Was National Bank’s Soft Quarter a Warning Sign, or a Buying Opportunity?

Key takeaways

Earnings strength depends on stable margins and disciplined cost control

Expansion outside Quebec adds growth but raises integration risk

Dividend reliability remains, but credit quality is the key watch-item

3 stocks I like better than National BankNational Bank of Canada looks fairly valued right now, especially after a softer quarter. The main thing a lot of investors are focusing on right now with the Canadian banks is credit quality. However, National has the added element of Canadian Western integration.

The stock’s already had a sharp run this year, so I’m not all that surprised to see it give some back on a weaker quarter. However, it wasn’t that weak.

I think the real swing factor is whether provisions hold up as funding costs rise and households face higher mortgage renewals.

This bank makes money the old-fashioned way: lending, deposits, and fee-based services. Its strength is a concentrated franchise in Quebec, now broadened by the CWB acquisition, which certainly adds diversification but also integration risk.

Strong capital levels and steady dividend growth is something National Bank has shown for years. The balance between rewarding shareholders and investing in future growth will matter more than ever now.

Let’s dig into whether or not this bank is still an opportunity in 2025.

Earnings Were Still Strong, But Market Growth Outside Quebec Is Key

National Bank’s latest quarter showed strength, but was also the softest out of the Big 6. Adjusted earnings per share increased, and return on equity stayed in the mid-teens, which shows efficient use of capital, especially compared to larger peers.

Growing earnings at this point gives the bank breathing room even in a slower economy. However, the bulk of the growth is coming through lower than expected provisions.

In the most recent quarter, provisions for credit losses climbed, which was in contrast to many of the other institutions which continued to post lower numbers. However, the bank’s capital position means it can absorb those bumps without putting its balance sheet at risk.

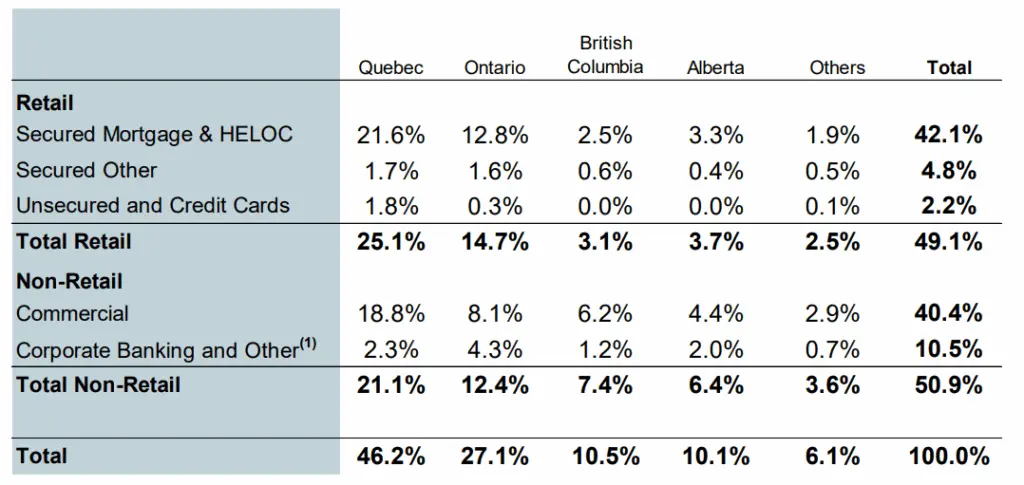

The core driver remains lending and fee income in Quebec, as you can see below.

National Bank holds a dominant market share in the province, and that concentration has been a consistent earnings engine. If you look to the other institutions, Ontario will be the main driver of revenue. This is where National Bank differs.

The challenge? Growth outside Quebec is still limited, and the rest of Canada offers tougher competition from the other Big Five. The bank is trying to diversify not only through the acquisition of Canadian Western but in the US as well.

Its U.S. Specialty Finance & International (USSF&I) segment has been expanding, though it remains a smaller piece of the overall picture. If that business scales, it could provide a counterweight to the Quebec-heavy profile, but it will certainly take time to grow.

Right now, the contribution is not large enough to move the needle on earnings. What matters next is whether revenue growth outside Quebec can keep pace with the strong base at home.

Without that, even solid ROE and a high CET1 ratio may not translate into sustained momentum across the broader Canadian market.

This company has an outstanding management team and I do have confidence they’ll be able to grow, but concentration risk certainly looms, especially with a weaker Canadian economy and particularly the Quebec economy being exposed to so many tariff issues.

Loan Growth Solid, Yet Exposure to Household Debt and Real Estate Remains a Watch‑Item

National Bank has kept loan growth steady, with mortgages and personal lending still driving much of the book. The integration of Canadian Western Bank has also added scale in commercial lending, giving the bank more regional balance.

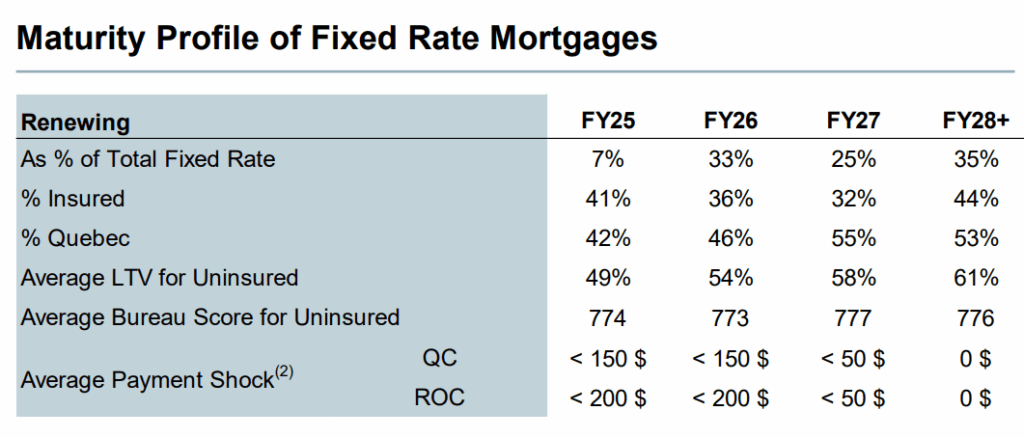

That’s encouraging, but the mix of growth matters as much as the pace. Mortgage exposure is the key swing factor.

Roughly two million Canadian mortgages are set to renew in 2025 and 2026 at higher rates, which will test household budgets, ones that are already very tight. The household debt-to-income ratio remains elevated, even if it has eased slightly in recent quarters. Debt service costs are climbing faster than incomes.

On the commercial side, office vacancies remain high in several major cities, and valuations in some segments haven’t fully reset. If interest rates stay at current levels, refinancing could become a challenge for weaker borrowers.

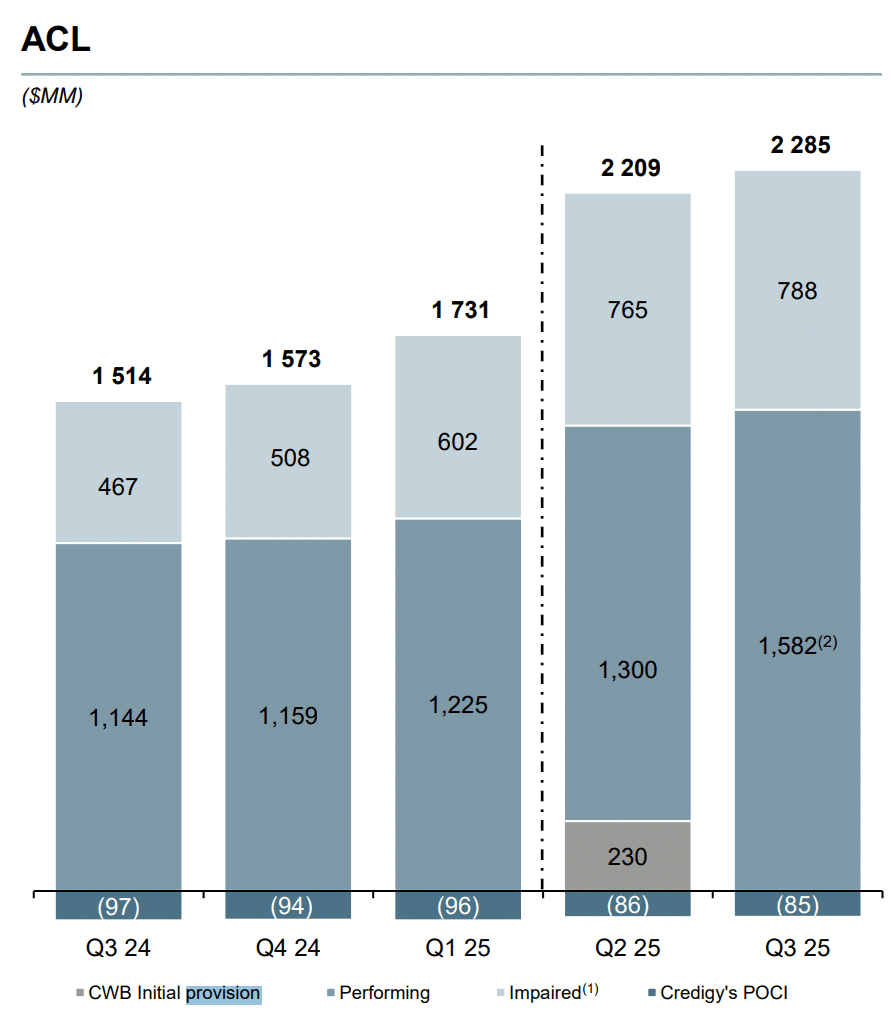

Provisions for credit losses and allowances have already moved higher, much like the other institutions. However, National’s are rising at a bit higher pace, likely due to its concentrated exposure.

This is sensible given the backdrop, but it also signals that credit costs could keep rising if unemployment ticks up. After the recent string of borderline ugly job reports, this is certainly something to keep in mind.

The upside is that National Bank’s capital ratio remains strong, giving it plenty of room to absorb stress.

The housing market itself is also a variable. Prices have held up better than expected, but affordability remains stretched. If values slip while mortgages reset, defaults will no doubt rise.

That would directly test the resilience of the loan book and the bank’s ability to manage through a softer cycle. For me, the watch‑items are clear: household debt service ratios, mortgage renewal performance, and commercial real estate refinancing trends.

Those three will tell us whether current loan growth is sustainable or masking future credit strain.

Acquisition Momentum via CWB Acquisition: Integration or Distraction?

National Bank closed its Canadian Western Bank acquisition earlier this year. At C$5.6 billion, it’s the largest deal in its history.

The move instantly expanded its footprint in Western Canada, a region where its presence was previously limited. The deal is already showing very positive numbers.

In Q3 2025, CWB added about C$284 million in revenue and lifted loans and deposits by 22% and 23%.

But integration costs cut adjusted net income by C$73 million in the same quarter. The swing factor is whether those synergies outweigh the drag. I believe they will, but we aren’t fully guaranteed this yet.

Management has flagged C$270 million in annualized synergy potential. So far, C$69 million has been realized, about 64% of the three‑year target. This is well ahead of schedule. The upside is clear: lower cost per dollar of revenue and a broader client base in commercial banking.

The downside? If expenses keep climbing faster than expected, the margin lift could vanish. Canadian Western wasn’t exactly the best run back prior to the acquisition. National needs to add its touch to realize outsized synergies.

CWB brings strong ties to agriculture, energy, and small‑business lending. That diversifies National Bank’s book away from its traditional Quebec dominance. It works for now, but only if client migration and system integration stay on track through 2026.

Integration risk doesn’t always scale cleanly. If wealth and commercial clients face friction in the transition, revenue could slip before synergies kick in. I don’t think this will happen, and the bank has shown no indications this is happening, but it is a possibility no doubt.

For me, the key metric to watch is the pace of expense normalisation. If costs stay elevated for more than a year or so, the deal starts to look more like distraction than momentum.

Margins Face Pressure from Funding Costs and Regulatory Overhang

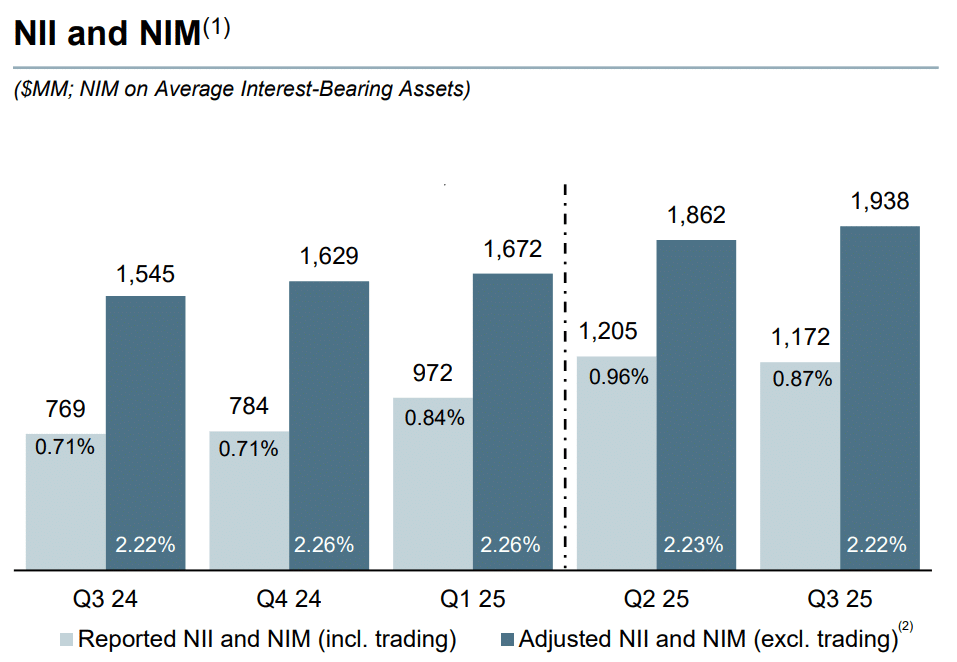

National Bank’s profitability picture right now comes down to one thing: margins. Net interest margin (NIM) is the core driver, and like peers, it’s been squeezed by higher deposit costs and tighter funding conditions.

The Bank of Canada’s recent rate cuts may ease deposit pricing, but analysts warn the benefit won’t flow through quickly. The way this business makes money is straightforward.

It borrows at one rate (deposits, wholesale funding) and lends at a higher one. The spread is the NIM. When depositors demand higher yields or when wholesale markets tighten, the spread narrows. That’s exactly what’s been happening.

Numbers tell the story. Across the sector, NIMs have slipped by around 10 basis points year over year, according to industry surveys.

That looks small, but on billions of dollars in assets, it hits earnings. Rising personnel and technology costs only add to the squeeze, nudging the efficiency ratio higher.

There’s also the regulatory side. OSFI has leaned harder on capital and stability buffers, forcing banks to hold more high-quality capital.

It’s prudent for resilience, but it drags on return on equity. For a bank like National, which competes on scale against bigger peers, that can be a tougher hurdle.

If deposit costs keep climbing while regulatory buffers stay elevated, margins could stay under pressure.

Overall, National Is a Strong Option, and One Soft Quarter Doesn’t Change the Thesis

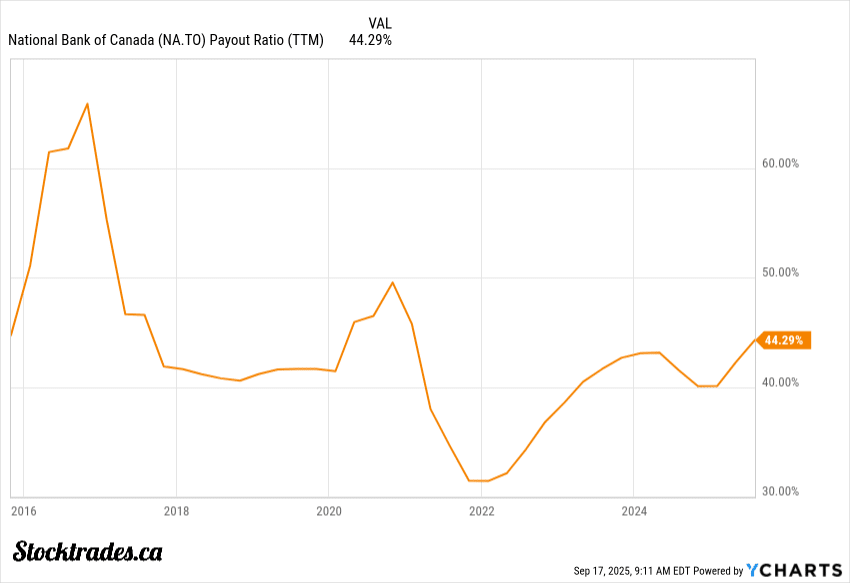

National Bank has leaned heavily on a steady dividend track record, with a payout ratio usually in the 40–50% range. That sits comfortably within the Canadian bank norm, and lets face it, Canadian investors demand strong dividends from these banks.

The dividend yield hovers in the mid‑single digits. That’s pretty appealing if you’re focused on income.

The bank also runs a modest share repurchase program, but with the acquisition of Canadian Western, share counts have ticked up over the last half decade.

I tend to see buybacks as a release valve when capital levels look strong, not really a structural driver of shareholder returns. There is no question these banks prefer dividends over buybacks.

National Bank isn’t the cheapest bank on the market today, nor is it without risk. Credit quality, mortgage renewals, and integration of Canadian Western all present real challenges, especially in a slower Canadian economy with heavy household debt.

But this is a bank with deep roots in Quebec, an expanding presence across Canada, and a proven track record of managing through cycles with discipline.

For long-term investors willing to accept some bumps along the way, the current pullback looks more like an opportunity than a warning sign. National Bank may not lead every quarter, but its ability to reward shareholders while broadening its franchise suggests the growth story is far from over.