2 Top Canadian Value Stocks to Look at Today

When the stock market is at an all time high, it’s very rare you’ll find Canadian stocks like the ones I speak about below.

That is, stocks that are actually providing strong value during a roaring market. Typically, a rising tide lifts all ships. But, these two Canadian value stocks I’m going to speak about today don’t seem to be benefitting from the markets continuing to post amazing (and ultimately unsustainable) returns.

Those learning how to buy stocks should take note of changes in the market that can be more favorable for value stocks as opposed to growth stocks, and shift their strategy as they see fit. This can be helpful in skirting some market volatility.

So why are these two stocks trading at attractive valuations?

First, one of them is in the material sector. Gold has once again started to dip, and as a result so are gold stocks. However, there is no questioning the fact that gold companies are still simply printing cash at today’s gold prices.

The second company is a beverage company that has put up some relatively strong numbers as of late.

With that being said, lets get started.

Kinross Gold (TSE:K)

Kinross Gold (TSE:K) is a senior gold producer here in Canada. With a market cap of just over $10B, its among the largest gold producers in the country.

With production in excess of 2.4 million ounces of gold in 2020 and over 30 million ounces of proven and probable gold reserves, it is in a position to outperform moving forward, despite falling gold prices.

The company has an outstanding record of telling investors what to expect, and meeting those expectations. In fact, the company has met or exceeded production, cost, and CAPEX guidance for 9 consecutive years.

With a gold miner, peace of mind is everything. When a company shoots for the moon, it can typically boost share prices. But when it inevitably fails to meet expected targets, its share price will plummet. So, the reduction in volatility with Kinross due to its reliability is nice.

55% of the company’s production comes from the Americas, 22% from Russia, and 23% from West Africa. So although half of its production does come from more stable regions, it is still exposed to some countries outside of North America. Although this does increase geo-politic risk, it also lowers costs, as it is typically cheaper to mine in these areas.

Analysts are marking Kinross Gold to be one of the best free cash flow yield generators in the industry over the next few years, with FCF yields in the range of 15%.

Overall, Kinross provides middle of the pack production and all in sustaining costs. It doesn’t compare to a company like Kirkland Lake when it comes to production or costs, but the fact of the matter is, it is much cheaper comparatively.

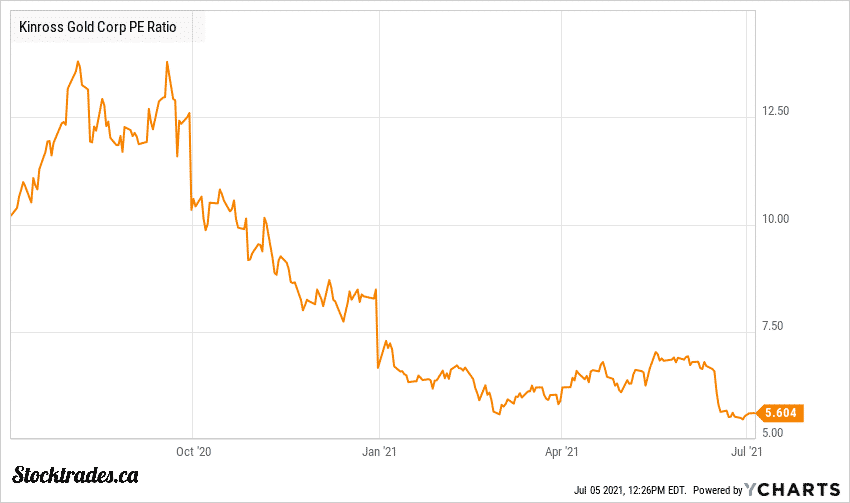

As of right now, Kinross is trading at 5.6 times trailing earnings and only 7.4 times forward earnings. As you can see by the chart below, it hasn’t been this cheap in quite some time.

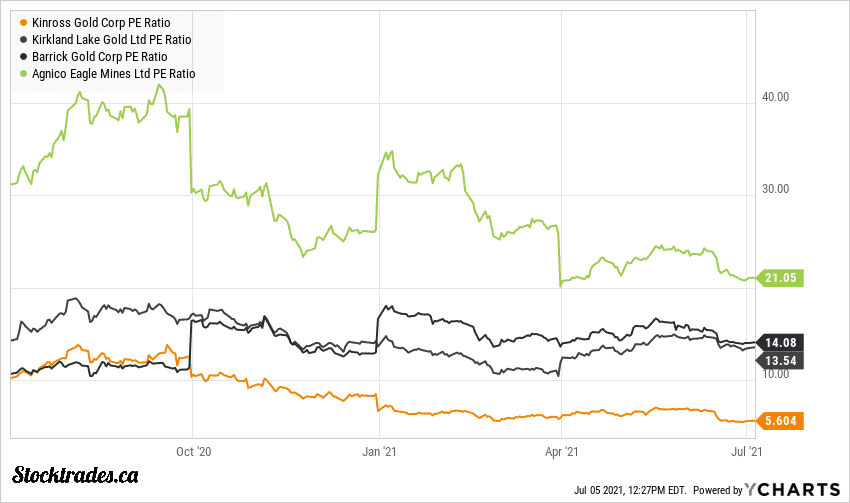

In fact, if we add in competitors such as Kirkland Lake, Barrick Gold, and Agnico Eagle Mines, we can really get a picture of how cheap Kinross is currently trading.

Overall, it is best to hold gold producers as a small portion of your portfolio, much like any other investment. Many who go overweight on commodity based companies tend to face extensive volatility.

Kinross is well covered by analysts, and the consensus price target out of the 19 covering the company is $12.82, which would signal 61.2% upside at the time of writing.

Lassonde Industries (TSE:LAS.A)

Lassonde Industires (TSE:LAS.A) develops, manufactures, and markets ready to drink fruit and vegetable juices in North America. The company has operations in both Canada and the United States, however the bulk of its revenue will come from the US. So, this is somewhat of an international play, despite being a Canadian stock.

The COVID-19 pandemic was good to Lassonde, primarily because of the shift in mentality to somewhat of a healthier lifestyle. Regardless of whether or not fruit juices and vegetable drinks achieve this, it’s clear that many purchased the company’s products in 2020.

With revenue of $1.98B, it marks a $310M jump from 2019 levels. The company hasn’t witnessed this type of revenue growth since the 2012 fiscal year. The company also managed to post diluted earnings per share of $14.11, a near 40% increase from fiscal 2019.

It is important to note however that the bulk of this revenue jump did come from the company acquiring a popular brand in Sun-Rype. Excluding the acquisition, sales were up around 6.8%. Still a nice number, considering how attractively valued the company is right now.

As the pandemic impacts wear off and people get back to living regular lifestyles, there is a chance that product demand could fall. But, it’s likely that some have taken a liking to Lassonde’s products, and may become frequent buyers.

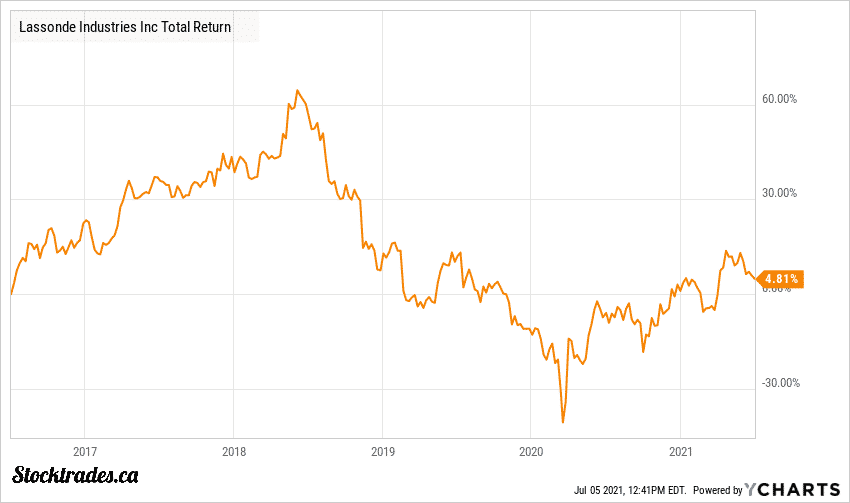

Lassonde is trading at only 12.47 times forward earnings. This is below the industry average, and is also well below the company’s typical 3, 5, and 10 year median price to earnings ratios. The same can be said about the company’s current 0.62 price to sales ratio.

The company also pays an attractive mid-yielding dividend of $3.52 on an annual basis, or around 1.98%. The dividend makes up only 18% of trailing earnings, and 10.7% of trailing free cash flow.

Overall, this isn’t a high flying growth stock that’s going to blow you away with outstanding returns. And, it’s likely that the company will only provide mid to high single digit revenue and earnings growth.

However, not every stock needs to be flashy, and Lassonde is certainly providing value not only on an income basis moving forward, but a share price basis as well.

The company is only covered by two analysts, both of which have price targets in the $211 range which would signal upside of 18.58% at the time of writing.

Interested in the future of AI? Check out the top Canadian AI stocks.