Is This Canadian Small Cap a Buy The Dip Opportunity in 2026?

Key takeaways

Revenue keeps growing, but profits still lag behind.

U.S. expansion adds scale and pressure to execute well.

Balance sheet looks solid, but leverage questions linger.

3 stocks I like better than Trisura Group.Finding a high-growth stock on the TSX that hasn’t already been bid up to the moon is a struggle. After all, the index is up more than 27% in 2025.

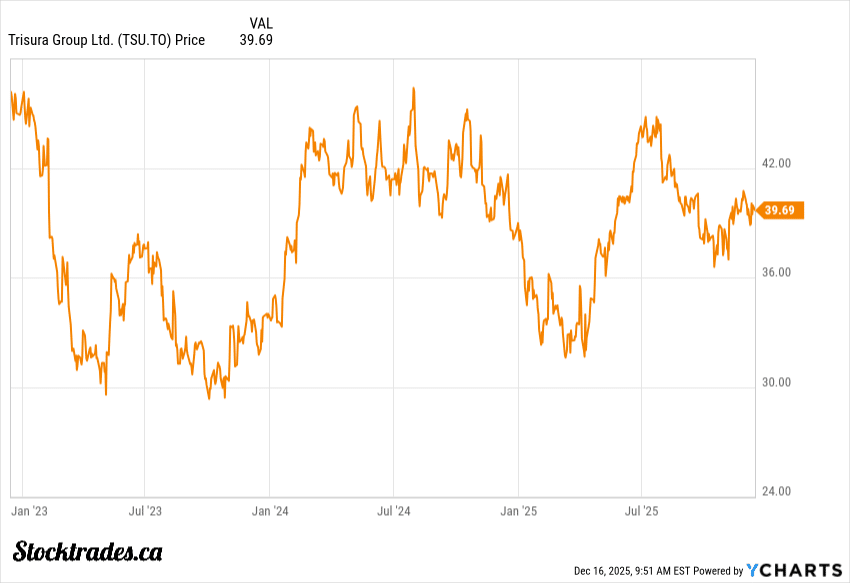

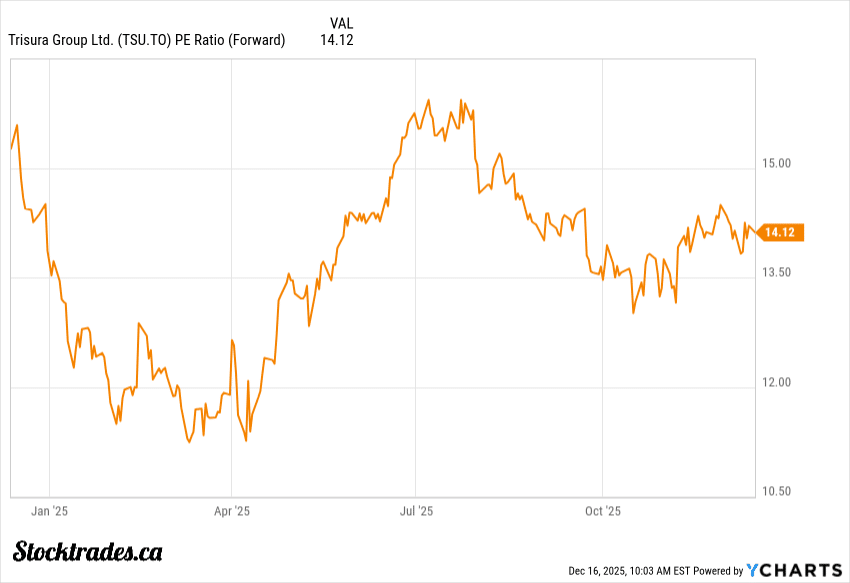

With Trisura, we now have a company that is going through a bit of a correction, much like other P&C insurance companies, as market sentiment cools off on these names. So now, the question is whether or not you’re running into a value-trap, or a hidden gem going through some consolidation.

I have been there plenty of times with insurance companies. You want exposure to specialty insurance because the economics can be fantastic, but the complexity of the business makes it hard to pull the trigger. Trisura Group sits squarely in that camp right now. It is priced for a rebound, but the market is clearly waiting for proof that it can turn revenue growth into consistent profits.

In this article, I am going to look under the hood of Trisura’s recent performance. I will break down their U.S. expansion, analyze the risks in their “fronting” model, and help you decide if this is an opportunity for your portfolio or just another stock spinning its wheels for the last 3~ years.

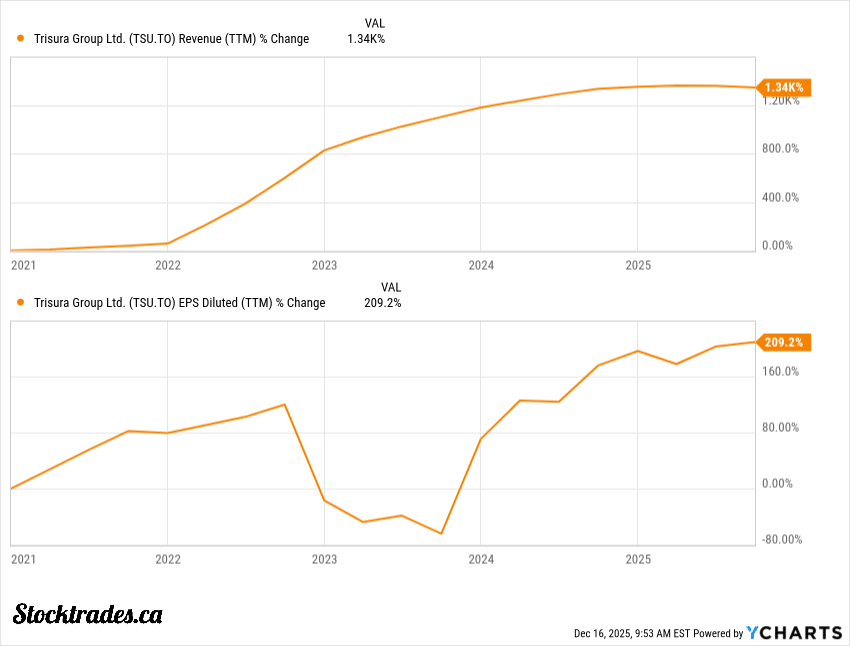

Revenue Is Flowing, But Where Are The Profits?

When you peel back the layers on their third quarter, the numbers tell a conflicting story. On the surface, the top-line growth is undeniable. Gross premiums written surged by over 11% year over year, driven largely by momentum in their U.S. programs. Net insurance revenue also climbed by more than 6%, proving that they are retaining clients and writing new business at a healthy clip.

The snag? Profitability hasn’t quite kept pace with that impressive revenue engine.

While the business is growing, the costs to run it are creeping up. The combined ratio, which measures profitability in the insurance world, nudged up to 86.0% from 84.4% last year.

Simply put, for every dollar of premiums they earn, they are keeping slightly less of it than they did a year ago. Higher losses in specialty lines chipped away at underwriting income, which slipped nearly 5%.

This is not a disaster by any means. An 86% combined ratio is still profitable, and many insurers would kill for that ratio. However, the gap between revenue growth and profit growth is a cloud hanging over the stock. As you can tell by the chart above, it’s drastic.

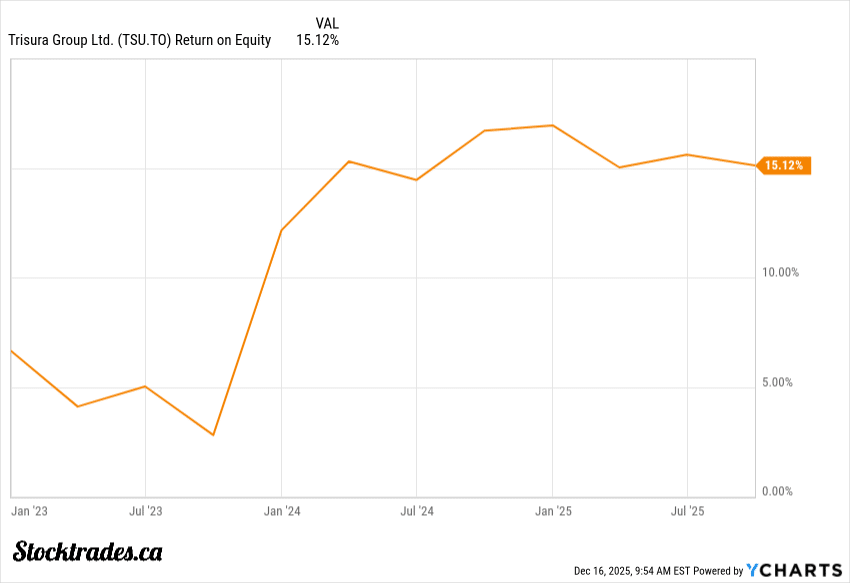

The saving grace here was net investment income. It jumped almost 24% as the company benefited from higher yields and a larger capital base. That tailwind helped offset the weaker underwriting results and kept their operating ROE near 15%.

That is a solid number, but I would prefer to see earnings driven by core operations rather than investment returns, which can be fickle.

The U.S. Expansion: A Double-Edged Sword

The U.S. market is the golden goose for Canadian financials. If you can crack it, the runway for growth is massive. Trisura is pushing hard here, adding licenses and expanding its network under Trisura Specialty and U.S. Programs.

The goal is scale. They want bigger, more diverse clients to smooth out their earnings.

The problem? Expansion is messy and expensive. Every new state or product line adds compliance headaches and puts pressure on margins. We saw this in 2025, where solid performance was tempered by the reality that not every new venture goes smoothly.

They now have 33 state licenses, which is a substantial footprint. But as they scale, execution becomes the primary risk. If expenses stay elevated for too long, the argument for margin leverage falls apart.

I view this as a classic “short-term pain for long-term gain” scenario. Cross-border growth and diversification should theoretically cut earnings swings down the road. But right now, the distribution side is growing faster than the underwriting control, and that is something I am watching closely.

The difficulty with a short-term pain scenario is the market generally doesn’t wait for that pain to subside. Patient investors certainly can, but the market tends to hammer the stock almost immediately.

Underwriting Discipline Versus Volatility

Trisura operates in a niche corner of the market. They balance growth in Surety and Warranty against the broader headwinds of the property and casualty market.

Surety insurance is a financial guarantee that a business or individual will meet a contractual or legal obligation. If they fail, the surety pays the affected party and then recovers the loss from the party that failed, unlike traditional insurance.

Surety is generally low-frequency but high-severity. That means you don’t see claims often, but when you do, they hurt. Warranty, on the other hand, brings steadier premiums but much thinner margins. Shifting the mix between these two can swing the loss ratio significantly.

This quarter, the loss ratio sat at roughly 34.3%. That is still solid. However, there are early signs of pressure as the U.S. program business outpaces domestic growth.

Expense control has been their primary defense here. The expense ratio stuck near 52%, which keeps underwriting margins in a decent spot.

That kind of discipline matters more than revenue growth. Spreading business across Canada and the U.S. helps dampen volatility, but until the U.S. book matures, I expect the results to remain all over the map.

A Fortress Balance Sheet With A Few Cracks

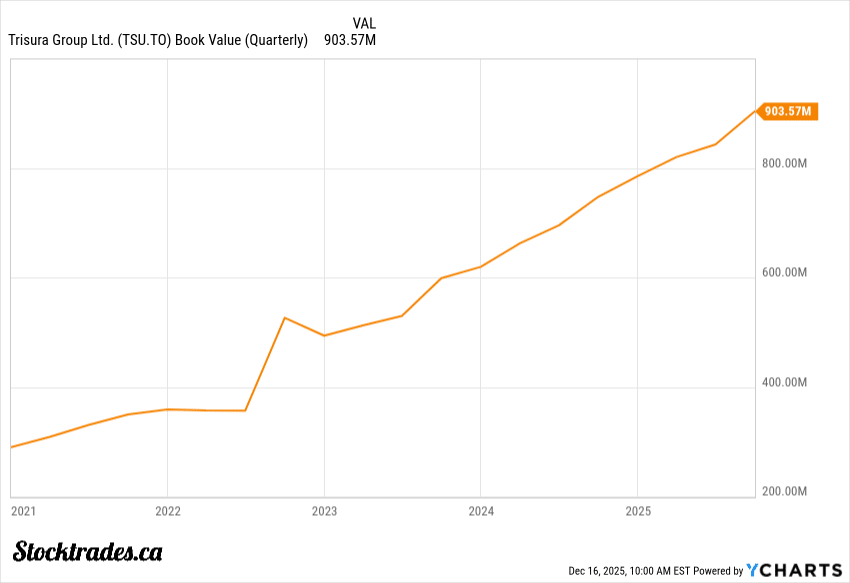

I always look at the balance sheet to see if a company can weather a storm. Trisura’s capital base looks sturdy after a long stretch of careful management.

The debt-to-capital ratio is hovering around 10.8%. That is incredibly conservative for an insurer, and it gives management plenty of dry powder to grow or protect margins if the markets get rough.

However, there is a risk to consider. The group has $75 million in senior unsecured notes maturing in 2026. While that isn’t a massive amount, refinancing risk is real in this higher-rate environment. Yes, rates have fallen, but bond yields have been sticky, resulting in higher refinancing across the board.

Book value per share keeps ticking up as underwriting gains feed retained earnings.

In my opinion, this is the most important metric for a company like Trisura. It shows that management is actually creating value, not just inflating the share count to buy revenue.

Liquidity is also a quiet strength here. They hold liquid securities and have a revolving credit facility that offers flexibility. But as they push further into U.S. surety lines, capital demands can shift fast. It works for now, but long-term expansion may eventually require taking on more debt or diluting shareholders.

The Complexity Of The ‘Fronting’ Model

Trisura’s business model leans heavily on reinsurance. Essentially, they act as a “front” for other insurers, writing the policy and then passing off a large chunk of the risk (and the premium) to reinsurers.

This allows them to punch above their weight class. They can write more business without locking up massive amounts of capital.

The question? What happens if the reinsurers pull back?

This model relies on the availability of cheap reinsurance capacity. If that capacity dries up, or if pricing shifts against them, Trisura’s margins could get squeezed fast. It also introduces counterparty risk. You are trusting that your partners will be there to pay the claims when they roll in.

So far, Trisura seems to use this framework well. Their loss experience is stable, and the underwriting margin is steady. From a capital perspective, it results in a high return on equity, with a recent ROE of 16.3%.

For analysts and DIY investors, this makes valuation tricky. Reinsurance makes reported earnings cleaner in some years and lumpier in others. It is working for now, but that’s not to say it will continue working.

My Final Thoughts

So, is Trisura a buy?

I believe Trisura represents a cautious opportunity for a specific type of investor. If you are looking for a “get rich quick” scheme or a high-yield dividend payer to fund your retirement, look elsewhere. This is a capital appreciation play, pure and simple.

The company is trading at a reasonable valuation, around 14x forward earnings according to some estimates, and the growth runway in the U.S. is substantial.

The management team has proven they can navigate complex markets, and the balance sheet is conservative enough to sleep well at night.

However, the “execution risk” cloud hasn’t fully cleared. They need to prove they can scale the U.S. operations without sacrificing margins.

I would treat Trisura as a long-term hold for a growth-focused investor. Start with a small position if it fits your risk tolerance. If they deliver a few more quarters of stable margins alongside that top-line growth, you can always add more. But for now, patience is the name of the game.