Is Shopify Stock a Buy After a 20% Runup Post-Earnings?

Key takeaways

Shopify’s growth is strong but comes with high expectations

New AI tools and global clients are boosting its edge

Valuation risk means investors should tread carefully

3 stocks I like better than Shopify.With blockbuster revenue gains, a bold move into artificial intelligence, and a bigger presence outside North America, Shopify doesn’t look like a one-trick Canadian tech darling anymore.

Right now, I think Shopify deserves a spot on serious investors’ watchlists. Whether it’s a buy? That depends on your risk tolerance and how long you’re willing to wait things out. a 20%~ jump after earnings certainly makes it tricky to take a position now. But there are a lot of promising things happening here.

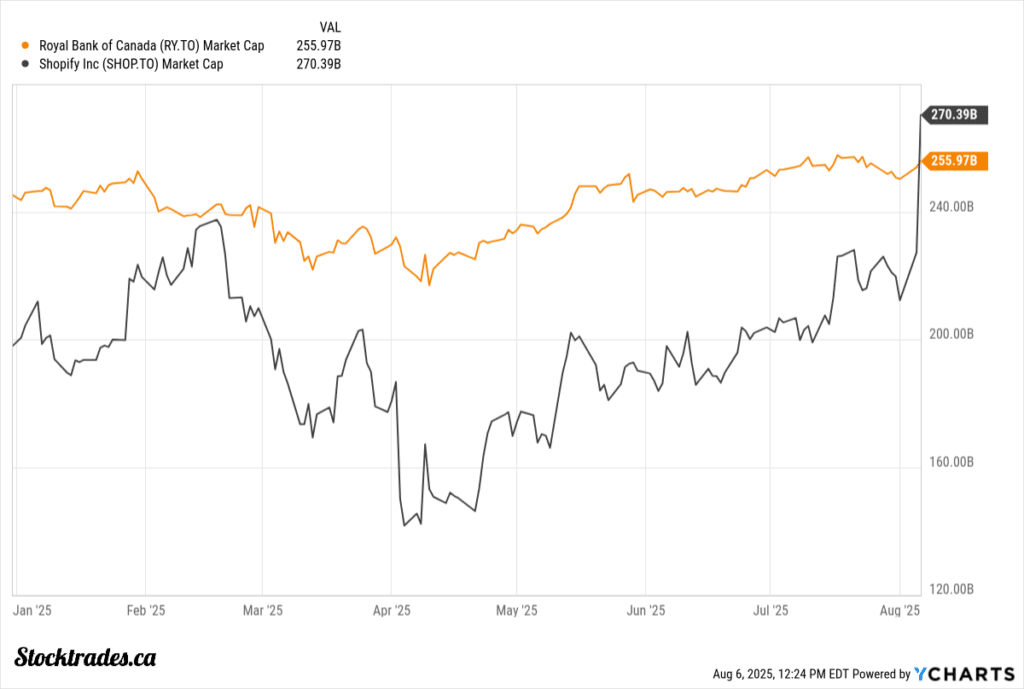

The company has posted double-digit revenue growth, signed deals with global brands, and rolled out AI features to give merchants an edge. It has now reclaimed the title of the largest company in Canada, outpacing top Canadian bank stock Royal Bank.

But let’s be honest. With high valuations and big expectations already baked into the price, there’s real risk if Shopify slows down or stumbles.

Let’s dig into the company.

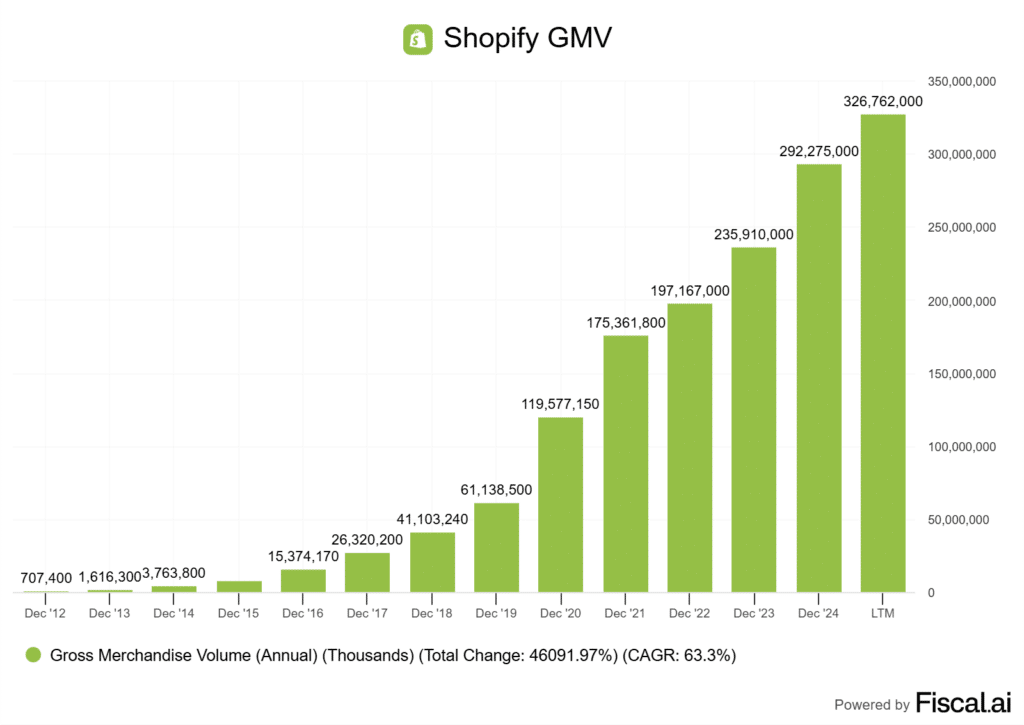

31% Revenue Growth and 30% GMV Surge. Fundamentals Are Catching Up

Shopify’s Q2 2025 results were outstanding. Revenue hit $2.68 billion, up 31% year-over-year, while Gross Merchandise Volume (GMV) soared to $87.84 billion, a 30% jump over the same period in 2024.

Those aren’t just good numbers, they’re jaw-dropping nummbers.

Here’s a quick breakdown of where the growth is coming from:

| Business Area | Q2 2025 YoY Growth |

|---|---|

| Merchant Solutions | 34 % |

| Subscription Revenue | 20 % |

| Total Revenue | 31 % |

Merchant solutions are the workhorse here. More merchants are using Shopify Payments, Capital, and shipping services, and these take-rates keep climbing.

To me, that means Shopify isn’t just adding new merchants, it’s getting existing merchants to do more business through the platform with game-changing tools. Subscription fees are rising too, though a bit slower.

Some folks might want to chalk up the recent acceleration to e-commerce tailwinds. That’s not the whole story.

The steady increase in merchant adoption and the outsized growth in merchant solutions point to a real shift in how businesses are using Shopify to scale, both locally and globally.

This is different than Shopify’s 2021 run, in which many merchants were simply using their platform because their brick and mortar business was in lockdown. This looks to be a permanent shift.

AI Integration and ‘Shopify Magic’ Makes for a Competitive Moat

When I see Shopify’s recent AI push, “moat” is honestly the first word that comes to my mind. Shopify Magic isn’t just a flashy add-on, it lets merchants automate everything from product descriptions and discount codes to building entire storefronts with just a few prompts.

That’s a huge time-saver, especially on a platform where every minute can mean another sale. If you can save retailers a bit of time, especially for a relatively small subscription cost, you gain a sticky customer base.

| Feature | Benefit for Merchants |

|---|---|

| Product description generator | Creates unique listings quickly |

| Automated discount creation | Responds fast to consumer sentiment and market changes |

| AI-powered Store Builder | Launches full stores from scratch |

| Email & content automation | Keeps customers engaged effortlessly |

The best part? These tools are built right into the Shopify dashboard. No steep learning curve, no extra software to mess around with.

I’ve seen plenty of small businesses, especially new ones, using Shopify Magic to compete with heavy hitters. They can create polished storefronts and run targeted marketing campaigns without big budgets or big tech teams.

This kind of tool levels the playing field in markets where global giants used to dominate. Retention and platform stickiness matter, and these AI tools make it harder for merchants to leave for a rival platform.

More merchants are choosing to stay and grow within Shopify’s ecosystem, primarily because Shopify is creating amazing tools to increase retention, which means stronger recurring revenue and a bigger moat.

International & Enterprise Growth

Shopify’s ambition to be more than a North American e-commerce platform is what is fueling a lot of its growth right now. Initially, 10 or so years ago, the company attempted (and succeeded) in planting its roots in North America. Now, it’s utilizing its popularity here to expand internationally.

In Q2, merchant growth in Europe stood out, with gross merchandise volume (GMV) growing around 42 percent. This clearly shows that consumers and businesses overseas are embracing Shopify.

The calibre of enterprise clients signing on lately is impressive. When names like Starbucks join, it tells me Shopify’s tools are mature enough for global brands, not just scrappy Canadian start-ups and small businesses.

Shopify isn’t just launching in new countries; it’s investing in local payment methods, multi-currency support, and foreign-language features.

If you’re running a business and want to scale abroad, you need seamless tax, shipping, and compliance in every country. The network effect is becoming a real moat here. As more international merchants join, Shopify learns what works in each region. That’s a feedback loop traditional POS vendors can only dream about.

International GMV is now a key driver of Shopify’s top-line growth, and will be for the foreseeable future.

Why U.S. Trade Jitters Haven’t Hurt Shopify

I’ve watched investors worry about U.S. tariffs for months now, but Shopify has mostly sidestepped the drama. When the latest wave of American tariff threats made headlines, many expected Shopify to take a serious hit.

The numbers tell a different story. Shopify’s global reach keeps it insulated. Only about 1% of its total GMV is tied to goods coming from China, so the vast majority of Shopify merchants operate outside high-tariff risk zones.

Even when U.S. policies rattled global supply chains, Shopify’s Q2 results showed steady demand and healthy volumes. This low exposure to tariff-targeted regions reflects Shopify’s merchant diversity.

Sellers on the platform aren’t tied to one country or product source. Many build their own brands, offer digital products, or use local suppliers. So, when politicians ramp up rhetoric on tariffs, Shopify’s ecosystem just keeps rolling.

With trade policy headlines driving short-term panic, investors should see opportunity. The company has shown it can handle outside shocks, a point highlighted by market analysts who noted that any hit to Shopify’s annual GMV from tariffs would be less than 5%.

Is the Growth Priced In?

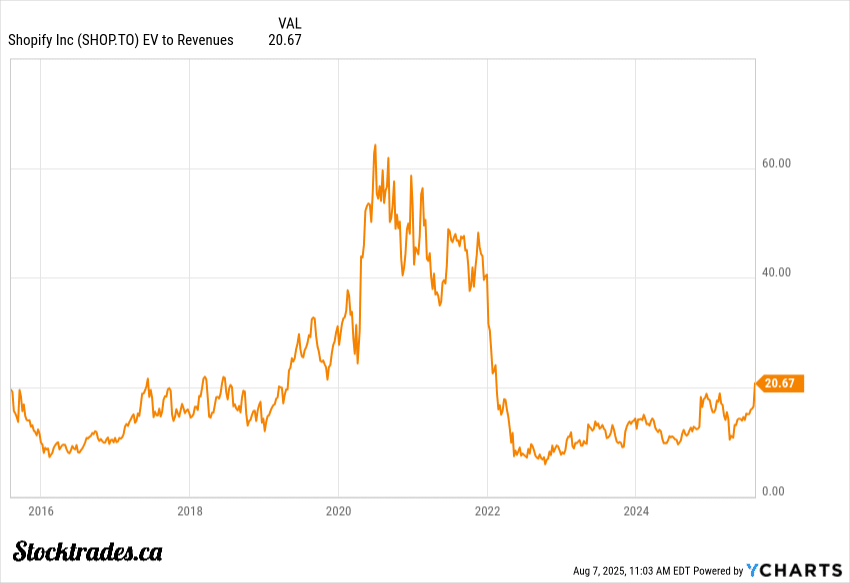

When I look at Shopify’s valuations, it’s obvious investors are paying a premium for rapid expansion. The stock price is hovering near record highs, however for those who are thinking this is a 2021 situation, it’s not the same.

During the runup in 2021, Shopify got to nosebleed valuations in the range of 60x EV/Sales. Now that it is back to its 2021 price, people believe it is that expensive yet again. However, the company is only trading at 20x EV/Sales, a much more appropriate valuation for a high growth technology company.

Yes, it is still “expensive” at this point, but it is within reason, and manageable if the company can continue to grow at a 30%~ pace and maintain 16% free cash flow margins.

Gross profit jumped 24% year-over-year, and management says margin expansion has been steady for six quarters now. That’s impressive, especially since they haven’t had to rely on aggressive cost-cutting to maintain merchants during an economic slowdown.

Still, the big question is whether growth levers like increased merchant subscriptions, new AI features, and further international rollouts can keep up with the market’s high expectations.

Personally, I want to see proof that new markets and AI monetization can deliver real gains, not just maintain what’s already priced in. Any stumble could hit the share price hard, considering how much future growth investors have already factored in.

However, if you can ride out the potential waves with this one over the long-term, there is still plenty of room for upside here. Growth is priced in, but there is a good chance the company can continue to deliver.

My Verdict on Shopify

Shopify’s numbers are impressive, zero doubt. The stock price can feel steep given current profits, but the growth story is very much in tact here.

Shopify one shows more consistency than most Canadian tech options, but the valuation is still a big question for new buyers.

Let me break down why I still see Shopify as a buy, albeit a cautious one at these valuations. The company holds a strong place in e-commerce, both at home and globally. Its software helps all sizes of businesses, so revenue streams feel a bit more steady, and a lot “stickier” due to the time it saves for many businesses.

Subscriptions and merchant services are both growing at double digits. That makes me optimistic the company can keep growing its top line, even if the pace slows.

However, there are no doubt risks. Valuation remains high, with shares trading near all-time highs. If we see a continued weakening in the economy, Shopify’s customers may tighten up. It hasn’t happened yet, but that is not to say it couldn’t happen.

The company looks built for long-term growth, provided you’re not expecting quick wins.