This Blue-Chip Canadian Stock Is Crushing It – Is It Too Expensive Today?

Key takeaways

Strong recurring revenues and disciplined management support steady performance

The stock’s high valuation means growth must continue at an aggressive pace

Thomson Reuters could still be a solid long-term hold, but the upside looks limited at today’s price

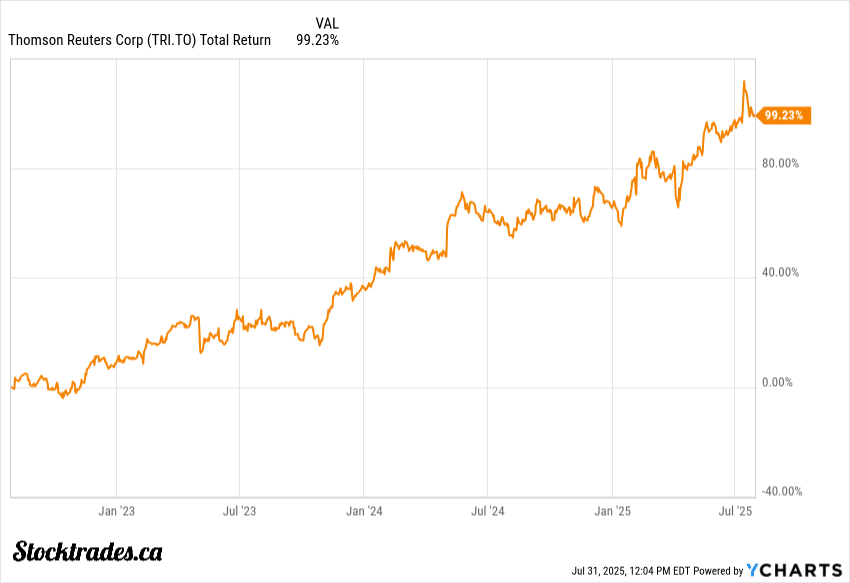

3 stocks I like better than Thomson Reuters right now.Every investor wants to find that sweet spot: a stock that feels expensive but keeps paying up year after year. Thomson Reuters has quietly doubled over the past few years and built a reputation for being one of the best stocks to buy in the country.

With AI shaking up every sector and Thomson Reuters making big moves in this space, I see a lot of investors asking if now is the right time to buy, or if the price already reflects the future.

Funny enough, I had investors ask me that three years ago, and it’s gone on to double in price.

At current share prices, I don’t see Thomson Reuters as a screaming buy. However, it’s still a very interesting option.

The company is delivering on organic growth and big capital deployment, but the shares trade at a premium that demands perfect execution from here.

I’ve watched a lot of Canadian blue chips chase premium valuations; some reward patient investors, but others hit a plateau once the easy wins are priced in. If you’re eyeing the stock, it’s worth taking a closer look at the recurring revenue, capital discipline, and whether management can really deliver growth from the recent bets on AI and acquisitions.

Fortunately, I’m going to dig into all that for you.

Is the AI Push Paying Off?

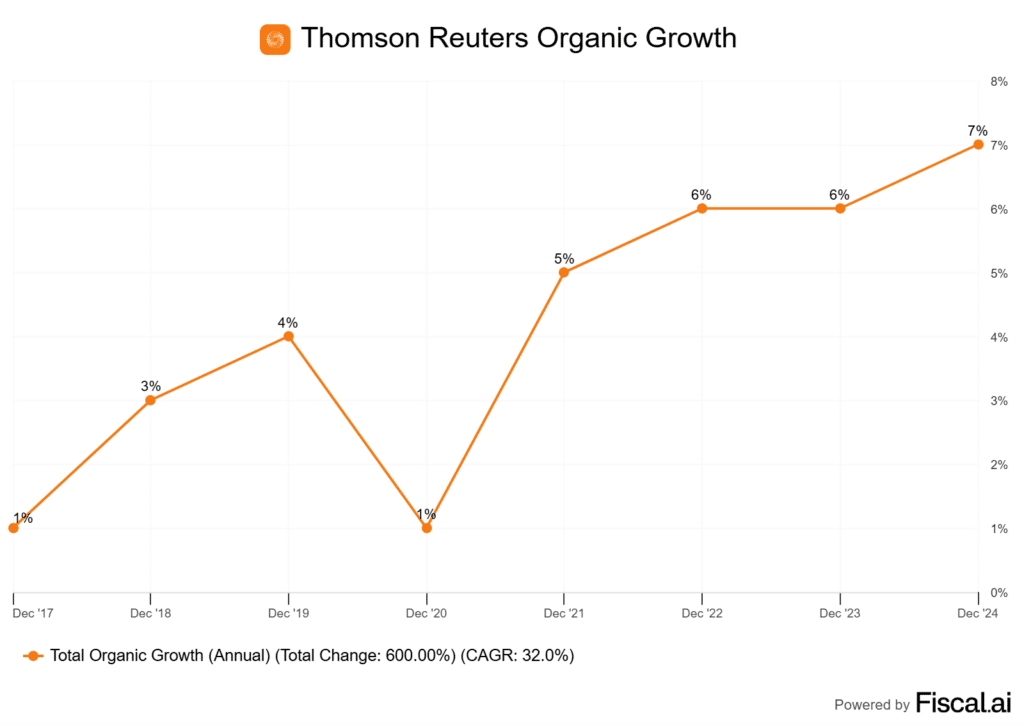

Thomson Reuters is not sitting on its hands. Management is guiding for organic revenue growth of 7–7.5 percent in 2025 and bumping up its estimates to 7.5–8 percent in 2026. As you can tell by the chart below, this would be above typical numbers.

What’s driving it?

AI-powered tools are finally breaking through in the professional services world. Early launches like CoCounsel Tax & Audit are steadily gaining traction among legal and tax professionals in Canada and the US.

I’ve discussed artificial intelligence with my accountant quite a bit, and his opinion on the overall risk. He sees AI augmenting (not replacing) their work, especially on routine tax prep and document review.

Recent acquisitions like SafeSend and Materia are another lever. Integrating these platforms gives Thomson Reuters a broader product stack, especially for small and mid-sized firms. The more it can appeal to a wider suite of businesses, the better.

The addressable market looks more defensive and less cyclical, as legal, tax, and compliance work rarely gets put on hold, even during Bank of Canada tightening cycles.

Here is a table highlighting the company’s projected organic growth. You will notice one thing: the numbers keep ticking upwards.

| Year | Projected Growth (%) |

|---|---|

| 2023 | 6.2 |

| 2025 (guidance) | 7–7.5 |

| 2026 (guidance) | 7.5–8 |

If Thomson Reuters can keep cross-selling new solutions and actually deepen adoption, the underlying business looks set to benefit for several years.

A Margin Engine With Traction

If there’s one thing that sets Thomson Reuters apart, it’s the power of its subscription-first business. We do not really have many of these companies in Canada. You’ll find most south of the border.

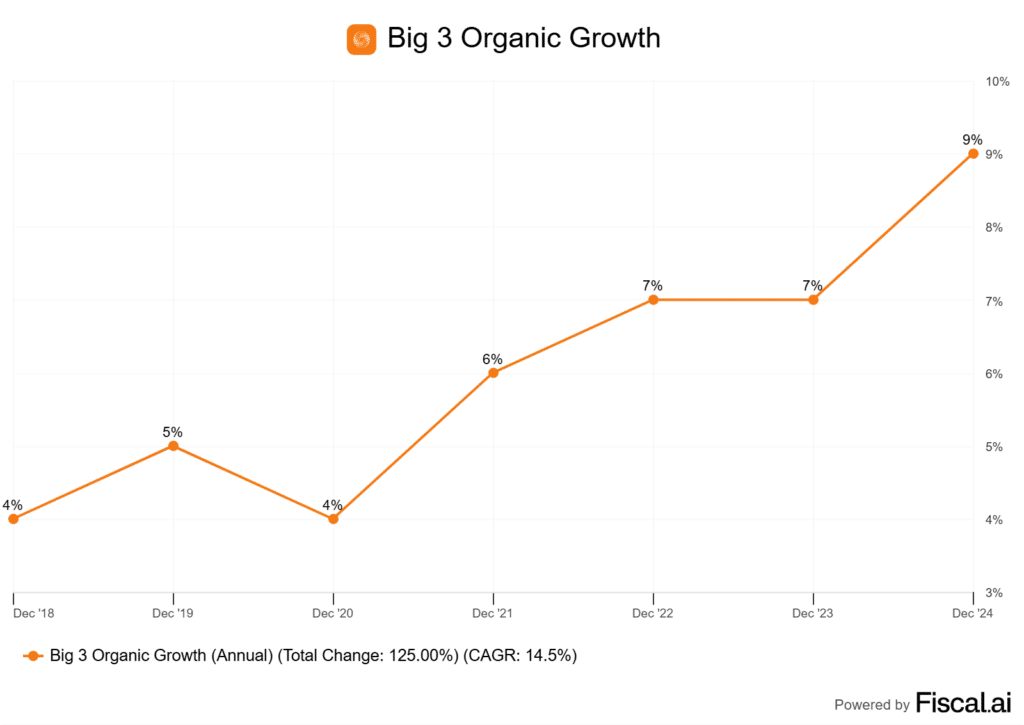

The bulk of revenue comes straight from recurring, contractual agreements in legal, corporate, and tax & accounting—its “Big 3.” It even allocates a specific organic growth rate to these Big 3, which is growing faster than its other products.

When cash flows show up on schedule and are recurring, it’s easier for management to forecast, invest, and return capital. That’s why you’ll find Thomson Reuters targeting free cash flow of $1.9 billion and adjusted EBITDA margins approaching 39% this year.

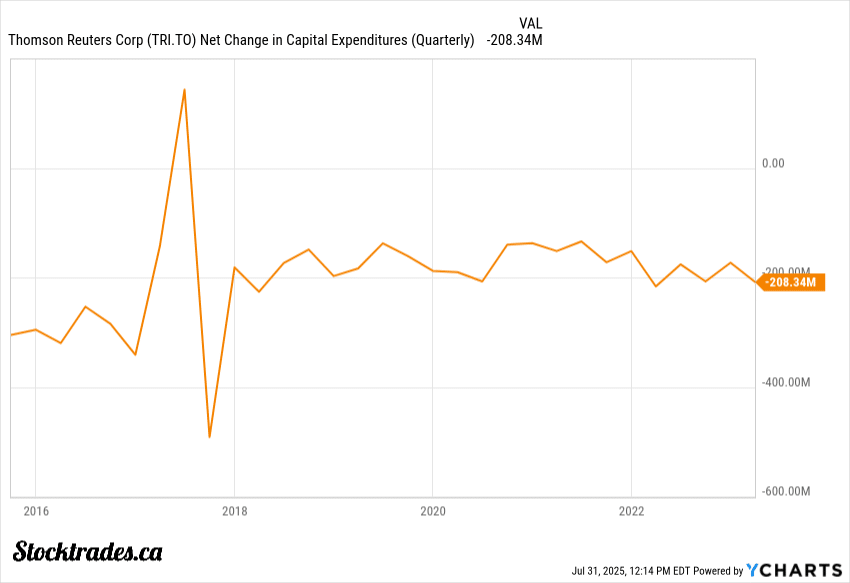

What impresses me is just how capital-light this setup is. Despite the company being worth $139B and generating $9B~ in revenue, it has just $200M~ in capital expenditures.

Most of every new dollar in sales drops straight to the bottom line, which supports long-term earnings strength. Recurring revenue also lets the company cruise through volatile markets with more resilience. This is precisely why valuations are so high.

All told, in my view, TR’s subscription engine gives it the kind of durability and operating leverage that’s rare on the TSX.

$10B to Deploy Over Two Years. Is Execution Scalable

Thomson Reuters has allocated up to $10 billion for acquisitions through 2027. The SafeSend purchase for $600 million signals they are serious about AI and automation in the tax and accounting space.

When I see a war chest this big, I always think about execution risk. It is one thing to announce a plan; it’s another to actually close strong deals that add lasting value for shareholders. However, they’ve done it for so long I have confidence.

I expect the company to keep bolstering its portfolio with niche software firms and AI-driven platforms.

But a rapid pace of deals isn’t risk-free. Integrating different tech stacks, teams, and cultures is messy work. We can look to numerous Canadian tech companies that have tried this and failed, like Lightspeed and OpenText.

Big plans can fizzle if synergies never materialize. Here is where the real test lies: can management stitch these parts together without losing the focus that made Thomson Reuters dominant in the first place.

Premium Multiple Backed by a Solid Dividend

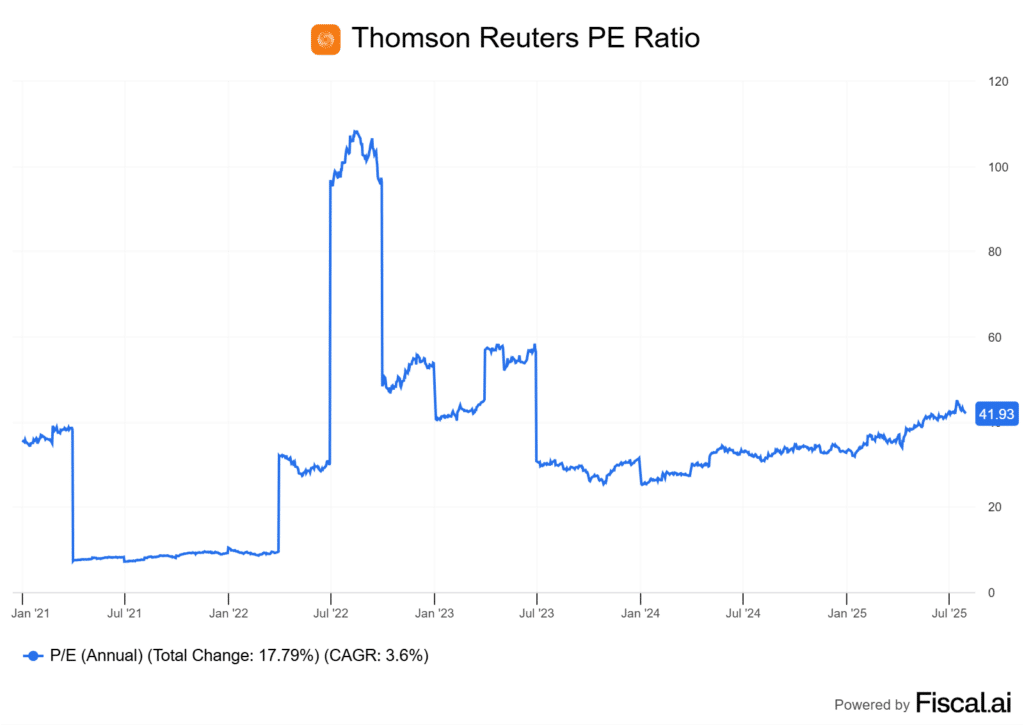

Thomson Reuters stock isn’t cheap by any measure. As of now, the shares trade at around 41x earnings.

That’s a steep price, especially when you stack it against the company’s slower growth. However, investors appreciate the subscription model of the platform and pay handsomely for it. As you can tell in the chart, they often always have.

The premium here is clear, and begs the question: is it deserved? On the cash return front, the dividend yield sits at about 1.3%. When share price has increased so much, it is relatively hard to get any sort of attractive yield. However, the dividend is well-covered, and growing.

At a projected 56%, Thomson Reuters gives up over half its earnings to shareholders. Management did boost the payout by 10% recently. Even so, this yield won’t turn heads compared to Canadian blue-chips like the banks.

At a projected 56%, Thomson Reuters gives up over half its earnings to shareholders.

Despite the high valuation, I don’t see runaway growth backing up this price tag, which is what makes me cautious. The return on equity at 18% is respectable and cash generation remains healthy, but growth rates are tepid.

Investors are paying up for consistency and reliability, not explosive expansion. But at this price, I’d watch for any stumble in their growth story. For me, this is a premium I’d only pay if you’re set on low volatility and defensive exposure.

Margins, Balance Sheet and More

I see a lot of investors talk about growth potential but overlook balance sheet and margin strength. With Thomson Reuters, I think this is a huge part of the story. They’re rock solid.

Its gross margin sits near 39 percent, with net margins around 32 percent, showing how much pricing power the company has.

The company generated about $1.9 billion in free cash flow over the last 12 months on $8.8B in revenue.

| Metric | Recent Value |

|---|---|

| Free Cash Flow | ~$1.9B |

| Gross Margin | 39% |

| Net Margin | 32% |

| CapEx as % of Revenue | ~8% |

Management keeps capital expenditures low, around 8 percent of revenue, which means more cash gets returned to shareholders via dividends or reinvested in the business via acquisitions.

The 1.3 percent yield may not look flashy, but the company does a better job of compounding capital internally. With double digit returns on invested capital, investors are better off leaving their portion of earnings with Thomson Reuters to invest.

Is the Company a Buy Right Now?

The first thing that jumps out to me is the company’s valuation. It’s trading at a price that puts it among the pricier names in Canada, especially on a EV/EBITDA basis. For me, this means there are some pretty high expectations baked into the share price.

The stock’s recent run-up makes it tough to argue for big upside from here, unless execution is perfect.

From my point of view, I see Thomson Reuters as stable, but definitely not cheap. Although the company has executed well over the last while, it’s just too expensive for me here and I don’t see much margin of safety.

If I’m honest, I’d wait for a better entry point or some kind of catalyst before loading up. But, I was wrong 3 years ago and could certainly be wrong again.