Has Manulife Stock Ran Out of Steam, or Is There More Room to Run?

Key takeaways

Manulife’s Asia growth and strong dividends back the long-term case.

The company’s US business is dragging, but not a large issue.

Stock’s recent rally might draw profit-takers, but core business looks solid.

3 stocks I like better than Manulife right now.When most investors chase flashy tech stocks, it’s easy to overlook quiet powerhouses like Manulife.

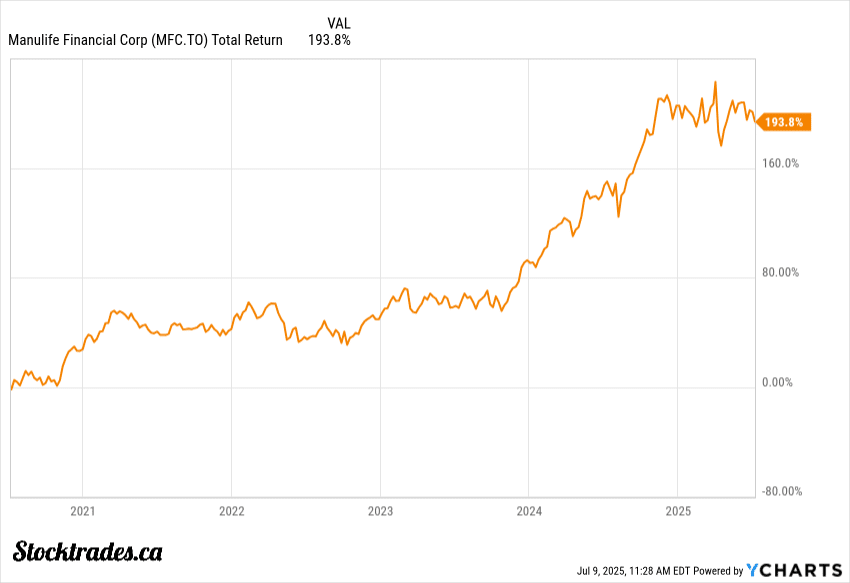

Despite its large runup in price over the last 5 years, Manulife looks fairly valued given its historic growth in Asia, rising dividend, and proven ability to deliver capital back to shareholders.

After a recent run toward its 52-week high, some investors are calling the stock “too expensive” or “out of steam.”

I’ll go over whether or not I think the company still has some runway left in this article.

Is Strength in Asia and Yield Power Still Enough?

Manulife’s surge is no accident, there’s real strength here, especially out of Asia, where insurance demand remains huge. Manulife’s ability to tap into markets like China and India stands out, and it’s a major reason earnings keep climbing.

Recent results show a big boost from Asia, not just in sales but actual profit, helping push Manulife’s share price to a level not seen in more than 15 years. This was a company that was firmly in the doghouse for many years, primarily due to a dividend cut. However, it’s broken out of that now, zero question.

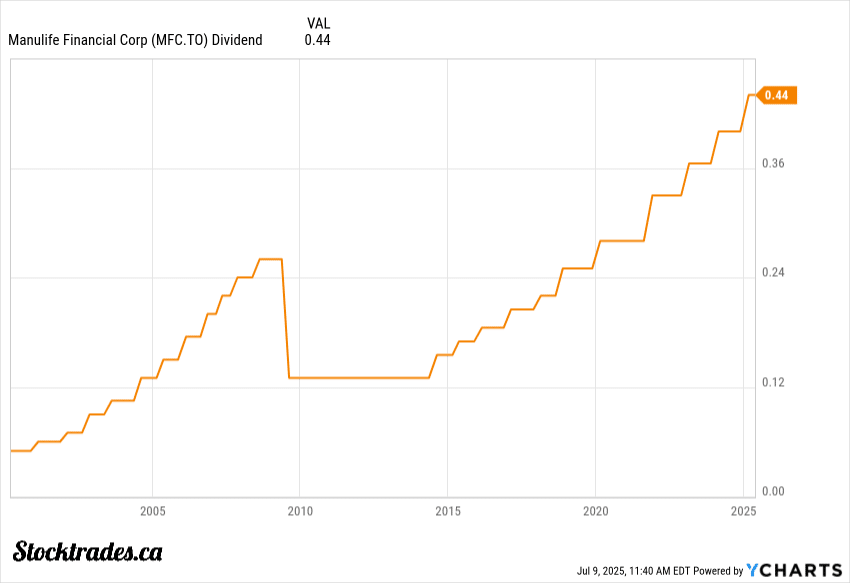

On the income front, the company raised its dividend again and yields just over 4%. Canadian’s love their dividends, and when you can combine that with the surge in overall price appreciation Manulife has witnessed over the last few years, I’m not surprised I have a lot of readers asking about it.

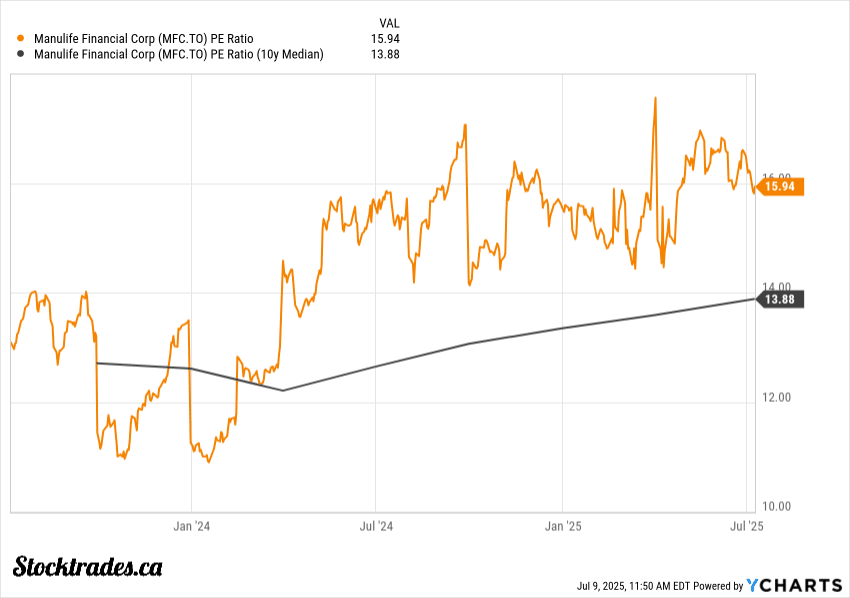

The only difficulty here is valuation. At around 17x earnings, Manulife isn’t exactly a bargain anymore compared to some peers. But the growth engine in Asia may justify the premium. That said, any stumble abroad or shift in rates from the Bank of Canada could test this runup fairly fast.

If I were to look to buy or add to a position, I’m watching those expansion plans closely. For now, Manulife’s formula, steady Asian growth, growing asset management, and consistent returns of capital back to shareholders still looks effective.

Is Manulife’s Capital Policy Still Investor-Friendly?

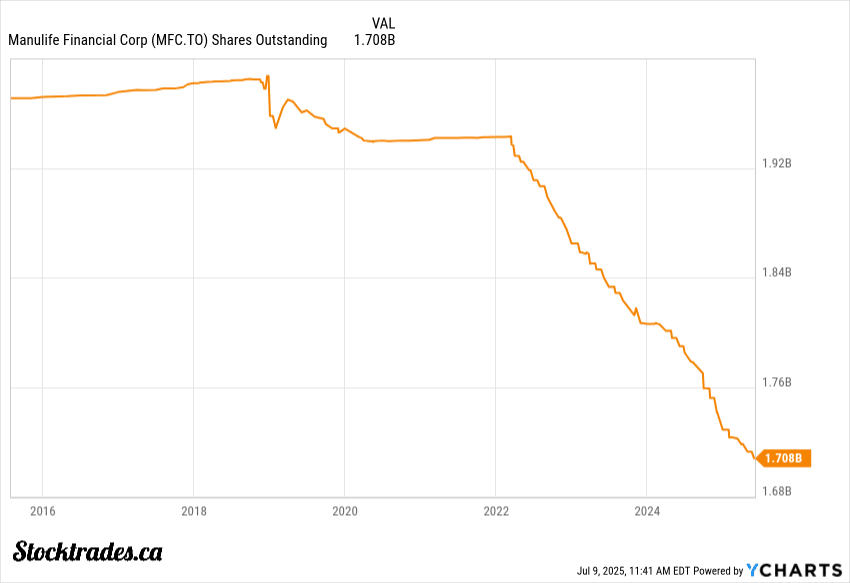

Sustained dividend bumps feel meaningful, along with share buybacks. However, they have to be done prudently and when affordable. Buybacks during high periods of high share prices can be a relatively ineffective way to get capital back to shareholders.

In regards to the dividend, it isn’t just consistent, it’s reliably climbing and well supported by growing cash flows. It seems like the market has finally forgiven Manulife for its financial crisis dividend cut. You can see where they ended up cutting it in the chart below.

Buybacks are the second leg of the stool. The company’s buybacks made in 2021/2022 are proving to be very profitable. However, at today’s valuations, I’m not sure excess capital used on buybacks is a good thing. However, the company is still aggressively buying back shares.

I see Manulife’s blend of rising dividends and a swap to opportunistic buybacks as a positive for reasonable returns. The company’s balance sheet remains strong, thanks to a large recovery in operations over the last couple of years.

If I’m thinking about parking my cash somewhere safe for income and growth, Manulife’s still hits that bar. It isn’t necessarily the stock for me, but I can see why it is loved so much.

Dividend growth plus buybacks, without stretching the balance sheet, remains a rare combination in the Canadian market.

New Business Growth in Asia, But U.S. Insurance Drags

When I look at Manulife, Asia jumps off the page. New business in Asia grew 36% in Q1, while APE sales spiked 37%. These aren’t just modest increases. They’re the kind of results that highlight how important the segment is to Manulife.

To put it simply, the company’s Asian operations are firing on all cylinders. Growth was strongest in countries like Japan and Hong Kong. In this region, insurance products are seeing both high demand and attractive margins, which is not something you see every day in the insurance space.

But there’s no ignoring the other side of the coin. U.S. insurance dragged down profits this quarter thanks to unexpected wildfire-related claims. This catastrophe losses are becoming more and more normal in North America, even globally, and it is just something we have to learn to expect with insurers.

| Region | New Business Value % | Notable Factors |

|---|---|---|

| Asia | +36% | Strong sales, high margins |

| U.S. | Drag on results | Wildfire claims, profit impact |

| Canada | Stable | Steady, little drama |

The divergence between Asia’s momentum and U.S. setbacks is something I’d keep an eye on, but nothing I’d be overly concerned with.

Asia’s contribution is compelling. If Manulife keeps capitalizing on these Asian trends, it could reshape the company’s entire earnings profile. But it also needs to prove it can manage the risks coming from its American book.

Is Manulife Still a Buy Today, or Is The Run Over

At this point in time I view Manulife as fairly valued. As you can tell by the chart below, the company is trading well above its historical price to earnings multiples.

One would probably come to the conclusion the stock is expensive after seeing this chart. After all, it is trading well above what it normally has over the last 10 years. However, I think it’s important to understand that Manulife’s accelerated growth in its Asia segment and just overall results likely have the market rewarding it with a higher multiple.

This is a company that struggled to gain ground for many years, and as I had mentioned the market firmly placed this one in the dog house since its 2008 dividend cut. However, right now we’re seeing multiple expansion and I do believe its justified.

You’re not getting the deal you once were, but I wouldn’t be overly concerned with that. It’s still a great company at a reasonable price. I prefer the P&C market in terms of insurers, but I wouldn’t object to anyone buying Manulife.