Population Trends Benefit This Top Canadian Stock Extensively

Key takeaways

Balanced growth and margin discipline support long-term stability

Expansion and acquisitions drive potential but add execution risk

Shares suit income-oriented investors seeking measured upside

3 stocks I like better than SavariaIf you have been reading Stocktrades for a while, you know I often say that “boring is beautiful.”

In a market obsessed with the next AI darling or tech rocket, it gets exhausting constantly chasing volatility. We all feel that pressure to find the “next big thing,” but the reality is that sustainable wealth is often built on the back of companies that simply do boring things very well.

The problem? It is hard to find a boring company that still offers decent growth.

That brings me to Savaria. This is a company that makes stairlifts, home elevators, and medical beds. It is about as far from a tech high-flyer as you can get. But for Canadian DIY investors looking for a defensive play with a reliable dividend, this might be exactly what the doctor ordered.

Let’s dig into the numbers and see if Savaria deserves a spot in your portfolio.

Margins Trumping Growth

Savaria’s recent 2025 results tell an amazing story of a company that is optimizing its engine rather than simply stepping on the gas.

The headline numbers show revenue climbing in the mid single digits. That is not going to turn heads on Bay Street. In fact, organic growth actually hit a snag, at some points declining through the year.

Simply put, the market for accessibility products is mature. We are seeing some headwinds in terms of pure volume growth. But here is where it gets interesting. While sales were flat, profitability improved substantially.

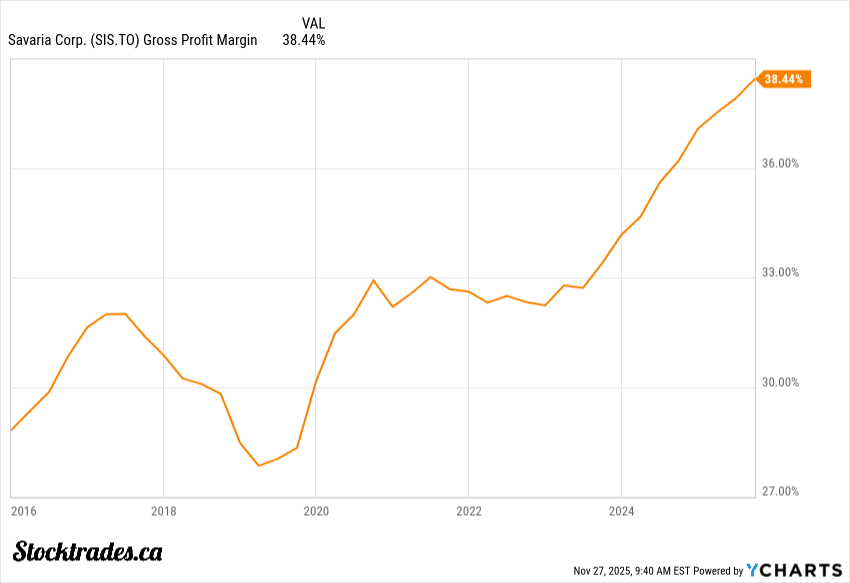

The company’s “Savaria One” initiative, a program designed to streamline operations and boost efficiency, is clearly bearing fruit. Gross margins hit a record 39 percent.

This is a classic case of a company focusing on what it can control. They cannot force people to buy more elevators, but they can control how efficiently they build them.

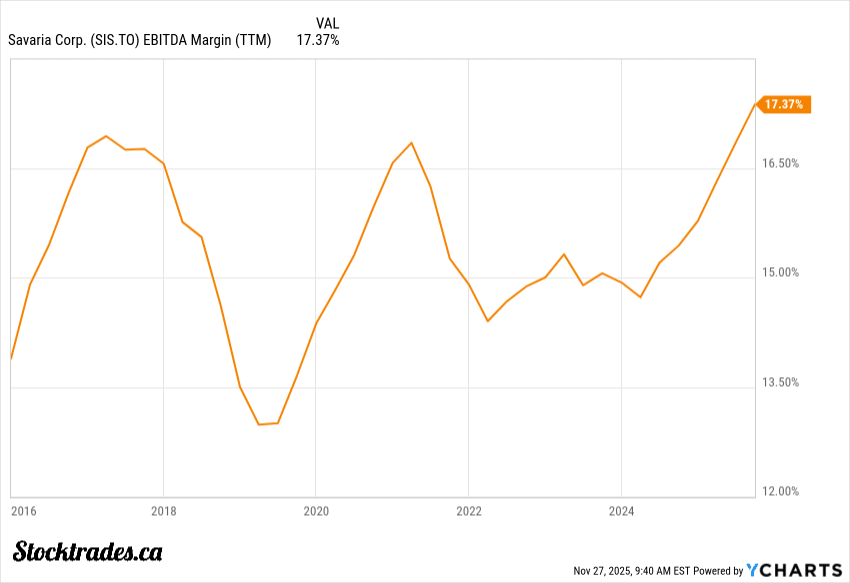

Adjusted EBITDA margins climbed to 20.6 percent, and net debt dropped. In my opinion, this shows a management team that is disciplined and respectful of shareholder capital. Of note, the chart below is GAAP EBITDA margins.

The efficiency is nice, but the risk to consider here is obvious.

You can only cut costs and improve efficiency for so long. Eventually, you need top-line growth to move the needle. If organic growth stays negative, those margin gains will eventually plateau.

A Tale of Two Segments

When we look under the hood, Savaria is really two different businesses operating under one roof.

First, you have the Accessibility segment. This is the bread and butter, accounting for about 78 percent of revenue. We are talking about stairlifts and home elevators.

This segment is growing, but slowly. It is driven by the “aging in place” trend, which provides a long-term demographic tailwind. However, it is also tied to the housing market and renovation cycles. If people stop renovating, they stop installing elevators.

Then you have the Patient Care segment. This includes medical beds and slings used in hospitals and long-term care facilities.

This segment is one of the faster growing ones in 2025, around mid single-digits. It offers a nice layer of diversification.

The snag with Patient Care is that it relies heavily on institutional budgets and government funding cycles. It is less consumer-driven and more bureaucratic.

I like the balance this provides. When the consumer wallet tightens, the institutional side can pick up the slack. But let’s be realistic. Neither of these segments is likely to see explosive growth. We are looking for singles and doubles here, not home runs.

This isn’t a bad thing. But it’s important to set expectations.

The Acquisition Strategy: Opportunity and Risk

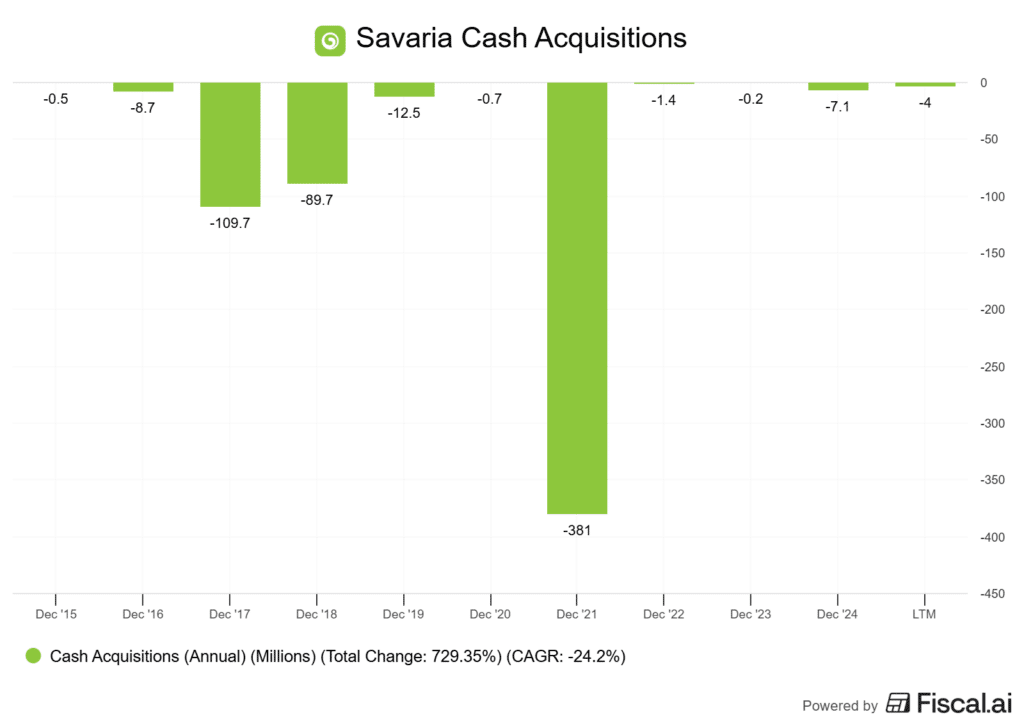

Savaria has long been an acquirer. If you look to the chart below, you’ll see sporadic jumps in acquisition activity. Of note, the large scale one in 2021 was Handicare, an acquisition that doubled the company’s size.

The recent purchase of Western Elevator is just the latest example of this strategy.

Acquisitions are a double-edged sword. On one hand, they allow Savaria to buy growth when the organic market is slow. They add strategic depth and expand the company’s geographic footprint.

On the other hand, integration is difficult. We have seen a ton of Canadian companies stumble because they bit off more than they could chew.

Historically, Savaria has done a decent job of integrating its buys. The Handicare acquisition a few years ago was a massive undertaking, and they seem to have digested it well.

However, execution risk is always present. As they expand further into Europe and other global markets, the operational complexity increases.

I believe the current leverage ratio of 1.34x Net Debt to EBITDA is healthy. It gives them dry powder to make more deals if the opportunity arises.

But I would be wary if they started chasing large, transformational deals that could strain the balance sheet. Handicare worked out. But if it hadn’t, it would have been a disaster, and that’s an understatement.

Priced for Execution

So, is the stock a buy at these levels?

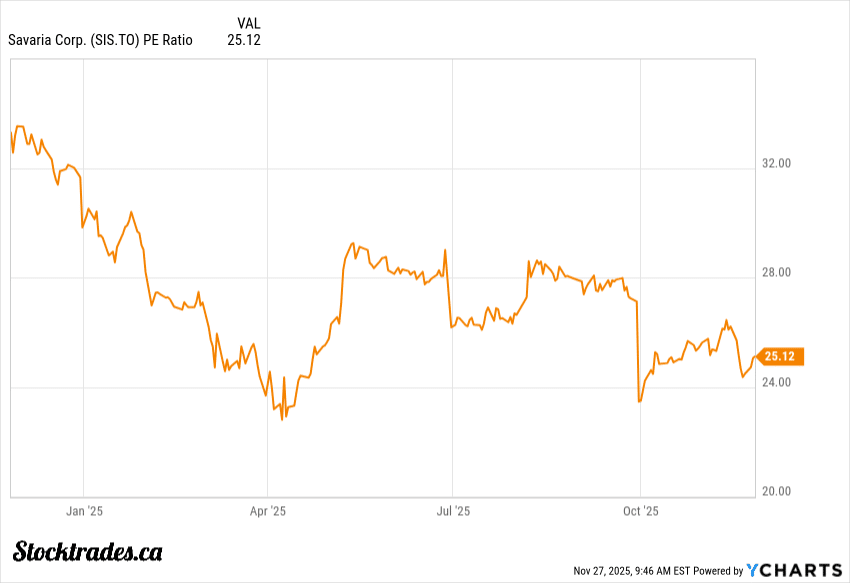

Trading around 25x expected earnings, Savaria is not exactly a bargain, but it is not expensive either.

It trades at a forward P/E in the mid-teens, which is fairly standard for a stable industrial compounder.

The market seems to have priced in the operational improvements from the Savaria One program. Investors expect the company to maintain these higher margins.

If they slip, if inflation rears its ugly head again or if supply chains snarl, the stock could take a hit, much like it did in past years.

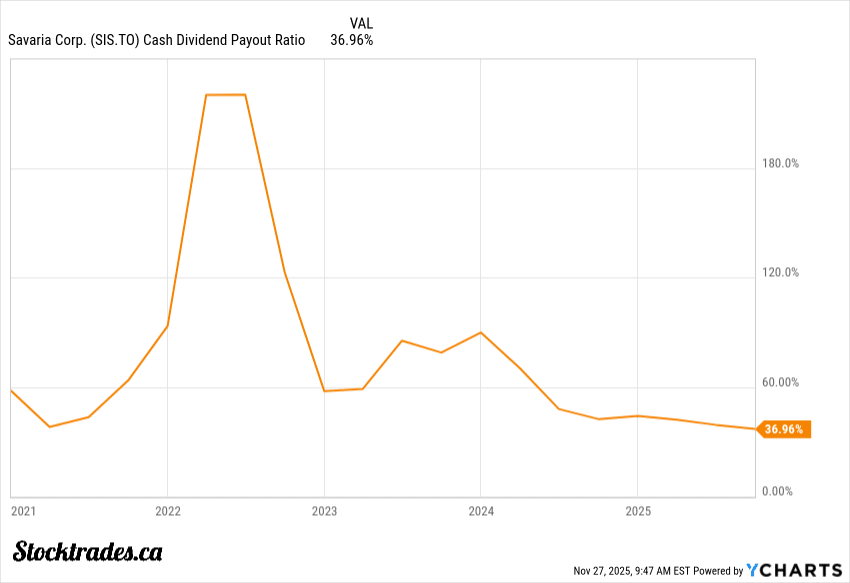

However, for an income-focused investor, the dividend is attractive. Savaria has a strong history of dividend growth, and with the payout ratio looking sustainable, I view it as a reliable income stream.

Just remember to focus on total return. Don’t just chase the yield. You want a dividend that grows over time, protecting your purchasing power against inflation.

My Final Thoughts

The bottom line is that Savaria is a solid, defensive hold in my opinion.

It is not going to make you rich overnight. It likely won’t be the best performer in your portfolio during a bull market.

But if you are looking for stability, a growing dividend, and a business that provides essential products to a demographic that is only getting larger, Savaria checks a lot of boxes.

I would rate it a moderate buy for the long-term, income-oriented investor.