Is Enbridge Stock a Buy, Or is Rising Debt a Concern?

Key takeaways

Enbridge continues strong dividend growth but faces rising debt questions

Recent acquisitions could boost cash flow if 2025 financial targets are met

New utility and pipeline projects add opportunity but also increase risk

3 stocks I like better than Enbridge.If you’ve watched Enbridge climb nearly 30 percent in the past year, you might be wondering if you’ve missed the boat or if there’s still value left on the table.

Right now, I see Enbridge as one of the rare TSX names offering a strong mix of dividend growth and defensive cash flow, even as it faces some genuine debt and interest rate headwinds.

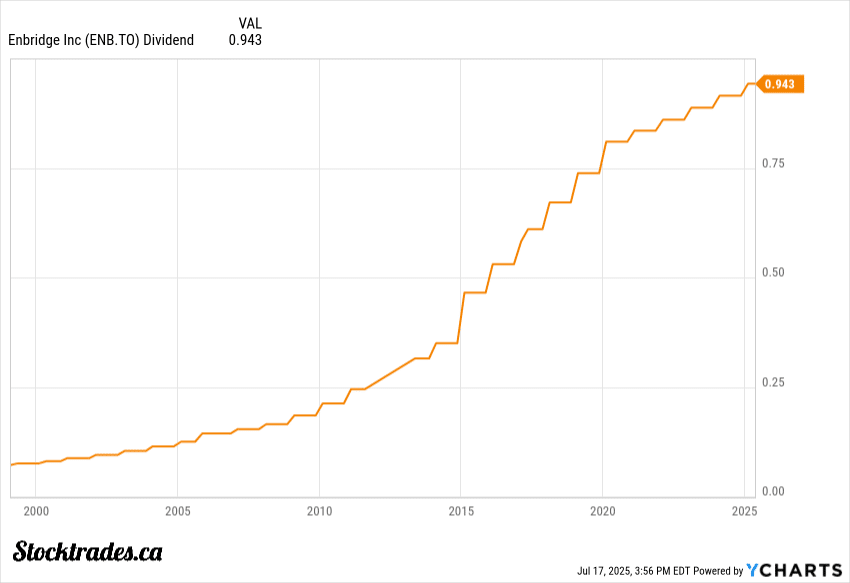

The track record is hard to ignore: Enbridge has raised its payout for 30 straight years.

It still delivers a hefty yield many Canadian investors crave, especially in a tax-sheltered account like a TFSA or RRSP.

But it’s not just the yield. There’s buzz around the new gas utility assets and their expected boost to EBITDA, but with $45 billion in debt, leverage risks aren’t going away soon, and I think it’s something investors should be looking at closely.

Some also believe Enbridge’s drive to bulk up renewables is more optics than substance. Others point to a meaningful shift as pipelines face tougher ESG scrutiny.

I like facts over hype, so I’ll walk you through what’s working, what isn’t, and the key numbers that actually matter.

30 Years of Dividend Growth. But Can Growth and Yield Coexist?

Last year, Enbridge posted its 30th straight annual raise, bumping the quarterly dividend by 3% to C$0.9425.

This kind of consistency as a rare find. Many TSX companies talk a big game about stable payouts, but few can back it up for three decades straight.

Enbridge’s appeal lies in its sustainable approach.

The company targets a payout ratio between 60% and 70% of distributable cash flow (DCF). This range isn’t arbitrary, it’s designed to leave a cushion for reinvestment, debt repayment, and shocks from unexpected market turns. At this point in time, the dividend makes up around 67% of distributable cash flows, so it’s well covered.

Even with higher spending on major projects and the C$26 billion capital program, management says cash flow should cover dividends and still leave room for growth.

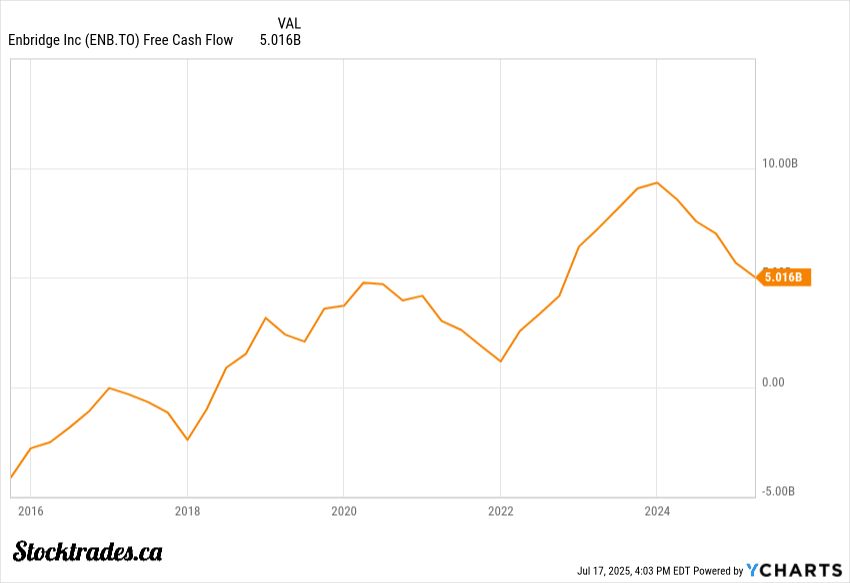

It’s also worth noting that free cash flow remains strong even as borrowing costs climb.

The company’s large-scale pipeline and utility assets keep the cash coming, helping the dividend stand up in times of market pressure. That’s the sort of resilience a lot of Canadian’s want in their portfolios.

If you’re looking for income and potentially a little bit of growth, Enbridge continues to pull its weight.

$19–20B EBITDA and $5.50–5.90 DCF. Are 2025 Targets on Track?

Enbridge expects 2025 adjusted EBITDA in the $19.4 billion to $20 billion range, with distributable cash flow per share between $5.50 and $5.90.

These are ambitious targets, but after seeing the Q1 numbers, I see reasons to be optimistic.

In the first quarter, Enbridge delivered an 18% jump in adjusted EBITDA and a 9% increase in DCF versus last year. These are not small beats, they’re pretty notable.

Given this start and considering the company’s recent U.S. gas utility deals closing, I think they’re realistically setting up to hit at least the midpoint of their guidance, possibly the high end if everything lines up.

In terms of valuation, if Enbridge lands toward the top of this DCF range, the stock’s forward yield becomes hard to ignore. Not just for income-focused investors but also for anyone looking to see outsized returns.

The business mix, pipeline, gas, western Canadian oil, is firing on all cylinders right now, even with oil in the tank price wise.

Mainline & Gas Utilities Backlog: $3B Added This Quarter

When I look at Enbridge’s latest quarter, what jumps out at me is the $3 billion surge in secured projects, mostly for the Mainline and gas utilities.

In particular, $2 billion is specifically earmarked for expanding the core Mainline pipeline. That’s not just maintenance capital, it’s growth money.

Here’s a quick breakdown:

| Project Type | Capital Allocation | Timeline |

|---|---|---|

| Mainline Pipeline Growth | $2 billion | 2025-2027 |

| Gas Utility Expansion | $1 billion | 2025-2028 |

These secured projects feed directly into the company’s backlog, which already boasts a solid track record for delivering new capacity on schedule.

Why does this matter for investors like me? Bigger pipeline capacity means more toll revenue, which should support steady dividend growth, even if oil demand shifts or energy policy becomes more strict.

Enbridge has already shown with recent results that higher Mainline use can drive impressive profits. For example, Mainline volumes ran at record levels and were a key reason for a strong profit jump this year.

I see sustained investment in utility and pipeline growth as a clear sign of management’s conviction. They aren’t just defending market share; they’re actively pushing to grow it.

Debt at $100B~. Is Leverage Falling or Becoming Risky?

Enbridge’s debt load hovers near $100B. That’s not chump change. But it tells only half the story unless you look closer at how leverage has shifted.

A key metric here is net debt to EBITDA. In 2020, Enbridge sat at about 5.2×. Definitely on the high side for a major pipeline operator. Today, it’s dipped to roughly 4.5×. Lower, but far from conservative.

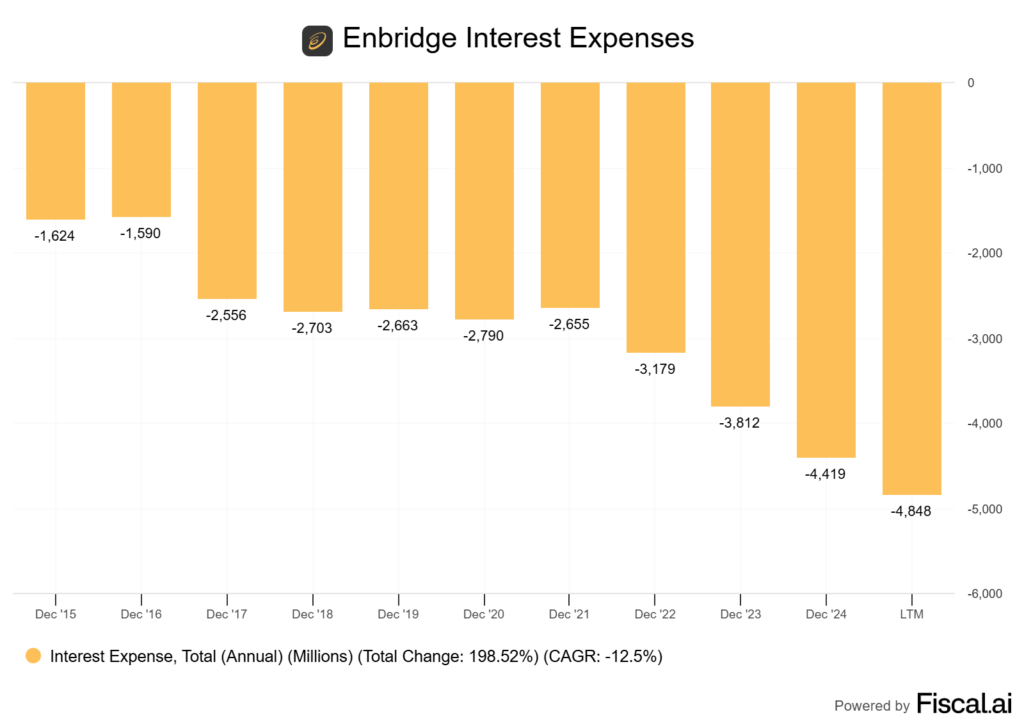

Rising rates make every turn of the debt wheel bite a bit harder.

I place a lot of weight on credit ratings, and Enbridge still largely defends its BBB+ status. We can compare this to another stock like BCE, which is heavily in debt, but its rating is near junk status.

That stamp is essential for pension funds and RRSP investors hunting for “blue-chip” reliability. If that slips, funding gets pricier and volatility can rise fast.

About 10% of the company’s debt is floating rate. That means Enbridge is not fully shielded from spikes in borrowing costs, but also not extremely exposed. Make no mistake about it though, debt is costing this company more. Look to the chart below of its interest expenses.

If oil and gas flows drop or market conditions sour, high leverage can move from a manageable issue to a real threat.

That’s when payout ratios, dividend safety, and the company’s management team come into play. Investors with long memories of energy cycles should watch this space carefully.

Transition Moves: Renewable Energy Gains vs. Greenwashing Concerns

Enbridge has been talking up its shift toward renewables for a while now. To be fair, the company is building a real portfolio.

I’ve watched as they invest in solar farms, wind projects, and even some geothermal, which is more than just window dressing. These aren’t small pilot projects, either.

Enbridge now claims one of the largest renewable capacity footprints on the TSX. Their stated goal is to reach net-zero emissions by 2050.

On paper, that matches what a lot of big global energy companies are promising. Here’s a quick look at their renewable asset portfolio:

| Renewable Asset | Location | Type | Status |

|---|---|---|---|

| Solar | Canada & U.S. | Utility-scale | Operational |

| Wind | Atlantic Canada, Europe | Offshore/onshore | Active, Expanding |

| Geothermal | Pilot in U.S. | Deep geothermal | Early stage |

That’s all well and good, except for one thing that nags at me. There’s growing scrutiny over how energy giants like Enbridge use sustainability-linked loans and finance new projects.

The issue? These loans often lack strict reporting standards. Without transparency and accountability, it’s easier for a company to make big ESG claims that don’t always hold up under closer inspection.

I’ve seen the term “greenwashing” tossed around by investors and media. According to research and recent reports, some critics believe that Enbridge’s sustainability-linked financing doesn’t go far enough to guarantee actual progress on emissions cuts.

I want to see hard numbers, third-party data, and clear targets. Otherwise, the risk of greenwashing is real.

However, a lot of this is still under investigation, so I’ll reserve most of my thoughts until something definitive comes out.

Until then, the company is a blue-chip powerhouse, and one a lot of Canadians will enjoy holding in their portfolios.