Is This Blue-Chip Canadian Dividend Growth Stock Still a Buy?

Key takeaways

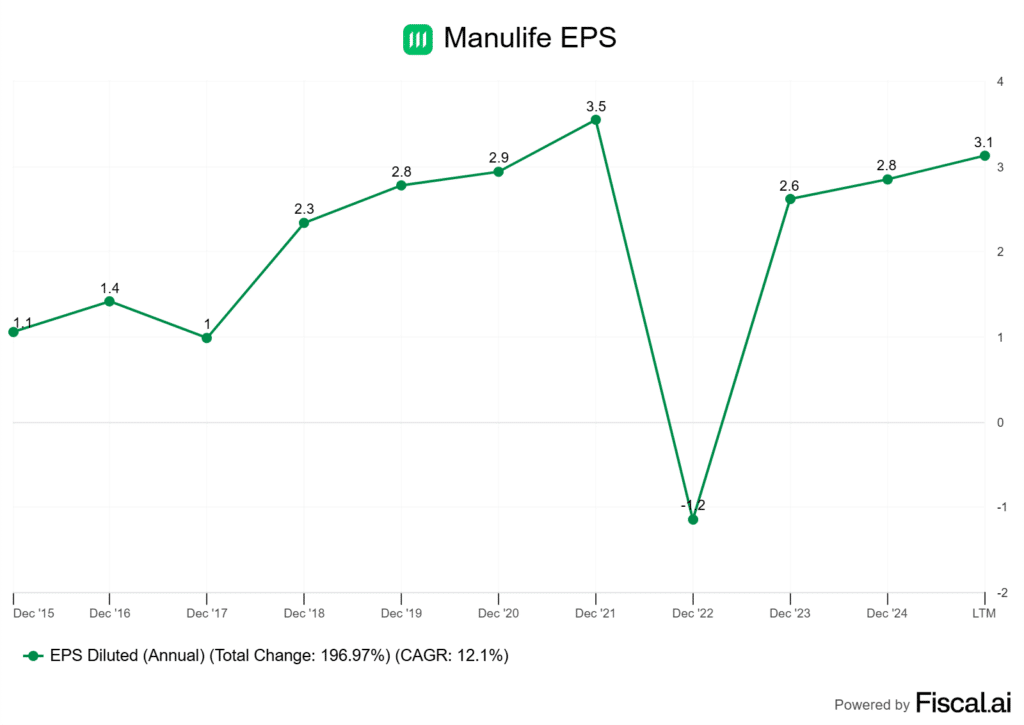

Earnings and capital returns show steady progress

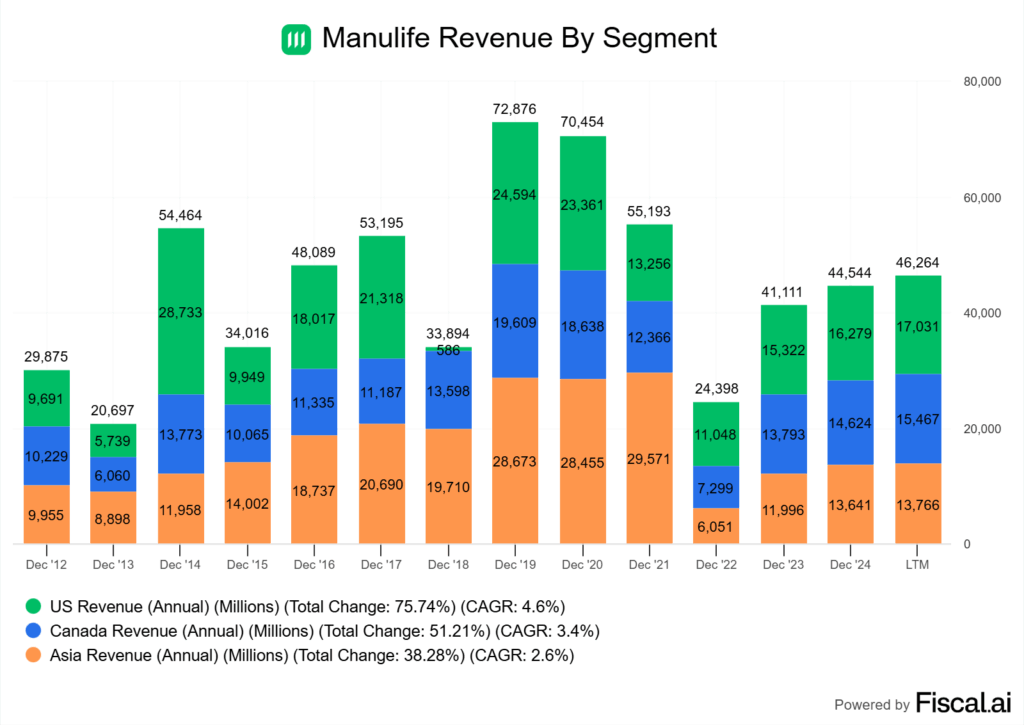

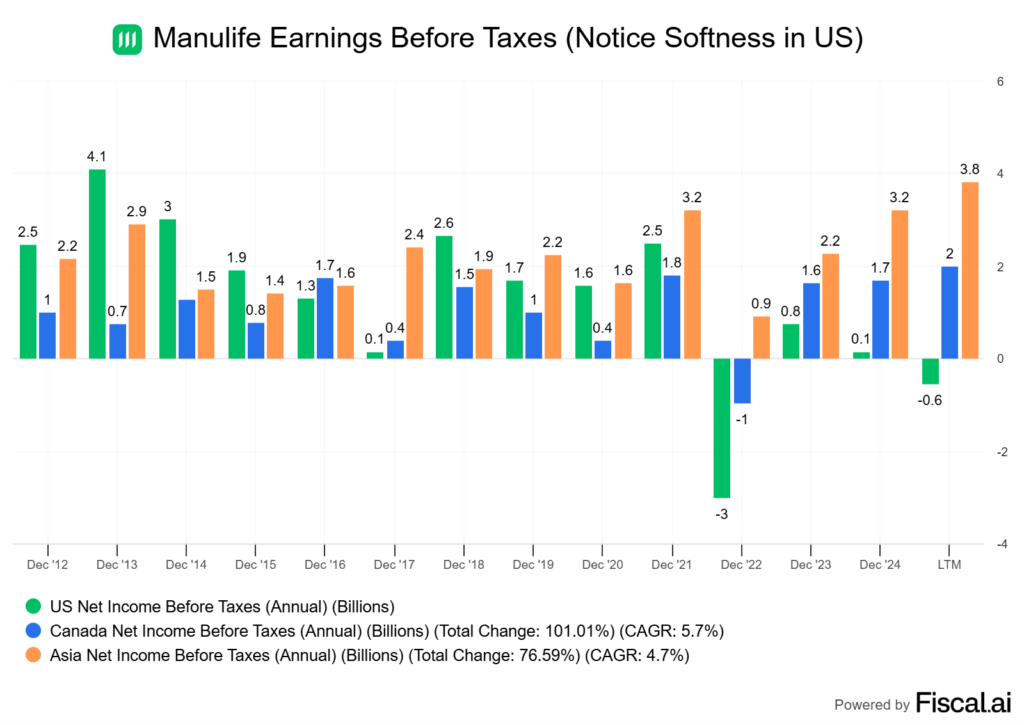

Growth in Asia offsets weaker U.S. results

Dividend strength and buybacks support long-term value

3 stocks I like better than Manulife FinancialYou don’t have to look far to see why Manulife sparks debate.

Some investors see a slow-moving insurance giant, while others see a dividend-paying machine still trading at a discount despite a large runup in price.

I sold my Manulife shares 3 years ago because of persistent underperformance operationally. However, I see a company that’s cleaned up its balance sheet, maintained a relatively stable dividend, and bought shares back at the right time. Look at its run since 2022. It has really turned things around.

The business mix shows strength in Asia, steady results in Canada, and some volatility in the U.S. This is similar to a company like Sunlife Financial, which is struggling south of the border, but Manulife’s diversity has definitely helped it.

In this article, I’ll dig into my overall thoughts on Manulife and whether or not I believe there is still value at these prices.

Q2 2025 earnings

Manulife’s second quarter numbers give me a mixed picture. Core earnings came in around $1.7 billion (down 2% CER) while net income hit about $1.8 billion.

That gap matters because it shows accounting gains propping up the headline number, while the recurring core business dipped slightly. At the per-share level, core EPS reached $0.95.

It’s not a blowout, but it’s steady growth in a quarter where credit loss provisions moved higher. Even the big insurers aren’t immune to the Bank of Canada’s tighter rate environment and the ripple effects on credit quality.

The capital position remains strong with a LICAT ratio of 136%, well above regulatory minimums. That’s a reassuring cushion, especially if we see more volatility in credit markets or equity valuations that feed into insurers’ balance sheets.

Flows were softer than I’d like, though still positive. Global WAM net inflows of about $0.9 billion show that money is coming in, but not at the pace we saw in past quarters.

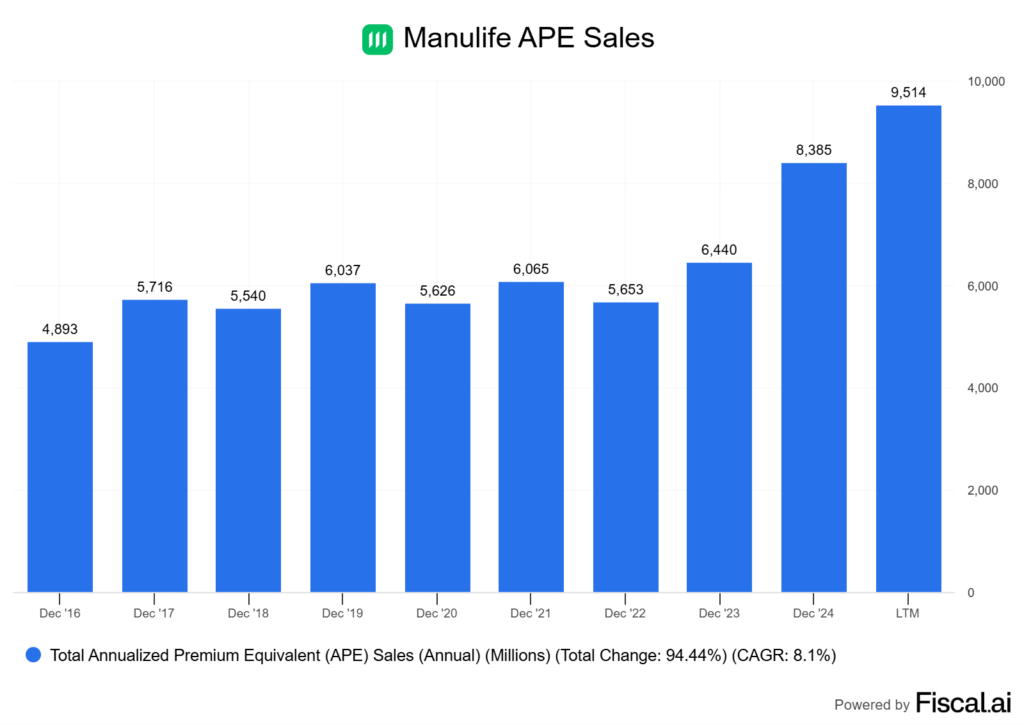

For investors that matters because asset managers like Manulife benefit most when markets are rising and investors are confident. One bright spot I can’t ignore is insurance sales.

APE grew 15% and NBV jumped 20%, pointing to strong demand in Asia and other growth markets. That’s the kind of driver that can offset short-term noise in credit or capital markets, and it’s where I see the longer-term upside in the stock.

Asia strength, U.S. volatility, Canada steady

When I look at Manulife’s segment mix, Asia stands out as the clear growth driver. Core earnings in the region hit US$520 million, up 13% year over year, powered by strong momentum in both annualized premium equivalent (APE) sales and new business value (NBV).

The company is capturing long-term demand for protection and savings products across key Asian markets. The U.S. is a different story, however.

Core earnings there dropped 53%, weighed down by elevated mortality claims and higher credit provisions. That kind of volatility is hard to ignore, however it has done a good job offsetting this weakness with strength in other areas.

I don’t see this as a structural weakness, but it does highlight why I wouldn’t rely on the U.S. arm to drive consistent growth. Canada, by comparison, delivered low single-digit growth in core earnings.

It’s not flashy, but it’s steady. They need the US side of the business to pick up the pace. If it does, it will have virtually every segment of the business firing on all cylinders.

Dividend, buybacks, and leverage

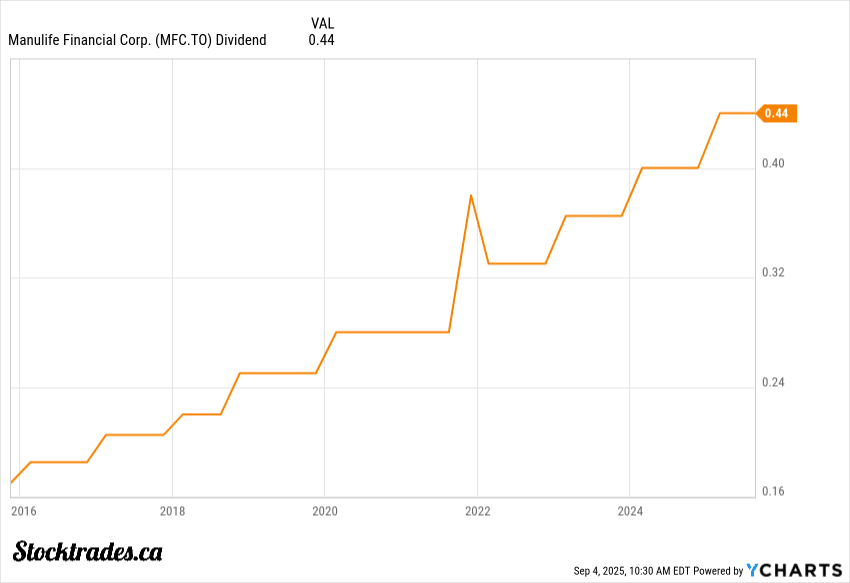

Manulife continues to impress me on the shareholder return front. The quarterly common dividend sits at C$0.44 per share, more than doubling over the last 10 years.

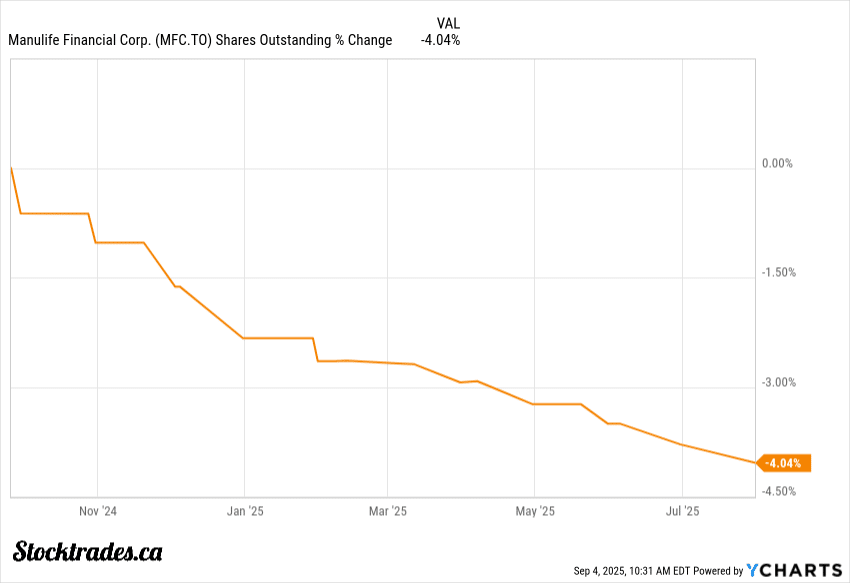

On top of dividends, the company has already repurchased about C$1.1 billion of common shares year-to-date. Over the last year, it has repurchased a whopping 4% of shares outstanding.

The balance sheet looks sturdy. Manulife reported a financial leverage ratio of 23.6%, well below its 25% target, and a group LICAT ratio of 136%.

That means plenty of flexibility to keep rewarding shareholders while still protecting against market or rate shocks. The company has also been very good at managing expenses.

Core expenses fell 3% year-over-year, which frees up capital for both reinvestment and returns. Too many financials let costs creep higher, but Manulife has kept a tight lid, and that discipline is showing up in its ability to fund growth without stretching the balance sheet, which as ultimately led to outsized returns in terms of share price.

The company’s acquisition of Comvest is big

I see Manulife leaning hard into two levers that matter most for long-term shareholders: growing fee-based income and reducing exposure to legacy insurance risks.

Both moves should support steadier earnings and a cleaner balance sheet, which is exactly what you want from a blue-chip dividend payer.

The agreement to acquire 75% of Comvest Credit Partners for US$937.5M is a big step. By combining Comvest with Manulife’s existing senior credit team, they’ll create a roughly US$18.4B private-credit platform. Unless you’ve been living under a rock, you’ll know that private-credit is exploding in popularity.

Management expects it to be immediately accretive to core EPS and ROE, while trimming the LICAT ratio by less than 3 percentage points. If this deal ends up going through at the end of 2025, it could be a meaningful one.

This deal matters because fee income from private credit is less sensitive to interest rate swings than traditional spread-based insurance earnings. It helps diversify revenue beyond the usual rate-driven cycles.

That’s another smart de-risking move. It frees up capital and reduces exposure to liabilities that have weighed on the stock’s valuation for years. Some would even say since the financial crisis of 2008.

Manulife’s strategy is clear. Build scalable, fee-driven businesses while offloading the old baggage. For me, that’s a disciplined way to support dividend growth and keep the balance sheet strong enough to weather volatility.

Risks to look out for

I keep a close eye on U.S. life claims. They can swing results more than investors expect. Higher-than-normal claims hit earnings directly. That kind of pressure can tighten up capital ratios fast. For a company like Manulife, that also means less flexibility on share buybacks in the short term.

Credit quality is another lever. Manulife has already strengthened expected credit loss (ECL) provisions, which tells me management is bracing for some stress. If defaults rise or spreads widen, provisions could climb again. That would pull down reported profit and dampen capital available for dividends or buybacks.

Market and rate sensitivity matter too. Fee income from wealth and asset management depends on asset values.

The Bank of Canada’s rate policy feeds into both bond yields and investor behaviour. A sudden shift in rates or equity markets can create real volatility in quarterly results.

Alternative long-duration assets (ALDA) like real estate and private equity add another wrinkle. These marks can boost or drag on results depending on valuations.

But honestly, they don’t always reflect long-term fundamentals. That makes the earnings line noisier than many retail investors might expect.

Finally, I see execution risk in integrating Comvest. Any stumble on systems, culture, or client retention could slow the expected benefits.

Integration costs and delays would flow through to core earnings. That hits the pace of capital return.

Overall, these businesses are very complex. Very few shareholders actually understand them entirely. If you’re looking to buy the company, don’t just do it for a growing dividend or an increasing share price. Dig deep and understand the pros/cons of the actual business.

My take on Manulife Financial Corporation

I see Manulife as one of the few Canadian financial names that gives investors both growth and income without forcing a trade-off.

The stock’s 4% dividend yield comes with a payout ratio in the 35–45% range. This is sustainable, especially since free cash flow is continually increasing. In fact, the company has ample room to continue to grow the dividend at a double digit pace.

What stands out most is the company’s Asia business. It could soon make up half of core earnings, which is pretty wild for a Canadian name.

That kind of diversification beyond Canada’s slower-growth market is rare. The expanding Global Wealth and Asset Management arm really adds another layer, Manulife is more than just a traditional insurer, despite often being labelled one.

Yes, the stock will face noise from markets, claims, and credit cycles. But I’m comfortable with that trade-off.

For those who are looking for slower growing blue-chip options with ample room to grow the dividend, this one might be right down your alley. For me, it doesn’t fit the overall structure of my portfolio. I prefer P&C insurance companies like Intact. But that does not mean it’s a bad company whatsoever.