Tesla Is Bleeding Margins. But Elon Has a $1 Trillion Plan

Key takeaways

Tesla’s future depends on stabilizing auto margins as competition grows

New bets in autonomy and robotics could help, but remain unproven

Valuation assumes flawless execution that has yet to materialize

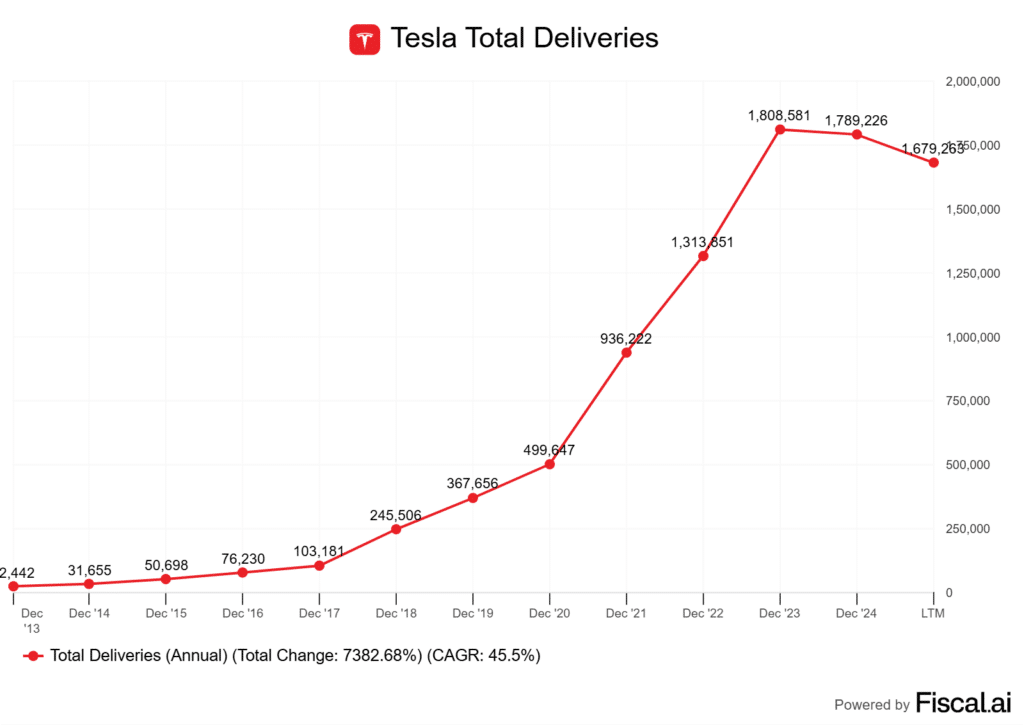

3 stocks I like better than TeslaTesla (TSLA) looks priced for execution risk, not value. The single driver that matters most right now is automotive gross margin. Deliveries are slipping against rising competition. Price cuts are squeezing profitability.

I think the stock only works if Tesla can prove that new revenue streams like autonomous services or robotics offset the margin pressure in cars.

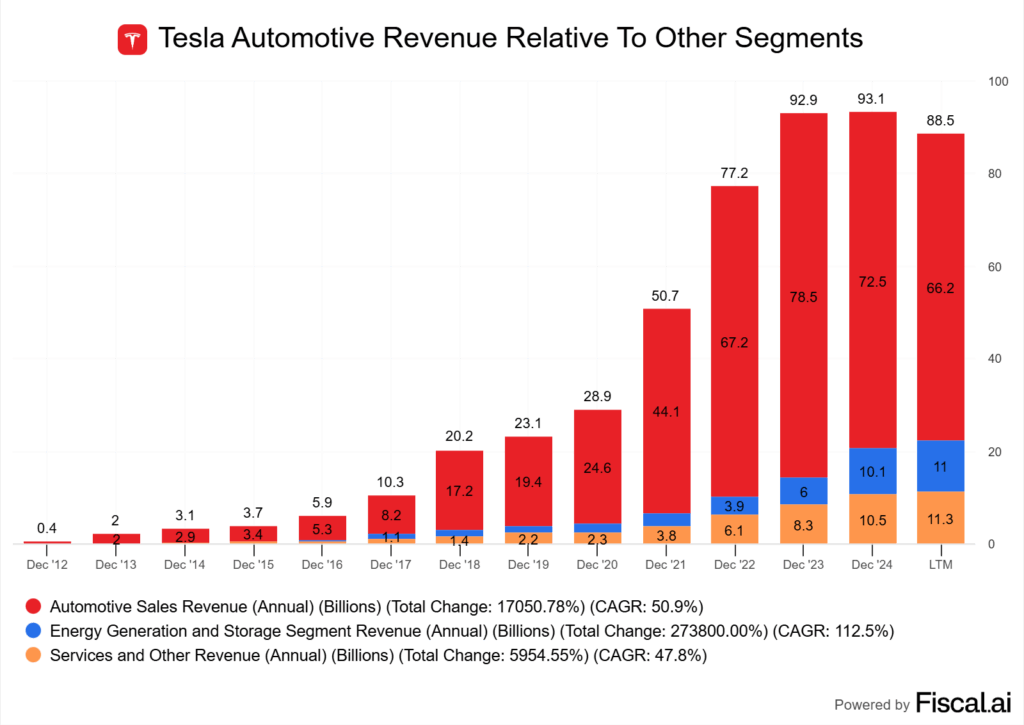

The business still earns most of its cash flow from selling electric vehicles, not from AI or robotics, despite the headlines. Unit economics in the core auto segment remain the swing factor.

Bulls argue that robotaxis and humanoid robots could transform the model. Those bets are years out and, honestly, still unproven.

I see the name as better suited to growth-focused investors who can tolerate volatility. It’s not for those seeking steady income or defensive stability.

If auto margins stay below 20% for more than two quarters, my stance weakens. This is a company that routinely posted 30%~ margins during COVID in this segment. The key test next quarter is whether Tesla can stabilize pricing power without sacrificing volume.

Tesla’s Robotaxi Pivot: Bold Innovation or Desperate Diversion?

Tesla’s focus has shifted from selling more cars to building a robotaxi network. Elon Musk argues that the company’s future depends less on vehicle margins and more on autonomy.

The pivot comes as EV sales flatten and competition from China intensifies. What matters is whether robotaxis can offset that slowdown.

The monetization path is simple in theory: cars become revenue-generating assets rather than one-time sales. Management suggests each vehicle could earn recurring income through ride-hailing.

If realized, this would diversify cash flow away from hardware sales. The catch? No regulator has yet cleared Tesla for fully driverless service, so the model stays speculative until proven.

In addition to this, you are now competing with major companies like Waymo and Uber.

Tesla’s Full Self-Driving (FSD) v12 software is central to this plan. It relies on a vision-only system trained on fleet data, supported by the Dojo supercomputer.

The upside is lower cost per unit compared to lidar-heavy peers. The risk: without redundant sensors, rare edge cases could derail safety validation. Unless FSD shows consistent performance across millions of miles.

The competitive landscape is already crowded. Waymo and Cruise operate limited commercial robotaxi services in U.S. cities, while China AV players are scaling pilots under government-backed frameworks.

Tesla’s advantage is data volume, but its logged driverless miles remain far behind peers. Unless regulators accept Tesla’s approach, that gap could widen.

The market potential is large. Analysts project robotaxi services could generate per-vehicle revenue well above traditional ownership.

But here’s the swing factor: if California and other key states delay approval beyond 2026, the cash flow story weakens. Investors need to watch whether Tesla secures permits in at least one major U.S. market within the next 12 months.

Are Price Cuts Enough to Keep Tesla Ahead?

Tesla’s most recent price cuts on the Model 3 and Model Y lowered average selling prices (ASP) by about USD 2,000.

Lower ASPs should expand Tesla’s addressable market, but they also compress operating margins. Margins fell to 7.6% from 17.2% a year earlier.

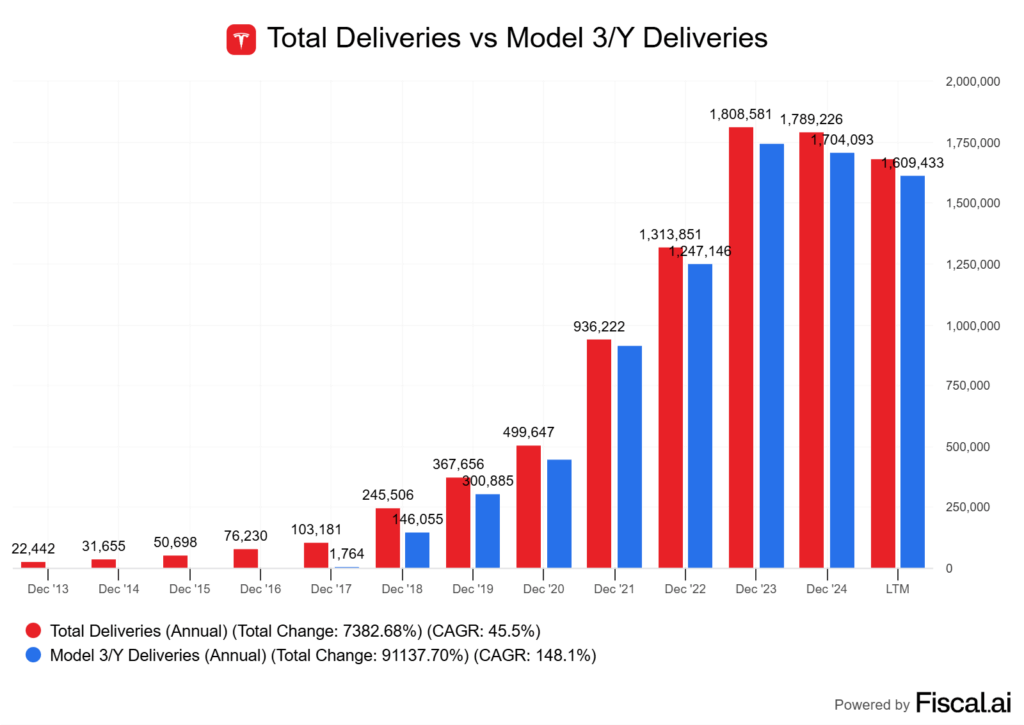

That swing shows pricing power is weakening unless volumes rise meaningfully. The company’s core monetization engine is still unit sales of Model 3 and Model Y, which together make up the bulk of deliveries. Look at the chart below.

Cutting prices is meant to defend share against BYD in China and Hyundai’s growing EV lineup in North America. If Model Y demand continues to lag competitors, price reductions risk becoming permanent rather than tactical.

What matters is whether incremental volume offsets thinner margins. We just haven’t seen that yet. Deliveries just continue to fall.

This means the margin sacrifice has yet to pay off. If deliveries continue to drop for more than 2-3 quarters, the strategy looks unsustainable.

Resale values have also started to decline as a side effect of repeated cuts. That erodes buyer confidence.

A weaker secondary market makes leasing less attractive and could hurt demand for new vehicles. Unless Tesla stabilizes pricing, depreciation risks will weigh on both brand and consumer trust.

Tesla’s challenge is balancing affordability with profitability. If operating margin stays below 10% while peers like BYD hold steady, the market will question whether Tesla is defending share or just losing pricing power.

Elon Wants a Trillion-Dollar Payday

Tesla’s board has put forward a new compensation plan that could make Elon Musk the first person with a trillion-dollar net worth. The package hinges on the company reaching a market value of about $8.5 trillion, up from roughly $1.1 trillion today.

That scale-up would require both operational breakthroughs and sustained investor confidence. This isn’t Musk’s first outsized pay deal.

Back in 2018, shareholders approved a plan worth up to $56 billion if Tesla hit a series of growth milestones. A Delaware court nullified that package in January 2024, calling the board’s process flawed and questioning whether directors acted independently.

That legal history makes the new proposal harder to separate from governance concerns. The structure of the new plan is performance-based, not guaranteed cash.

Musk would need to remain at Tesla for up to 10 years and deliver on ambitious targets such as one million autonomous taxis and large-scale robotics. The upside is clear: if he delivers, shareholders benefit from massive value creation.

The risk is that the goals may be unrealistic, which could shift focus away from core profitability and instead towards hitting those targets. Shareholders will vote on the deal this November, and the outcome will signal how much influence Musk still has over the board.

A “yes” vote could cement his control, potentially giving him nearly 29% ownership. A “no” vote would reflect growing unease with concentrated power.

The broader question is whether tying Musk’s wealth to Tesla’s $1 trillion vision, including links to xAI and SpaceX, aligns with investor interests. If execution matches ambition, the package looks like pay-for-performance. If not, it risks looking like entitlement dressed up as incentive.

Valuation vs Reality: Is Tesla Priced for Perfection Again?

Tesla’s market cap sits above USD 1T. That puts it closer to mega-cap tech than to traditional automakers.

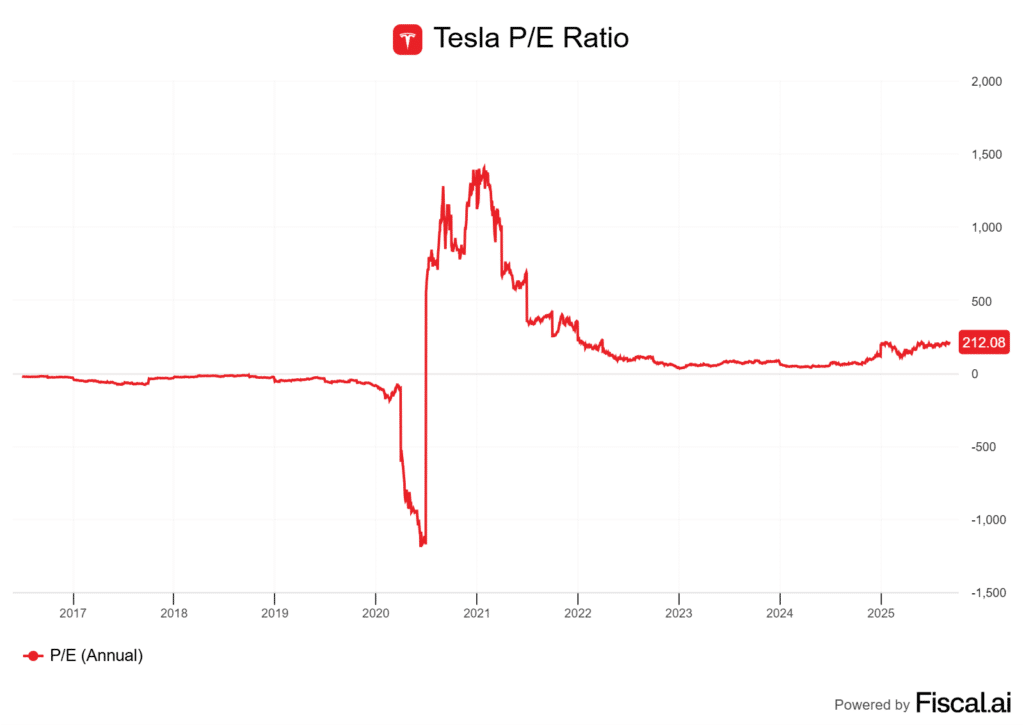

The stock trades at a price-to-earnings (P/E) ratio in the 200× range.

That kind of multiple only makes sense if earnings growth stays well above 30% every year.

If growth dips below that, the case for this valuation gets shaky fast. The company still earns most of its revenue from selling cars, a historically low margin business with little room for error.

The Model 3 and Model Y do most of the heavy lifting. Margins have slipped into the mid-teens as price cuts keep coming.

That’s far from the 20% target management once talked about. It’s hard to argue the auto business alone justifies the premium multiple.

Investors are betting big on software and services like full self-driving, robotaxis, and energy storage. Morningstar bumped up Tesla’s fair value estimate partly because of autonomous driving progress.

Yet they still see the stock as about 60% overvalued. Unless robotaxi launches actually happen on time and at scale, I’m skeptical those assumptions hold up.

Compared with its peers, Tesla looks pricey. Nvidia’s PEG (price/earnings to growth) ratio is closer to 2, while Tesla’s implied PEG is well above that at around 8X. What this is saying is both of these companies are priced to perfection, but Tesla is hitting nosebleed levels.

Apple trades at less than half Tesla’s forward P/E. BYD delivers more cars at a fraction of the valuation.

But if regulatory delays slow down autonomous approvals, or if margins stay under 20% for an extended period of time, defending this premium gets tough. It’s already hard enough.