The Palantir Bubble is Set To Burst – Unless This Happens

Key takeaways

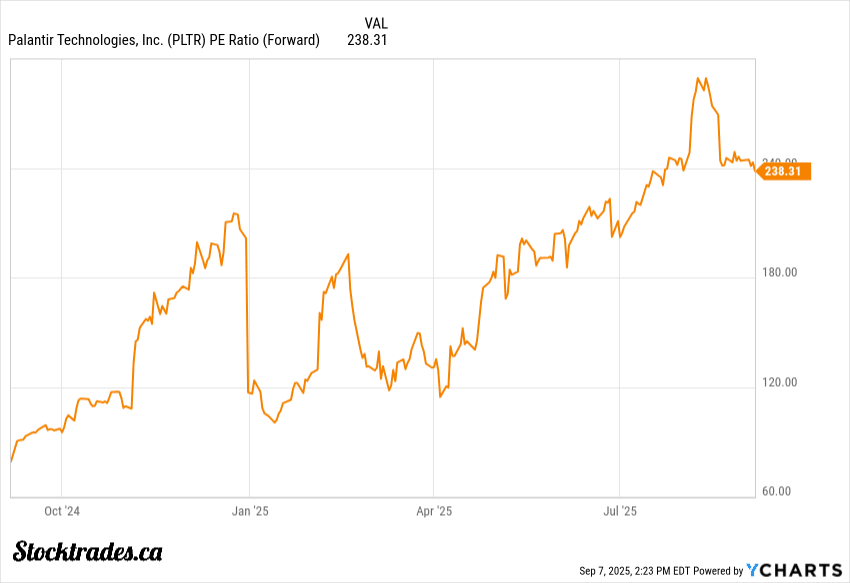

Valuation is in bubble territory, demanding perfection in terms of results

Government contracts provide stability but won’t drive the stock alone

Customer stickiness helps, but execution on scaling beyond government is key

3 stocks I like better than PalantirPalantir stock is priced to perfection. Execution needs to be on point, and any slipup at nosebleed valuations will cause substantial volatility. The main driver right now is growth in U.S. commercial revenue, but the main question is whether or not it will last.

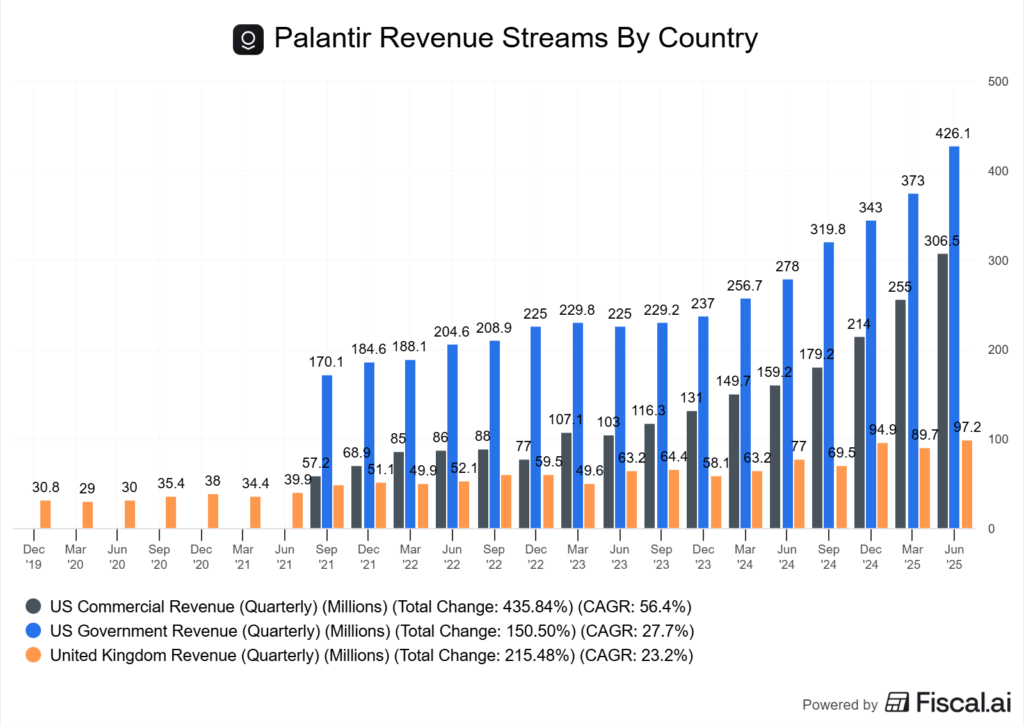

The company has doubled its stock price over the past year, fueled by strong adoption of its artificial intelligence platform and steady government contracts. I think the stock only works at today’s valuation if Palantir can keep up high double‑digit commercial growth (currently 56% CAGR) while also maintaining margins.

The business model is pretty simple: Palantir sells software that helps governments and companies organize data and make decisions. U.S. government contracts tend to stick, but the real question is whether commercial clients will keep scaling up.

Last quarter, U.S. commercial revenue grew more than 60% year over year, which shows demand exists. If that pace slows, though, the premium multiple gets a lot harder to defend.

Sceptics argue the valuation is stretched, and honestly, I agree. There’s not much room for error here.

For me, the next test is whether commercial revenue growth stays above 50% over the next two quarters. If it does, the case for holding Palantir as a long‑term growth name still holds up.

Palantir’s Valuation: Still Too Hot or Finally Reasonable?

Palantir’s stock is trading at levels that still look pretty detached from fundamentals. The company’s price-to-sales (P/S) ratio hovers near 80–100×, while its forward price-to-earnings (P/E) sits in the high triple digits.

That’s what I’d call a “hopes and dreams” valuation. Most of the price reflects flawless matching of future expectations, not today’s earnings power.

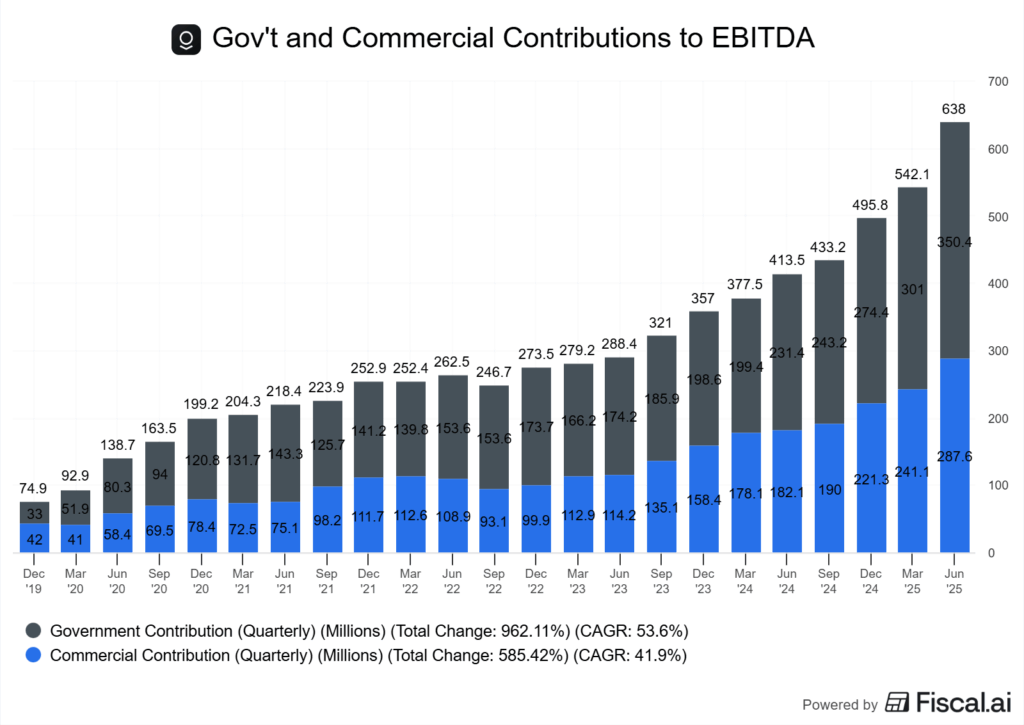

Palantir makes money by selling software platforms to governments and businesses. More than half of revenue still comes from government contracts. These can be steady but are also vulnerable to political budgets.

Commercial growth has picked up, but it’s not yet enough to balance that reliance. One bright spot is the “Rule of 40” score. Palantir reported a figure above 90, which means its growth rate plus operating margin is far stronger than most software peers.

That helps explain why some investors stay optimistic, even at these stretched levels. Listen, I’m not saying the stock can’t execute and deliver what the market has priced in. I’m just saying it’s going to be extremely difficult for it to do so.

Some analysts suggest as much as 97% of the valuation is speculative rather than tied to current financials.

Palantir Is Winning Contracts. But Will the Market Reward Execution?

Palantir has landed a string of major defence deals, including its first $10 billion U.S. Army contract and an extension tied to the Maven AI program. These wins confirm the company’s place as a trusted government partner, which is a difficult task to achieve.

The business still leans heavily on government work. Government contracts bring stability. But commercial growth shows the product can scale beyond defence.

If commercial slows below current growth for any extended amount of time, the investment case weakens. Investors are watching execution against lofty expectations.

A recent Mizuho upgrade lifted the stock to Neutral, but the firm warned that valuation remains stretched. Palantir trades at a forward price-to-sales multiple near 25, a level that assumes sustained 30%+ revenue growth.

If growth dips into the teens, that multiple is tough to defend. Contract size also matters.

The Maven deal adds about USD $20 million per year, or less than 1% of projected 2025 revenue. That’s meaningful for credibility but not a needle-mover financially.

Unless Palantir converts pilot projects into billion-dollar, recurring agreements, the stock risks being priced for execution it hasn’t yet delivered.

The Commercial Puzzle: Can Palantir Scale Beyond Government Work?

Palantir’s latest quarter put one figure in focus: U.S. commercial revenue rose 93% year-over-year, outpacing its government segment. That kind of growth shows the company can win outside defence and intelligence.

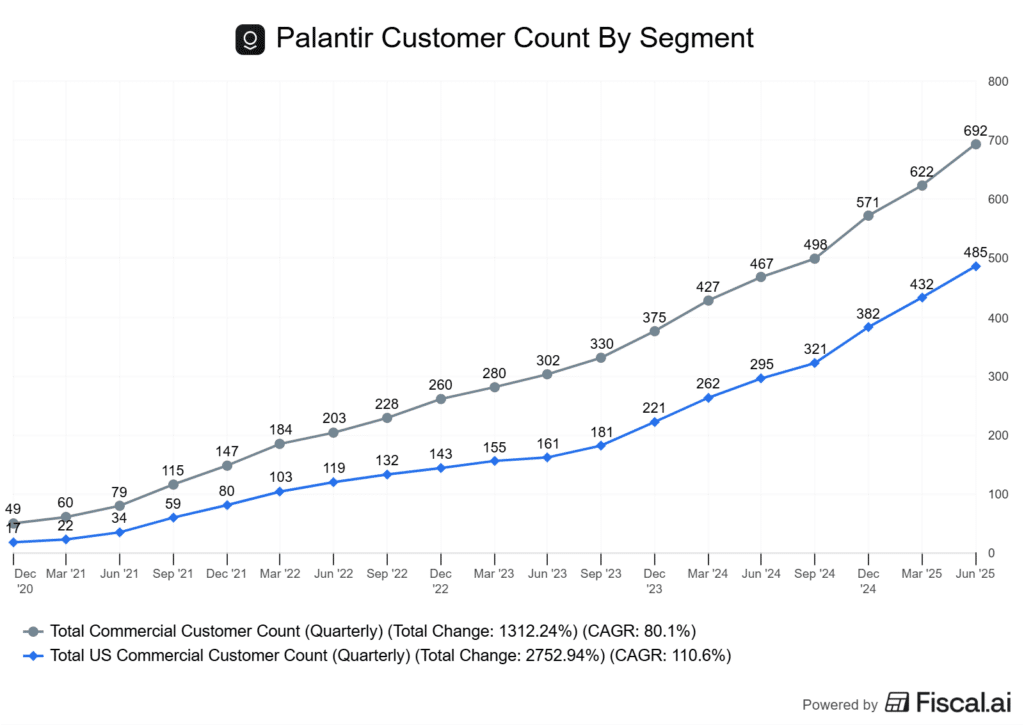

The question is whether this pace is sustainable once the early wave of adoption slows. The commercial engine today is built on the Artificial Intelligence Platform (AIP).

Customers use it to connect large language models with their own data while keeping control over security and governance. Palantir has encouraged adoption through short “bootcamps” where clients test the software before committing.

This model has helped convert pilots into paying contracts. What matters is whether these wins can scale. They are thus far, as you can see by the customer count chart below.

Deployments are still labour-intensive and often need a lot of customization. That raises costs and slows down rollouts, especially compared with more standardised enterprise software.

If Palantir can’t streamline this model, margins may lag even as revenue grows.

Real-world adoption is the swing factor. Some international contracts remain small pilots rather than multi-year deals, which makes forecasting tough.

Analysts have noted that Palantir’s ability to convert these pilots into recurring, large-scale relationships will determine if it can justify its current valuation or not, as seen in this analysis of its global expansion.

The opportunity is clear: strong demand for enterprise AI and a proven track record with government clients.

The risk is also clear: without easier deployment and broader commercial uptake, Palantir could stay too dependent on government contracts despite its recent surge in business.

Sticky Customers But Expensive Stock

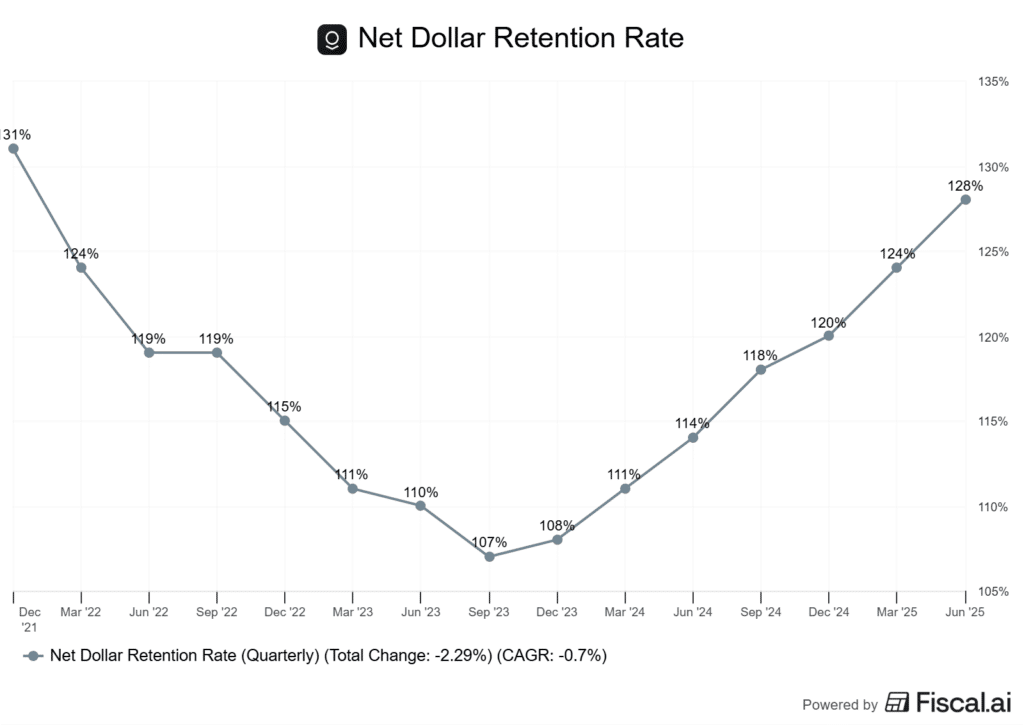

Palantir’s latest quarter showed that customer relationships remain durable, with net revenue retention above 100%. Existing clients aren’t just sticking around, they’re spending more.

That’s important because it eases the pressure to constantly chase new business. Still, the client base feels pretty concentrated.

About 45% of revenue comes from the top 20 customers, many of them U.S. government agencies. That kind of concentration brings some stability, but it also ties Palantir to political cycles and procurement budgets in a big way.

There’s a clear trade‑off here. On one hand, you get strong economics from loyal customers and long contracts. On the other, the valuation looks pretty stretched.

The stock trades at revenue multiples well above its peers. Investors are basically paying upfront for growth that hasn’t shown up yet.

Government contracts still anchor the business. But commercial growth is what everyone’s watching now. U.S. commercial revenue more than doubled year over year.

But unless Palantir keeps up that pace, it’s tough to justify the current price. The company really needs to keep retention above 100% and deliver strong growth on both government and commercial sides.

If either metric drops for more than a couple of quarters, the premium multiple will shrink, and it will shrink fast.