Is Waste Connections (TSE:WCN) The Perfect Defensive Stock?

Having a good foundation can help investors navigate market volatility. Investing in strong and consistent blue-chip Canadian stocks can also lead to outsized returns.

The trick to finding foundational stocks is to find those with a strong moat.

What is a strong moat when looking at stocks to buy?

What is a moat? Simply put, a moat is a sustainable competitive advantage. Often, a company with a high moat is one that offers a product or service that is not easily replicable, or the business operates in an industry with high barriers to entry.

One good example that doesn’t get nearly enough attention is the waste management industry. There are few publicly traded companies that operate in the space and the market is dominated by a handful of key players.

What does Waste Connections (TSX:WCN) do?

One of which is Waste Connections (TSE:WCN). Waste Connections is the third largest solid wasted company in North America, and the largest in Canada. It has delivered 17 consecutive years of positive shareholder returns and for people buying stocks this company has been an excellent one to own.

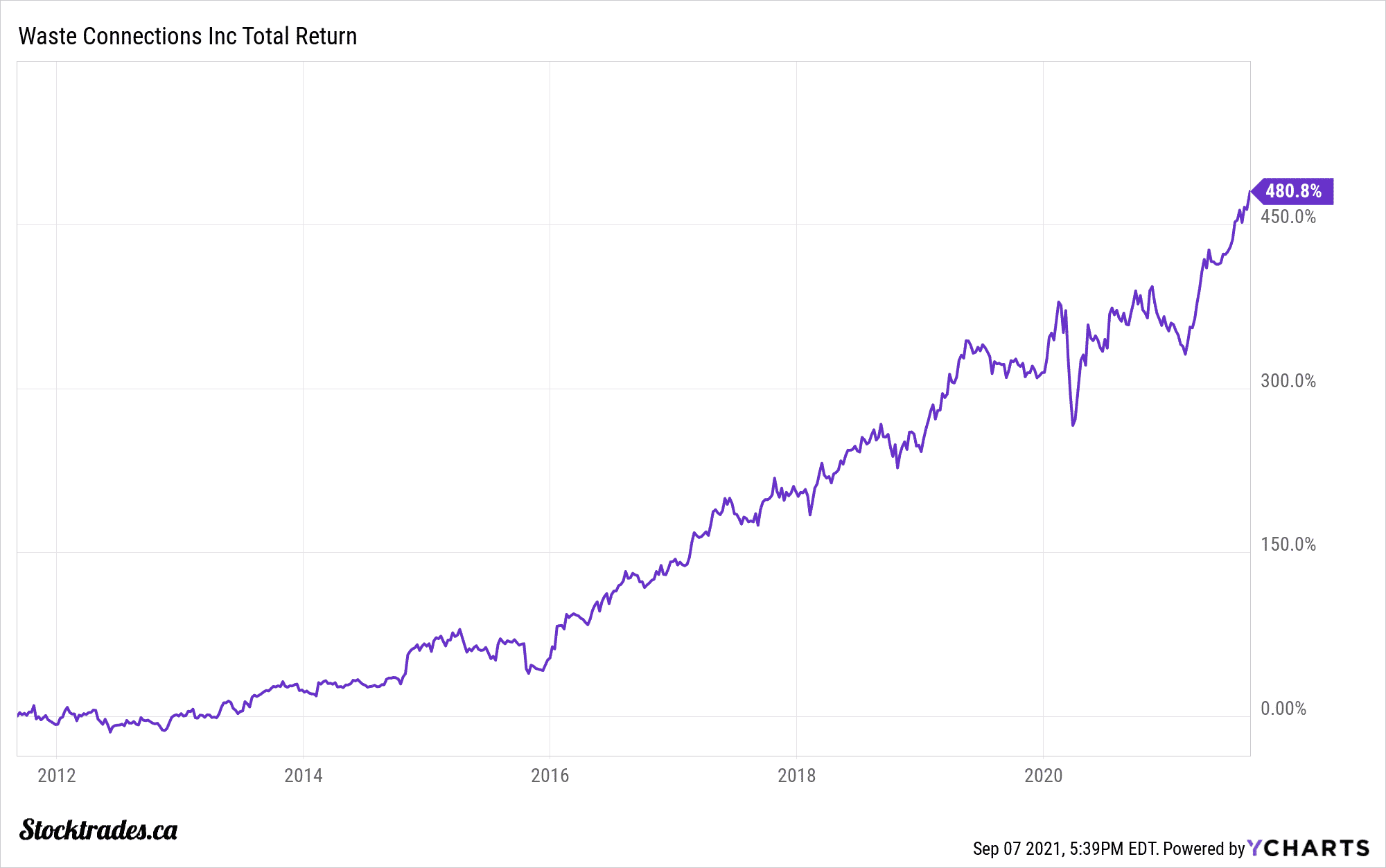

Over the past decade, the stock has delivered total returns of 480% and $10,000 invested would be worth $58,080 today. That is equal to a compound annual growth rate of 19.23%. Investors would be hard pressed to find that kind of return from other blue chip stocks.

Performance excellence in this Canadian stock

Waste Connections performance has been nothing short of impressive. Strong share price appreciation has been supported by consistent growth. Over the past five years, this leading waste management company has averaged 21% and 18% annual revenue and free cash flow growth.

Free cash flow which has supported a growing dividend. Waste Connections is a Canadian Dividend Aristocrat with an 11-year dividend growth streak. Over this time, it has averaged double-digit dividend growth. The company’s last raise came last October when it announced a 10% bump. Waste Connections has a stable track record and as such, investors can expect the company to extend the dividend growth streak to 12 years this coming fall.

Given the company’s strong performance through the first six month of the year, investors are likely looking at another double-digit raise. In the company’s last quarterly update, management increased full year Fiscal 2021 outlook for revenue, EBITDA, and free cash flow.

What are analyst expectations for Waste Connections (TSX:WCN)

Looking forward, Waste Connections is well positioned to continue delivering for investors. Already up 26.70% year to date, analysts are expecting the company to exit the year with ~10% and ~20% revenue and earnings per share growth. Beyond this year, expectations are for high single-digit and mid-teen revenue and earnings growth through 2023. Keep in mind, estimates consider organic growth and don’t account for any potential acquisitions down the road.

Speaking of analyst expectations I am reminded of another stock, in the retail sector,analysts love this top Canadian stock. But is the upside gone?

Waste Connections (TSX:WCN) eyes mergers and acquisitions

Speaking of which, Waste Connections has been an active consolidator with more than $7.75 billion spent on mergers and acquisitions over the past five years. In 2021, it has been aggressive with above average capital deployment and in the first half of the year, the company closed on 14 acquisitions with total annualized revenue of $115M.

Overall, the company estimates that 25% of capital deployed will be targeted towards M&A over the next three years.

Potential core contender in Waste Connections (TSX:WCN)

Waste Connections is ideally situated to be a core holding of one’s portfolio for years to come. It operates in an industry with high barriers to entry and is one of those stocks that will likely do well regardless of economic conditions.