This Mid-Cap Canadian Stock Has Been a Gem – But Is It Too Pricey Today?

Key takeaways

Stable operations support steady income returns.

Growth depends on scaling data and analytics.

Acquisition execution will shape long-term results.

3 stocks I like better than TMX GroupMost Canadian DIY investors have a love affair with monopolies. Whether it’s the “Big Five” banks, the railways, or the pipelines, we crave that sense of security that comes from owning a business with a massive moat.

But there is one monopoly that often flies under the radar, despite being the literal infrastructure that allows us to trade all the others: TMX Group.

I’ve always viewed TMX Group as the ultimate toll road. If you want to list a major company in Canada, or if you want to trade that company’s stock, you pretty much have to go through them.

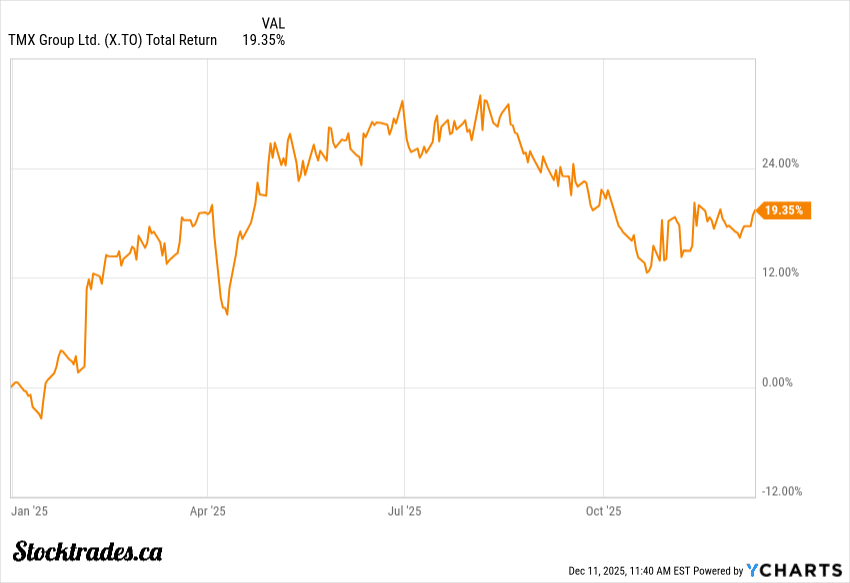

However, recent performance has pushed this “boring” stock into growth territory. With the stock hitting all-time highs earlier on in the year and posting a 19.3% gain in 2025, many investors are asking if this dip is an opportunity to add shares.

Is TMX Group still a solid defensive hold for your portfolio, or has the valuation stretched too far?

The Business is More Than Just a Ticker Tape

When most people think of TMX, they think of the Toronto Stock Exchange. And while listing fees and trading volumes are the bread and butter, the company is quietly transforming into something much more valuable: a data powerhouse.

The problem? Trading volumes are volatile. In a bear market, people stop trading, and IPOs dry up. That’s a serious headwind for a company relying solely on transaction fees.

The solution? Data and Analytics.

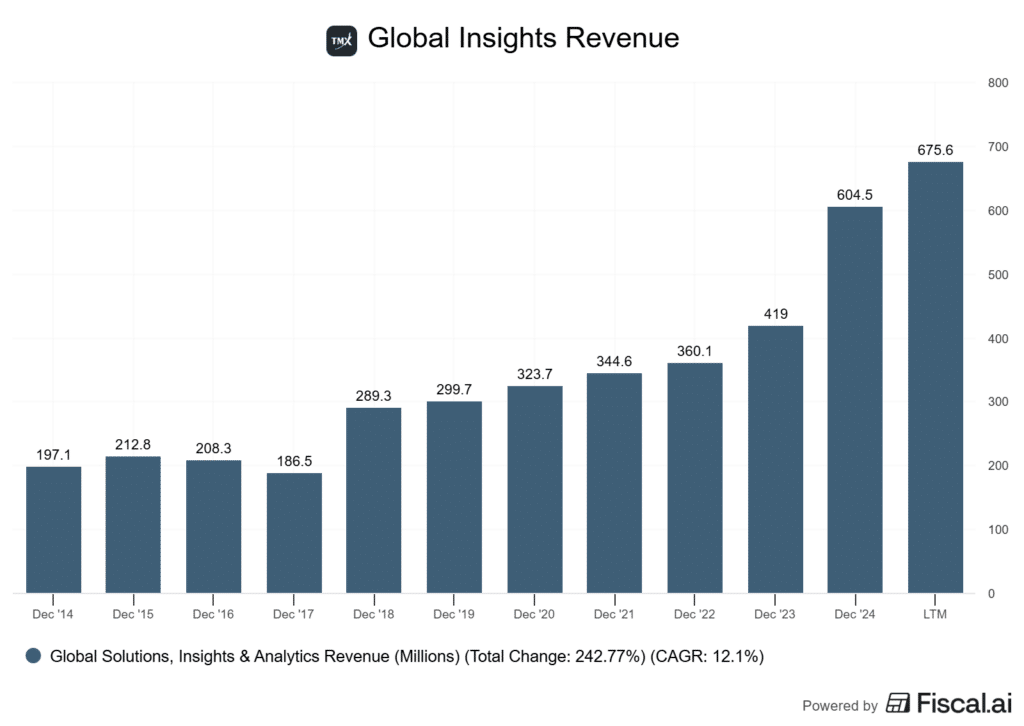

TMX has been aggressively expanding its “Global Insights” division, which includes TMX Datalinx and the recently acquired VettaFi.

These units sell market data, indices, and analytics. Services that generate recurring subscription revenue regardless of whether the market is up or down.

In my opinion, this is the most critical part of the bullish thesis. In the third quarter of 2025, revenue from this segment helped drive total revenue up 18% year-over-year. That is not the growth profile of a sleepy blue-chip. This is a company that has successfully pivoted its business model and it’s starting to show.

Valuation: A Darling with a Price Tag to Match

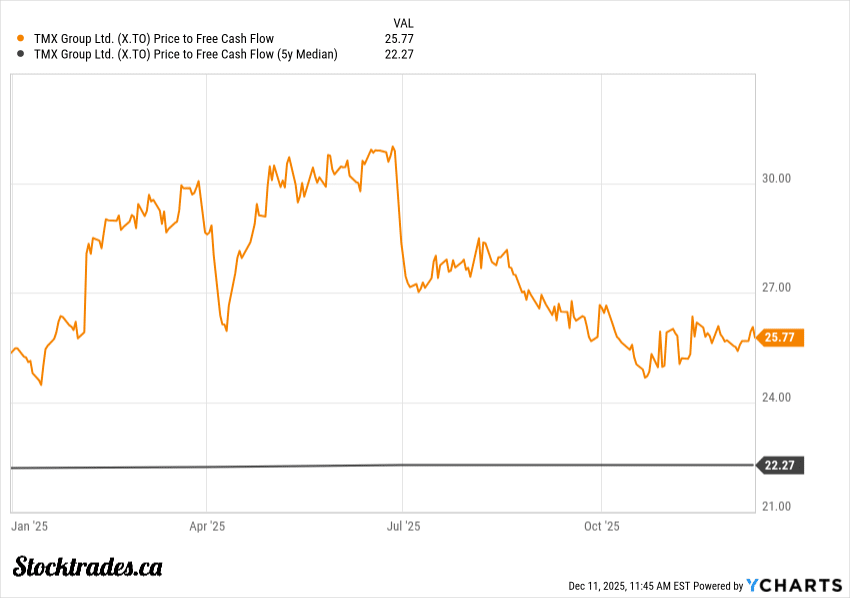

Simply put, TMX Group is not cheap right now.

The stock has had a plethora of tailwinds recently, from strong earnings beats to a general rotation back into Canadian equities. But whenever a stock goes on this large of a run, it’s easy to get cautious.

The valuation is currently sitting at the higher end of its historical range. Investors are paying a premium for that recurring data revenue I mentioned earlier.

Is it justified? Maybe. If TMX can continue to integrate its recent acquisitions like Verity (purchased for US$97.9 million in late 2025) and VettaFi without hitting any major snags, the premium might be warranted.

But if listing activity or market activity slows down in 2026, we could see the company hit a snag. Yes, the company is accumulating more recurring revenue. But that will take more time to grow into the largest portion of the business. For now, trading activity is key.

The Dividend is Reliable, But Don’t Expect Fireworks

If you are looking for a large yield, TMX Group might disappoint you.

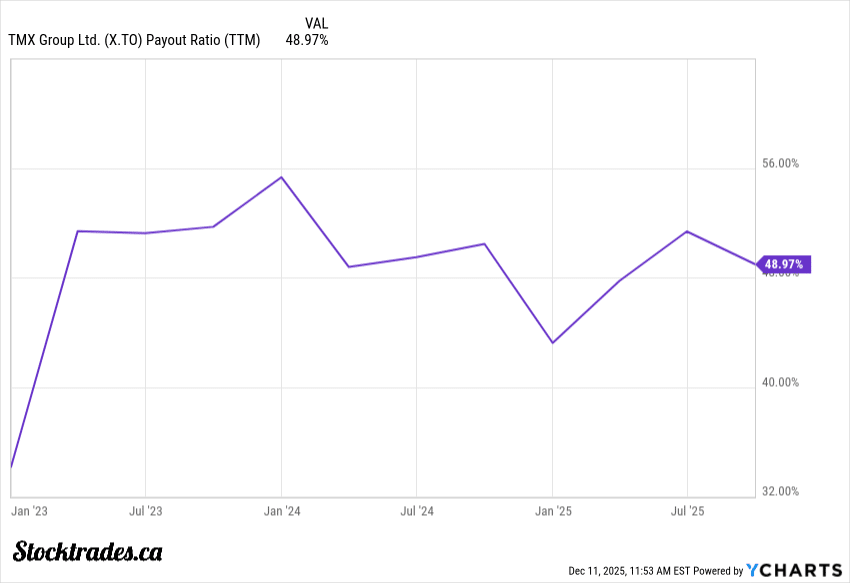

This company is a reliable dividend growth stock, with a long string of consecutive dividend increases. So, how can the yield still hover around 1.7% to 2%? Well, a large run up in price is how. We should be excited about that.

I believe TMX fits perfectly into a Dividend Growth strategy.

The company has a history of raising its dividend, and with a payout ratio that generally sits comfortably around 40-50%, those dividends are safe. They aren’t paying out more than they can afford, which leaves plenty of cash for those strategic acquisitions to drive more recurring revenue.

Overall, treat the dividend as a nice bonus on top of capital appreciation, not the main event.

Risks to Consider and My Final Thoughts

As a defensive optimist, I have to look at what could go wrong.

- The “Moat” is Canadian-Sized: While TMX dominates Canada, it is a small fish in a global pond. It faces potential stiff competition from US giants like Nasdaq and ICE, who have massive scale.

- IPO Cyclicality: TMX needs new companies to list on the TSX to grow its listing fees. If the Canadian economy faces headwinds, IPOs are the first thing to vanish. In addition to this, mining activity is causing a lot of the new issuances.

- Integration Risk: The company is spending heavily on acquisitions. Integrating different corporate cultures and tech stacks is never easy. If they overpay or fail to synergize these new assets, it will weigh on earnings.

So with all that said, is TMX Group a buy?

I think so. Sure, it’s not as good of an opportunity as it was a few years ago. However, buying TMX gives you exposure to a high-quality, monopoly-like business that is successfully modernizing itself. You get to enjoy the dividend growth and the stability.

If you are a stickler for price, however, I would wait for a pullback. The current valuation feels a bit frothy after such a strong run in 2024 and 2025. Overall, I tend to worry less about this these days though and just buy quality at any opportunity.