investors counting on these record margins need to watch whether this efficiency trickles across the whole portfolio or concentrates in just a few core projects.

Chevron Asset Acquisition: Value Creator or Integration Risk?

When Canadian Natural Resources dropped $6.5 billion on Chevron’s Alberta assets, my first reaction was curiosity about whether this deal could truly move the needle for shareholders.

After all, shareholders were enjoying 100% returns of free cash flow up until this deal. Now? They’re relying on Canadian Natural creating value from an acquisition, which is less money in their own pockets, for now.

We’re talking about a 20% stake in the Athabasca Oil Sands Project and a 70% operated interest in the Duvernay shale, two of the biggest names in Canadian energy.

But deals like this come with risks. Integration doesn’t happen overnight.

Canadian Natural now faces the challenge of blending new operations and teams, not to mention squeezing out promised cost synergies. I’ve seen companies in the oil patch pay dearly when cultures clash or integration drags on.

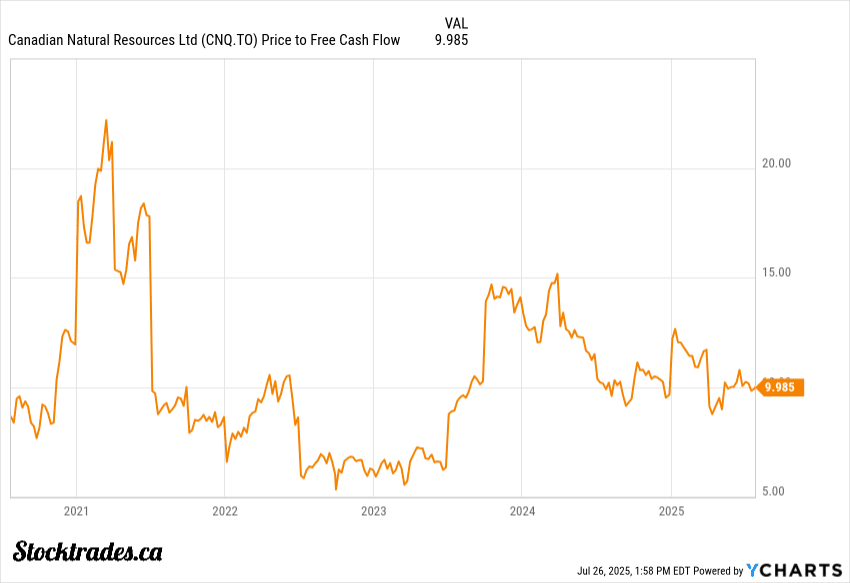

Looking at the numbers, the company’s price-to-earnings and price-to-cash flow ratios remain at reasonable levels even after the transaction.

This suggests the purchase is not dilutive and might actually add material per-share value.

In my view, the Chevron acquisition gives Canadian Natural enviable growth levers. But strong execution will be key. If management manages the handoff and finds the expected synergies, shareholders could see clear benefits, much higher than simply getting that free cash flow back as a dividend or buyback.

If not, the risk is wasted capital and operational headaches. If I were to place a wager, it would be on the fact that synergies go smoothly. However, the chances are certainly not 100%.

Is CNRL’s Dividend and Buyback Policy Sustainable?

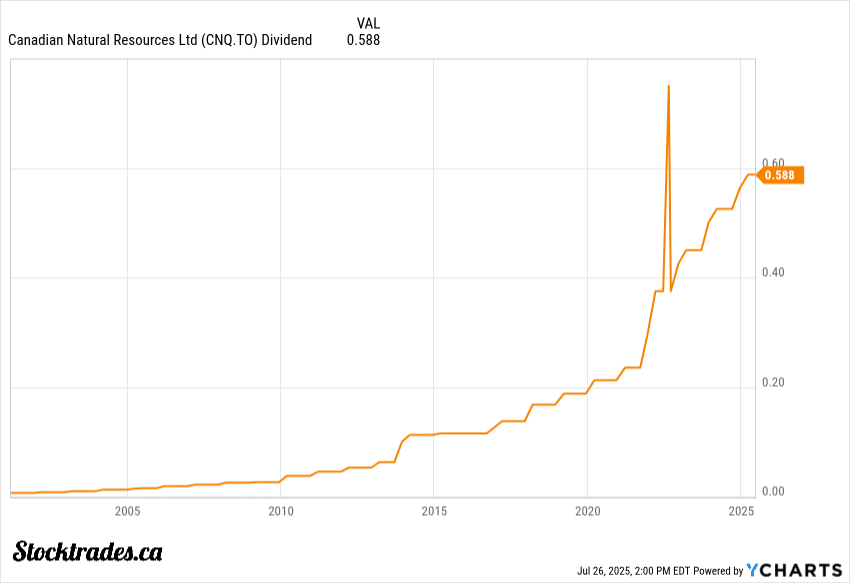

In Q1 2025 alone, the company returned $1.7 billion to shareholders, split between a $1.2 billion dividend and $500 million in buybacks.

That’s not a blip. 2025 marks their 25th straight year of raising the dividend, which now sits at $0.5875 per share every quarter, or $2.35 annualized. Remember, this was a company that raised the dividend in one of the worst commodity crashes we’ve ever witnessed in 2020.

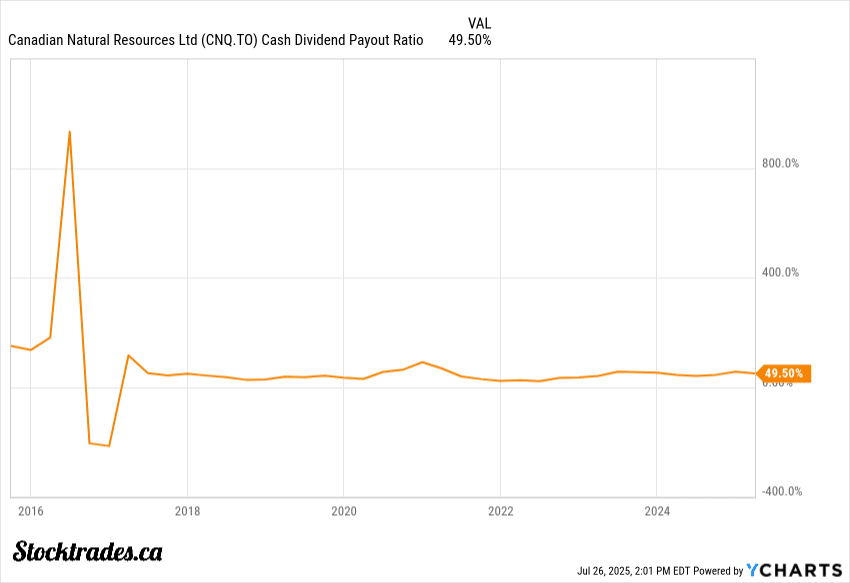

Last quarter, CNRL’s payout ratio was well below its free cash flow, which is exactly the breathing room I want to see.

CNRL’s guidance commits at least 60 percent of free cash flow to shareholders through a mix of dividends and buybacks. Management’s strategy hinges on solid, low-cost oil sands assets that keep generating cash, even when WTI prices cool.

If oil drops below $60, buybacks may slow, but the dividend looks protected thanks to manageable debt and capital discipline.

If the Chevron acquisition goes well, it is likely this company returns to a 100%~ FCF return policy for shareholders. All it has to to is get debt back to a comfortable range before it pulls the trigger on this.

Can CNRL Thrive as Canada Pushes Energy Expansion?

With Ottawa’s new drive to expand energy infrastructure, I see Canadian Natural Resources (CNRL) standing out as a top contender in the sector.

The political climate is favouring faster project approvals. Industry groups are pushing for six-month regulatory decisions and streamlined rules.

If these ambitions become reality, it’s tough to ignore what that could mean for a giant like CNRL.

Ottawa’s willingness to greenlight pipelines and LNG terminals more quickly would make it much easier for CNRL to get product to international buyers. Demand for Canadian LNG is climbing in Asia, which makes this especially interesting.

There’s policy risk, of course. The debate over federal emissions caps or carbon levies feels unpredictable.

CNRL is directly involved in big decarbonization projects, like the CCS Pathways Alliance. That makes me a bit more comfortable with their ability to adapt.

Overall, I think the company is a solid buy here for long-term investors who want exposure to the sector. Although many of the other major producers have done better than Canadian Natural over the last few years, if we look to previous history, this is a company that simply never fails to execute.

Because oil is one of the more volatile commodities that trades, we want a company that can manage efficiently in any environment. We just haven’t really got that from the other majors, which is why I still prefer Canadian Natural.