Is This Blue-Chip Dividend Payer a Slam-Dunk Buy on a Correction?

Key takeaways

Strong underwriting and diversification support consistent earnings.

Solid capital and dividends sustain long-term resilience.

Valuation already prices in much of the near-term upside.

3 stocks I like better than Intact FinancialIn a market obsessed with the next AI breakout or uranium lottery ticket, insurance is boring. It’s dense, it’s regulated, and it’s about as exciting as watching paint dry.

The problem? Most “exciting” stocks in Canadian portfolios end up being wealth destroyers. You chase the hype, you get burned, and you’re left wondering why you didn’t just stick to the basics.

Enter Intact Financial.

I believe Intact is the antidote to portfolio volatility. It’s not flashy, and it certainly isn’t cheap, but it executes with a level of discipline that few companies on the TSX can match.

My goal today is to break down whether this boring insurance giant still deserves a spot in your long-term portfolio, or if its premium price tag has finally caught up with it.

Execution Over Excitement

Intact trades with the consistency of a mature company, but it also has the returns of a high growth company. The company’s advantage isn’t really a secret, it’s just superior risk modelling and execution.

In the most recent quarter, Intact posted a combined ratio of roughly 86%.

Why does this number matter? Simply put, the combined ratio measures profitability in insurance. A ratio of 86% means that for every dollar of premium Intact collected, they kept roughly 14 cents as profit before investment income.

In an industry where competitors often struggle to break even on underwriting (a combined ratio of 100%), this is a substantial margin. It is industry leading.

That strength didn’t come from luck. It came from discipline in personal property and auto lines, which offset heavier catastrophe losses. While competitors were fighting for volume, Intact was fighting for profitability.

The company isn’t without its headwinds. International results have lagged as management continues to reshape the UK portfolio (following the RSA acquisition).

While capital levels remain strong, the “catch” is that growth may slow as pricing normalizes and weather losses remain unpredictable.

If the company’s UK segment recovers, it truly will be filing on all cylinders.

A Balance Sheet Built for Storms

Underwriting discipline is the backbone of Intact’s steady performance, but the balance sheet is the safety net.

Recent performance highlights a combined ratio consistently better than the industry average. This is supported by a solid capital base that allows them to absorb the shocks of severe weather, something we are seeing more frequently across Canada.

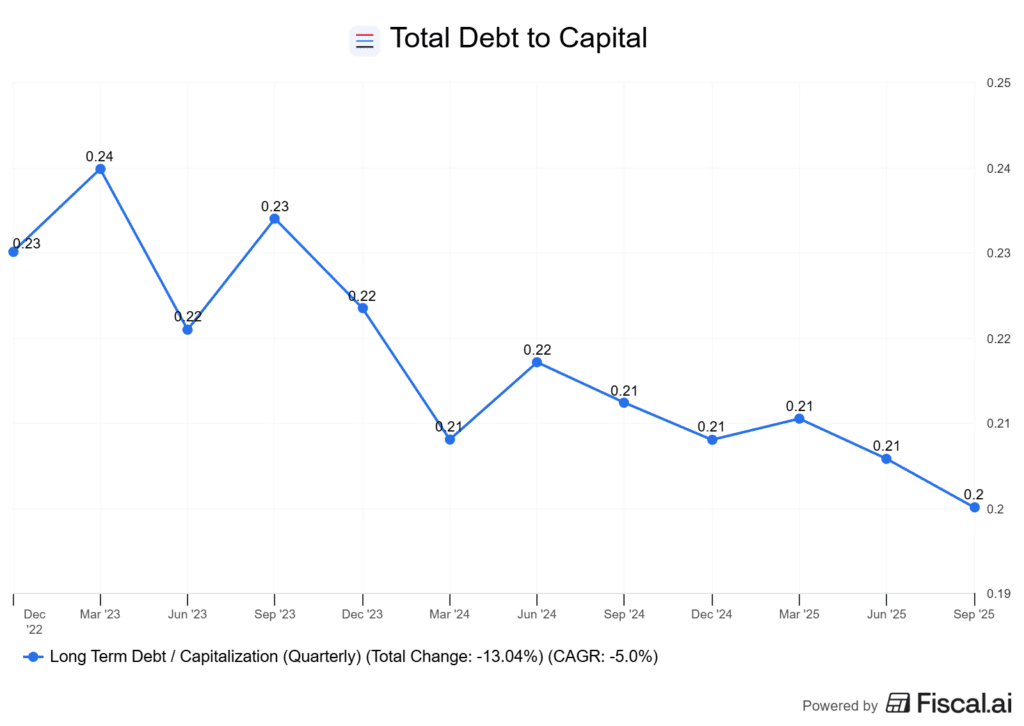

Debt to capital has finally normalized after acquisitions made in 2023, and is now sitting at lows.

Canadian operations have been the darling here, with double-digit growth in personal auto and property lines. Even the U.S. business has become a quiet success story, with better risk selection pushing the combined ratio below 85% in that region.

The question is is this resilience already priced in? The answer? I would argue yes. But that doesn’t mean it’s a bad buy.

The Valuation – Is it a Snag?

Here is the reality check. Intact is not a value stock. It trades at valuation multiples that assumes exceptional execution. Why is it so expensive? Primarily because the company has executed so well for so long.

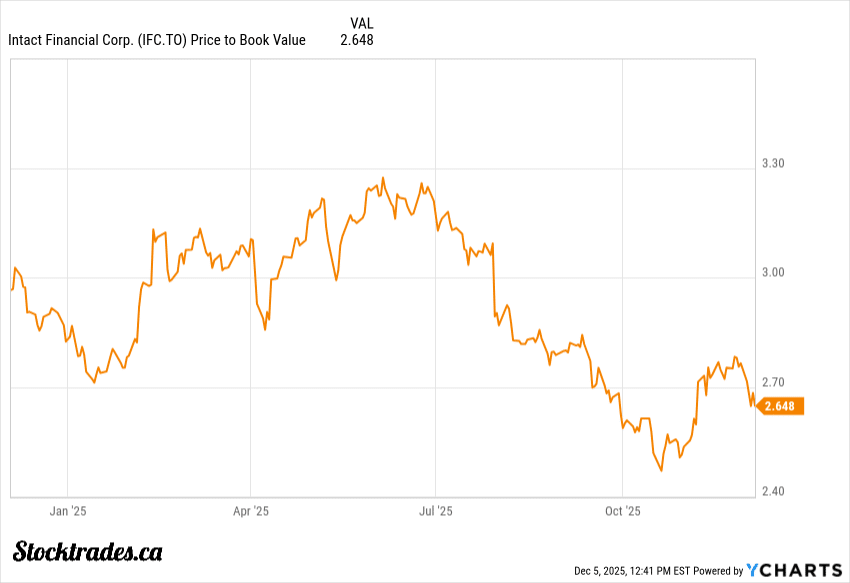

The company’s price to book sits at 2.64x, which is historically high for insurers. But keep in mind, the recent drawdown has sent book value from 3.3x to what it is today.

You are paying a “quality premium.” The risk is that if claims inflation stays high or investment income plateaus, the stock could see a correction.

My take is simple: The balance sheet offers meaningful downside protection, but don’t expect this stock to double overnight. It is a slow compounder.

Growth vs. Yield – Intact Provides Both

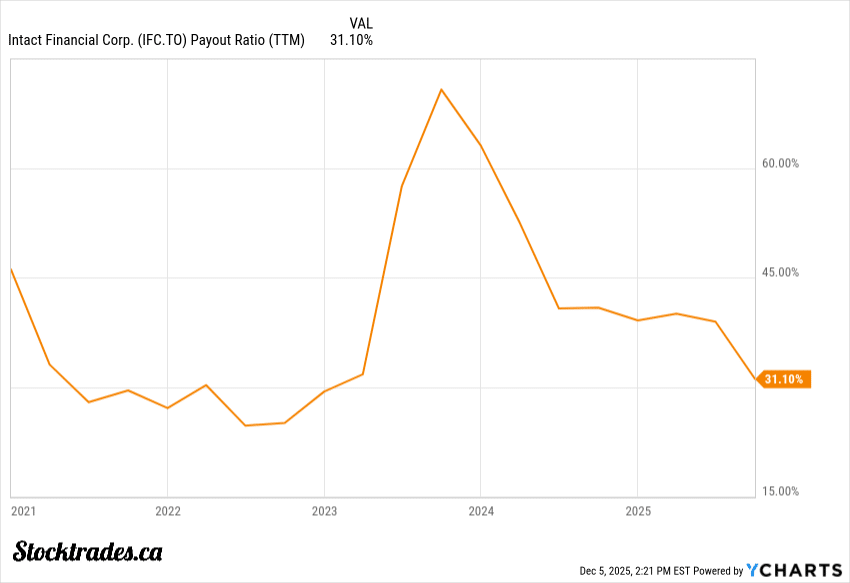

If you are looking to live solely off the yield, Intact might disappoint you.

The dividend yield currently sits in the mid-2% range.

On the surface, that looks modest compared to some of the high-yield companies on the TSX. But if you focus only on the current yield, you are missing the forest for the trees.

Intact is a Dividend Growth play, not a high-yield play. This is a company that has grown the dividend every year since its IPO. In order for the dividend to grow that much but the yield remain that low, share price must go up. And it has.

The company’s payout ratio is very healthy, and should support growth for the foreseeable future.

This is the model that builds generational wealth. By holding back cash, Intact strengthens its ability to survive catastrophe-heavy years without cutting the dividend. It’s a trade-off I am willing to make. I would rather have a safe, growing 2% yield than a risky 7% yield that keeps me awake at night.

Investment Income is the Hidden Tailwind

One factor often overlooked is the impact of interest rates.

Rising rates have given insurers a massive tailwind. Intact’s investment income has climbed as bond yields stayed high, providing a nice supplement to their underwriting income. In 2025, underwriting income increased by double digits.

Essentially, Intact is earning money on your premiums before they ever have to pay out a claim. This “float” becomes much more valuable when interest rates are not at zero.

However, economic risks lurk. If we see a hard recession or a sudden drop in rates, that investment income could compress. For now, it’s a nice buffer, but I am watching macroeconomic indicators closely.

The Bottom Line

Is Intact Financial a buy today?

I believe Intact remains the “Best in Breed” for Canadian insurance. It offers a plethora of competitive advantages: scale, data supremacy, and a history of exceptional capital management.

The Pros:

- Industry-leading combined ratios (profitability).

- Diversified across Canada, US, and UK.

- Strong dividend growth track record.

The Cons:

- Valuation is high (you are paying for quality).

- Weather-related risks are increasing.

- International integration is still a work in progress.

If you are a defensive investor looking for a “sleep well at night” stock, Intact fits the bill perfectly.

I would look to snag shares on any market weakness or weather-related dip, which is what we are going through right now. It’s a core hold for a long-term, income-oriented portfolio, but patience on the entry price is key.