This High Yielding Blue Chip Is at All Time Highs. Is It Still a Buy?

Key takeaways

Dividend appeal depends on cash flow keeping up with debt

Regulated gas utilities provide steadier growth than pipelines

Legal and policy risks remain a key watch item

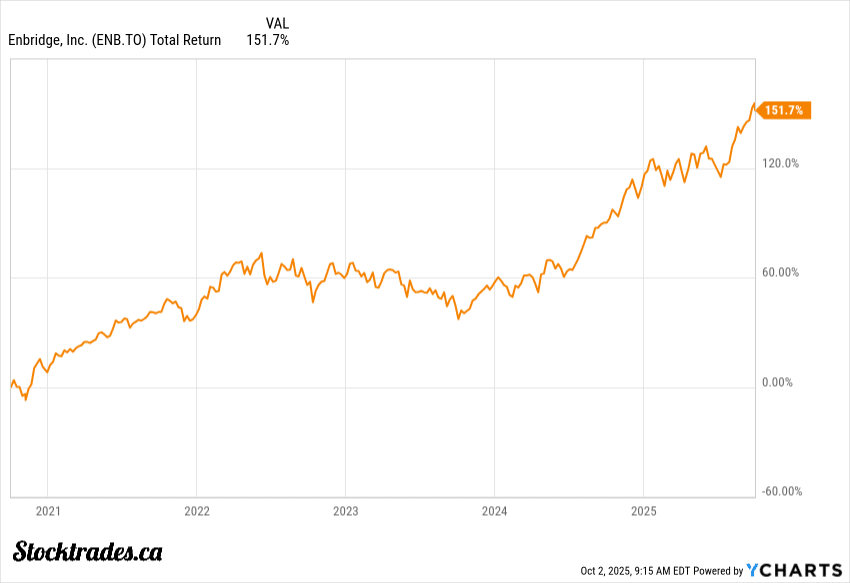

3 stocks I like better than Enbridge.Despite the stock sitting at all time highs, Enbridge (ENB.TO) looks fairly valued. These pipeline stocks will never move the needle much in terms of outsized returns, but there is something to be said about a company that can provide the reliability they do.

Declining rates were a huge benefit for this one, now sitting at 151% returns over the last half decade. The question now is whether it will continue.

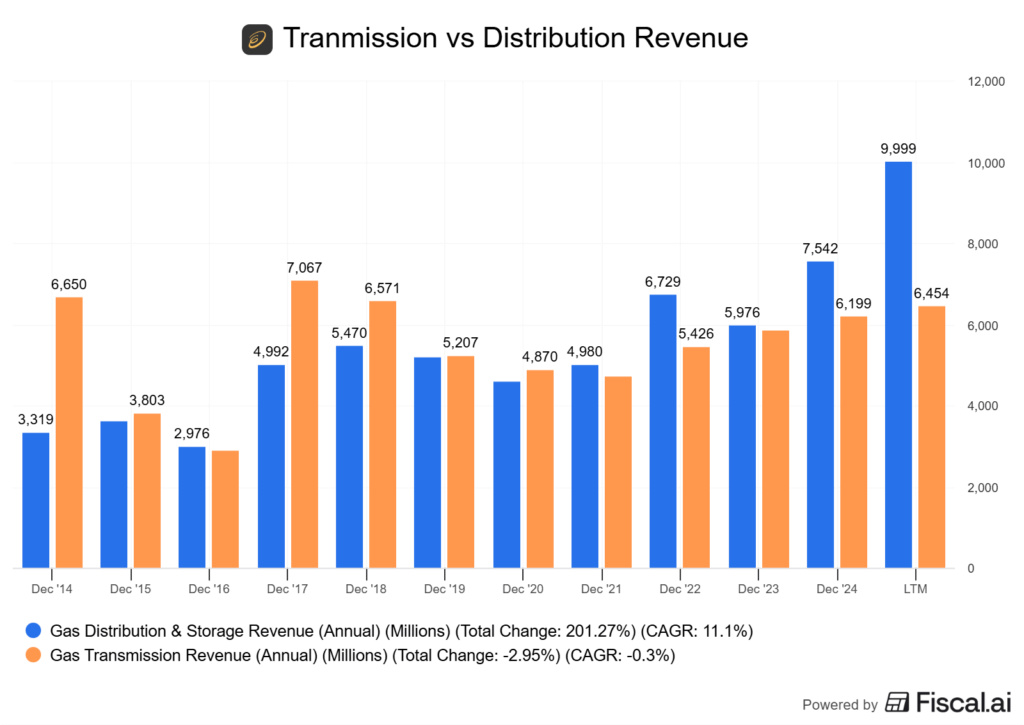

The company just closed a US$14 billion deal for three U.S. gas utilities, shifting the story toward regulated earnings rather than pure pipeline exposure.

I still think the stock works for income-focused investors, mostly because of its reliable dividend. The swing factor is whether cash flow growth can keep up with rising debt and capital demands. I think the value gap has closed, so I wouldn’t expect 150%+ returns moving forward, but that doesn’t mean a stock isn’t attractive.

Enbridge makes money by collecting fees on oil and gas transport. However, the real growth driver now lies in expanding its utility and gas distribution footprint. That segment offers steadier returns than long-haul oil pipelines.

These growth projects require billions in spending. High leverage leaves little room for missteps. But, I think they can execute.

Record EBITDA and Guidance Reaffirmed, But Capex Demands Remain High

Enbridge just posted record second-quarter results. Adjusted EBITDA hit $4.6 billion, up 7% from last year, while Adjusted Earnings rose to $1.4 billion.

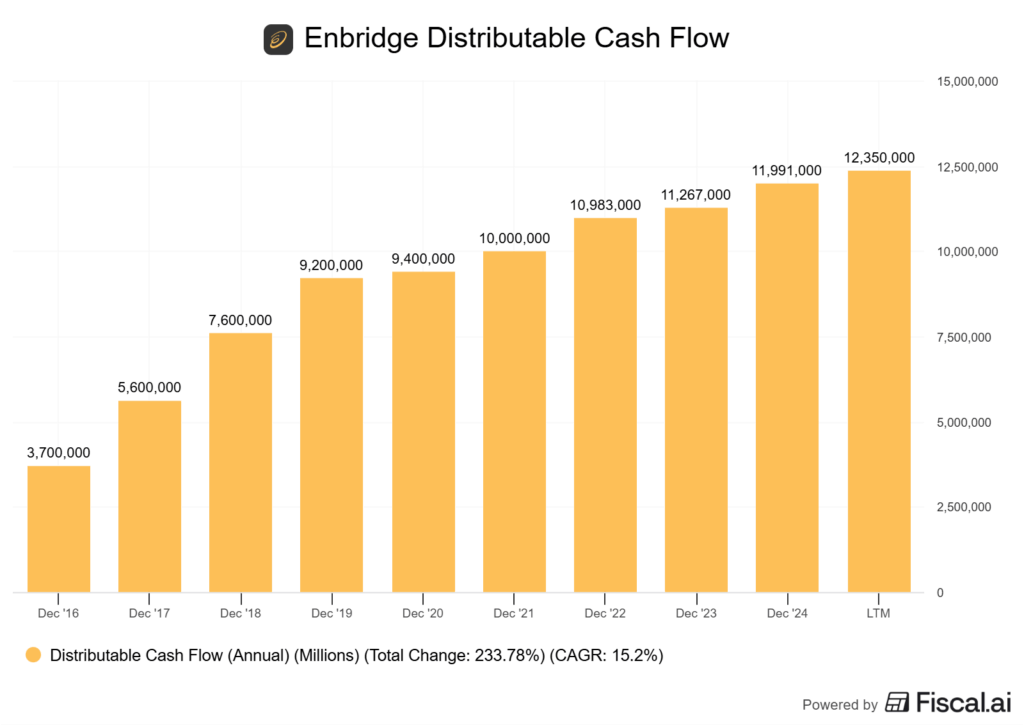

Distributable Cash Flow (DCF) held steady at $2.9 billion, so the company’s still tracking with its 2025 guidance. In fact, there is the potential it could come out of the year above that guidance.

Enbridge keeps committing billions in Growth CapEx. From solar projects to gas transmission expansions. As a result, maintenance CapEx will creep higher as the asset base grows.

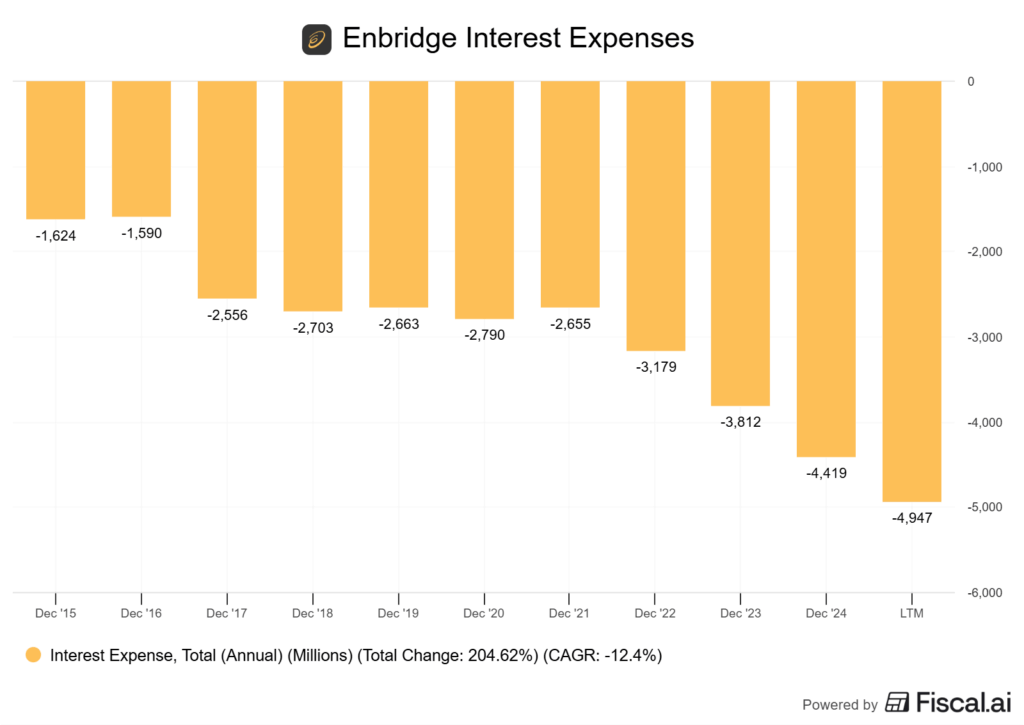

The company added about $2 billion of new projects to its backlog in the last quarter alone. Debt levels remain manageable, with leverage at 4.7x Debt-to-EBITDA, near the mid range of the company’s targets. With policy makers continuing to reduce rates, this could provide some relief in terms of interest expenses.

With a $32 billion secured project backlog, the balance between funding growth and protecting cash flow feels tight. Operating cash hit $3.2 billion in the quarter, but higher financing costs (see chart below) and ongoing capital spending could strain flexibility.

Enbridge needs steady DCF per share in the $5.50–$5.90 range to cover dividends and keep investors patient. Predictable earnings from regulated pipelines and utilities are the upside.

The risk? Heavy CapEx demands tie up cash just as interest expenses continue to pick away at earnings. It works for now, but only if new projects deliver on schedule and margins hold up.

Utility & Gas Distribution Growth Offsets Sluggish Oil‑Pipeline Dynamics

Enbridge’s latest quarter showed that utility and gas distribution is doing the heavy lifting while oil pipelines tread water.

The Gas Distribution and Storage unit nearly doubled EBITDA year-over-year to $522 million CAD, thanks to U.S. acquisitions that now make Enbridge the largest natural gas distributor in North America.

Regulated utilities earn returns on invested capital through rate settlements approved by regulators. That means predictable cash flow, even if volumes swing with weather.

Profitability depends on timely regulatory approval of rate increases. Enbridge is still waiting on decisions from the Ontario Energy Board.

Tolls remain under regulatory pressure, and transportation volumes aren’t growing much beyond that ceiling. Even with record flows, margins get capped by tariff disputes and cost pressures tied to maintaining an aging network.

U.S. gas acquisitions like Dominion Energy utilities are adding dependable scale, while oil pipeline earnings are stuck in a slow grind. If cost inflation eats into utility margins or regulators delay approvals, the cushion weakens.

But if reliability holds and rate cases land as expected, the gas side can continue offsetting sluggish oil‑pipeline dynamics, which will eventually turn around. That’s the hope, anyway.

Regulatory & Legal Risks Around Pipelines (Line 5 Tunnel)

Line 5 has moved oil and natural gas liquids through the Great Lakes region since 1953. The section under the Straits of Mackinac is the most contentious, with Enbridge pushing to build a tunnel that would encase the line in concrete.

The plan is framed as a safety upgrade, but it’s become a legal and political flashpoint. The permitting process is layered.

State regulators in Michigan have signed off, but the project still needs approval from the U.S. Army Corps of Engineers. That federal review has been extended, so timelines remain uncertain.

Until those permits are secured, the tunnel is more of a proposal than a guaranteed asset. Opposition isn’t just from environmental groups.

Several Native American and First Nations communities argue the pipeline threatens treaty rights, water quality, and cultural resources. Their legal challenges focus on whether regulators considered the full necessity of the pipeline, not just the tunnel segment.

That distinction matters because it could reopen broader questions about Line 5’s operating licence. The spill risk is real.

Past coating gaps and the 2018 anchor strike show how exposed the line is in its current form. Independent studies have estimated billions in potential damages if a rupture occurred.

Enbridge argues the tunnel reduces that risk, but litigation keeps the debate alive and slows progress. Public trust is another factor.

Each court ruling, whether favourable to Enbridge or not, shapes how communities view the company’s role in the Great Lakes. For investors, that reputational weight can be as important as the direct regulatory costs.

Every year of delay adds legal expense, construction inflation, and political risk. I think this is something we’re going to have to learn and accept with oil and gas stocks.

Transitioning Toward Lower‑Carbon Solutions

Enbridge has tied its long‑term credibility to reaching net‑zero emissions by 2050. That’s a big commitment, but the real test is whether investments in lower‑carbon solutions can deliver returns while reducing exposure to transition risk and stranded asset risk.

Zero emissions sounds great. But for shareholders, is it the best path to increased profitability?

The company is putting money into renewables like wind and solar. Those projects remain a small slice compared to its core pipeline business, but they’re growing at least.

The upside is clear: these assets are long‑lived and align with tightening emissions targets. The downside? Margins are thinner, and scaling takes time.

Hydrogen is another focus. Clean hydrogen can reduce emissions in hard‑to‑decarbonize sectors, and Enbridge has started pilot projects and blending studies.

The challenge is cost and infrastructure. Without broader adoption, hydrogen risks staying niche. That’s the risk, it just doesn’t scale cleanly yet.

Carbon Capture and Sequestration (CCS) is also on the table. Capturing CO2 and storing it underground could help offset emissions from heavy industry.

Enbridge is developing projects across North America, but CCS remains capital‑intensive and depends on regulatory support.

Renewable Natural Gas (RNG) is another piece. By capturing methane from landfills or farms, RNG offers a lower‑carbon fuel that can run through existing infrastructure.

That’s very practical and achievable, but the supply is limited. Enbridge highlights RNG as part of its new energy technologies, yet it won’t replace the scale of conventional gas.

The swing factor is whether these investments can offset risks tied to tightening climate policy. If carbon pricing rises faster than expected, the value of lower‑carbon assets goes up.

If technology costs stay high, the payback weakens. That tension will define how much weight to give these projects in the investment case.

Enbridge is in a difficult situation where global economies are demanding cleaner technology, but cleaner technology doesn’t necessarily translate into higher levels of profitability.

So, Does The Dividend Make This Company a Buy?

Enbridge’s dividend yield sits in the 5-6% range. Pipelines certainly drive higher yields than most industrial and energy stocks, and it is primarily due to the fact cash flows are more consistent.

The payout looks appealing, but only if cash flow keeps flowing in predictably. The company has raised its dividend for three decades, so the track record’s definitely there, and I don’t see that slowing anytime soon. The company’s distributable cash flow is effectively a chart that is up and to the right.

Most of Enbridge’s earnings come from fee-based contracts, not direct commodity trading. About 98% of cash flow ties back to regulated or long-term agreements, which helps blunt wild swings from oil and gas prices.

This stabilizes the payout ratio and keeps dividend coverage intact, even when crude prices move sharply. But let’s be honest, external shocks can still shake things up.

Tariffs on Canadian energy exports, like those recently debated in the U.S., could pressure margins and test how much cash is left after debt service. Analysts have already flagged tariff risks as a headwind, and that’s not something the company can fully control.

Other variables creep in too. A weaker Canadian dollar against the U.S. dollar can eat into reported results. Rising interest rates make refinancing pricier. Sure, rates are declining now, but where will they be in 3 years, 5 years?

Each of these factors chips away at distributable cash flow, which is really the buffer behind the dividend.

I think the value gap here has closed in terms of valuation, and I now expect Enbridge to grow inline with earnings, which is likely at a low single digit pace. Keep in mind, with the company yielding 6%~, this is really not all that bad of a proposition. 3-4% earnings growth combined with a 6%~ yield can easily get someone a market-matching return.

Not in recent times, of course, with the markets going parabolic. However, at some point, we’re going to revert back to the mean here.

For conservative shareholders, I don’t see Enbridge as that bad of a play at all.