Is All the Growth Priced Into Microsoft Stock, or Is It Still a Buy?

Key takeaways

AI demand supports growth but must prove margin durability

Cloud revenue momentum is intact, yet costs pressure profitability

Strategic bets like gaming test focus while valuation stays premium

3 stocks I like better MicrosoftMicrosoft (MSFT) looks fairly valued right now, but that’s considering large scale forward growth. The big question is whether AI-driven cloud demand can actually turn into lasting margin strength and earnings growth.

The stock pulled back after guidance let people down, even though revenue growth in Intelligent Cloud stayed strong. That tells me the market isn’t just rewarding top-line growth anymore, profitability and capital efficiency matter more now.

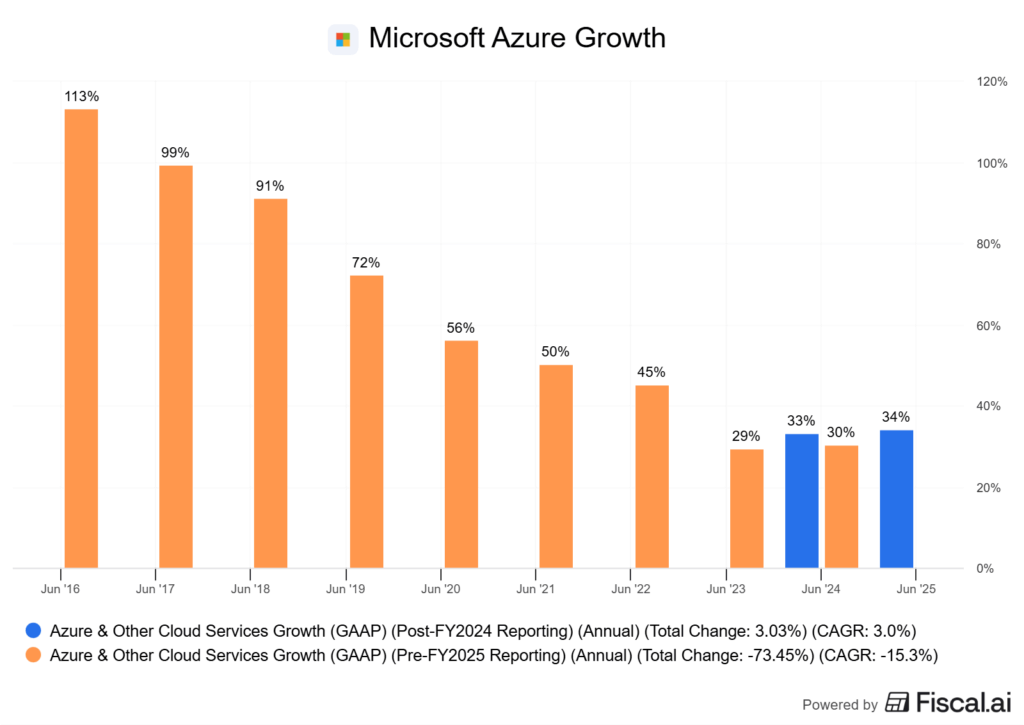

Azure remains the company’s cash engine. AI services helped lift growth but also drove capital spending higher.

Last quarter, commercial bookings jumped 67% year over year, so demand is solid. Still, operating margins faced pressure as infrastructure costs climbed.

That’s the trade-off: scale looks impressive, but it only creates value if Microsoft can balance capacity build-out with earnings leverage.

Microsoft’s AI Integration Is Powerful But Is It Fully Priced In?

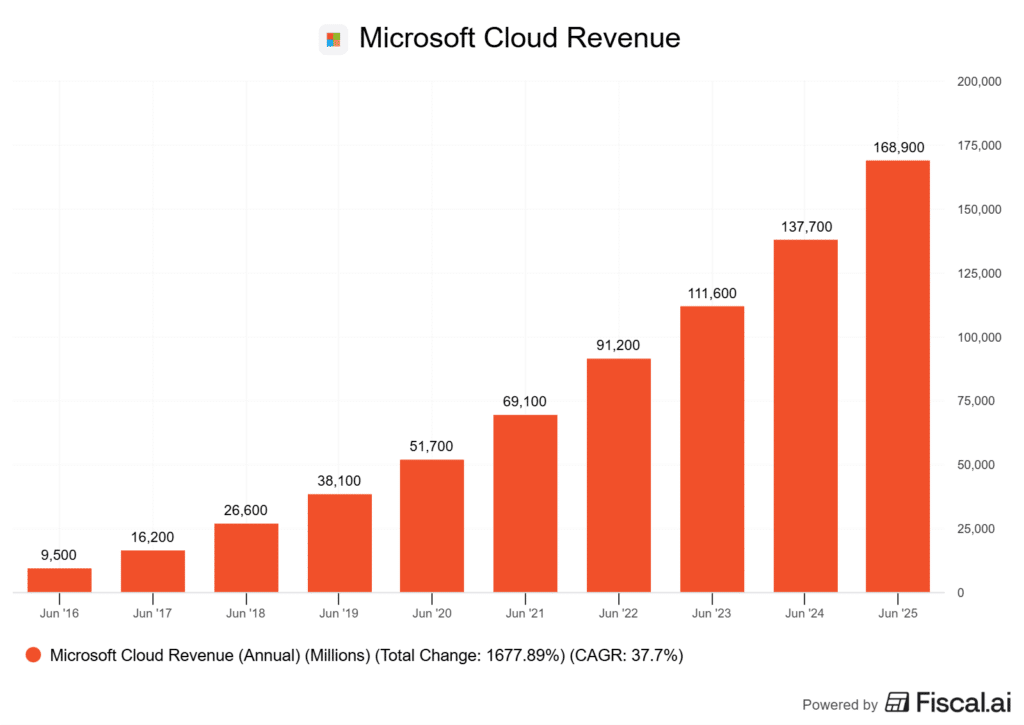

Azure just cleared $75 billion in annual revenue, up 34% year over year. Although it is slowing, it is still growing at an exceptional pace, showing how central Azure AI services have become for enterprise clients.

But growth at this scale makes me wonder: how much of that strength is already baked into Microsoft’s premium valuation? I don’t believe in a perfectly efficient market. But it’s generally pretty good at pricing this stuff in.

The Copilot integration across Microsoft 365 and GitHub is sticky. It keeps users inside the ecosystem and nudges subscription revenue higher.

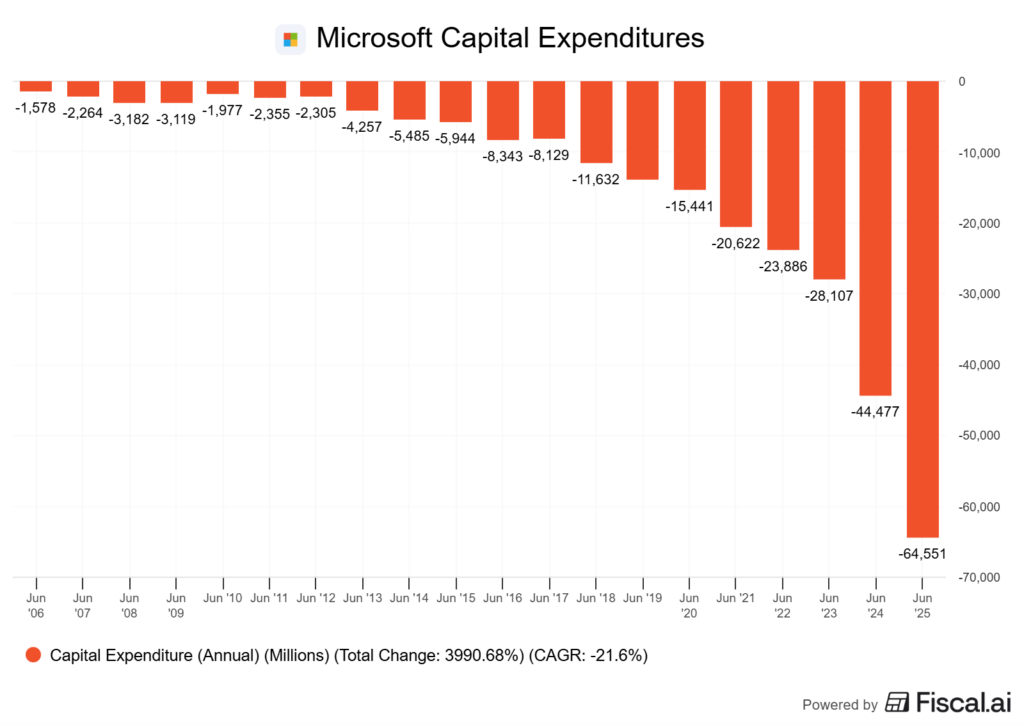

That’s a smart move, but it also comes with heavy infrastructure costs. AI models aren’t cheap to run, and scaling them across millions of users puts pressure on margins. Look to the chart below. Microsoft’s capital expenditures are monumental.

Microsoft trades at a premium multiple compared with peers. Investors are paying up for the belief that AI will deliver outsized returns, in addition to the moaty business they already have.

The risk is that adoption may be slower than expected, or that the cost of AI infrastructure and scalability eats into the very margins investors are counting on.

I look at the balance sheet and see a company returning billions in dividends and buybacks, while still investing heavily in capacity. That’s a healthy mix, but it also signals management knows the investment vs. return equation on AI isn’t settled yet. If they did, they’d be investing everything into it.

The upside is clear. So is the risk.

For context, Oppenheimer recently argued Microsoft’s AI upside is not fully priced in and upgraded the stock to Outperform with a $600 target, highlighting underappreciated growth in Azure and AI workloads. That’s one view. Personally, I’m not sure the market is ignoring those risks.

Cloud Growth Stabilizes, But Margins Remain Under Watch

Microsoft’s cloud business keeps pulling weight, but the spotlight has shifted from growth to profitability. In the latest quarter, Intelligent Cloud revenue hit about USD 29.9 billion, up 26% year over year.

Azure itself grew 34%, which is strong by any standard, but the pace isn’t accelerating anymore.

That kind of growth is encouraging. Still, gross margin for Microsoft Cloud slipped to roughly 68–69%, down a few points from last year.

When a segment this large drops even a couple of points, the impact on operating income is meaningful.

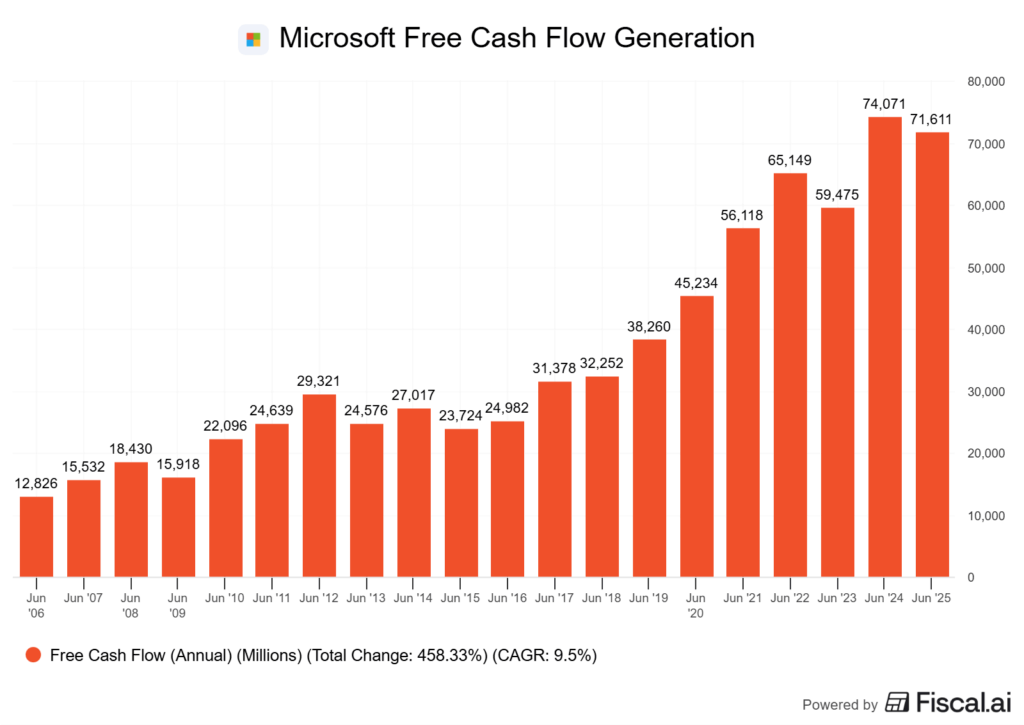

Capital spending is the swing factor here. Microsoft poured billions into new data centres and AI infrastructure, which pressures free cash flow in the short term.

Management says efficiency gains will offset the hit, but honestly, the numbers haven’t shown that yet.

Azure’s top-line growth is still a positive, but if margins keep sliding, the model looks less scalable.

AI workloads are sticky and enterprise demand is strong. The risk? It doesn’t scale cleanly if every dollar of revenue requires heavier infrastructure spend.

What matters next is whether new capacity drives better unit economics. If efficiency gains kick in, margins could stabilize, and this company will print more money than it already does.

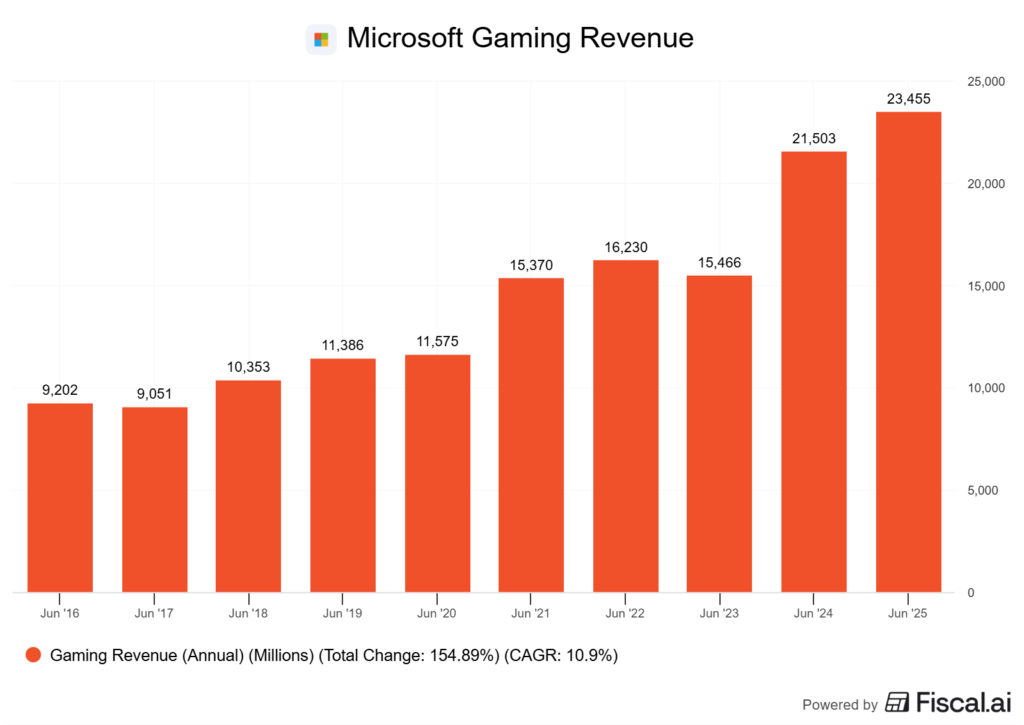

Gaming and Activision Deal: Long-Term Strategy or Distraction?

Microsoft’s gaming arm has grown into a meaningful line item, primarily due to the acquisition of Activision a few years ago. Xbox content and services rose 13% year over year, driven by new releases and higher engagement.

These are some solid numbers, but it sits next to Azure, which still drives the bulk of operating profit. Is gaming a core growth engine or just a side bet?

Game Pass now brings in close to USD 5 billion annually. For a subscription model, that’s scale.

The catch is margin: content costs and licensing fees weigh heavily, and hardware like the Xbox Series S is sold at thin spreads. It works for now, but only if subscriber growth offsets rising costs.

Gaming is still a small share of total company revenue, but it provides optionality. It diversifies cash flow beyond cloud and productivity software.

If margins hold and engagement stays high, it adds long-term value. If not, it risks becoming a distraction from the higher-return cloud and AI businesses.

Next quarter, I’ll watch Game Pass growth closely. If revenue keeps climbing without sharper cost pressure, gaming strengthens its case as a durable contributor rather than a costly side project.

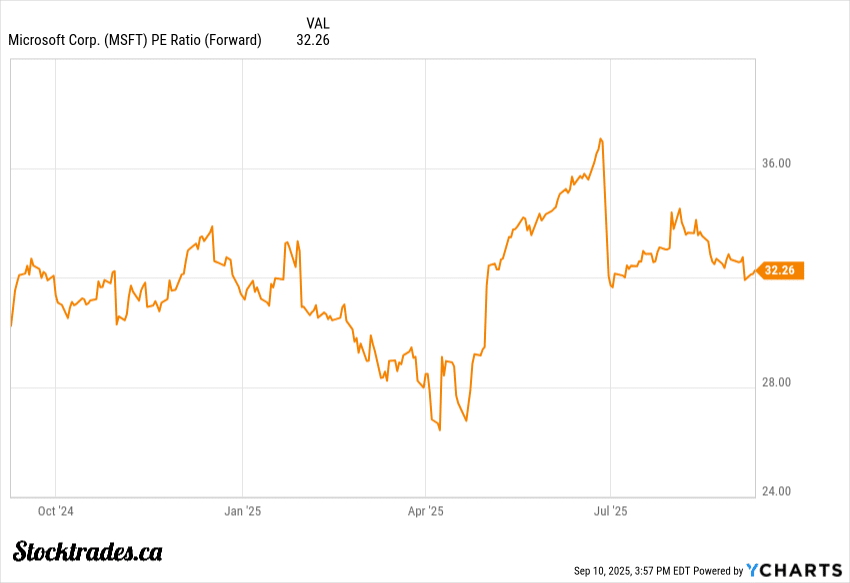

Valuation: Premium Multiple, Justified or Stretched?

Microsoft’s valuation isn’t cheap by any stretch. At around 31x forward earnings, it sits well above peers like Alphabet, which trades at 22x.

That gap shows investors want consistency and scale. It also means the company has to deliver. There’s not much room for error here.

The numbers still look solid. Revenue for FY25 is projected at about USD $281.7B, up 15% year over year. EPS growth is tracking at 16%. Operating leverage seems alive and well.

Free cash flow stays strong. The company returned USD $9.4B to shareholders this quarter through dividends and buybacks.

But here’s the thing. With a USD $4T market cap, Microsoft now faces expectations that almost no one else does.

Cloud and AI strength help justify some premium. Still, the higher the multiple, the less room there is for any stumble in margins or enterprise demand.

Compared to peers, the premium looks a bit stretched. Oracle and SAP grow slower, but their multiples are far lower. And now that Oracle reported a 300%~ increase to their backlog, it makes it even more interesting.

Even Apple, which has that same mega-cap vibe, trades at a modestly lower valuation. Yes, it’s growing slower, but it also doesn’t have as much execution risk due to capital expenditure rollouts. Microsoft’s being treated as both a growth stock and a defensive anchor. That’s a tricky position to keep up.

The upside is obvious: recurring revenue, sticky enterprise contracts, and AI baked into Azure and Microsoft 365. The risk? If EPS growth falls short of mid-teens or the capital expenditures laid out in regards to AI don’t start to show meaningful results in the next few years, the multiple will probably compress.