You Finally Have a Chance to Add This Tech Compounder on the Cheap

Key takeaways

Topicus shows steady recurring revenue but organic growth is slowing

Acquisition integration is under scrutiny with Mark Leonard leaving Constellation

Valuation looks high, so execution must stay strong to justify it

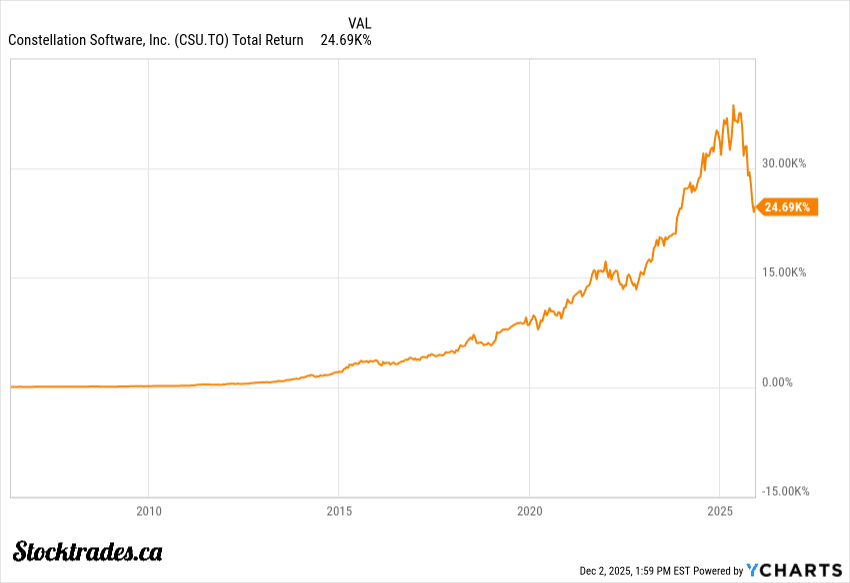

3 stocks I like better than Topicus TOI.V.We all want to find the next “multi-bagger” early. It’s the universal struggle of the DIY investor: you look at the chart of a company like Constellation Software or some other high growth technology stock, see the thousands of percent in returns you missed, and think, “If only I could find the next one.”

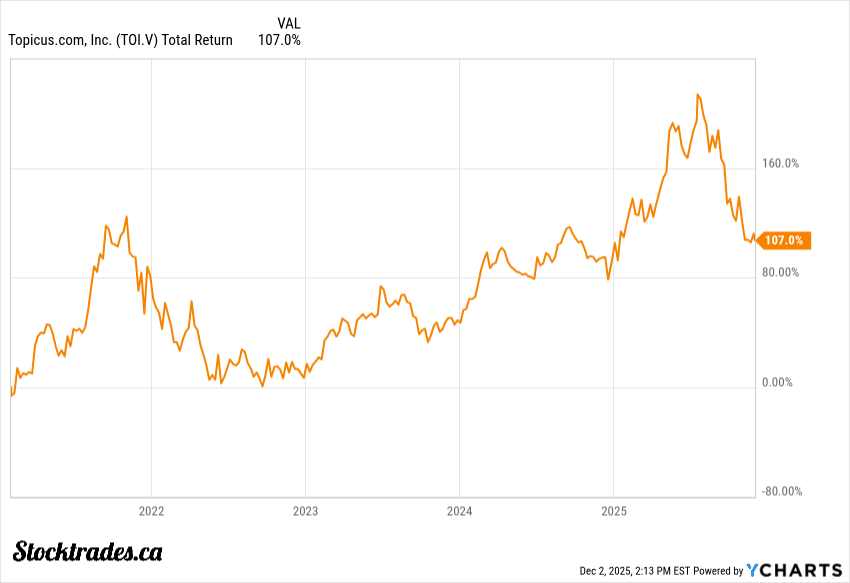

Naturally, many eyes turn to Topicus.com (TOI.V). After all, this is a spin off from Constellation with the same DNA, the same business model, and the same legendary backing. But here is the reality check: the market knows this, and it has priced the stock accordingly.

The question?

Whether Topicus is a legitimate growth machine or a stock that was priced to perfection that is starting to show cracks.

Let’s dig into why.

Revenue Growth vs. Organic Growth

Topicus recently reported strong top-line growth, with revenue climbing to roughly €387.9 million, a 24% jump year over year. On the surface, that looks like a stock firing on all cylinders.

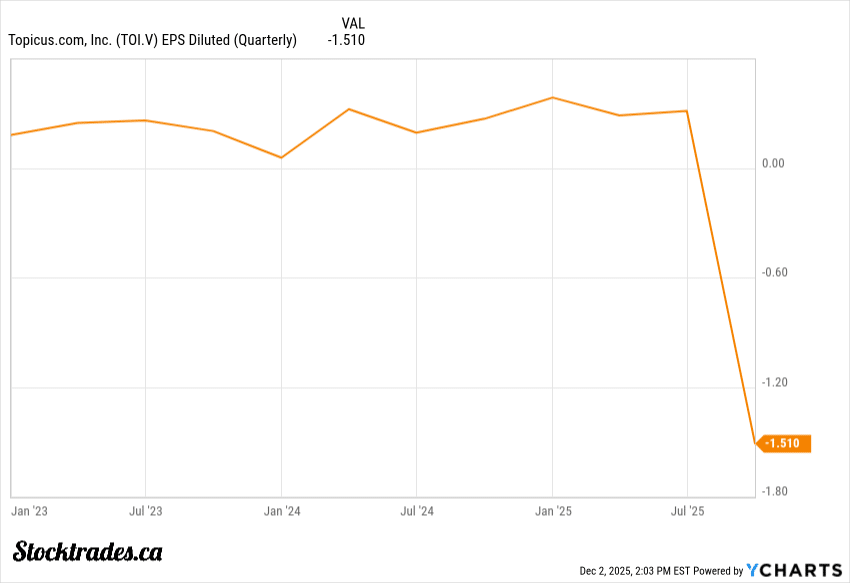

However, if you look closer, you’ll see a cloud hanging over the bottom line: a significant net loss.

Is this material? For those looking on the surface, potentially. But some simple digging highlights the fact that this is largely a complex accounting issue, and not a company bleeding money.

The loss was largely driven by a massive accounting expense related to how Topicus records its recent investment in Asseco Poland. Essentially, it’s a non-cash paper hit that wiped out reported profits for the quarter.

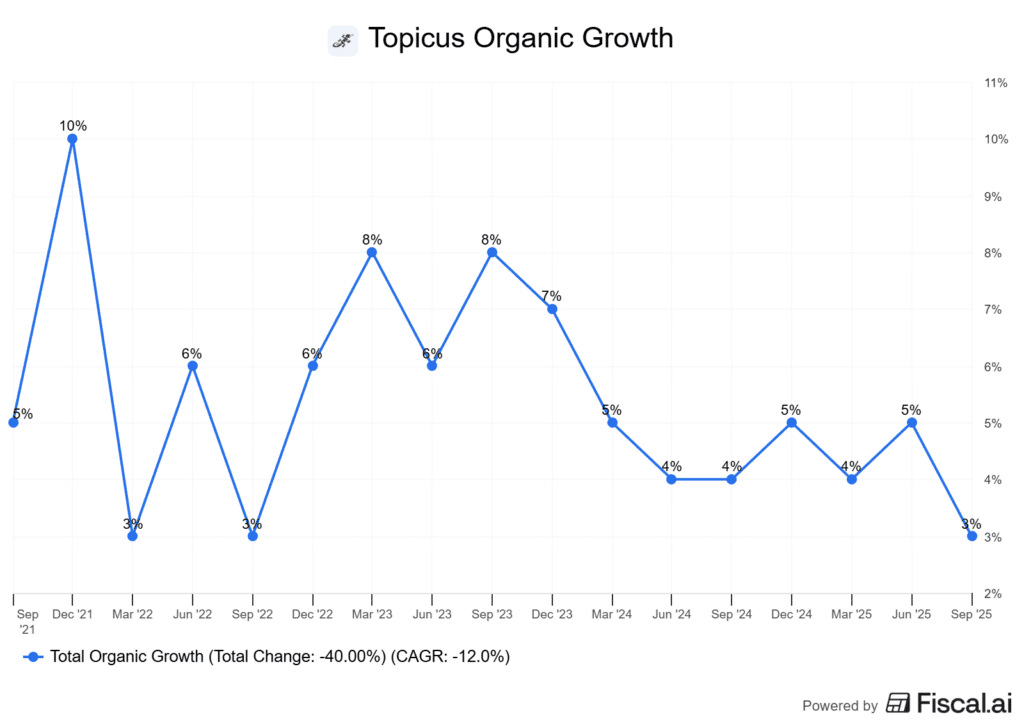

The problem? Even stripping that out, organic growth is hovering near the low end of historical averages (3–4%).

As an acquisition heavy company, the vast majority of Topicus’s “growth” comes from buying other companies, not from selling more software to existing clients.

This is the lowest levels of organic growth over the last 5 years for a company like Topicus. I’m not overly concerned by a single quarter, but then again, I do want to see a recovery to that 4-5% level over the next few quarters here. It would likely reduce some the downward pressure on the stock price.

Buying Growth in Europe

Topicus follows the Constellation playbook: buy small, niche software companies (VMS) that provide mission-critical services, and never sell them.

This year, they have been busy. The acquisition of Cipal Schaubroeck, a Belgian provider of local government software, is a classic example of their strategy. These are boring, steady businesses with high recurring revenue. They also increased their stake in Asseco Poland, betting big on the Eastern European tech sector.

That is the upside. You get exposure to a massive, fragmented European market that is decades behind North America in digitization. The tailwinds here are undeniable.

But there is a risk to this aggressive pace. Buying companies is easy; integrating them is hard, especially with the large-scale fears that artificial intelligence will replace a lot of software companies.

Constellation Software has spent decades perfecting this “trust-but-verify” decentralized model. Topicus is younger, and managing dozens of new acquisitions across different languages, cultures, and regulatory environments in Europe is a logistical nightmare, in theory. They’ve pulled it off thus far, but it’s certainly something to keep an eye on.

If the integration engine stalls, or if they overpay for these assets, that “compounding machine” narrative falls apart. We’ve witnessed the market pricing the potential of this in recently, with the stock getting hit hard in terms of share price.

Valuation: Priced for Flawless Execution

This is where a lot of investors start to get spooked when it comes to Topicus. The company trades at a valuation that assumes everything will go right for the next decade. It has often held this valuation because it compounds faster than Constellation, but also has the backing and large influence of the “mothership” company.

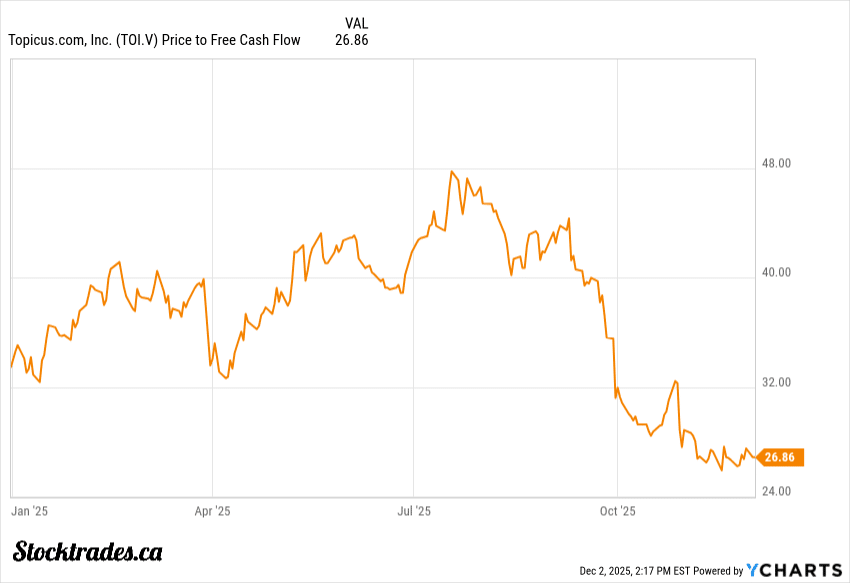

The stock often trades at a price-to-free cash flow ratio 40x. For context, that is significantly higher than many established software peers. Right now that valuation has fallen off a cliff, which is why investors are asking if there is opportunity here now.

The price-to-earnings ratio is essentially meaningless right now due to the recent net loss, but I don’t look at P/E much for Topicus anyways. The accounting intricacies of this acquisition heavy business make P/E a pointless ratio.

Investors are paying a “Constellation Premium” and always have for Topicus. They are betting that the management team, and the guidance of Mark Leonard, will ensure success.

However, Mark Leonard is now stepping down, and that premium has evaporated at a rapid pace.

When you pay 35x+ normalized earnings for a company growing organically at 4%, you are relying entirely on their ability to make brilliant acquisitions forever. So, when the leader steps away, it’s cause for concern.

However, the entire management team is brilliant, and I have zero doubts they will be able to continue making promising acquisitions for many years.

My Final Thoughts

It feels uncomfortable to buy when a stock is down and a legend like Mark Leonard is stepping away. I get it. The optics are messy right now, and the headline risks are enough to make any investor hesitate.

But here is the reality: the “Constellation Premium” that made Topicus expensive for years has finally deflated. For the first time in a long time, the valuation isn’t demanding perfection. It is simply demanding execution.

The accounting loss is largely noise, and while the organic growth needs to tick up, the acquisition engine remains fully intact. You are getting a high-quality asset that dominates the European software market, now trading without the euphoric markup it carried last year.

The management bench here is deep, and in my opinion, capable of steering the ship without Leonard holding the wheel. If you sat on the sidelines watching Constellation Software run because it always looked “too expensive,” this pullback is likely the entry point you have been waiting for.

I believe Topicus is a buy at these levels for the long-term compounding investor.